Author: ARK Invest

Translation: Felix, PANews

In the macro context of 2026, ARK Invest points out four major trends that are enhancing Bitcoin's value and believes that Bitcoin is evolving from a "optional" fringe asset to an indispensable strategic asset in institutional portfolios. Here are the details.

By 2025, Bitcoin continues to be deeply integrated into the global financial system. The launch and growth of Bitcoin spot ETFs in 2024 and 2025, the inclusion of digital asset public companies in major stock indices, and the continuous improvement of regulatory transparency are driving Bitcoin from the fringes towards a new asset class that ARK Invest believes is worthy of institutional asset allocation.

ARK Invest believes that the core theme of this cycle is Bitcoin's transformation: from a "optional" emerging monetary technology to a strategic allocation asset in the eyes of an increasing number of investors. Four major trends are enhancing Bitcoin's value proposition:

- Macroeconomic and policy contexts shaping the demand for scarce digital assets

- Structural ownership trends among ETFs, corporations, and sovereign nations

- The relationship between Bitcoin and gold, as well as broader value storage means

- Compared to previous cycles, the drawdowns and volatility of Bitcoin are decreasing

This article will elaborate on these trends.

Macroeconomic Background of 2026

Monetary Conditions and Liquidity

After a long period of monetary tightening, the macro landscape is changing: the quantitative tightening (QT) in the U.S. ended last December, and the Federal Reserve's rate-cutting cycle is still in its early stages. Furthermore, over $10 trillion in low-return money market funds and fixed-income ETFs may soon rotate into risk assets.

Policy and Regulatory Normalization

Regulatory transparency is both a constraint and a potential catalyst for institutional adoption. In the U.S. and other countries, policymakers have been advancing relevant frameworks aimed at clarifying the regulation of digital assets, standardizing custodial, trading, and disclosure processes, and providing more guidance for institutional allocators.

For instance, if the CLARITY Act in the U.S. is implemented—where the Commodity Futures Trading Commission (CFTC) regulates digital commodities and the Securities and Exchange Commission (SEC) regulates digital securities—it could significantly reduce compliance uncertainty for companies and institutions focused on digital assets. The act provides a compliance roadmap for the lifecycle of digital assets, allowing tokens to transition from SEC oversight to CFTC regulation through standardized "maturity tests." The act implements a dual registration system for broker-dealers, reducing the historical legal "vacuum" that digital asset companies faced offshore.

The U.S. government is also addressing Bitcoin-related issues in the following ways:

- Legislators are discussing the inclusion of Bitcoin in national reserves.

- Standardizing management of seized Bitcoin holdings (currently mostly controlled by the federal government).

- State-level adoption of Bitcoin, with Texas leading the way by purchasing and incorporating it into the state reserves.

