作者:Nancy,PANews

随着十月收官,上市公司陆续晒出三季度成绩单。美国网红券商Robinhood交出了一份超出预期的财报,营收与利润双双刷新纪录,多元化战略初显成效,正加速迈向金融科技公司转型。然而,尽管业绩亮眼,Robinhood的股价却在财报发布后逆势下跌。

加密货币交易是核心增长来源,预测交易成新增长引擎

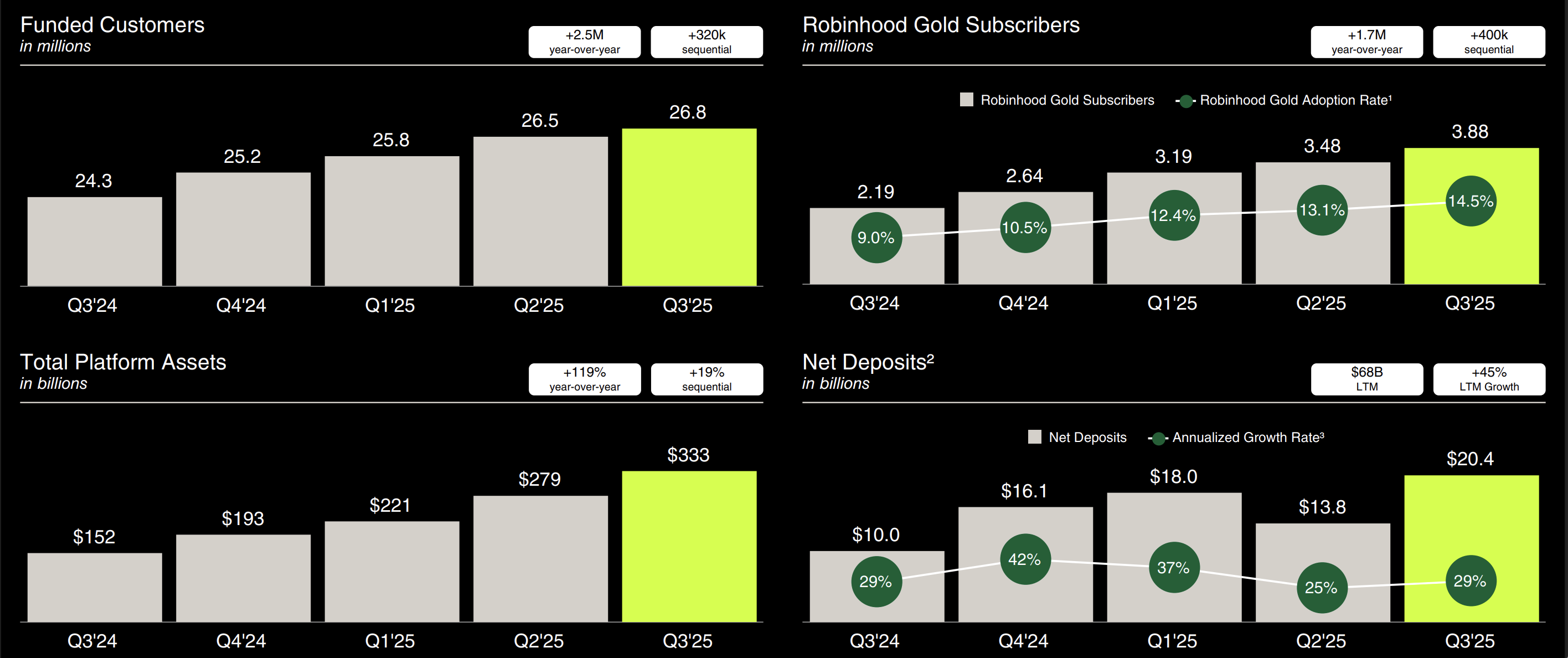

2025年第三季度,Robinhood交出一份亮眼的成绩单。平台总营收达到12.7亿美元,同比增长100%;净利润达5.56亿美元,同比增长271%;摊薄每股收益(EPS)0.61美元,同比增长259%。与此同时,本季度新增了250万名资金账户,整体达到2680万个。从数据来看,在免佣金交易带来的早期红利消退多年后,Robinhood显然找到了新的增长路径,从单一交易平台转型为多元化金融科技集团。

