Author: Max.S

When Wall Street analysts digested the Q4 financial reports of Robinhood and Coinbase during the morning meeting on February 13, a harsh reality was laid bare: despite both giants desperately trying to escape the gravitational pull of the Bitcoin price cycle through "diversification," they remain perceived as high beta derivatives of Bitcoin in the eyes of the market.

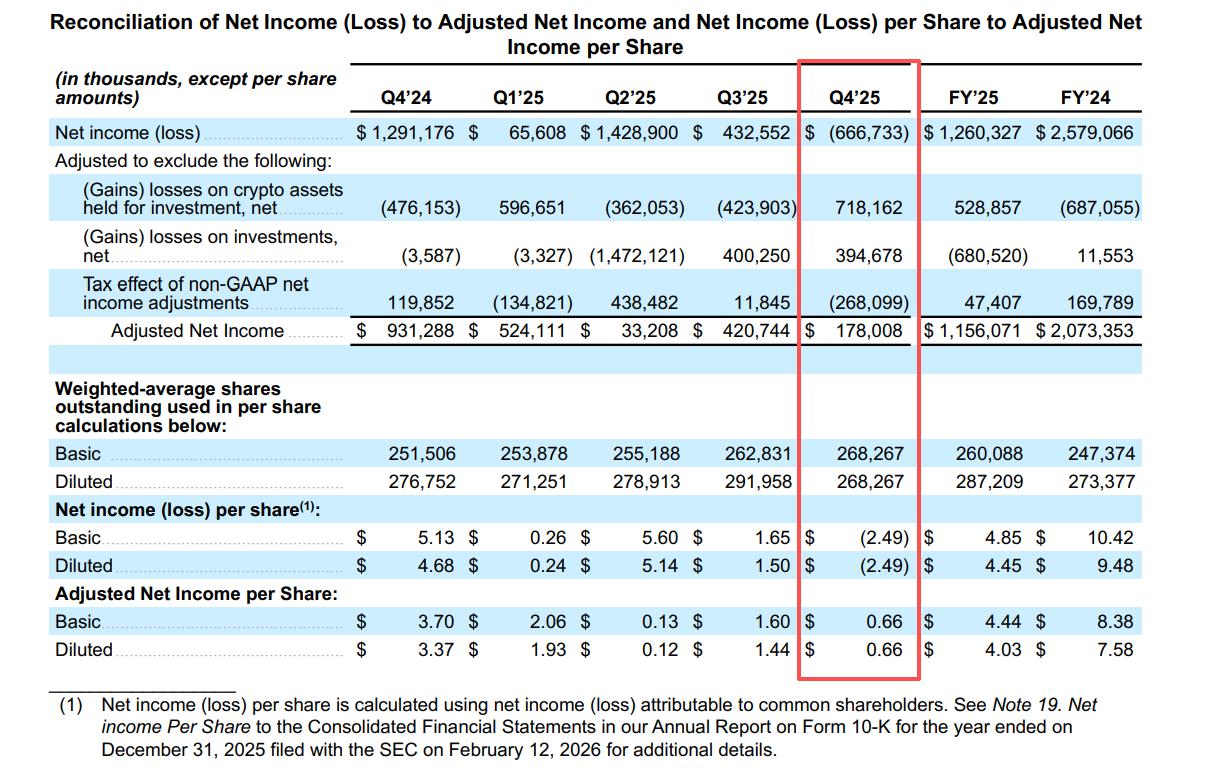

On one hand, Robinhood delivered its strongest revenue report ever, yet its stock price was halved; on the other hand, Coinbase swung from profit to losses, reporting a single-quarter massive loss of $667 million. These two reports are not only health check-ups for the companies but also tombstones reflecting the retail sentiment across the entire crypto market.

