Senior policy officials from Bank of America, JPMorgan Chase, and Wells Fargo will sit face-to-face with representatives from the cryptocurrency industry at the White House, as negotiations surrounding stablecoin yields may determine the competitive landscape of the future U.S. financial system.

Sources in Washington have revealed that the White House will hold a second round of closed-door meetings on cryptocurrency next week, with the core agenda focused on regulating stablecoin yields.

Unlike previous meetings, this one will be the first to invite senior policy officials from several major banks, including Bank of America, JPMorgan Chase, and Wells Fargo.

The banking sector is concerned that cryptocurrency companies paying interest to stablecoin holders could lead to a significant outflow of funds from the traditional banking system, thereby affecting the stability of bank loan funding. This concern has been somewhat acknowledged by Treasury Secretary Scott Bentsen.

1. Meeting Background

● The upcoming White House cryptocurrency meeting is the second round of a series of meetings, still at the staff level, and will not invite CEOs from various companies.

● The list of attendees shows that major banks such as Bank of America, JPMorgan Chase, and Wells Fargo have confirmed their invitations, with PNC Bank, Citibank, and U.S. Bank also likely to be included.

● Representatives from the banking industry include the Bank Policy Institute, the American Bankers Association, and the Independent Community Bankers of America. Notably, the number of representatives sent by each party is expected to decrease, indicating that the meeting may focus more on substantive negotiations.

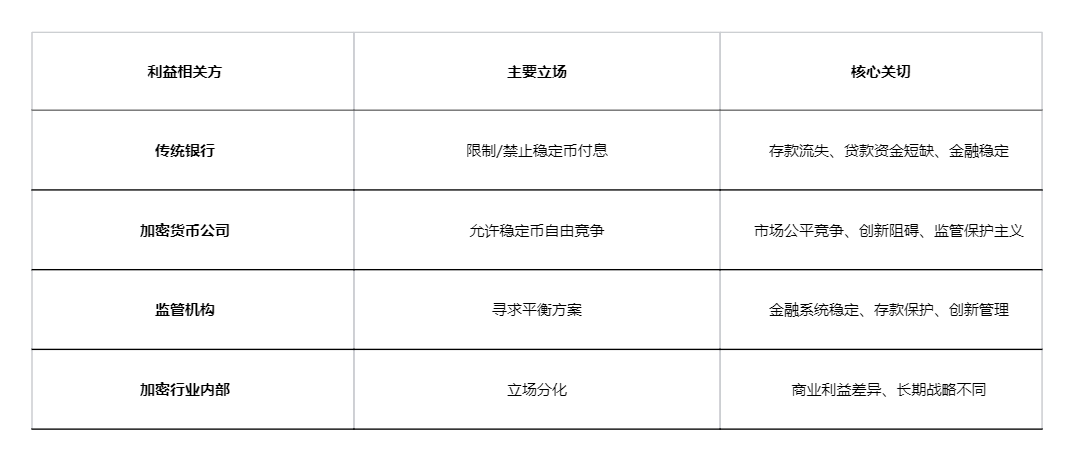

2. Points of Controversy

● The positions of banks and cryptocurrency companies on stablecoin yields are sharply opposed. The banking industry wants to limit the interest that cryptocurrency companies can offer on stablecoins, believing it poses a threat to their own business. Banks are concerned that a large influx of funds into high-yield cryptocurrency accounts could lead to a shortage of bank loan funding and potentially trigger broader financial turmoil.

● Banking lobbyists point out that approximately $6.6 trillion in bank deposits could be threatened by yield-generating stablecoins. Cryptocurrency companies argue that the banks' actions aim to undermine market competition, maintain their regulatory barriers, and stifle innovation.

3. Legislative Connections

This meeting is directly related to the future of the Cryptocurrency Market Structure Act, which aims to establish a clear regulatory framework for the digital asset market.

● According to a report from the Congressional Research Service, the bill would give the CFTC a central role in regulating digital commodities and related intermediaries while retaining certain jurisdiction over primary market cryptocurrency trading for the SEC.

