美国通胀放缓数据带来的美股狂欢,未能阻挡比特币跌破86,000美元关口,整个加密市场市值在隔夜交易中再度蒸发。

东八区时间12月19日,比特币在隔夜市场下行跌破86,000美元,最低触及85,450美元。

以太坊一度短时跌破2800美元,SOL则跌破120美元。全球加密货币总市值在隔夜重挫中失守3万亿美元大关,现报约2.96万亿美元。

一、行情速览

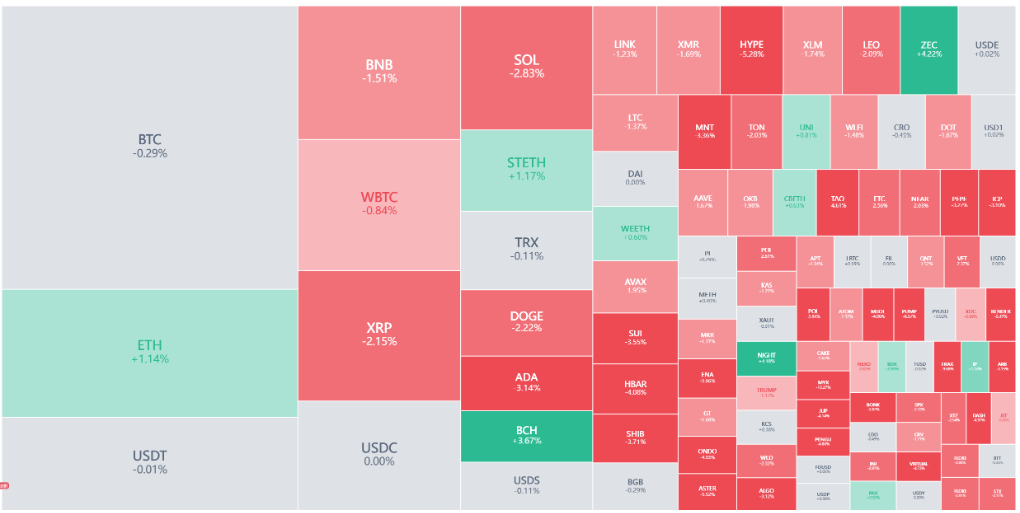

● 隔夜加密市场再现普跌。比特币现报85,382美元,24小时跌幅0.68%。此前,比特币已跌破86,000美元的关键支撑位。以太坊现报价2,825美元,24小时微跌0.02%。更多山寨币(Altcoins)跌幅更为显著。

● 部分山寨币成为领跌主力:PUMP和GIGGLE均暴跌11.41%,AXL下跌9.3%,DOLO下跌8.7%,VELODROME下跌8.8%。

市场恐慌情绪蔓延。加密货币恐惧与贪婪指数已降至16,“极度恐惧”区域。

二、市场结构

● 本轮回调呈现明显的结构性分化。高风险板块和山寨币承受了更大压力。在各类细分板块中,AI概念板块领跌5.34%,其中Fartcoin(FARTCOIN)下跌19.81%。Meme币板块整体下跌4.76%。

● 与此同时,比特币表现出了相对较强的抗跌性。尽管价格下跌,但其跌幅远小于许多山寨币。这种分化表明,在市场避险情绪升温时,资金正从高风险资产向相对稳健的资产转移。

三、下跌动因

本次下跌并非单一因素导致,而是多重压力共同作用的结果。

● 首要压力来自宏观货币政策环境的变化。市场普遍预期,日本央行可能将利率上调至三十年来的最高水平,这一预期正撬动全球日元套利交易的松动。历史数据显示,过去三次日本央行加息后的4至6周内,比特币均下跌了20%至30%。

● 与此同时,美联储在完成首次降息后,后续路径尚不清晰,市场开始主动下调对2026年流动性的预期。

● 链上数据也揭示了直接压力。12月18日,比特币交易所净流入达到3,764 BTC,创下阶段性高点,明显指向大户集中充值、准备抛售的行为。

● 矿工层面也出现抛售迹象。比特币全网算力出现显著下跌,根据F2pool数据,截至12月15日,比特币全网算力暂报988.49 EH/s,较前一周下跌17.25%。

市场分析认为,近期可能有大量比特币矿机关机,矿工在流动性紧缩期被迫出售比特币。

四、与美股的背离

与加密市场的疲软形成鲜明对比的是,美股隔夜集体收涨。

● 道指收涨0.14%,标普500指数涨0.79%,纳斯达克综合指数表现尤为强劲,大涨1.38%。大型科技股普涨,特斯拉涨超3%,英伟达涨近2%。这一涨势主要受到通胀数据放缓的提振。美国11月核心CPI同比增长2.6%,创四年来最低增速,数据有利于美联储明年降息。

● 然而,加密货币并未跟随美股反弹,反而在短暂冲高后回落。比特币在美股盘前一度涨破8.94万美元,但在美股早盘尾声时转跌,午盘跌破8.55万美元。

这种背离突显了加密货币市场当前独立面临的流动性压力和避险情绪。

五、概念股分化

美股加密概念股表现涨跌不一,未能形成统一趋势。

● Strategy (MSTR)下跌1.33%,Coinbase (COIN)下跌2.04%,MARA Holdings (MARA)下跌2.4%。但与此同时,Riot Platforms (RIOT)逆势上涨3.24%,Circle(CRCL)也上涨2.38%。

● 值得注意的是,特朗普媒体科技集团(DJT)股价在合并消息刺激下大幅飙升41.9%。该公司宣布将与获得Alphabet支持的核聚变能源公司TAE Technologies进行全股票交易合并,交易总价值超过60亿美元。

● 合并后的公司计划于2026年选址并开始建设全球首座公用事业规模的聚变发电厂。这一消息刺激了市场对颠覆性能源技术的热情,但并未惠及加密货币领域。

六、前景展望

技术分析显示,比特币当前在85,800至86,000美元区域存在关键支撑,这是一个重要的心理关口。

● 若这一支撑区域被有效跌破,比特币可能进一步下探至82,000至84,000美元区间,甚至考验78,000至80,000美元的历史需求密集区。动量指标显示市场已接近超卖区域,短期可能出现技术性反弹。

● 对于整个加密货币市场而言,2.87万亿美元市值水平构成短期支撑。市场需要重新站稳2.93万亿美元上方,才能开启向3万亿美元大关的回归之路。

● 宏观层面,市场的下一步走向将高度依赖全球主要央行的政策协调。分析师指出,当前全球货币政策正处于“高度分化、难以形成合力的阶段”,这种“不统一的流动性环境”往往比明确的紧缩更具杀伤力。

比特币价格紧贴85,000美元边缘,交易者屏息等待下一个方向的突破。加密货币与美股科技股的相关性已升至近0.9的高位,但昨夜两者的走势却截然相反。

市场对日本央行加息的预期如悬顶之剑,而美联储降息路径的迷雾仍未散去。在新疆矿场关机传闻和链上大额转出的阴影下,加密世界正在经历一场流动性紧缩的考验。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。