政府停摆造就了历史性的统计空白,这张拼图式的CPI报告,每一块都可能让美联储和市场得出不同的方向。

东八区时间12月19日(周四)21:30,美国劳工统计局(BLS)将公布11月消费者价格指数(CPI)报告。

因政府停摆,这是自9月以来的首次通胀数据发布。此次报告不仅因10月数据缺失而变得复杂,其质量也因数据收集不完整而面临质疑。

一、市场预期与核心关切

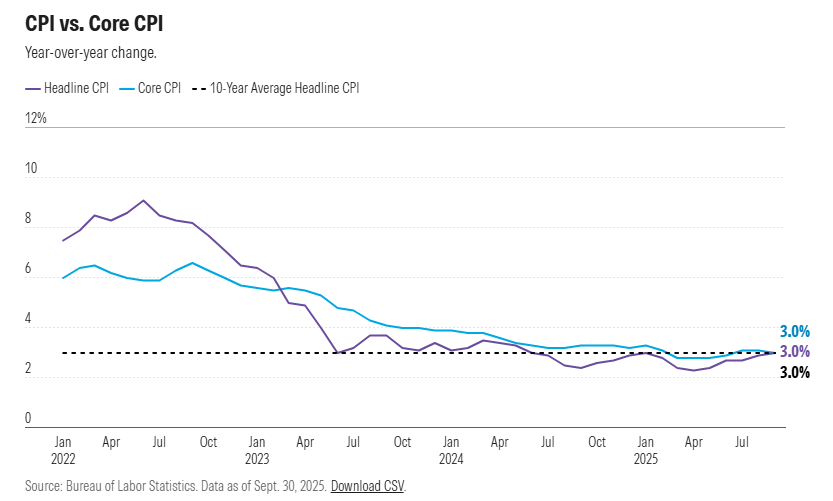

● 根据财经数据公司FactSet的共识预测,经济学家普遍预计11月CPI将较去年同期上涨3.1%,略高于9月的3.0%。剔除食品和能源价格波动的核心CPI,同比涨幅预计也达到3.1%。

● 从环比(月率)角度看,由于官方将无法提供对比上月的变化数据,经济学家通过对比9月水平来估算,预计整体CPI环比增长0.25%,核心CPI环比增长0.3%。

● 法国外贸银行首席美国经济学家克里斯托弗·霍奇(Christopher Hodge)直言,市场更关注的正是环比变化,因其更能揭示通胀短期趋势,而同比数据则信号有限。

二、双月数据与质量疑云

● 十月数据的缺失是核心挑战。由于联邦政府停摆打断了价格数据的收集,BLS取消了10月的CPI发布。官方发言人称,11月的新闻稿和数据库中,将不包含单月环比百分比变化数据。

● 因此,11月的CPI报告实质上反映的是9月至11月这两个月的价格累积变化。里士满联储在一篇分析中指出,这是历史上前所未有的情况,自1921年1月以来,月度CPI数据系列首次出现这样的中断。

● 数据质量问题同样突出。高盛经济学家指出,由于停摆至11月13日才结束,加之感恩节假期,当月可用于采集价格数据的时间明显缩短,收集到的样本数量可能少于往常。

● 由于许多商品价格在11月中旬假日促销季开始时通常会下降,集中在后半月的价格收集可能对数据产生下行偏差。

三、推动通胀的主要力量

● 关税被普遍认为是推高商品通胀的关键因素。经济与政策研究中心的分析预计,自9月以来,汽车、家电和服装等商品的价格在关税影响下持续上涨。

● 住房成本可能呈现分化态势。主要住宅租金和业主等价租金的通胀率在9月已显现放缓迹象。尽管11月租金可能有所反弹,但盈透证券经济学家何塞·托雷斯认为,高企的抵押贷款利率和紧缩的移民政策将继续限制住房成本的强劲反弹。

● 此外,食品通胀可能保持高位。9月批发层面的食品价格(特别是牛肉和火鸡)出现了显著跳涨。

● 能源与保险方面,受季节性调整影响,汽油价格可能在报告中显示为上涨,而汽车保险价格预计将再次录得可观涨幅。

四、美联储的两难抉择与市场展望

● 通胀前景对美联储货币政策至关重要。当前市场预测的3.1%的通胀率,仍比美联储2%的长期目标高出超过一个百分点。

● 纽约联储的最新调查显示,美国家庭对未来一年的通胀预期中值维持在3.2%,未来三年和五年的预期则稳定在3%。

● 部分经济学家认为,如果关税水平不再进一步提高,其对通胀的推动应视为一次性效应,未来通胀可能再次趋于缓和。例如,托雷斯预计到2026年夏季,通胀可能稳定在2.5%左右。

五、如何解读这份“非标准”报告?

鉴于报告的特殊性,多家机构建议投资者保持审慎。

● 瑞银(UBS)的经济学家认为,市场应“几乎不用关注”即将发布的11月CPI数据,因为它的信息基础弱于常规月份,且依赖于未完全披露的技术假设。

他们认为,直到2026年5月发布4月CPI报告时,因政府停摆造成的数据偏差才可能被完全消除。

● 因此,更合理的做法是将11月和12月的通胀数据结合起来,作为评估四季度通胀趋势的参考。同时,应更密切关注美联储更看重的个人消费支出(PCE)价格指数,因为它不受CPI中健康保险计算方式变更的影响。

历史的统计序列被政府停摆意外打断,今晚的数据将是一份“双月拼图”。尽管分析师们试图从高频数据和模型推演中描绘十月通胀的“幽灵图像”,但真实的轮廓已然模糊。

数据之外的信号更值得关注:在物价粘性、关税压力与家庭通胀预期顽固的三重夹击下,美联储通往2%目标利率的道路,似乎比一条缺少路标的崎岖山路更加漫长。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。