The New York Times conducted a systematic analysis of thousands of government documents and court records from the last three U.S. administrations and interviewed more than twenty current and former government officials.

A cryptocurrency company operated by twin billionaire brothers Winklevoss was facing a severe lawsuit in federal court at the time. After Trump returned to the White House, the U.S. Securities and Exchange Commission (SEC) took action to freeze the case.

The SEC had previously sued Binance, the world's largest cryptocurrency exchange, but after the new administration took office, the SEC completely withdrew its lawsuit against the company.

Additionally, after years of legal battles with Ripple Labs, the new SEC attempted to reduce the fines imposed by the court to lessen the penalties on the cryptocurrency company.

An investigation by The New York Times found that the SEC's easing of these cases reflects a comprehensive shift in the federal government's attitude toward the cryptocurrency industry during President Trump's second term.

The SEC's collective withdrawal of lawsuits against a single industry is unprecedented.

However, The New York Times found that when Trump returned to the White House, the SEC slowed down over 60% of ongoing cryptocurrency cases, including suspending lawsuits, reducing penalties, or directly dismissing cases.

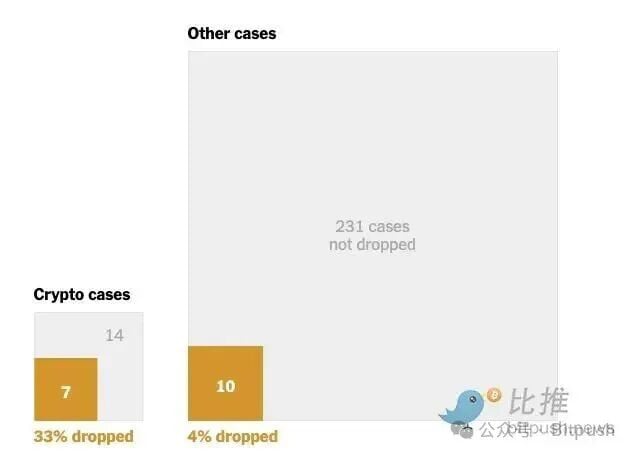

The investigation pointed out that the dismissal of these cases is particularly unusual. During Trump's term, the SEC's dismissal rate for cryptocurrency companies was significantly higher than for other types of cases.

Although the specific circumstances of these cryptocurrency lawsuits vary, the companies involved often share a commonality: they have financial ties to Trump, who calls himself the "crypto president."

As the highest federal agency regulating U.S. financial markets, the SEC is no longer actively pursuing any company with a public connection to Trump.

The New York Times investigation found that for all companies associated with Trump's cryptocurrency business or that had previously funded his political endeavors, the agency has adopted a retreating stance. The only remaining cryptocurrency cases the SEC is pursuing involve unknown defendants with no apparent ties to Trump.

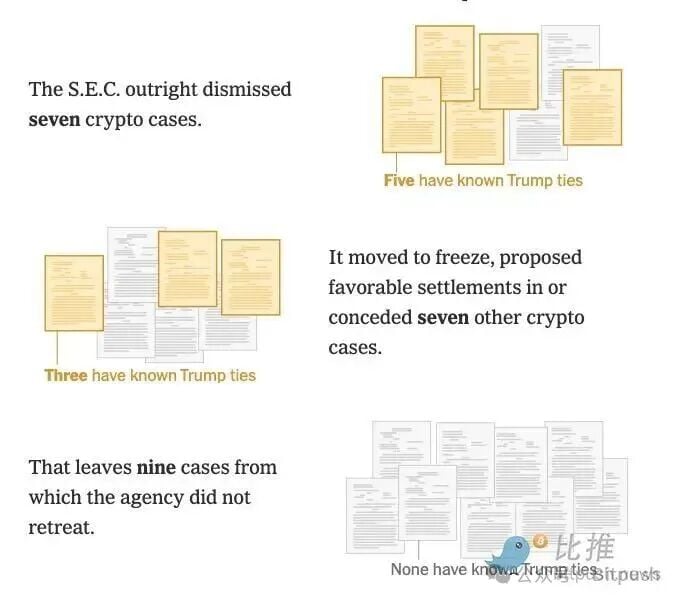

Case Handling Statistics (Data as of December 15, 2025):