尽管业绩增长强劲,但结果仍低于市场预期,其股价在财报公布后不涨反跌,背后是投资者对其未来盈利持续性的担忧。

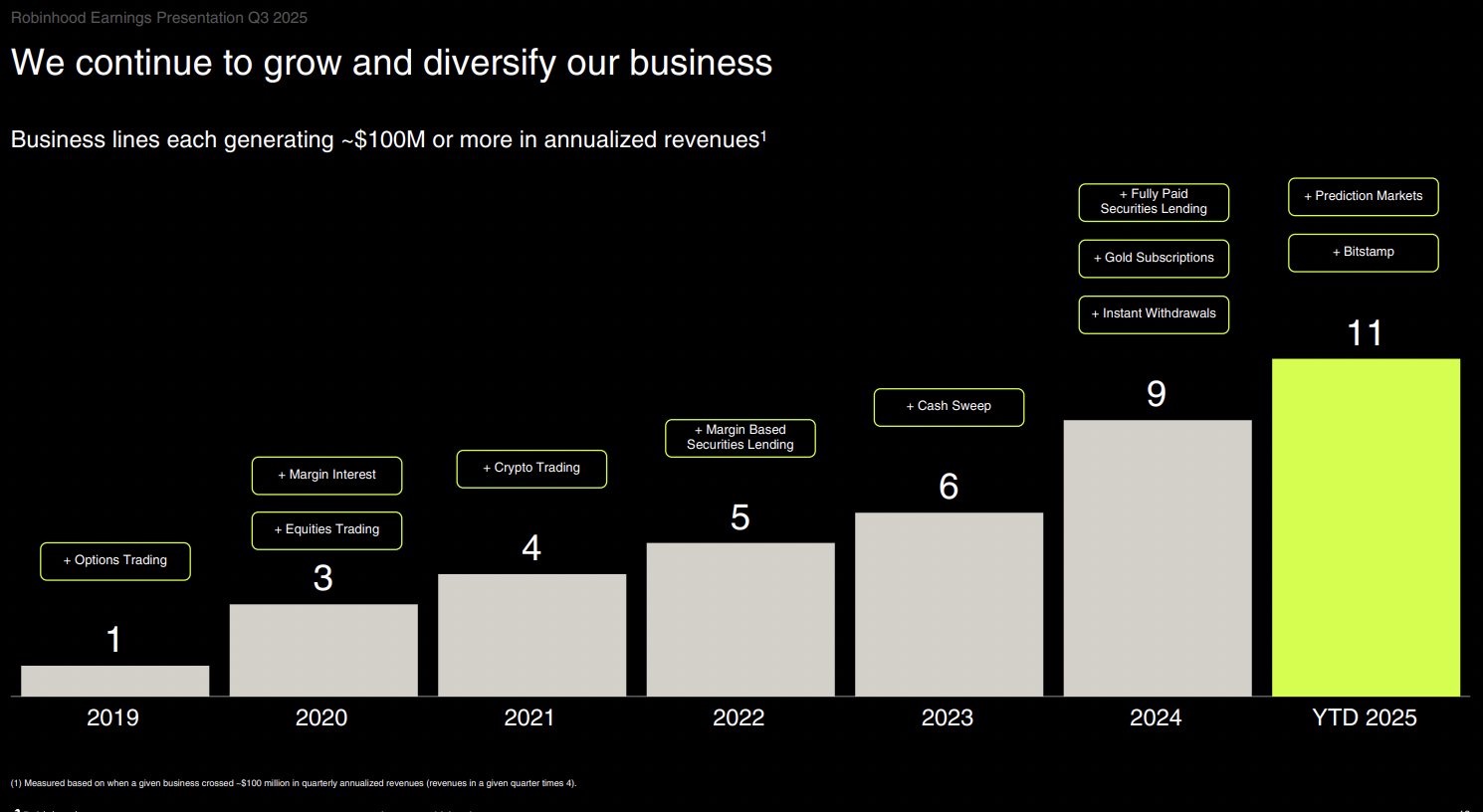

从结构来看,Robinhood当前收入主要来自交易收入(57%)、净利息收入(36%) 和 订阅类其他收入(7%)。其中,加密货币交易成为本季度的核心增长来源。该业务收入达到2.68亿美元,同比增长超过300%,占交易收入的三分之一以上。

Robinhood在今年扩大了加密业务线,收购了加密交易所Bitstamp并联手预测市场Kalshi合作,也成为了本季度收入突破的两大动力,并被列为年化收入超1亿美元的主要业务线之一。加密市场回暖带动零售与机构活跃度回升、Bitstamp并表带来机构与衍生品交易贡献以及预测市场业务上线吸引大量新增用户推升了加密交易收入的增长。不过,加密收入仍略低于市场预期的2.872亿美元。

Bitstamp的加入显著提升了交易量。财报显示,10月Robinhood平台加密货币名义交易额超过320亿美元,其中Bitstamp贡献180亿美元(主要为机构交易)。接下来,Bitstamp也将成为Robinhood推进代币化股票业务的主要业务平台。然而,Bitstamp的机构交易虽带动成交量暴增,但由于费率相对较低,实际收入贡献有限,这也引发市场对收入增长的担忧。