Structural Demand: ETFs and DATs

ETFs as Structural New Buyers

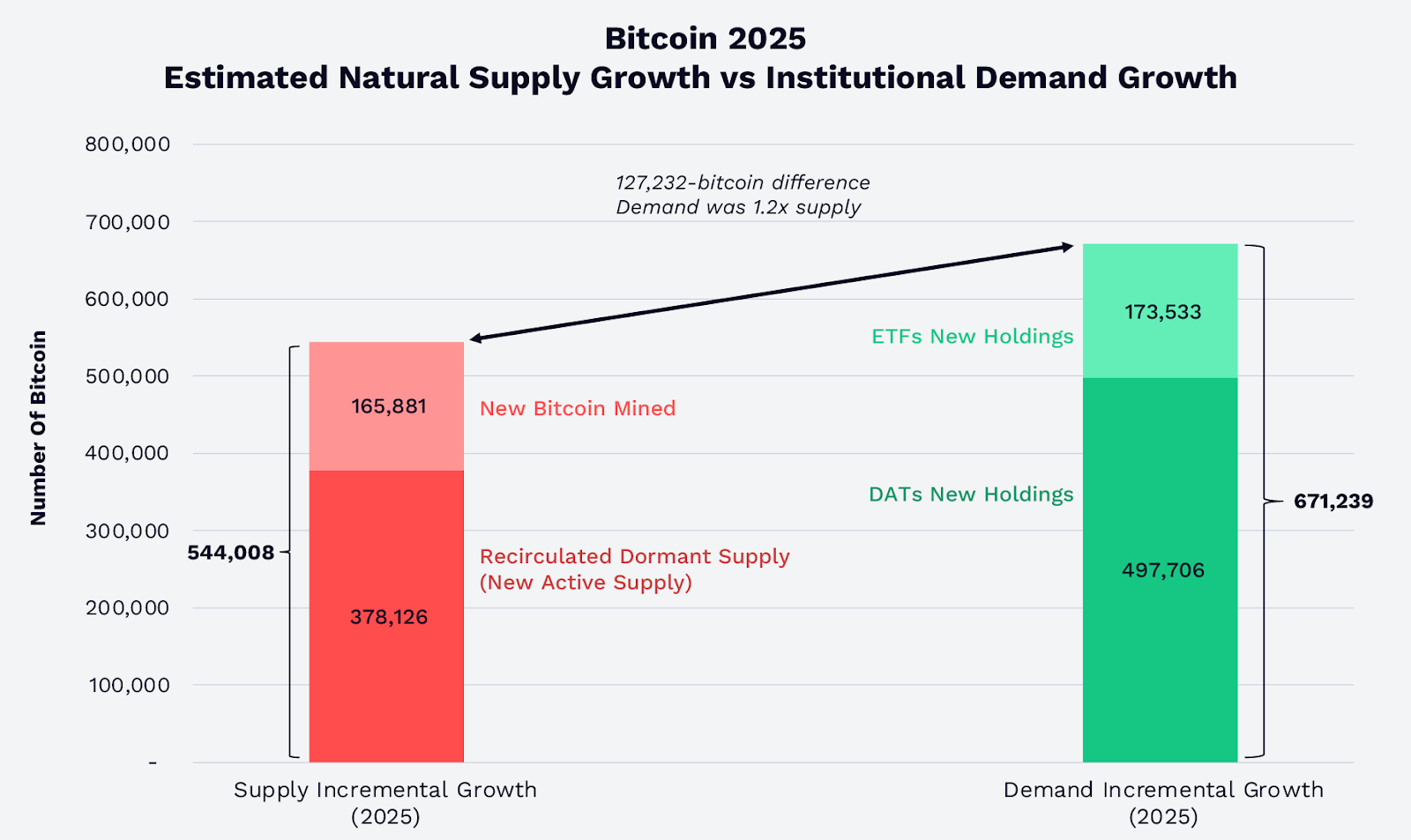

The scale expansion of spot Bitcoin ETFs has reshaped the supply-demand landscape of the market. As shown in the image below, by 2025, the amount of Bitcoin absorbed by U.S. Bitcoin spot ETFs and DATs is 1.2 times the sum of newly mined Bitcoin and dormant Bitcoin re-entering the market (active supply growth). By the end of 2025, the total amount of Bitcoin held by ETFs and DATs exceeds 12% of the circulating total. Although the demand for Bitcoin has outpaced supply growth, its price has fallen, seemingly influenced by external factors: the massive liquidation event triggered by a software glitch on October 10, concerns over the Bitcoin four-year cycle turning point, and negative sentiment surrounding the potential threat of quantum computing to Bitcoin's cryptographic technology.

Source: ARK Investment Management LLC and 21Shares, 2026 forecast, data from Glassnode, as of December 31, 2025.

In the fourth quarter, Morgan Stanley and Vanguard incorporated Bitcoin into their investment platforms. Morgan Stanley expanded the channels through which clients can access compliant Bitcoin products (including spot ETFs). Surprisingly, Vanguard, after years of rejecting cryptocurrencies and all commodities, also added third-party Bitcoin ETFs to its platform. As ETFs mature, they will increasingly play a structural bridging role connecting the Bitcoin market with traditional pools of capital.

Bitcoin-Related Companies in Indices, Corporate Adoption, and Bitcoin Reserves

Corporate adoption of Bitcoin is no longer limited to a few early adopters. The S&P 500 and NASDAQ 100 indices have included stocks of companies like Coinbase and Block, bringing Bitcoin-related exposure into mainstream portfolios. The company formerly known as MicroStrategy, as a DAT entity, has built a substantial Bitcoin position amounting to 3.5% of the total supply. Additionally, Bitcoin DAT companies currently hold over 1.1 million BTC, accounting for 5.7% of the supply (valued at approximately $89.9 billion as of the end of January 2026). To a large extent, these corporate reserves belong to long-term holders rather than short-term speculators.