- Directly Dismissed Cases: 7 └ 5 of which involve defendants with public ties to Trump

- Mitigating Measures Taken: 7 └ Including suspending asset freezes, proposing favorable settlements, or substantial concessions └ 3 of which involve defendants with public ties to Trump

- Maintaining Original Litigation Position: 9 └ Currently, none have been found to have public ties to Trump

The SEC stated in a statement that political favoritism has "nothing to do" with how they handle cryptocurrency enforcement, claiming that the agency's shift is due to legal and policy reasons, including concerns about its authority to regulate the industry. The SEC pointed out that even before Trump embraced the crypto industry, the current Republican commissioners of the agency fundamentally disagreed with bringing most cryptocurrency cases and emphasized that they "take securities fraud and investor protection seriously."

There is currently no indication that the president pressured the agency to go easy on specific cryptocurrency companies. We also found no evidence that these companies attempted to influence cases against them through donations or business ties to Trump, some of which were established only after the SEC's policy shift.

However, Trump is both a participant in the cryptocurrency industry and its highest decision-maker, and he stands to profit from companies regulated by his government. The fact that many companies sued by the SEC have ties to him indicates a conflict of interest arising from the president promoting policies that align with his own interests.

At the beginning of his second term, the White House announced that the president would "halt aggressive enforcement actions and overregulation that stifle cryptocurrency innovation."

Although the SEC's abandonment of some cryptocurrency cases had already drawn public attention, The New York Times' analysis of thousands of court records and dozens of interviews revealed an unprecedented scale of regulatory rollback this year and the significant benefits it brings to Trump's industry allies.

All defendants named in The New York Times investigation deny any wrongdoing, with many companies insisting they were only accused of technical violations. Some companies whose cases were dismissed by the agency have no apparent ties to the president.

Cryptocurrency companies welcomed what Trump-appointed SEC Chairman Paul S. Atkins referred to as a "new day" for the industry.

White House Press Secretary Karoline Leavitt dismissed claims of any conflicts of interest involving Trump and his family. She stated that Trump's policies are "fulfilling the president's promise to make America the global capital of cryptocurrency, bringing innovation and economic opportunity to all Americans."

The Trump administration has fully relaxed cryptocurrency regulations, including the Justice Department closing a cryptocurrency enforcement division. However, the changes at the SEC this year mark a particularly sharp reversal.

According to The New York Times' analysis, during the Biden administration, the SEC initiated more than two cryptocurrency cases per month on average (whether in federal court or its internal legal system). Even during Trump's first term, the agency initiated about one case per month on average, including the well-known case against Ripple.

In contrast, since Trump returned to the White House, the SEC has not initiated a single cryptocurrency case (by The New York Times' definition), although it continues to file dozens of lawsuits against other types of defendants.

Number of Cryptocurrency Lawsuits Filed by the U.S. SEC During Different Administrations:

- Trump's First Term: 50

- Biden Administration: 105

- Trump's Second Term (Current): 0

Trump's newly appointed SEC Chairman Paul S. Atkins argued in a statement that his agency is merely restraining the previous administration's overly enthusiastic attitude toward the cryptocurrency industry. He insisted that the SEC during the Biden era is using its enforcement powers to establish new policies.

Atkins said, "I have made it clear that we will end the practice of substituting enforcement for regulation."

While cryptocurrency companies welcome what Atkins calls a "new day" for the industry, the SEC career attorneys responsible for bringing some of these cases express concern about this retreat. They worry that this agency, established during the Great Depression to protect investors and oversee markets, is emboldening the cryptocurrency industry in ways that could harm consumers and threaten the broader financial system.

Christopher E. Martin, a senior litigation attorney at the SEC who led a case against a cryptocurrency company, chose to retire after the agency dismissed its lawsuit this year.

