By: David, Deep Tide TechFlow

On February 12, after the U.S. stock market closed, Coinbase released its financial report for the fourth quarter and the entire year of 2025.

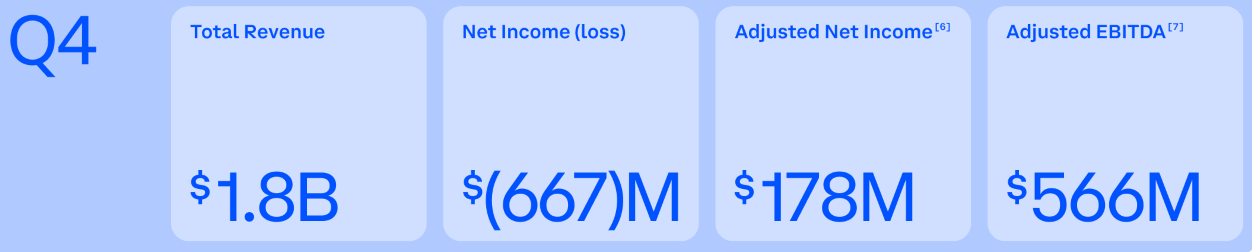

Annual revenue was $7.2 billion, a year-on-year increase of 9%. That sounds okay, but last year, this growth rate was 115%; Q4 single-quarter revenue was $1.78 billion, down 21.6% year-on-year, below Wall Street's expectation of $1.85 billion. Earnings per share were $0.66, while the market expectation was $1.05, a difference of 37%.

The market's expectations for this financial report have already been reflected in the stock price.

COIN closed the day at $141, down 68% from last July's peak of $445. In after-hours trading, it touched $134 at one point, setting a new low for nearly 52 weeks.