Sovereign Nations and Strategic Reserves

In 2025, following El Salvador, the Trump administration established the U.S. Strategic Bitcoin Reserve (SBR) with seized Bitcoin. Today, this reserve holds approximately 325,437 BTC, accounting for 1.6% of the total supply, valued at $25.6 billion.

Bitcoin and Gold as Value Storage Means

Gold Leading, Bitcoin Following?

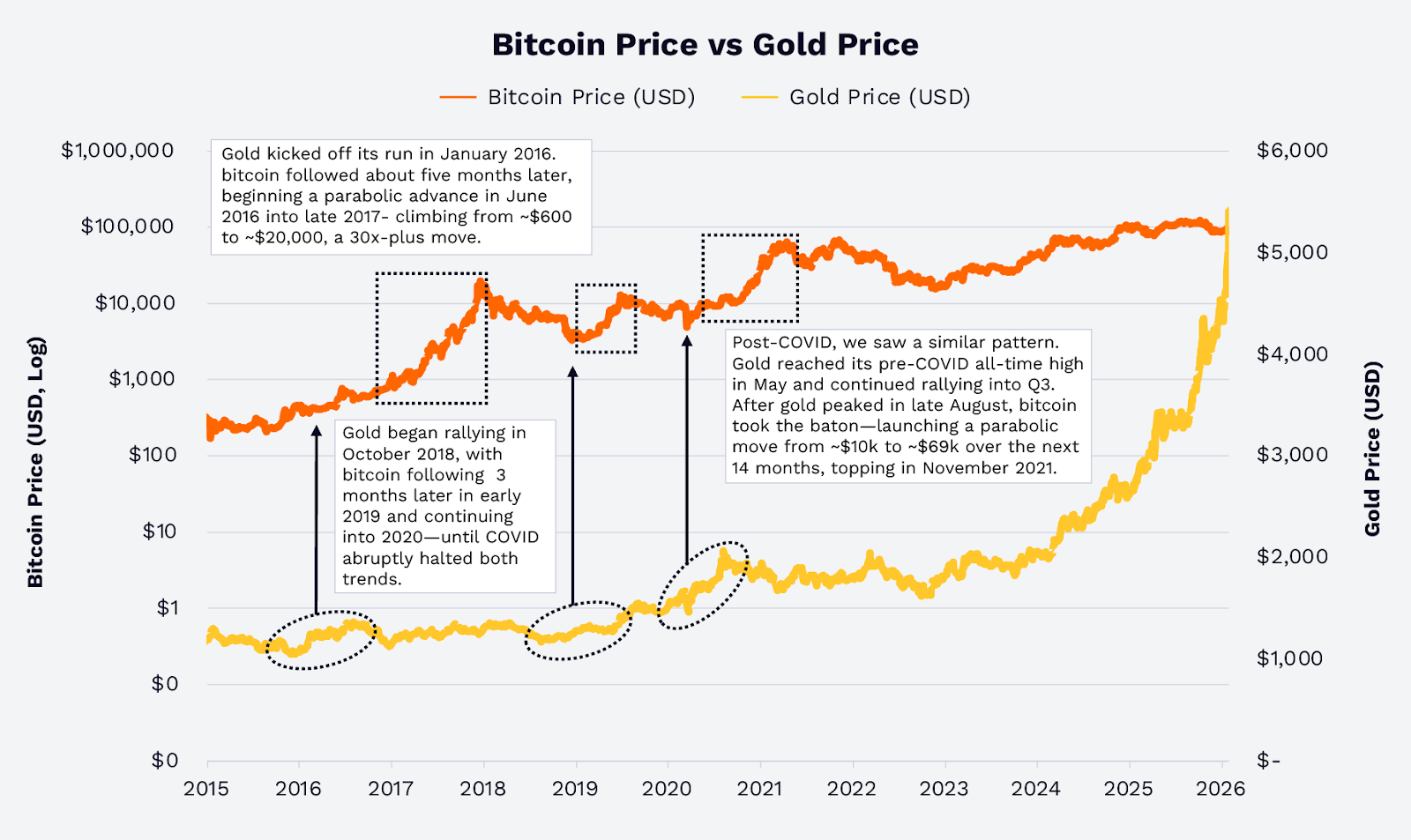

In recent years, gold and Bitcoin have reacted differently to macro narratives such as currency devaluation, negative real interest rates, and geopolitical risks. In 2025, influenced by inflation concerns and fiat currency devaluation, the price of gold surged by 64.7%. Unexpectedly, Bitcoin's price fell by 6.2%, and this divergence is not unprecedented.

