Author: Thejaswini M A

Translated by: Block unicorn

A pattern recurs across various industries, eras, and markets. First, there is explosive growth. Countless products emerge like mushrooms after rain, each claiming to do something better than any other. Specialized tools abound, and niche tools also proliferate. Consumers are told that choice is freedom, customization is power, and the future belongs to those who break traditional monopolies.

Then, quietly yet inevitably, the pendulum begins to swing back.

Not because the experts were wrong, nor because the overall system is so good, but because the costs of fragmentation accumulate silently. Each new tool means remembering another password, learning another interface, and adding another point of failure to a system you were originally responsible for maintaining. Autonomy begins to feel like a burden, and freedom starts to become an extra expense.

In the integration phase, the ultimate winners are not those who do everything perfectly, but those who do enough things well enough that the friction of leaving (to rebuild the entire system elsewhere) becomes insurmountable. They do not bind you with contracts or lock-in clauses, but capture you with convenience. This convenience comes from countless subtle integrations and accumulations of efficiency, which may not seem worth giving up individually, but together form a moat.

We have seen this happen in e-commerce, cloud computing, and streaming. Now, we are witnessing this in the financial sector.

Coinbase has just made a bet on which side of the cycle we are about to enter.

Let me rewind a bit.

For most of its development, Coinbase has been clear and straightforward. It is the preferred platform for Americans to buy Bitcoin, allowing them to feel they are not doing anything suspicious. It has regulatory licenses, a clean interface, and while customer service often performs poorly, it at least theoretically exists. The company went public in 2021 with a valuation of $65 billion, with the core idea of being the entry point to cryptocurrency, which indeed held true for a while.