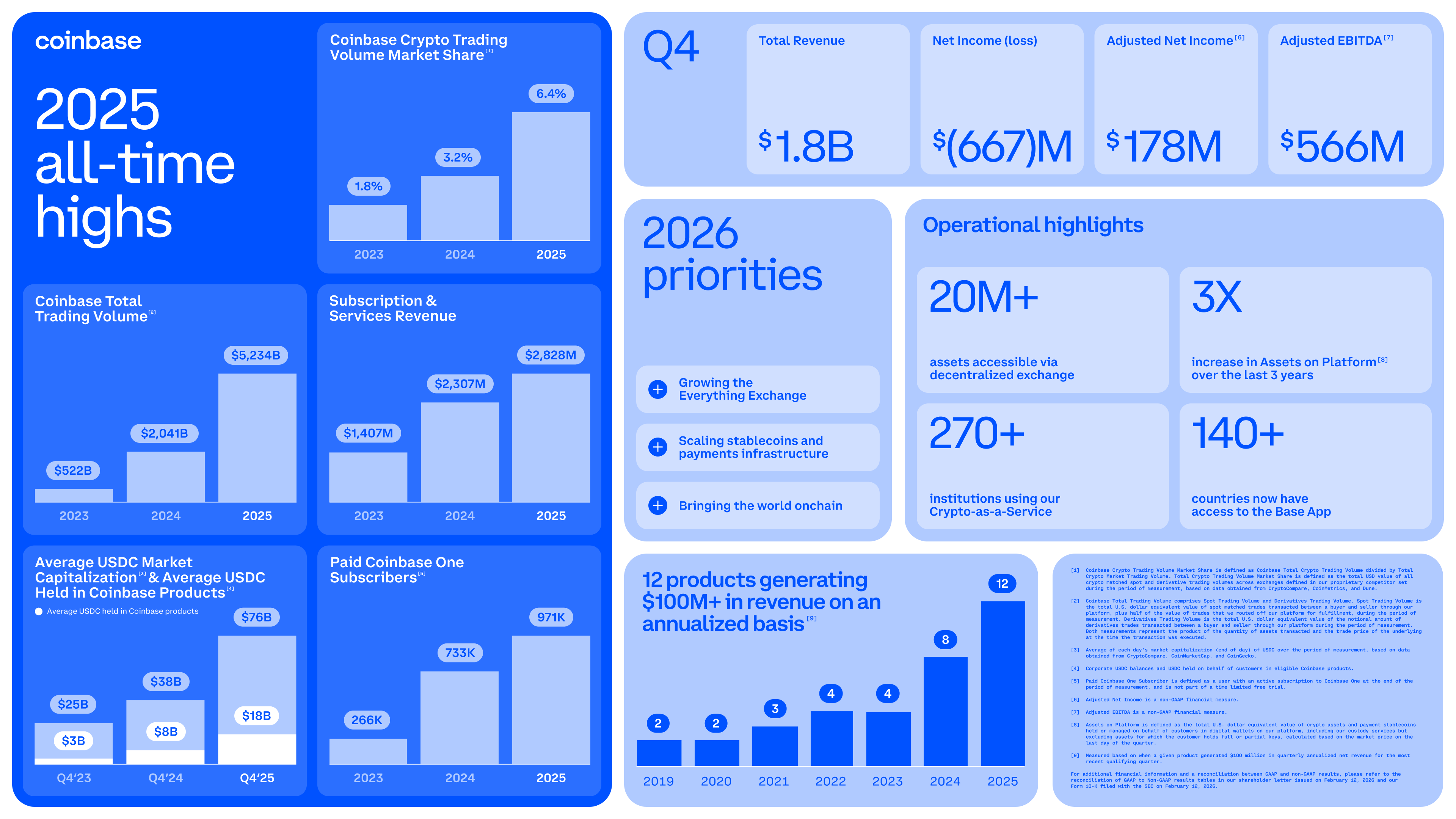

However, in the shareholder letter issued the same day, Coinbase was once again filled with "historical highs":

Annual trading volume doubled, market share in cryptocurrency trading doubled, holdings of USDC reached record levels, and paid subscription users approached 1 million.

CEO Brian Armstrong said in the subsequent earnings call that 2025 was a "strong year," and Coinbase has taken a significant position.

However, on the same day as the earnings report was released, Coinbase's platform experienced technical issues, causing some users to be unable to trade and transfer normally for hours. The official stated that the issue was under investigation and that user asset security was assured. But hitting the earnings report day, this timing was somewhat awkward.

A financial report filled with historical highs, matched with a 52-week low stock price. Coinbase in 2025 shows two faces laid out on the table.

We have compiled Coinbase's shareholder letter, earnings call, and public market data to break down this contradictory report card.

Trading volume doubled, but profits decreased

The contradiction starts with trading volume.