In both 2016 and 2019, the rise in gold prices led that of Bitcoin. During the initial shock of the COVID-19 pandemic in early 2020, a surge in fiscal and monetary liquidity also indicated an increase in Bitcoin prices. As shown in the figure below, this "Gold-Bitcoin" pattern was especially evident in 2017 and 2018. Will history repeat itself? According to historical relationships, Bitcoin serves as a high-beta, digital-native extension under the same macro trading logic, a logic that has historically supported gold.

Source: ARK Investment Management LLC and 21Shares, 2026, data from Glassnode and TradingView, as of January 31, 2026.

ETF Assets Under Management: Increasing Shares of Bitcoin

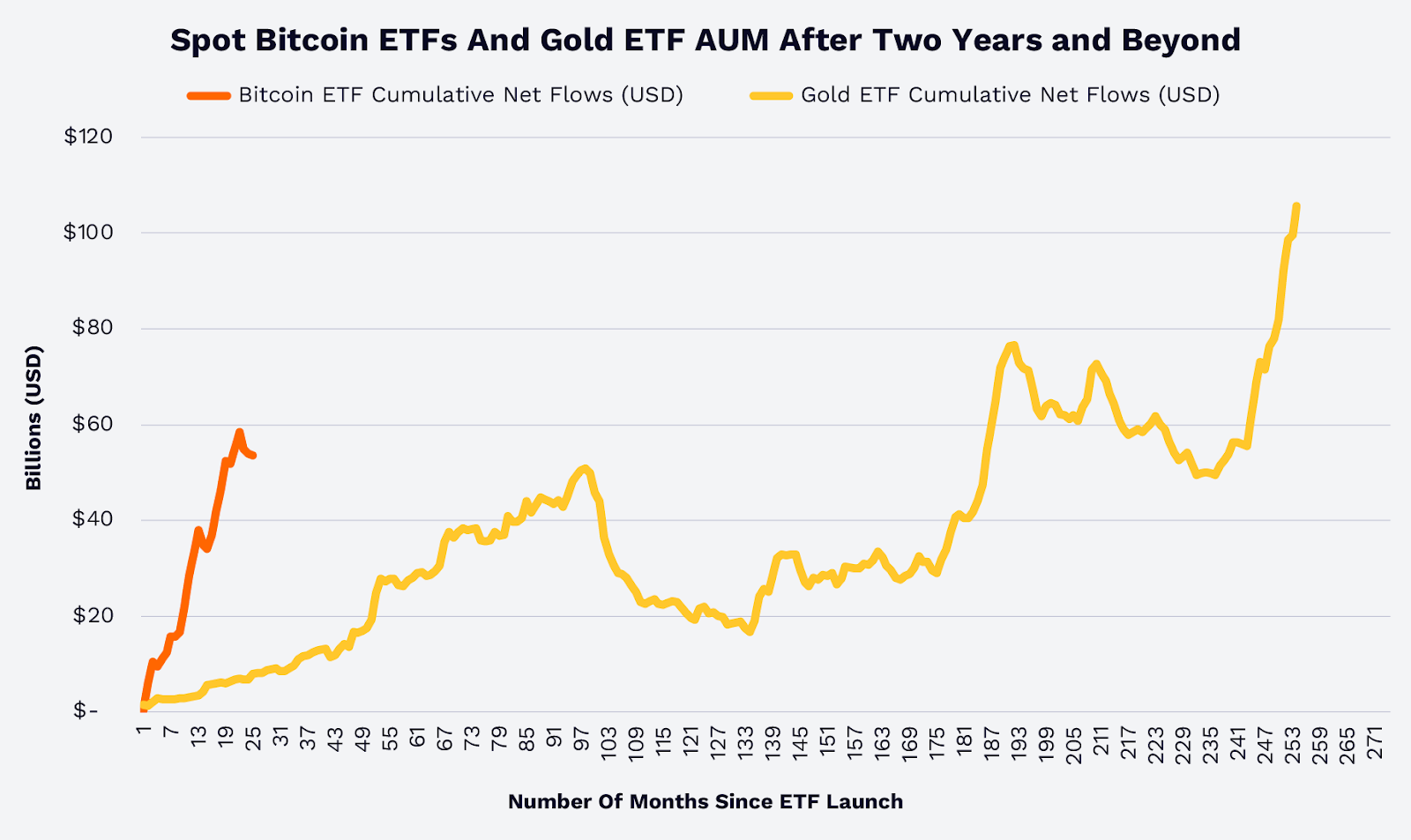

Cumulative net inflows into ETFs provide another comparative dimension for Bitcoin and gold. According to data from Glassnode and the World Gold Council, spot Bitcoin ETFs achieved the level that gold ETFs took over 15 years to reach in less than two years, as shown in the figure below. In other words, financial advisors, institutions, and retail investors seem to recognize Bitcoin's role as a value storage means, a diversification tool, and a new asset class more readily.