He described the SEC's broad retreat as a "complete surrender," stating, "They really threw investors to the wolves."

The End of Tough Regulation

At the SEC's glass-walled headquarters in Washington, the agency's crackdown on cryptocurrency had already reached its breaking point by the end of last year.

Then-Chairman Gary Gensler (appointed by the Biden administration) hoped to advance multiple cryptocurrency investigations, but he ran out of time.

Trump won re-election, having just announced a cryptocurrency venture capital company involving himself and his family—World Liberty Financial—and vowed to rein in the SEC.

Trump has not always supported cryptocurrency. During his first term, he stated on Twitter that cryptocurrencies are based on "thin air" and could fuel drug trafficking and other illegal activities.

His first SEC also took a hardline stance. The agency established a division specifically tasked with combating misconduct in the cryptocurrency and cyber sectors and filed dozens of cases.

Under Biden, the agency's efforts intensified even further. By 2022 (the year of the collapse of the giant cryptocurrency exchange FTX), the SEC's cryptocurrency division nearly doubled in size, reaching about 50 lawyers and industry experts.

During both presidencies, the SEC maintained that since investors can put their life savings into cryptocurrencies, they should understand the associated risks.

But a tricky legal question has always loomed over the agency: does it actually have the authority to bring these cases? The answer depends on whether cryptocurrencies are considered securities, a modern variant of stocks and other financial instruments.

The SEC argues that many cryptocurrencies are indeed securities, meaning that companies like cryptocurrency exchanges and brokers must register with the agency, submit extensive public disclosure documents, and, in some cases, undergo independent review. If they fail to register, the agency can sue them for violating securities laws.

The industry counters that most cryptocurrencies are not securities but rather a different asset class that requires a set of specialized rules that the agency has yet to establish.

Blockchain Association CEO Summer Mersinger said, "We are not seeking to be unregulated; we are seeking clear regulations under which we can operate."

Last year, as Trump transitioned from a cryptocurrency skeptic to an evangelist, the situation began to shift for the cryptocurrency industry.

In a speech in July 2024, he promised cryptocurrency enthusiasts that the "persecution" against their industry would stop and stated, "On my first day in office, I will fire Gary Gensler."

The SEC is an independent agency composed of five commissioners appointed by the president, including a chair whose views often reflect the stance of the administration that appointed him. The commissioners vote on whether to bring, settle, or dismiss cases, but career enforcement officials are responsible for the actual investigations. This system allows for shifts in regulatory focus but traditionally avoids drastic swings in political will.

However, after Trump won the election for a second time, a sense of sober reality permeated the SEC. Gensler announced his departure shortly after the election.

What was once seen as a career springboard in cryptocurrency regulation suddenly became a "toxic asset" overnight.

According to insiders, during the presidential power transition, enforcement chief Sanjay Wadhwa under Gensler implored the enforcement team in an internal meeting to "complete the work that the people who pay our salaries expect us to do." (Due to the nature of the internal meeting, the individuals requested anonymity.)

Despite this, some staff members still backed down.

Insiders say a senior leader on the cryptocurrency team took an unexpectedly long leave of several weeks and did not respond to emails regarding cases.

Another senior official refused to sign off on a few cryptocurrency cases that the agency initiated after the election.

Other officials completely stopped working on ongoing cryptocurrency cases, hindering Gensler's final efforts.

Victor Suthammanont, who worked at the agency for ten years and recently served as Gensler's enforcement advisor, said that during the previous two transitions, staff had persisted.

"But this transition is unlike any I have seen," Suthammanont said, declining to discuss specific cases. "The atmosphere changed immediately."

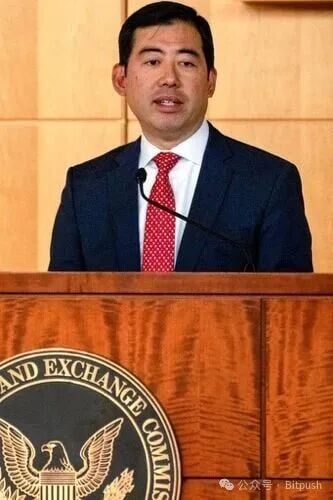

After Trump was sworn in, there was no turning back. He appointed Mark T. Uyeda, one of the Republican commissioners of the SEC, as acting chair until the president's nominee, Atkins, received Senate confirmation.