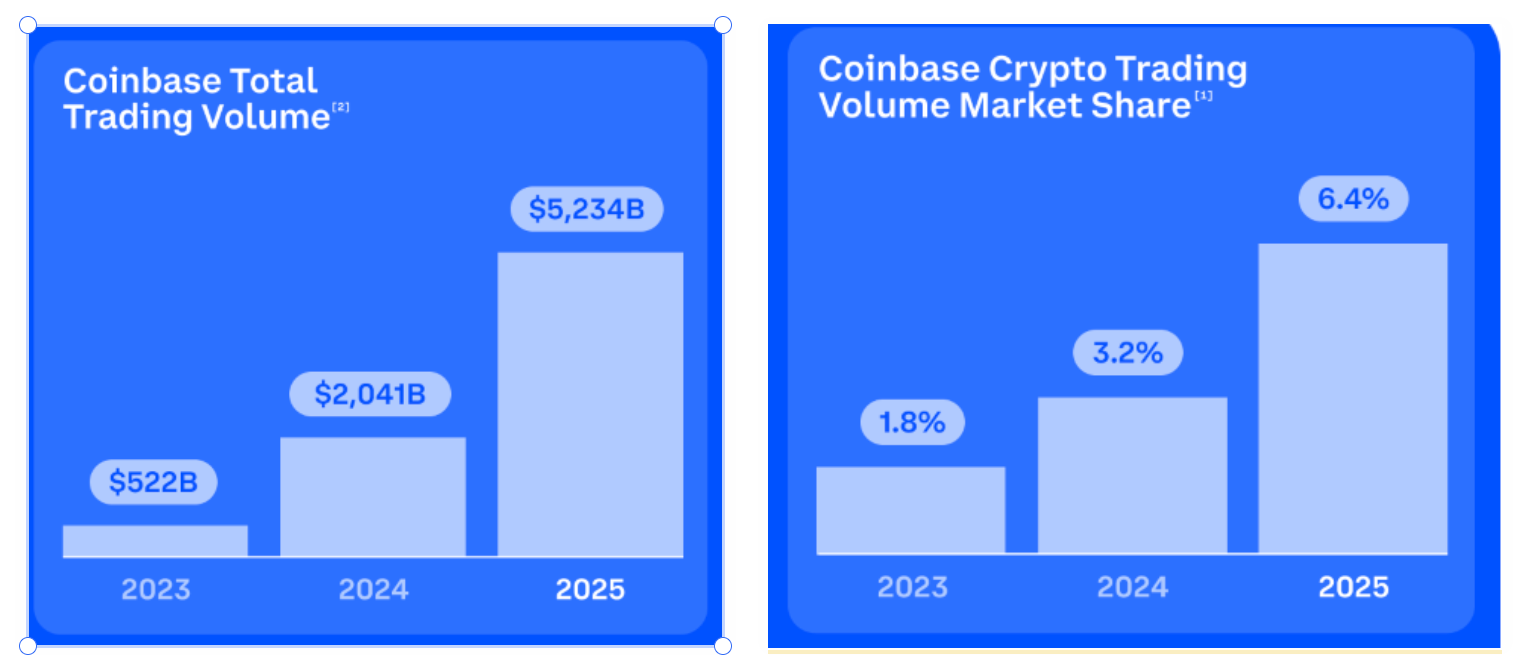

In 2025, the total trading volume on the Coinbase platform reached $5.2 trillion, a year-on-year increase of 156%. The market share in cryptocurrency trading increased from 3.2% to 6.4%. Both of these numbers are the highest since the company went public.

However, trading revenue was only $4.1 billion, which rose merely 2% year-on-year.

Trading volume increased by more than one and a half times, while revenue barely moved. The reason is that the fee rates for individual transactions are declining.

In August 2025, Coinbase completed its acquisition of Deribit, with this $2.9 billion deal being the largest merger in cryptocurrency history. Deribit is the world's largest cryptocurrency options exchange, bringing in massive derivatives trading volume, but the fee rates for derivatives are much lower than for spot trading.

In other words, the "historical high" in trading volume is inflated. The scale has increased, but unit profits have shrunk.

Let’s look at Q4 alone. Trading revenue was $983 million, the first time in six quarters it fell below $1 billion. This represents a year-on-year decline of 36.8%. The backdrop is that BTC has declined from last October's historical high of around $126,000 to about $90,000 by the end of Q4.

Entering 2026, the decline has intensified, with a drop below $60,000 at the beginning of February.

Overall market capitalization in the cryptocurrency market shrank by 11% quarter-on-quarter in Q4, volatility decreased, and retail trading activity significantly contracted.

According to Zacks data, Q4 consumer-end spot trading volume was $59 billion, while institutional trading volume was $237 billion. Institutions supported the volume, but retail investors were leaving the market.

