Most financial institutions don't touch crypto because they can't.

Banks need private flows and verified accounts with full transaction attribution, which is opposite to what public blockchains offer.

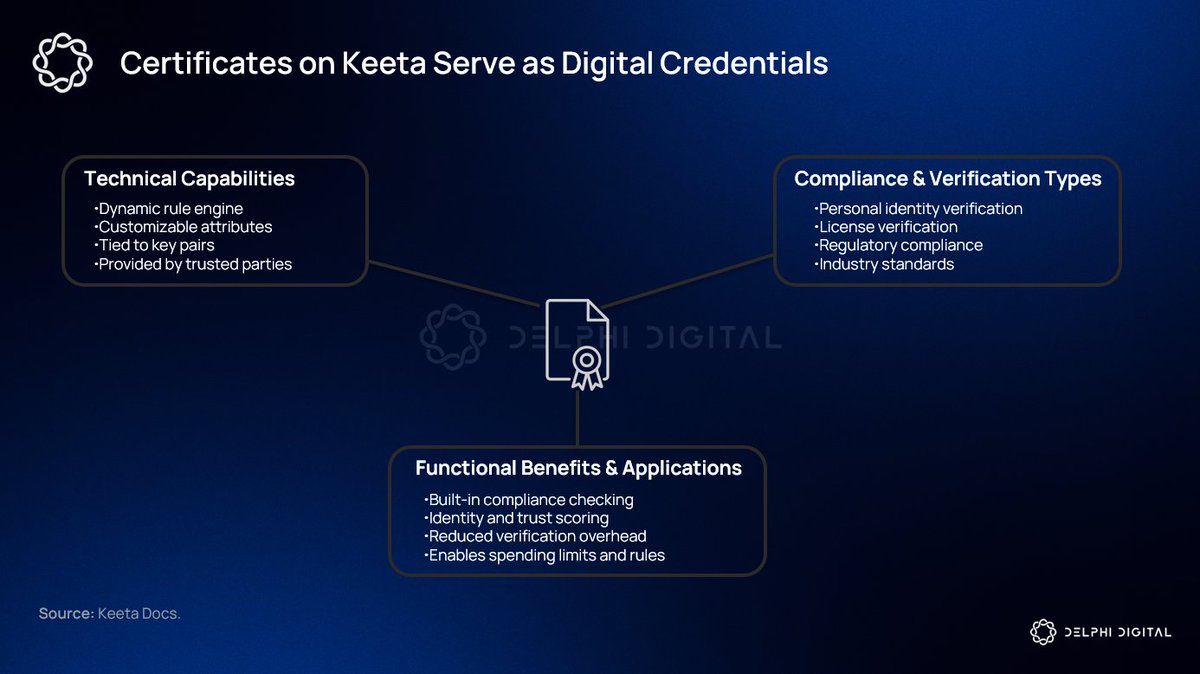

@KeetaNetwork is building for this gap. Their approach uses onchain identity certificates via the X.509 standard, the same cryptographic framework used across internet protocols). Wallets get tied to verifiable identity attestations without exposing the underlying personal data.

With selective disclosure, users can prove specific attributes (KYC status, jurisdictional permissions, business licenses) to counterparties without revealing everything else. Compliance is enforced at the protocol level while pseudonymity is preserved on the public ledger.

Keeta has also built a permission system around asset issuance that includes jurisdictional restrictions, KYC-gated transfers, and role-based permissions for custodians. These features are standard in traditional finance but still missing from most crypto infrastructure.

Keeta is building the compliant rails institutions need before they can move onchain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。