Uyeda has long opposed the agency's approach to handling cryptocurrency cases. In a statement to The New York Times, he indicated that Gensler was adopting a novel theory that "existing laws do not support."

However, in a speech in 2022, Gensler explicitly stated that he held the opposite view. "When a new technology emerges, our existing laws do not disappear," he said.

By early February, Uyeda had marginalized Jorge G. Tenreiro, who had previously helped lead the cryptocurrency division and oversaw most cases.

Tenreiro was reassigned to the information technology department, a move seen internally at the SEC as a demotion with derogatory implications.

Without Tenreiro, the agency began to abandon investigations into cryptocurrency companies facing potential lawsuits. While some investigations continued, at least ten companies announced they were no longer under scrutiny, including one that made the announcement just last week.

"Nothing to Negotiate"

Uyeda soon faced a more difficult decision: how to handle the lawsuits from the Biden era that the agency was still pursuing in court.

While the SEC often drops investigations, dismissing ongoing cases is rare and requires approval from the agency's commissioners.

In one of the most high-profile cryptocurrency cases, the SEC sued Coinbase, the largest cryptocurrency exchange in the U.S., accusing it of failing to register with the agency. The company mounted an aggressive defense during the Biden administration, persuading the presiding judge to allow a higher court to review the case before trial.

Now, with the SEC under Trump's administration, Coinbase was one of the first companies to seek dismissal of the case.

Traditionally, the SEC chair's office stays out of such negotiations, leaving them to the career officials overseeing the cases. However, an official from Uyeda's office participated in some negotiations with Coinbase, as well as meetings with enforcement attorneys.

Coinbase's Chief Legal Officer Paul Grewal said in an interview, "We were very careful to ensure that the acting chair's office was kept informed of everything that was happening and was aware of all developments."

Uyeda stated that it was "entirely appropriate" for his staff to attend these meetings.

Initially, the SEC under Uyeda was reluctant to drop the case. An insider revealed that their initial proposal to Coinbase was merely to pause the litigation.

But Coinbase rejected the delay.

Subsequently, the SEC made a more generous offer: it would dismiss the case, provided that the agency retained the power to reinstate the lawsuit in the future if leadership changed its mind.

Coinbase also refused to settle.

Grewal, a former federal judge, said, "We were very clear—either they surrender, or we continue the litigation because we have nothing to negotiate."

Ultimately, the SEC made concessions. By that time, due to Gensler and another Democratic commissioner leaving, the agency was left with only two Republican commissioners and one Democratic commissioner.

Uyeda, without mentioning any specific decisions, stated, "Such cases should not continue, especially if the SEC is likely to negate its potential theories in the near future."

However, the remaining Democratic commissioner, Caroline A. Crenshaw, stated in an interview that the agency had given the cryptocurrency industry a comprehensive favor.

She said, "They can essentially do whatever they want."

Shift in Attitude

The cryptocurrency industry viewed Coinbase's dismissal as a white flag of surrender.

Lawyers for other cryptocurrency companies sought similar settlements. By the end of May, the agency had dismissed six more cases.

An analysis of court records by The New York Times highlighted the unusual nature of this situation.

During the Biden administration, the SEC did not proactively dismiss any pending cryptocurrency cases from Trump's first term, although it did dismiss a case against a deceased defendant and parts of another case after an unfavorable ruling by a judge.

However, during Trump's second term, the agency dismissed 33% of the Biden-era cryptocurrency cases it inherited. In contrast, the dismissal rate for cases in other industries was only 4%.

Although the SEC vowed to continue pursuing fraud, it still dismissed the lawsuit against Binance. In that case, the SEC accused two related entities of fraudulently misleading customers, claiming they were working to prevent manipulative trading.