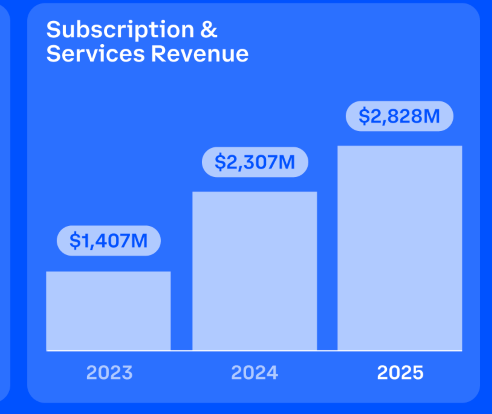

Subscription revenue 5.5 times higher than the last bull market peak, but growth is slowing

The good news is in another section.

Subscription and service revenue for the year reached $2.8 billion, a year-on-year increase of 23%, which is 5.5 times the peak during the bull market in 2021. This revenue now accounts for 41% of net revenue.

Diving deeper, stablecoin revenue is the biggest contributor.

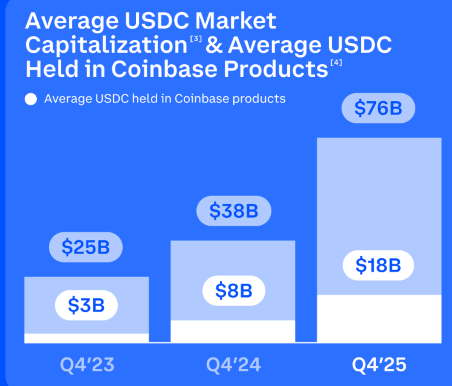

Q4 stablecoin-related revenue reached $364 million, a year-on-year increase of 61.2%. The average holdings of USDC on the platform hit $17.8 billion, with the total market cap of USDC averaging about $76 billion during Q4.

Coinbase takes a cut from the interest revenue of USDC and circulation profit, a model that doesn’t depend on user trading, more like “deposit to earn interest.”

Coinbase One paid subscriptions approached 971,000 at the end of 2025, having tripled over three years. The annualized revenue from 12 products exceeded $100 million, with 6 products exceeding $250 million and 2 products exceeding $1 billion.

However, Q4 subscription and service revenue was $727 million, down 3% quarter-on-quarter. At the same time, management's outlook for upcoming subscription revenue isn't optimistic.

During the earnings call, CFO Alesia Haas provided a forecast range for subscription and service revenue in Q1 2026: $550 million to $630 million, dropping another tier from the just-past Q4.

She mentioned two reasons; the Fed lowered rates by 25 basis points each in October and December, which reduced the interest yield of USDC; and the continued decline in cryptocurrency asset prices has impacted staking-related income.

Armstrong also mentioned in the call that Coinbase is building an "everything exchange" for trading anything.

Subscription revenue is the new pillar in this story. But under the test of the cryptocurrency winter, this pillar is also shaky.

Huge net loss on paper, but not due to poor business performance

Q4 saw Coinbase report a net loss of $667 million under U.S. GAAP. The same period last year recorded a profit of $1.3 billion.

The bulk of the loss did not come from the business itself. Two unrealized investment losses impacted the income statement.

The first loss was from unrealized losses in the cryptocurrency portfolio, amounting to $718 million.

Coinbase continuously increased its BTC holdings in 2025, doubling the amount of BTC held throughout the year and buying every week. This strategy came with a considerable paper cost during the quarter when BTC halved from its peak.

The second loss was from strategic investments, totaling $395 million. A large portion of this came from Coinbase's holdings in Circle shares. Circle is the issuer of USDC and one of Coinbase’s most important partners.

Circle's stock fell about 40% in Q4, directly dragging down Coinbase's investment accounts.

Combined, these two losses exceed $1.1 billion. But these are "unrealized" losses, meaning the assets haven’t been sold and were only marked to market. If BTC rebounds, these losses will reverse.

If we exclude these investment fluctuations, Coinbase's adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization, typically used to measure a company's core operating profitability) was $566 million, with adjusted net income of $178 million.

