美国总统特朗普在社交媒体上划出红线:任何不同意在经济表现良好时降息观点的人,都绝不会成为美联储主席。

白宫与美联储之间的博弈,因特朗普的直接施压而再度升级。当地时间12月10日,美联储宣布将联邦基金利率目标区间下调25个基点至3.5%-3.75%,这是其年内连续第三次降息,累计降息幅度达75个基点。

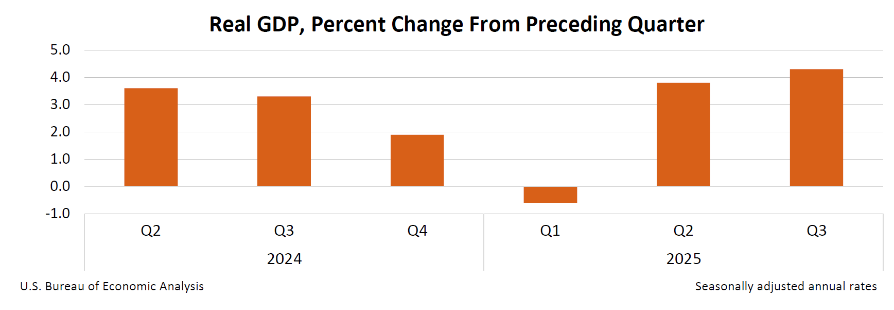

次日,美国商务部发布的数据显示,今年第三季度美国国内生产总值环比按年率计算增长4.3%。

面对经济增长超预期与持续降息并行,特朗普却在社交媒体上发文批评:“在过去,有好消息时,市场会上涨,如今有好消息时,市场却下跌,因为每个人都认为利率会立即上调以应对‘潜在的’通胀。”

一、最新施压

自特朗普重返白宫以来,他与美联储之间的矛盾几乎从未停歇。近期这场争执因一则消息和一份经济数据而变得更加具体和尖锐。

● 12月23日,美国商务部公布的首次预估数据显示,今年第三季度美国国内生产总值环比按年率计算增长4.3%。这一数字高于多数经济学家的预期,显示美国经济仍保持较强增长动力。

● 就在经济增长数据公布的第二天,特朗普在社交媒体上再次施压美联储。他希望美联储“在市场表现良好时降低利率,而不是无缘无故地摧毁市场”,并明确指出:“任何不同意我观点的人,都绝不会成为美联储主席!”

● 这已不是特朗普首次公开施压美联储。他之前曾多次批评美联储主席鲍威尔“糟糕”,并多次威胁要让鲍威尔“走人”。特朗普认为鲍威尔降息太慢,不符合其通过低利率刺激经济增长的政策取向。

二、施压层级

特朗普对美联储的施压并非一时兴起,而是层层递进,构成了一个完整的政治压力体系。

● 最为公开和直接的是舆论施压,特朗普通过社交媒体和公开声明不断批评美联储的利率政策。他多次表示,即使不降息,美国也做得很好,但降息后美国会更好。

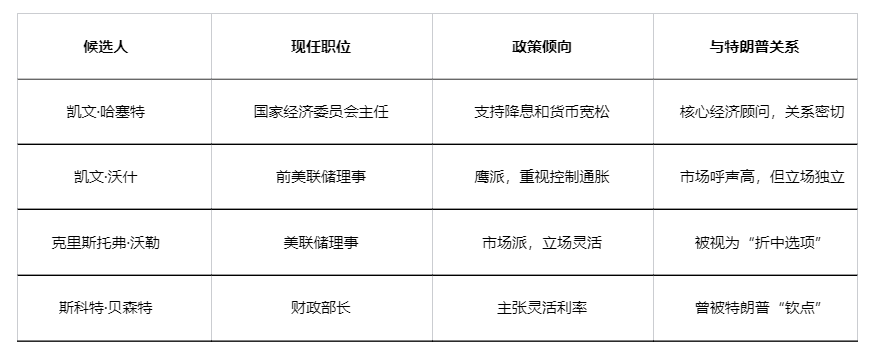

● 更深一层是人事布局。特朗普已多次表示,有意打破近期的市场趋势,并急于提名一位致力于降低借贷成本的主席。据《金融时报》报道,特朗普已将候选人名单缩小至三到四人,包括前美联储理事凯文·沃什、财政部长斯科特·贝森特、白宫国家经济委员会主任凯文·哈塞特和美联储理事克里斯托弗·沃勒。