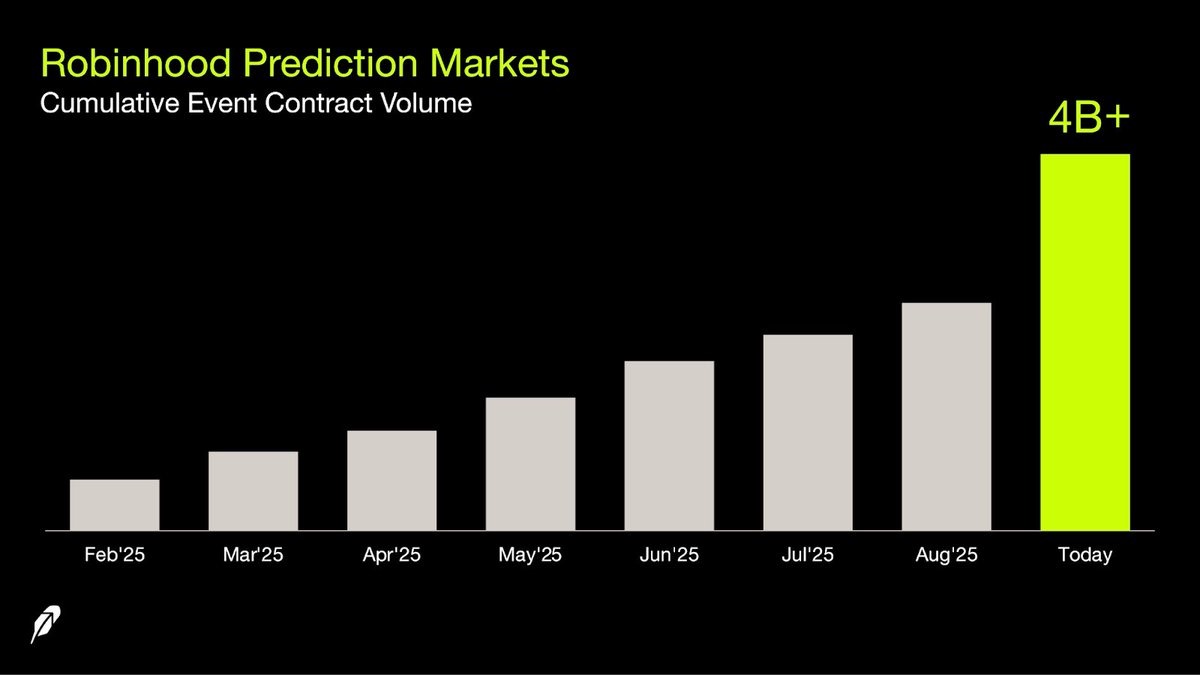

与此同时,预测市场业务也增长迅猛。三季度,Robinhood的预测合约交易量环比翻倍至23亿份(每份合约价值1美元),成为继股票和期权之后的第三大活跃交易品类。10月交易量更是达到25亿美元,预计当月平台从中获利约2500万美元。

除加密与预测市场外,Robinhood的股票交易收入增长132%,期权交易收入增长50%。然而,这些交易业务被普遍视为周期性较强。Rothschild & Co Redburn分析师Charles Bendit给予 Robinhood “卖出”评级,认为公司在产品执行上表现出色,但当前业绩可能反映的是周期高点,而市场估值却隐含了尚未被验证的长期稳定性。

成为今年标普500黑马,正筹备银行和投资业务

2025年,Robinhood成为标普500指数中表现最亮眼的股票之一,年内股价累计上涨超过222%,远超纳斯达克100指数。股价强势背后不仅是市场对Robinhood增长故事的认可,更是其基本面持续超预期的表现。

实际上,自2024年启动股票回购计划以来,Robinhood已累计回购约8.1亿美元股份。与此同时,Robinhood CEO Vlad Tenev的长期激励计划(若股价在2025年前达到每股101.5美元,Robinhood两位创始人将各自获得1380万股股票)已在第三季度全部兑现,目前其年现金薪酬仅为4万美元。

而Robinhood强劲的财务表现也为业务多元化拓展提供了充足的现金流支持。财报显示,截至三季度末,Robinhood持有43亿美元现金及等价物,股东权益约85.7亿美元,预计2025年全年调整后运营费用约为22.8亿美元,略高于原预期,主要由于业绩超预期带来的员工奖金增加,以及对新业务和技术平台的持续投入。虽然运营费用在Q3同比增长了31%,但营收实现翻倍增长,利润率得以持续提升。

