作者:达伦终结者

近日界面新闻借着赵鼎新老师《社会与政治运动讲义》第三版出版的机会(本书第二版真是好书),采访了赵老师。赵老师在访谈中说道,芝加哥大学最近的种种削减经费的举措,是因为“据说校方似乎听了某些诺贝尔奖得主的投资建议,炒加密币输掉了六十多亿美元,可以说芝加哥大学的文科缩减与特朗普的政策没有什么关系。”

那么芝加哥大学真的炒币亏了六十多亿美元吗?

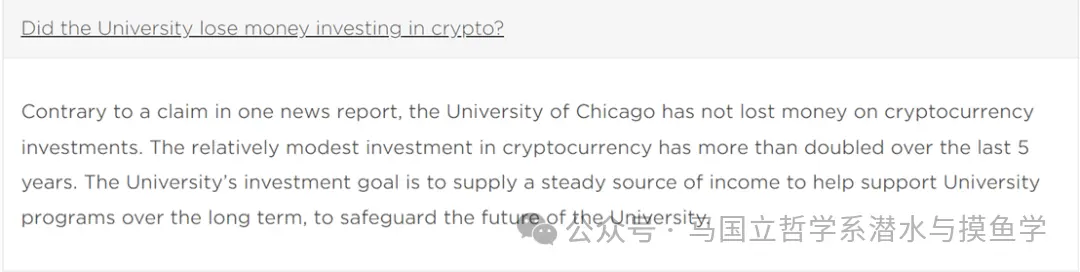

无独有偶,芝加哥大学2025年12月更新的答疑中[1],提到了炒币的事情。根据官方网站的说法:“与某一新闻报道中的说法相反,芝加哥大学并未在加密货币投资上遭受亏损。我校对加密货币的投资规模相对不大,但在过去五年中已增长至原来的两倍以上。我校的投资目标是提供稳定的收入来源,以长期支持我校各项项目,并保障我校的未来。”

那么芝加哥大学教务长就一定说真话了吗?

难说。可是从直觉上判断,芝加哥大学最近五年捐赠基金的总额大约在100亿美元上下(2021财年史高,约为116亿美元;2025财年约为109亿[2]),除非芝加哥大学真的疯狂到拿自己捐赠基金的至少60%去炒币(这显然违反各种规定),或者挪用大笔运营经费炒币,并且全亏掉了,否则应当不会亏六十亿这么多。

那么到底亏了多少?还是其实真如官方答疑所说,赚翻了?

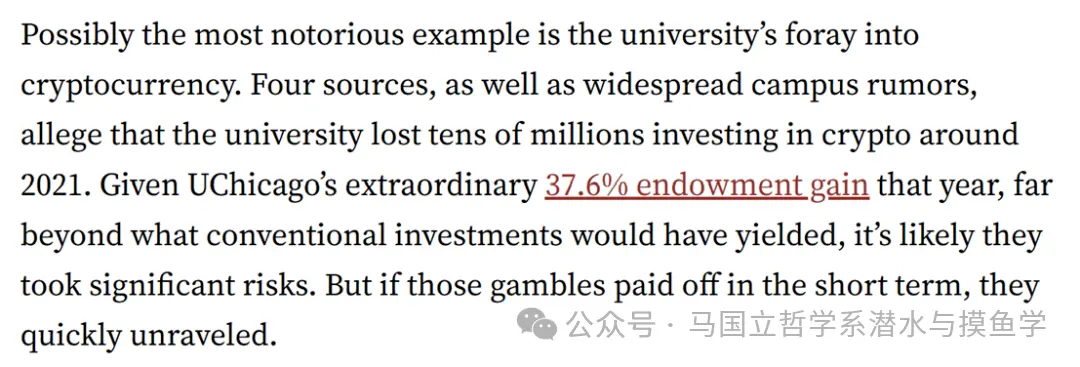

斯坦福大学校报[3],金融时报[4]和Investopedia[5]在去年报道了这件事。根据斯坦福校报的说法,他们的四个消息源指出:“芝加哥大学在大约2021年前后因投资加密货币投资,亏损了数千万(tens of millions)美元。

那么芝加哥大学的财报[6]怎么说?