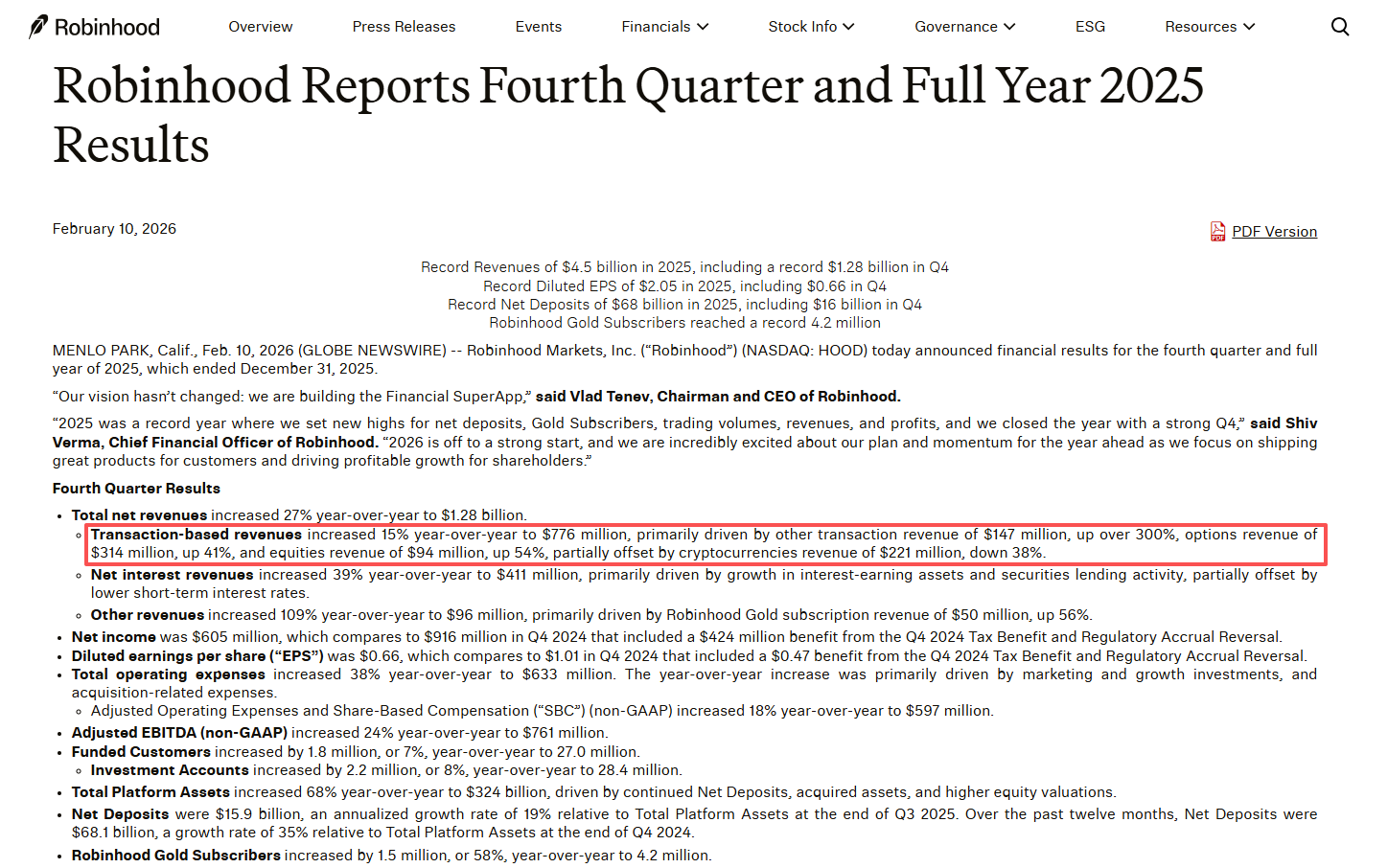

Robinhood: A luxurious casino without gamblers, its financial report is filled with magic realism. If you only look at the upper half, it appears to be a peak financial technology giant: revenue in 2025 is projected to reach $4.5 billion, creating a historic high, with a net profit of $1.9 billion and a 58% surge in Gold membership to 4.2 million. CEO Vlad Tenev confidently declared on the conference call: "What we are building is a financial super App."

But the market focused only on the lower half: retail investors have stopped playing.

The most glaring data in the report concerns the collapse of cryptocurrency trading revenue. In Q4, this revenue dropped to $221 million, a year-on-year plunge of 38%. Correspondingly, in January 2026, the nominal trading volume of cryptocurrencies within the Robinhood App halved year-on-year by 57%, plummeting to just $8.7 billion.

Currently, Robinhood’s traditional financial business (TradFi) is booming, with stock trading revenue up 54%, options up 41%, and even the prediction markets becoming a new growth driver, with contract transactions exceeding 12 billion in the first year. However, their crypto business is rapidly cooling: as Bitcoin retreated from last year's peak of $126,000 to around $65,000, FOMO turned into fear itself. Retail investors not only stopped trading but even began to redeem and exit.

For Wall Street, Robinhood feels like a newly renovated luxury casino, with the latest slot machines (options) and poker tables (prediction markets), but the most profitable VIP room (cryptocurrency) is empty.