● The bill defines digital commodities as “digital assets inherently linked to blockchain, whose value derives from or is reasonably expected to derive from the use of blockchain systems.” Currently, the issue of stablecoin yields has become a focal point of the White House's attention, even surpassing other contentious points such as ethics or decentralized finance.

4. Positions of Various Parties

● Recent statements from Treasury officials indicate that a regulatory stance is forming. Treasury Secretary Scott Bentsen stated, “I have always been an advocate for these small banks; deposit volatility is highly undesirable. We will continue to work to ensure that stablecoin yield payments do not lead to deposit volatility.”

● There are divisions within the cryptocurrency industry on this issue. Coinbase CEO Brian Armstrong has withdrawn his support for the bill, stating that “bad laws are worse than no laws.”

● Meanwhile, Kraken co-CEO Arjun Sethi continues to support the bill, warning that failure of the bill could have consequences. Blockchain Association CEO Sumner Mersing stated that the cryptocurrency industry holds internal meetings almost daily to coordinate positions and prepare realistic proposals.

5. Market Impact

● The stablecoin market now has a total size of $300 billion. The market capitalization of USDC alone reached $74 billion in the third quarter of 2025. The average holding of USDC on the Coinbase platform is $15 billion, which means billions of dollars in revenue are at risk. For banks, this also relates to protecting their traditional deposit business.

● Analysts have differing assessments of the likelihood of the bill passing. Betting odds on Polymarket have dropped from 80% to 50%.

● Ron Hammond, policy director at Wintermute, believes the probability of passage is only 40%, while TD Cowen analyst Jarrett Seberg warns that Coinbase's exit could derail the entire legislative process during this session.

6. Industry Response

● In the face of regulatory pressure, the cryptocurrency industry is beginning to adjust its strategy. Industry analysts suggest that individual users should reassess their asset portfolios, leaning towards assets that may be explicitly classified as “digital commodities.”

● There is also a need to reconfigure stablecoin strategies and seek alternative yield solutions. If the bill leads to zero interest for compliant exchanges, consider shifting funds to non-custodial on-chain DeFi protocols.

● The industry also needs to be cautious about the real-world asset sector, being wary of liquidity traps. Given the Senate's revised version shows an extremely harsh attitude towards real-world assets, it may even prohibit their listing on compliant exchanges.

7. Future Direction

● Patrick Whitt, executive director of the White House cryptocurrency committee, urged all parties to reach an agreement by the end of this month. Banking industry sources indicate that they have reached a consensus on important principles but are participating in the meeting with a positive mindset, optimistically believing that results can be achieved.

● The American Bankers Association previously stated that preventing the growth of stablecoin yields will be one of its main priorities for 2026. Representatives of financial institutions are concerned about trillions of dollars in potential outflows and weakened lending capacity.

● This meeting will test the White House's ability to mediate between traditional finance and the emerging cryptocurrency industry, and its outcome may set the tone for digital asset regulation in the U.S. for the coming years.

After the meeting, the cryptocurrency market reacted swiftly. Major cryptocurrency prices fluctuated as traders assessed the potential impacts of the regulatory negotiations.

Coinbase's stock fell slightly in after-hours trading, while traditional bank stocks remained stable. An anonymous attendee stated, “The negotiations are proving to be more difficult than expected, with both sides holding firm on their positions.”

The Chief Strategy Officer of stablecoin issuer Circle posted on social media, stating, “We still believe that a reasonable regulatory framework can balance innovation and financial stability, but certain provisions in the current draft may need to be reconsidered.”

The White House Press Secretary, when asked about the meeting during a routine press conference, stated, “The government continues to be committed to providing a clear and balanced regulatory framework for the digital asset market, protecting consumers while promoting innovation.” However, she declined to disclose specific details or progress from the meeting.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: [https://aicoin.com/link/chat?cid=l61eM4owQ](https://aicoin.com/link/chat?cid=l61eM4owQ]

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。