By this measure, Coinbase has maintained profitability for 12 consecutive quarters.

Here lies a structural contradiction. Coinbase is operating as both an exchange and an asset holder. Its balance sheet holds significant amounts of BTC and cryptocurrency-related investments.

In a bull market, this is a profit amplifier, with a large portion of the $1.3 billion net profit in 2024 derived from investment gains. In a bear market, the same logic bites back.

CFO Haas did not shy away from this issue during the call. Her statement was that Coinbase has "slightly increased its weekly BTC purchase volume" in the current price environment.

To translate that: it has dropped, but we are buying more.

This stance is similar to that of Strategy (formerly MicroStrategy), both betting on the long-term value of BTC with the company's balance sheet.

The difference is that Strategy treats this as a primary business, while Coinbase sees it as a secondary business. But when BTC's decline is close to 50%, even a secondary business can significantly impact the perception of financial reports.

Finally, the financial report shows Coinbase's cash and equivalents at the end of the year were $11.3 billion. There is no shortage of cash on hand, but constantly buying BTC while suffering losses also raises concerns.

What does Coinbase actually want to become?

There is an unavoidable fate for cryptocurrency exchanges:

Profiting immensely in bull markets, while income is halved in bear markets. In its four years as a public company, every financial report from Coinbase has repeated this rhythm.

In 2025, management attempted to rewrite the script.

Armstrong repeatedly mentioned a term during the earnings call: everything exchange. He wants Coinbase to be more than just a place to buy and sell cryptocurrencies, but a platform where any asset can be traded.

In fact, some actions have already been implemented.

In Q4 last year, Coinbase opened the prediction market feature to all users, allowing them to bet on sports events, political elections, and other real-world outcomes; this February, the platform plans to launch nearly 10,000 U.S. stock ticker symbols.

Armstrong mentioned on the call that the trading volume of prediction markets and gold and silver broke records in the first quarter of this year.

The significance of these new categories is that their trading volume does not fluctuate with the ups and downs of the cryptocurrency market.

BTC falls 50%, users can still trade Tesla stock or bet on the Super Bowl on Coinbase. The more diversified the revenue sources, the lower the dependence on cryptocurrency cycles.

Another major initiative is Deribit.

In terms of derivatives, Coinbase completed the acquisition of Deribit for $2.9 billion in August 2025, capturing approximately 80% of the global cryptocurrency options market share. Along with the existing futures and perpetual contracts business, Coinbase now has a complete product line of derivatives.

Stablecoins are what Armstrong refers to as the "second killer application." The USDC holdings on the platform hit a record high in Q4, with stablecoin-related revenue increasing by over 61% year-on-year.

He even proposed a further vision:

AI agents will use stablecoins as the default payment method in the future, and Coinbase's Base chain will become the entry point.

Stocks, derivatives, prediction markets, stablecoins, AI infrastructure. Coinbase has almost covered all possible tracks in 2025, completing 10 acquisitions or talent buyouts throughout the year.

The blueprint for the so-called "everything exchange" has been drawn up, but a bear market is the best time to test a transformation. A detail you might overlook is:

Before and after the financial report release, Monness Crespi Hardt downgraded Coinbase's rating from "buy" to "sell," citing that the market underestimated the duration of the crypto bear market.

On the other hand, among 35 analysts, 23 maintained a "buy" rating, with a consensus target price of $326, indicating more than double the upside potential relative to the current stock price.

Those bullish and bearish are betting on the same question: can Coinbase's transformation outpace the cycles?

The best times for exchanges may not necessarily be over. But those days of doubling revenue and earning effortlessly are likely not coming back. Coinbase knows this too, which is why it is striving to move in the direction of the everything exchange.

When cryptocurrency prices halve, retail investors exit, and trading fee rates decrease, are these new tracks truly the income engines, or just embellishments of a larger story from the bull market?

The answer may only become clear after a couple of quarters of financial reports.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。