The market cruelly cast its vote with its feet: despite Robinhood’s efforts to prove it is not just a "crypto broker," under the crypto winter, investors still regard it as a shadow stock of Bitcoin. The stock price has fallen 50% from its peak last October; this valuation decline is not aimed at its performance, but rather at its "crypto exposure."

Coinbase: The winter of the naked swimmers, if Robinhood can still rely on stock and options businesses to "hedge" against the winter, Coinbase is exposed bare to the blizzard. The Q4 financial report shows that Coinbase’s revenue fell 21.6% year-on-year to $1.78 billion, and even more shocking to the market is that its net profit turned from profit to a massive loss of $667 million. This significant loss mainly stems from investment losses in their crypto asset portfolio—this is a typical case of "bull market assets, bear market liabilities."

(Image source: Coinbase 2025 Q4 Shareholder Letter)

Coinbase's data reveals a deeper industry crisis than Robinhood's:

- Retail investors are completely flatlining: Consumer trading volume is merely $59 billion compared to institutional trading volume of $237 billion; retail investors in Coinbase's ecosystem can almost be said to be "missing."

- Institutional players and derivatives play a solo act: The only bright spot comes from institutional business and derivatives (thanks to the integration after the acquisition of Deribit), but this low-fee flow cannot compensate for the loss of high-fee retail trading.

- Dependence on USDC: Stablecoin revenue reached $364 million, becoming the "stabilizing anchor" to support revenue. In the current environment of depleted trading volumes, Coinbase is increasingly resembling a bank living off dollar interest, rather than an exchange.

Coinbase's current predicament resembles a replay of 2022. Brian Armstrong’s vision of an “Everything Exchange” appears impotent during the Bitcoin price down cycle. When the underlying asset (Crypto) price plummets, as a "shovel," the exchange not only can't sell shovels but the shovels it holds are also dramatically depreciating.

When we put the financial reports of both companies side by side, we can clearly see the underlying logic of the crypto market in 2026: whether it's Web2's Robinhood or Web3's Coinbase, neither has escaped the Beta of Bitcoin. Over the past year, both companies have been trying to build their own Alpha opportunities.

- Robinhood bets on "decryptoization," attempting to dilute the volatility of its crypto business through the acquisition of Bitstamp and even entering the Indonesian brokerage market.

- Coinbase bets on "deepening," focusing on Layer 2 (Base chain), derivatives, and payment infrastructure, in an effort to retain institutional capital.

However, the data ruthlessly shows that as long as Bitcoin falls, retail investors will exit, and trading frequency will drop to zero. Robinhood's monthly active users (MAU) decreased by 1.9 million, which is not just a reduction in numbers but a loss of faith.

MicroStrategy (MSTR)’s Q4 report also corroborates this point—with a single-quarter impairment loss of $12.4 billion due to Bitcoin depreciation. Whether it's MSTR, which directly holds Bitcoin, or HOOD and COIN providing trading services, their stock price trends still highly correlate with Bitcoin's candlestick chart, with over 90% correlation. This represents a kind of "false diversity." No matter how many business lines you have (Robinhood claims to have 11 profitable business lines), as long as the core narrative—Crypto Adoption—burns out, the market's valuation system will collapse rapidly.

For financial practitioners, combining these two financial reports sends three clear signals:

- Oversupply of infrastructure and scarcity of users: The bull market of 2024-2025 has spawned extensive infrastructure development (Layer 2, wallets, payments), yet Q4 reports indicate that the number of truly active users (especially high-net-worth retail investors) is sharply shrinking. 2026 will be a year of “supply-side reform,” with only top platforms surviving the winter.

- The "presence of stable income" in revenue structure is crucial: Coinbase's USDC income and Robinhood's Net Interest Income are the oxygen masks enabling them to survive. Before the next bull market arrives, whoever's cash flow resembles a bank's will be safer.

- Reconstruction of valuation logic: The market is punishing those "disguised as tech companies' Beta." Unless Robinhood’s prediction market can prove itself as an independent growth driver, or Coinbase's Base chain can generate significant non-trading income, their stock prices will continue to fluctuate with Bitcoin until the market is convinced of a bottom.

At the end of the conference call, Robinhood's Tenev said: "We are building a financial ecosystem for the next generation." But at this moment, the next generation of investors is staring at a screen full of red candlesticks, closing the App.

For Coinbase and Robinhood, the "record" year of 2025 has become history. The keyword for 2026 is no longer "growth," but "resilience." As Buffett said, only when the tide goes out do you discover who has been swimming naked. Now that the tide has gone out, although these two giants are wearing swimsuits, the cold wind is biting; they must prove to the market that they have enough cash flow to survive until the next summer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。