● 最激进的一步则是法律挑战。据《纽约时报》披露,特朗普曾起草解雇美联储主席杰罗姆·鲍威尔的信件。尽管特朗普后来否认了这一说法,但这一举动被视为美国总统历史上对美联储独立性最直接的挑战。

三、政治分歧

白宫与美联储的这场博弈,引发了美国政坛的两极反应,直接反映了美国经济治理体制内部的深刻矛盾。

● 在共和党内部,掌握金融与预算事务的议员对此持明显保留态度。银行委员会成员汤姆·蒂利斯明确表示:“终止美联储独立性将是一个巨大的错误”,并警告如果真的罢免主席,参议院将“迅速回应”。

● 民主党方面则普遍认为此举损害了美国经济治理机制和国际信用,是“政治干预金融”的危险信号。多位民主党参议员明确表示,特朗普此举打压了美联储独立性。

● 华尔街与财经界对此表示了普遍担忧。多家金融机构分析人士认为,此举将导致市场波动,并可能引发投资者对美元与美国国债信用的担忧。

四、经济困境

当前美联储面临的决策困境,源于美国经济“滞”与“胀”并存的矛盾局面。

● 增长强劲与通胀黏性形成对比。美国第三季度GDP增长4.3%,但通胀压力并未缓解。美联储偏好的PCE指标9月同比上涨2.8%,虽略低于预期,却远高于2%的政策目标。

● 与此同时,就业市场已出现降温信号。10月美国雇主裁员和解职数量达185.4万个,为2023年1月以来最高。这种“就业下行+通胀黏性”的组合,让美联储陷入“保就业”与“控通胀”的两难境地。

● 美联储最新一次议息会议的表决结果也反映出这种内部矛盾。12名投票委员中9人支持降息,3人投出反对票,这是2019年9月以来的首次。这种“滞胀式”矛盾将长期考验政策制定者,美联储的“等待观察”立场可能成为全球央行的普遍选择,政策响应的滞后性将加剧市场波动。

五、继任者角逐

随着鲍威尔任期将于2026年5月结束,围绕下任美联储主席人选的角逐已悄然展开。

特朗普已将候选人名单缩小至“三到四人”。在众多可能人选中,几位关键人物各具特点:

● 凯文·哈塞特作为国家经济委员会主任,是特朗普的核心经济顾问,支持降息和货币宽松。

● 凯文·沃什,前美联储理事,舆论称其为“鹰派代表”,重视控制通胀和金融稳定。

● 克里斯托弗·沃勒,现任美联储理事,政策立场偏“市场派”,在加息与宽松之间立场较灵活,被视为一种“折中选项”。

● 斯科特·贝森特,现任财政部长,市场派风格,主张灵活利率与财政协调,曾被特朗普“钦点”。

以下为可能的美联储主席候选人政策立场对比:

无论谁最终获得提名,这位新主席都将面临如何在政治压力与专业判断之间找到平衡的巨大挑战。

标普500指数在GDP数据公布后,连续第四天上涨并创下历史新高。这一市场反应与特朗普描述的“好消息就是坏消息”悖论相悖,似乎表明市场正在自我调节。

特朗普在12月初表示,他已将美联储主席提名候选人名单缩小到“三到四人”,并预计将很快做出决定,将在“未来几周内”宣布。凯文·哈塞特和凯文·沃什被认为是这一职位的领跑者,而克里斯托弗·沃勒也曾受到特朗普面试并得到赞扬。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。