以太坊下滑,索拉纳飙升,比特币延续资金流入势头

加密货币交易所交易基金(ETF)市场在12月2日(星期二)以分化的叙述收盘,比特币稳步上涨,以太坊则遭遇挫折,而索拉纳则继续其显著的表现。当天的资金流动描绘了投资者偏好的变化,以对BTC和SOL的坚定买入为标志。

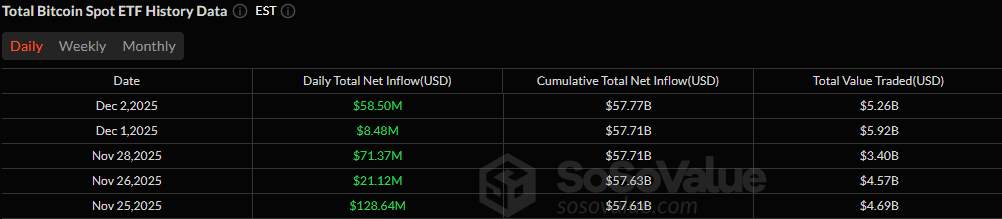

比特币ETF自信地回归绿色,净流入达5850万美元。黑石的IBIT主导了当天的表现,吸引了高达1.2014亿美元的资金,再次确认其作为机构比特币流动的风向标的角色。富达的FBTC增加了2185万美元,Bitwise的BITB又贡献了744万美元。

尽管ARK和21Shares的ARKB出现了9094万美元的剧烈流出,但这并不足以破坏该类别的上升轨迹。交易量达到52.6亿美元,总净资产上升至1195.9亿美元,显示出对BTC投资的重新信心。

比特币ETF连续五天实现资金流入。

以太坊ETF在寻找立足点方面遇到困难,最终以992万美元的净流出收盘。两只基金稳居正区间,富达的FETH流入5065万美元,Grayscale的以太坊迷你信托流入2811万美元。

然而,由于黑石的ETHA出现了8868万美元的重大撤出,叙述发生了戏剧性的转变。尽管遭遇挫折,交易仍然活跃,达到16.5亿美元,类别净资产略微上升至186.6亿美元,显示出即使在资金流动不均的情况下,投资者的参与度依然很高。

阅读更多:比特币ETF在12月初以温和的增幅开始,而以太坊和索拉纳则下滑

索拉纳ETF交出了迄今为止最强劲的一天,录得4577万美元的总流入。Bitwise的BSOL以2945万美元领先,其次是富达的FSOL,流入692万美元,Grayscale的GSOL流入628万美元。

Vaneck的VSOL贡献了271万美元,21Shares的TSOL贡献了41.85万美元,确保了所有发行者的资金流入均匀。交易活动达到5671万美元,净资产上升至9.297亿美元,进一步巩固了索拉纳作为当天表现最佳资产的地位。

常见问题📈

- 为什么比特币ETF今天会有强劲的资金流入?

BTC基金增加了5850万美元,因为IBIT和FBTC推动了机构需求的回升。 - 是什么导致以太坊ETF重新出现资金流出?

ETHA的8868万美元大额撤出超过了FETH和Grayscale迷你信托的流入。 - 索拉纳ETF与其他资产相比表现如何?

索拉纳在所有发行者中录得统一的4577万美元流入,使其成为当天表现最强的细分市场。 - 今天的资金流动模式说明了投资者的情绪?

市场对BTC和SOL的投资表现出明显的偏好,同时对ETH保持谨慎态度。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。