The SEC also requested that a judge freeze a fraud case against cryptocurrency mogul Justin Sun and his Tron Foundation, which was one of four cases the agency was handling to reach a settlement. Agency officials have yet to announce a resolution for this case.

In total, the SEC inherited 23 cryptocurrency-related cases from the current Trump administration, of which 21 originated during Biden's presidency, and the other 2 date back to Trump's first term. Of these 23 cases, the agency has taken a retreating approach in 14 of them.

Eight of the cases involved defendants who established connections with the president or his family shortly before or after the case was resolved.

For example, Justin Sun purchased $75 million worth of "World Liberty Financial" digital tokens. His company, Tron, did not respond to multiple requests for comment. In court documents, Sun and Tron stated that the SEC lacked evidence of fraud and jurisdiction to prosecute.

Just weeks before the Binance case was dismissed, the company was involved in a $2 billion business deal that utilized "World Liberty Financial" digital currency. This deal is expected to generate tens of millions of dollars in annual income for the Trump family.

A spokesperson for World Liberty Financial stated, "World Liberty Financial has no connection to the U.S. government whatsoever," adding that the company "has no influence on the policies or decisions of the executive branch."

Binance stated in a statement that the SEC's actions against it were "a product of a war on cryptocurrency."

In March of this year, the SEC dropped a case accusing cryptocurrency trading company Cumberland of acting as an unregistered securities dealer.

About two months later, its parent company, DRW, invested nearly $100 million in a media company owned by the Trump family.

DRW officials stated that the company only received the investment opportunity after the case concluded and that the dismissal was entirely due to false allegations.

In the case against Ripple (which had donated nearly $5 million to Trump's inauguration), the SEC attempted to overturn its own efforts.

During Trump's first term, the SEC accused Ripple of depriving investors of important information when selling its cryptocurrency tokens. Last year, after dismissing some of the SEC's allegations, a federal judge ordered Ripple to pay a $125 million fine for certain securities violations.

However, after Trump returned to the White House, the SEC sought to reduce the fine to just $50 million. The judge rebuked the government's change in attitude and rejected the new settlement agreement.

Ripple argued to the judge that they deserved a lower fine, partly because the SEC had taken action to dismiss complaints against other similar cryptocurrency companies. Ripple ultimately paid the full fine.

The president's media company announced in July that they planned to include Ripple's cryptocurrency in a publicly available investment fund.

In an interview, Republican commissioner Hester M. Peirce, who leads the SEC's newly established cryptocurrency task force, stated that the retreat on many cases is a correction of errors. She said these cases should not have been brought in the first place.

"I would say that aggressive actions occurred in the past few years, namely bringing cases that we had no legal basis for," she added, stating that she believes these cases stifled legitimate innovation.

Peirce stated that political or financial considerations did not influence this situation. She said, "We are making decisions based on facts and specific circumstances, not based on 'who this person knows.'"

"Well-Funded"