很可惜,财报里并没有直接告诉我们究竟炒币亏了多少钱。不过,在2022财年的财报中,芝加哥大学公布了自己加密货币的投资(公允市场价值):截至2021年6月底约为六千四百万美元,而截至2022年6月底则约为四千五百万美元(差值约为一千九百万美元)。而在之后的财报中,或许是因为赚麻了,又或是因为亏麻了,芝加哥大学更改了统计方式,不再公布自己加密货币的投资了。不过,根据2025年的答疑的说法,芝加哥大学仍然在相对谨慎地投资加密货币。

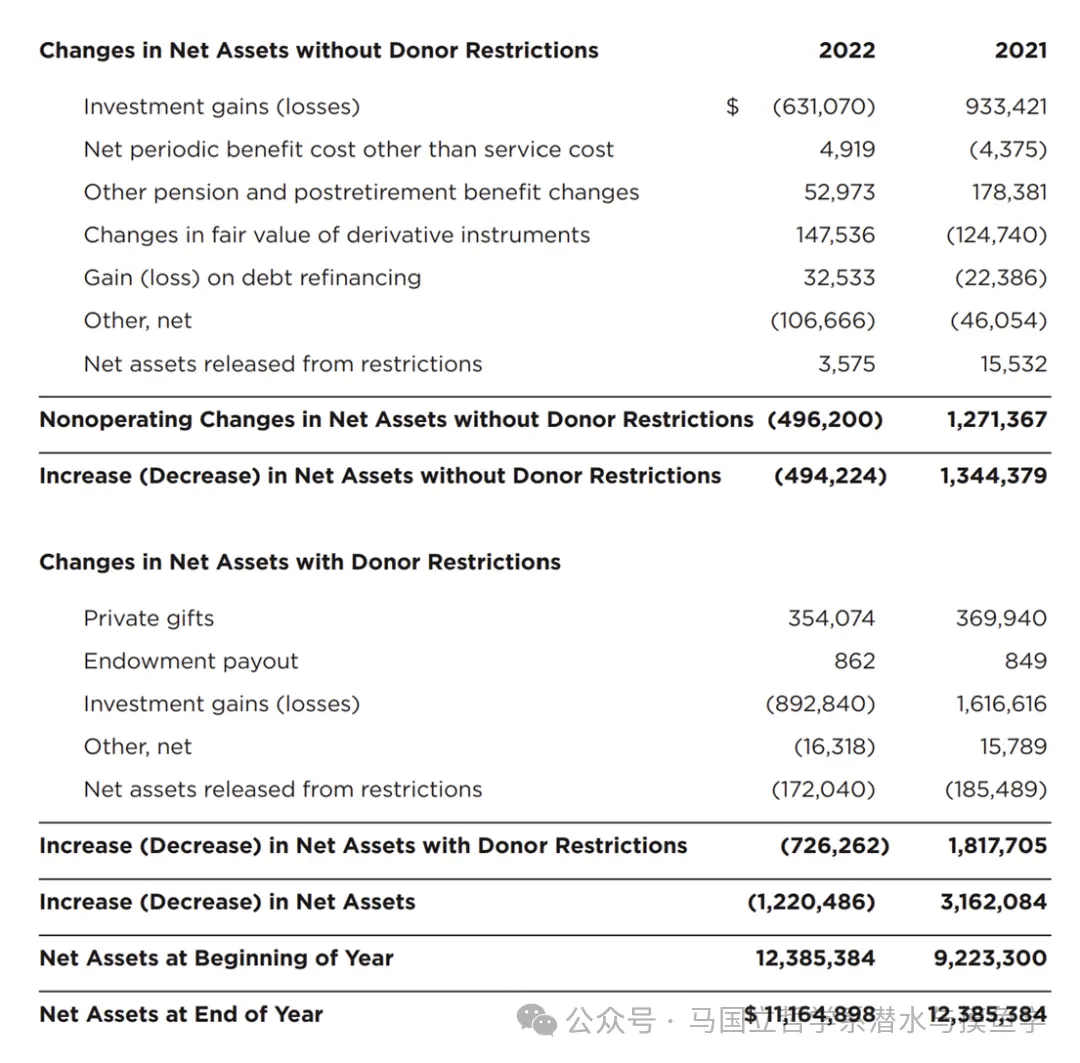

值得注意的是,2022年财报显示,截至当年六月底,芝加哥大学捐赠基金投资的总亏损竟然高约十五亿美元。2023年财报则显示,芝加哥大学的投资只是小亏了一笔。随后两年,芝加哥大学就翻红了。