Source: ARK Investment Management LLC and 21Shares, 2025, data from Glassnode and the World Gold Council, as of December 31, 2025.

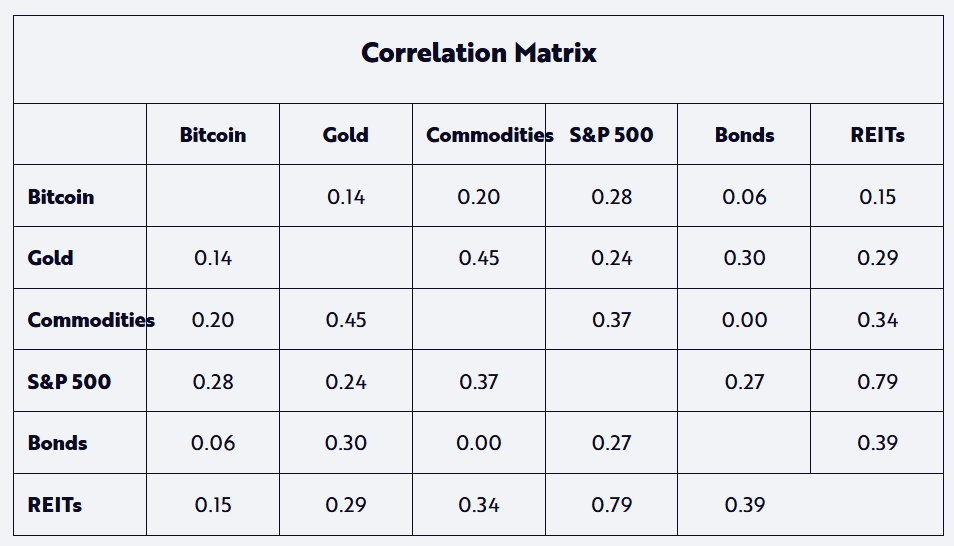

Notably, as shown in the figure below, since 2020, the correlation of returns between Bitcoin and gold during the previous cycle has been very low. This suggests that gold might be a leading indicator.

Note: The above correlation matrix uses weekly return data from January 1, 2020, to January 6, 2026.