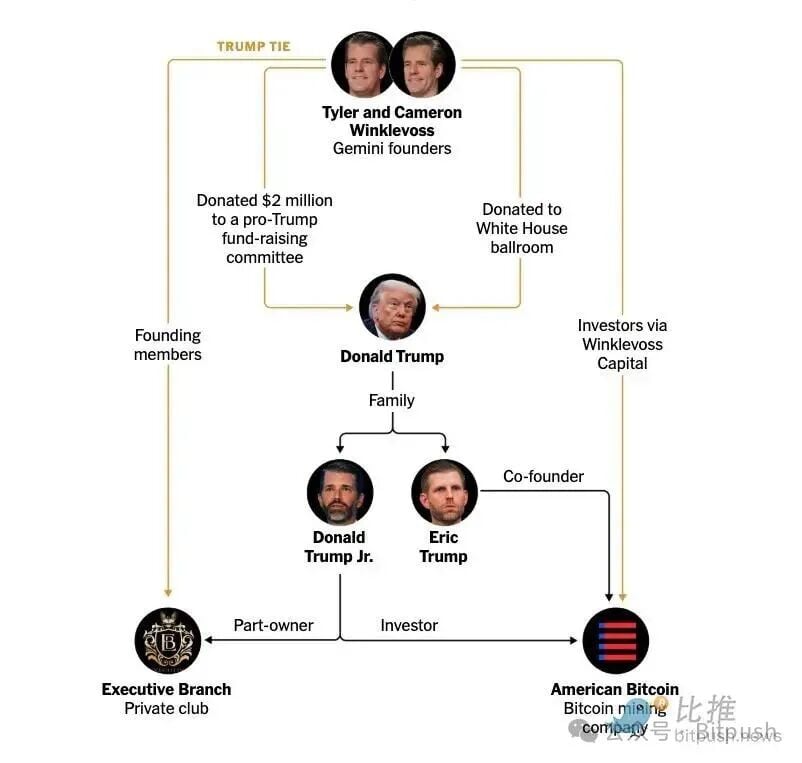

Few participants in the cryptocurrency industry are closer to Trump than the Winklevoss twins, Tyler and Cameron.

The twins founded and operate Gemini Trust, and they have donated to fundraising committees and other Republican organizations supporting Trump's re-election campaign.

They also provided funding for the construction of the White House ballroom (a private project of the president).

They supported a new exclusive club in Washington called the "Executive Branch," which is partially owned by the president's eldest son, Donald Trump Jr.

Additionally, the brothers' investment company recently invested in a new cryptocurrency mining company called "American Bitcoin";

Trump's second son, Eric Trump, is a co-founder and chief strategy officer of the company, and Donald Trump Jr. is also an investor.

The president has praised the twins multiple times, describing them as high-IQ smart models.

Trump said at a White House event, "They have looks, they have talent, and they have plenty of cash."

But Gemini Trust has legal troubles.

In December 2020, Gemini and another company, Genesis Global Capital, agreed to offer Gemini customers the opportunity to lend their cryptocurrency assets to Genesis. In return, Genesis would lend these assets to larger participants.

Genesis paid interest to customers, who were promised the ability to withdraw their assets at any time, while Gemini earned a share for acting as an intermediary. Gemini promoted the program as a way for account holders to earn up to 8% interest.

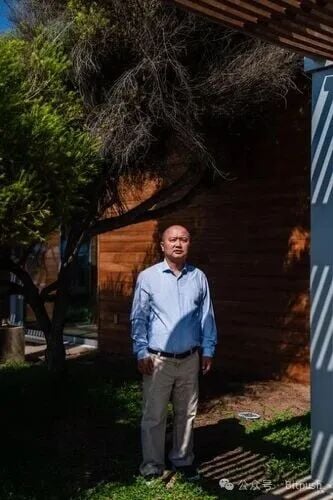

Peter Chen, a data scientist from San Diego, said in an interview that he trusted Gemini enough to hand over more than $70,000. He said, "They gave me the impression that they were clean, compliant, and one of the most regulated among all cryptocurrency companies."

Then, at the end of 2022, the bankrupt Genesis froze the accounts of 230,000 customers, including Peter Chen's account.

A 73-year-old grandmother pleaded with Gemini to return her $199,000 life savings. "Without that money, I'm done," she wrote.

Genesis reached a $2 billion settlement with New York in May 2024, and customers eventually got their money back. Gemini also reached its own agreement with the state, agreeing to pay up to $50 million to cover any remaining losses if needed. It denied any wrongdoing, blaming the disaster on Genesis, and pointed out that ultimately no customers lost money.

But the SEC also sued both companies, accusing them of selling cryptocurrency without registration. On social media, Tyler Winklevoss called the lawsuit "a fabricated parking ticket."

Genesis settled, but Gemini has been fighting back until this April, when the SEC took action to freeze the case to seek a settlement. The agency disclosed in September that it had reached an agreement with Gemini, but it still needed a vote from the commissioners for approval.

The SEC informed the presiding federal judge that the agreement would "fully resolve this litigation."

Source: The New York Times, original title: The S.E.C. Was Tough on Crypto. It Pulled Back After Trump Returned to Office

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。