只不过,我们不知道究竟这些亏损和盈利中,有哪些来源于炒币。斯坦福大学校报,则给出了一个不太靠谱的线索:“[芝加哥大学的]目标资产配置显示,大学对私募债务和‘绝对回报’类投资(其中包括加密货币等另类资产)的理想配置比例,已从2020年的25.5%下降到2022年的20%,这暗示了高风险另类资产出现了一轮明显的撤离(或下挫)。”

不过斯坦福大学校报也给出了一个很有意思的观察:“2013年至2023年期间,芝加哥大学捐赠基金的年化回报率仅为7.48%,而同期股市的年化回报率为12.8%,常春藤盟校的平均水平则为10.8%。如果芝加哥大学当初只是跟随市场表现,其捐赠基金如今将多出 64.5 亿美元。并且这笔(梦中的)资金已绰绰有余,可以偿还学校的全部债务。当然,大学不可能简单地复制市场指数,因为它们必须在经济下行时期进行对冲,以维持财务稳定。但即便芝加哥大学只达到其常春藤盟校这一近似同侪群体的平均水平,其捐赠基金规模如今也仍将多出36.9亿美元。这足以覆盖学校未来15年的当前预算赤字。”

不过,除了炒币和投资亏损,还有什么原因能解释芝加哥大学削减经费?

常见的说法,除了特朗普是流氓之外,还常常强调芝加哥大学自己的策略失误:举债加杠杆、大兴基建、激进扩张。[7][8]截至2025年六月底,芝加哥大学的负债约为九十二亿美元[9],约为捐赠基金的90%。虽然这些债务的融资成本相对较低,和大洋彼岸不太一样,但是芝加哥大学本财年所需支付的利息仍然高达两亿多美元。

这么高的债务当然不是凭空而来。自新世纪以来,芝加哥大学为了提升声望和招生,以及与各种老牌名校竞争,在新实验室、图书馆、宿舍、技术等方面花了大钱,并且这些扩张多以大量借债为支撑。可是,新基建带来持续运营成本,但学校没想好怎么长期供养。

芝加哥大学校报[10]引述该校教授Clifford Ando的说法指出,任何想送孩子上芝加哥大学的宝爸宝妈,都需要思考,你们辛辛苦苦交的学费,到底是在为孩子的教育买单,还是在替学校的债务埋单。而疯狂扩张与随之而来的债务问题,显然是学校管理层头脑发热、好大喜功的责任。更讽刺的是, 2006–2022 年间校长基础薪酬上涨了285%。如今遇到了一些经济问题,管理层却把困难转嫁给学生和一般教师:哪怕卖资产、裁员、停招的年份,高层薪酬也照涨不误。

那么下一步芝加哥大学该怎么办呢?

除了继续节流之外,当然要开源。显然,美国大学多收钱的一个惯用伎俩就是多招本科生。芝加哥大学也要这么做了,不过理由肯定是说得冠冕堂皇。

[1]https://provost.uchicago.edu/actions-budget

[2]本文中芝加哥大学的预算、捐赠基金和负债均为大学本部、医学中心(Medical Center)和海洋生物实验室(Marine Biological Laboratory)合并计算。常见的新闻报道(特别是芝加哥大学自己的宣传稿),通常于捐赠基金处合并计算,而于负债处只计算大学本部。

[3]https://stanfordreview.org/uchicago-lost-money-on-crypto-then-froze-research-when-federal-funding-was-cut/

[4]https://www.ft.com/content/4501240f-58b7-4433-9a3f-77eff18d0898?utm_source=chatgpt.com

[5]https://www.msn.com/en-us/money/careersandeducation/university-s-investment-losses-spark-outrage-resulting-in-drastic-program-cuts/ar-AA1Nxhgx

[6]https://intranet.uchicago.edu/en/tools-and-resources/financial-resources/accounting-and-financial-reporting/financial-statements

[7]https://www.wsj.com/us-news/education/colleges-face-a-financial-reckoning-the-university-of-chicago-is-exhibit-a-8918b2b0

[8]https://www.ft.com/barrier/corporate/d5c7c0f4-abf1-4469-8dca-87ff01cbebf6

[9]大学本部的负债约为六十亿美元。或许这是赵老师六十亿美元的来源。

[10]https://chicagomaroon.com/40486/news/uchicago-professor-sounds-alarm-over-troubling-university-finances/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。