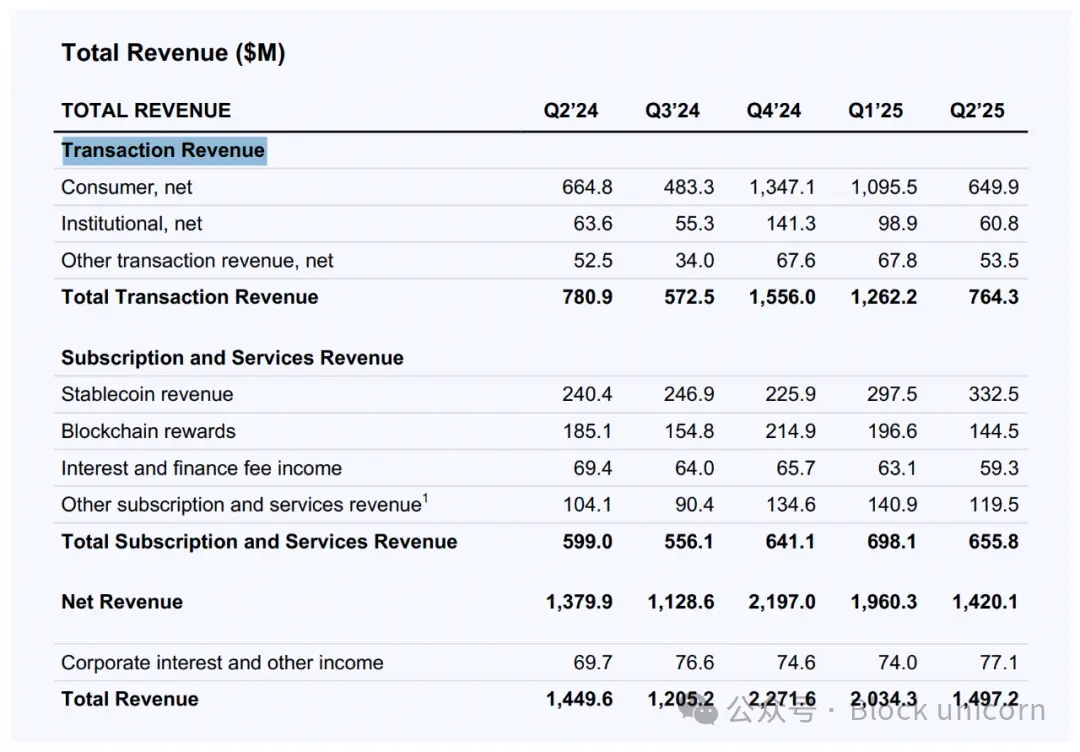

But by 2025, the positioning of "cryptocurrency entry" began to look less favorable. Spot trading fees were continuously compressed. Retail trading volumes exhibited severe cyclical fluctuations, soaring in bull markets and plummeting in bear markets. Bitcoin whales increasingly preferred to use self-custody wallets. Regulators were still suing the company. Meanwhile, Robinhood, which started as a stock trading app and later ventured into cryptocurrency, saw its market cap suddenly soar to $105 billion, nearly double that of Coinbase. In 2021, over 90% of Coinbase's revenue came from trading. By the second quarter of 2025, that figure had dropped to below 55%.

So, when the core product faced pressure, Coinbase adopted the strategy you would take: it tried to become everything else.

They call it the theory of "everything exchange," which posits that aggregation will outperform specialization.

Stock trading means users can now react to Apple's earnings report at midnight using USDC without leaving the app. Prediction markets mean they can check the price trends of "Will the Fed cut rates?" during lunch. Perpetual futures mean they can leverage their Tesla position 50 times on a Sunday. Every new market that emerges is a reason to open the app, an opportunity to capture spreads, fees, or interest on idle stablecoin balances.

This strategy is about "let's become Robinhood" or "let's ensure users never need Robinhood."

There has long been a view in fintech that users need specialized applications. For example, one app for investing, one for banking, one for payments, and one for cryptocurrency trading. Coinbase, however, goes against this: they believe that once users complete a KYC verification and link a bank account, they shouldn't have to repeat that nine more times elsewhere.

This is the argument for "aggregation over specialization." In a world where underlying assets are increasingly just tokens on a blockchain, this argument makes sense. If stocks are tokens, prediction market contracts are tokens, and meme coins are also tokens, why can't they all be traded in the same marketplace?

The mechanism works like this: you deposit dollars (or USDC), the exchange trades all assets, and then you withdraw dollars (or USDC). No need to transfer funds between different platforms. No minimum deposit requirements for multiple accounts. There is only one pool of funds flowing between all asset classes.

The more Coinbase resembles traditional brokers, the more it needs to compete under traditional broker rules. Robinhood has 27 million funded accounts, while Coinbase has about 9 million monthly active users. Therefore, Coinbase's differentiation cannot merely be "we also offer stock trading now," but must be reflected in the trading platform itself.

They promise to provide 24/7 uninterrupted liquidity covering all types of trades. No trading time limits, no settlement delays, and no waiting for brokers to approve your margin application when trades are not in your favor.

Is this important to most users? It may not be at the moment. Most people do not need to trade Apple stock at 3 AM on a Saturday. But some do. If your platform allows them to trade, you can capture their trading flow. Once you capture their trading flow, you can obtain their data. Once you have their data, you can build better products. Once you have better products, you can capture more trading flow.

This is a flywheel, provided the flywheel can start turning.

Prediction Market Games

Prediction markets are the most unusual part of this combination, and perhaps the most important. They are not "trading" in the traditional sense, but structured bets on binary outcomes. For example: Will Trump win? Will the Fed raise rates? Will the Lakers make the playoffs?

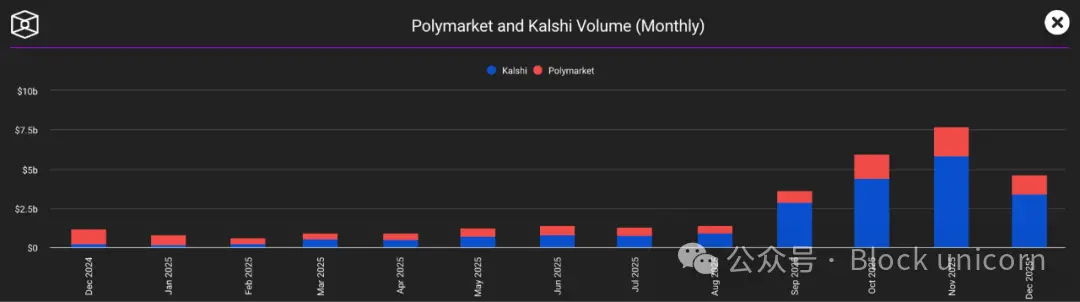

These contracts disappear after settlement, so there is no long-term holder group. Liquidity is event-driven, meaning liquidity can be volatile and unpredictable. However, platforms like Kalshi and Polymarket saw their trading volume soar to over $7 billion in November.