而Robinhood也对未来的财务表现较为乐观,其指出第四季度开局非常强劲,10月份平台的股票、期权、预测市场和期货的月度交易量均创历史新高,保证金余额也创下新高。目前,Robinhood已有11条业务线年化收入达到或超过1亿美元,未来将上线更多资产类别。

“在产品思路上,我们计划将Robinhood打造为家庭金融中心。”Vlad Tenev在财报电话会上透露,源于过去几年在组织、文化与技术上的系统性调整,公司产品执行与迭代速度的显著提升,并确立了“快速交付产品”的核心目标,目前平台正在大力推动多条业务线。

例如,在预测业务方面,Robinhood的预测市场板块进入快速扩张阶段,目前已上线超过1000种合约,覆盖体育、金融、娱乐、文化与科技等领域。公司正与包括英国金融行为监管局(FCA)在内的海外监管机构沟通,探索在美国以外推出离岸预测市场的可行性。

银行业务上,Robinhood Banking正在分阶段推出,目标是通过提供多元化的金融产品与服务,成为用户工资入账的首选平台。

投资业务方面,公司正筹备Robinhood Ventures,并已向美国SEC提交文件,将聚焦创新项目投资,为平台引入新的增长引擎。

此外,代币化股票方面,Robinhood已在30多个国家推出了相关业务,并扩展至400多种产品,接下来计划在Bitstamp平台推行相关交易,以及纳入DeFi生态。

除了美国市场,Robinhood正在计划进行国际扩张,提出未来十年内要让美国以外市场和机构客户贡献超过50%的收入,以改变目前零售业务占比过高的结构。但其倾向于通过有机增长实现扩张,但也不会排除并购的可能。目前国际化仍处于早期阶段。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。