Market Structure and Investor Behavior

Drawdowns, Volatility, and Market Maturity

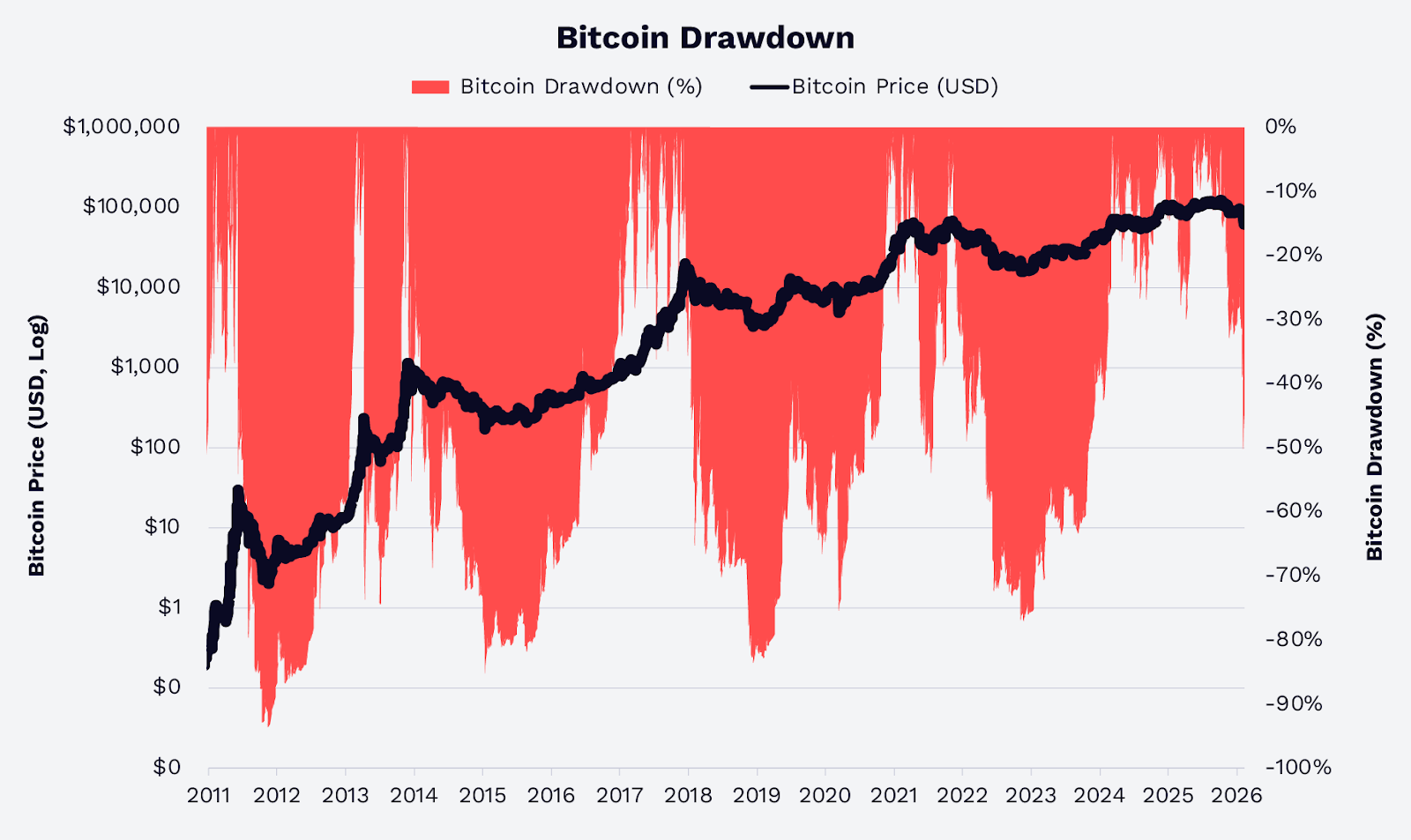

Bitcoin is a highly volatile asset, but its drawdown magnitude has decreased over time. In previous cycles, declines from peak to trough often exceeded 70-80%. In the current cycle since 2022 (as of February 8, 2026), the declines from historical peaks have not exceeded about 50% (as shown below). This indicates that even when faced with significant corrections (such as the adjustment that occurred in the first week of February 2026), the market behaves more robustly due to increased participation and deeper liquidity.

Source: ARK Investment Management LLC and 21Shares, 2025 forecast, data from Glassnode, as of January 31, 2026.

These observations suggest that Bitcoin is transitioning from a speculative asset to a globally tradable macro-financial tool, with an increasingly diverse holder base and supported by robust trading, liquidity, and custody infrastructure.