Why? Because prediction markets are a social tool. They allow people to express their opinions and take on corresponding risks. They make people check their phones during the fourth quarter of a game or on election night.

For Coinbase, prediction markets solve a specific problem: user engagement. When cryptocurrency prices are stagnant, users may feel bored. When your stock portfolio is flat, stock trading can also become tedious. But there will always be events happening that capture people's attention. Integrating Kalshi allows users to have a reason to stay in the app even when Bitcoin prices are not fluctuating.

The bet is that users coming from the election market will continue to engage in stock trading, and vice versa. The bet is that the broader the coverage, the higher the user stickiness.

The Business Model Centers on Profitability

Setting aside the innovative narrative, you will find that this is actually a company trying to profit from the same user in more ways. Stock trading fees, decentralized exchange (DEX) swap spreads, stablecoin balance interest, cryptocurrency lending fees, Coinbase One subscription revenue, and infrastructure fees for developers using the Base blockchain.

I am not criticizing. This is how exchanges operate. The best exchanges are not those with the lowest fees, but those that users are reluctant to leave, because leaving means rebuilding the entire system elsewhere.

Coinbase is building a closed ecosystem, but these walls are not meant to lock in users; they are meant to provide convenience. You can still withdraw your cryptocurrency, and you can still transfer your stocks to Fidelity. It’s just that you might not do so, because why would you?

Coinbase's advantage lies in its on-chain technology, which can provide tokenized stocks, instant settlement, and programmable money. But for now, its stock trading is very similar to Robinhood's, just with longer trading hours. Its prediction markets are also very similar to Kalshi's, just embedded in a different application.

The real differentiation advantage lies in the Layer 2 blockchain Base that Coinbase builds and controls. If stock trading truly occurs on-chain, payments are genuinely made using stablecoins, and AI agents start trading autonomously using the x402 protocol, then Coinbase will have created a product that is difficult for Robinhood to replicate easily.

But that is a long-term consideration. In the short term, the key to competition lies in whose app has the highest user stickiness. Adding more features does not automatically enhance user stickiness. On the contrary, it may make the app interface more cluttered and complex, leaving new users who just want to buy Bitcoin feeling overwhelmed.

Some cryptocurrency users may be dissatisfied with this. They are true believers. They want Coinbase to be the gateway to decentralized finance, not a centralized super app with some DeFi features hidden in submenus.

Coinbase has clearly chosen scale over purity. What it wants is a billion users, not a million purists. It wants to be the default financial platform for the masses, not the preferred exchange for those running self-hosted nodes.

This may be the right business decision. The mass market does not care about decentralization. They care more about convenience, speed, and avoiding economic loss. If Coinbase can meet these needs, then the underlying philosophy becomes irrelevant.

But this does create a peculiar contradiction. Coinbase is trying to be both the infrastructure of the on-chain world and a centralized exchange competing with Charles Schwab. It is trying to be both an advocate for cryptocurrency and a company that makes cryptocurrency invisible. It is trying to maintain a rebellious spirit while accepting regulation.

Maybe it can be done. Perhaps the future will be a regulated on-chain exchange that is as convenient to use as Venmo. Or perhaps trying to please everyone will ultimately make you irrelevant to everyone.

This is Amazon's strategy. Amazon is not the best at any one thing. It is not the best bookstore, nor the best grocery store, nor the best streaming service. But it does everything well enough that most people are too lazy to go elsewhere.

However, many companies try to create an all-encompassing app, but most end up creating a chaotic app.

If Coinbase can control the complete cycle from earning, trading, hedging, lending to payments, then it does not matter if certain specific features are slightly inferior to specialized competitors. The switching costs and the hassle of managing multiple accounts will keep users within its ecosystem.

That’s all about Coinbase's universal exchange.

Recommended Reading:

Why Asia's largest Bitcoin treasury company Metaplanet is not bottom-fishing?

Multicoin Capital: The era of fintech 4.0 has arrived

a16z-backed Web3 unicorn Farcaster forced to pivot, is Web3 social a false proposition?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。