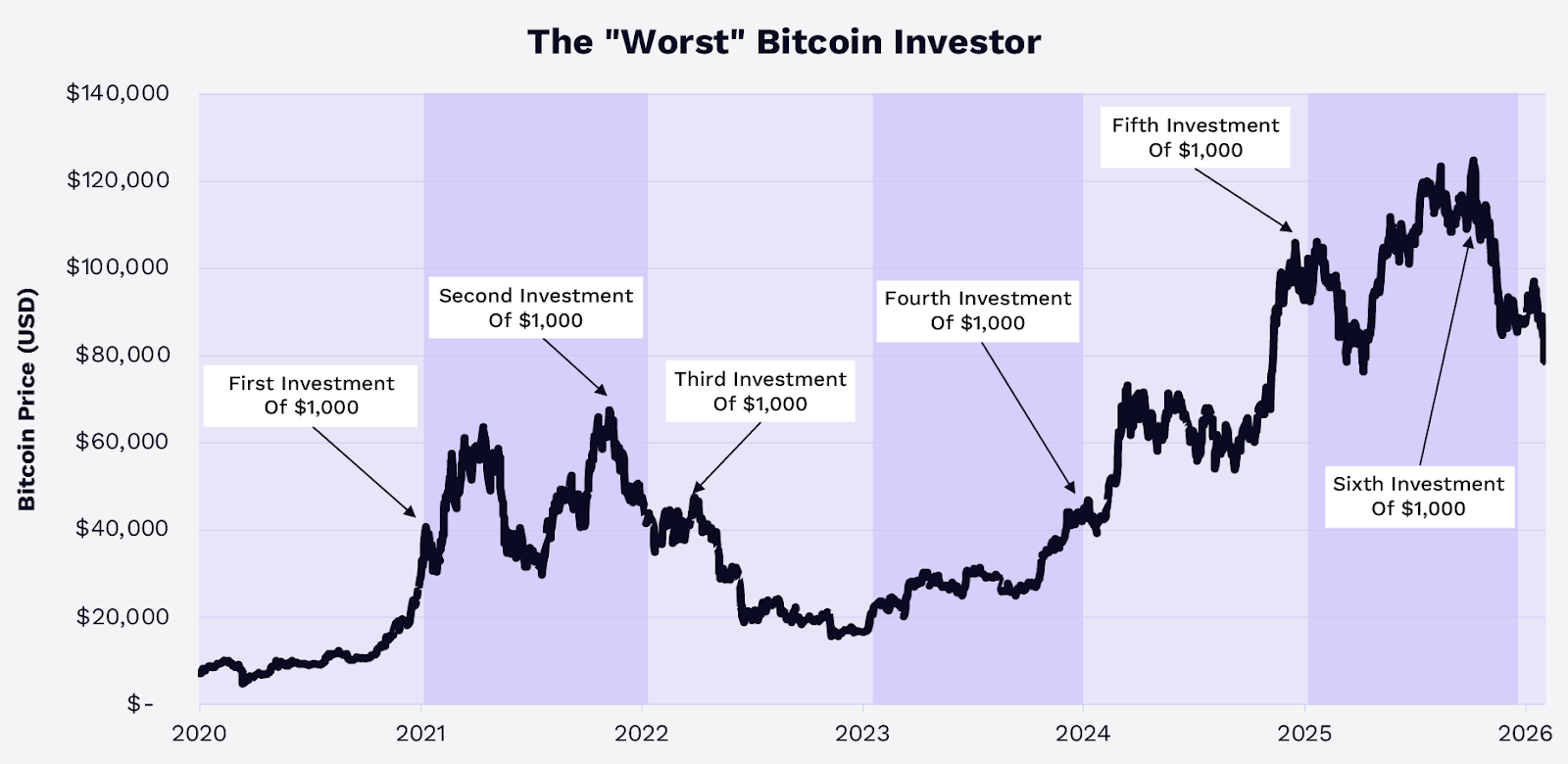

Long-Term Holding vs Timing the Market

According to Glassnode data, assuming a "least lucky" Bitcoin investor invested $1,000 each year at the peak price from 2020 to 2025, their investment would total approximately $6,000, which would appreciate to about $9,660 by December 31, 2025, and further to about $8,680 by January 31, 2026, yielding returns of about 61% and 45%, respectively (as shown in the figure below). Even considering the pullback in early February, by February 8, this investment would still amount to $7,760, with a return of about 29%.

Source: ARK Investment Management LLC and 21Shares, 2026, data from Glassnode, as of January 31, 2026

Thus, since 2020, the holding period and position size have been more important than when to buy: the market typically rewards those investors who focus on Bitcoin's value proposition rather than its volatility.

Strategic Questions for Bitcoin Today

In 2026, the narrative surrounding Bitcoin has shifted from whether it will "survive" to its role in a diversified portfolio. Bitcoin is:

- A scarce, non-sovereign asset amidst the evolution of global monetary policy, government deficits, and trade imbalances.

- A high-beta extension of traditional value storage assets (like gold).

- A global liquidity macro tool accessible through regulated instruments.

As advances in regulation and infrastructure lower barriers to entry, long-term holders including ETFs, corporations, and sovereign entities have absorbed a significant amount of new Bitcoin supply. Historical data also suggest that configuring Bitcoin could enhance a portfolio's risk-adjusted returns given its low correlation with other assets (including gold), especially after its volatility and drawdown magnitude have decreased across a complete market cycle.

ARK Invest believes that when investors evaluate this new asset class in 2026, the question will no longer be "whether" to allocate Bitcoin, but "how much" and "through what channels" to allocate.

Further reading: A Conversation with Cathie Wood: Eight Insights on the 2026 Grand Plan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。