Written by: Yangz, Techub News

The chill from the "flash crash" on October 11 has not yet dissipated, and the crypto market has been hit hard again. Under the impact of the "Black Tuesday" in the U.S. stock market, Bitcoin briefly fell below the psychological threshold of $100,000, dipping to $98,944. Although the market has since rebounded and regained this key position, confidence in the market has been shaken—what was once seen as a psychological pillar marking the start of a new bull market has now become a fragile line that needs to be fiercely defended. An uneasy sentiment is continuing to spread within the market.

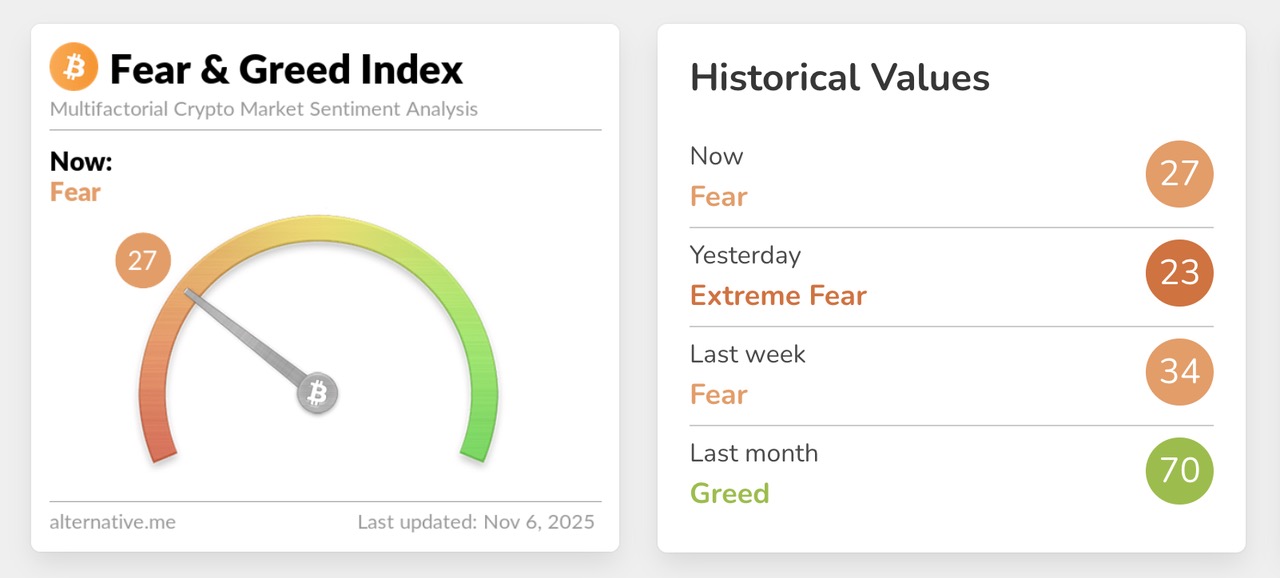

Behind the price drop is a growing crisis of confidence. The once fervent enthusiasm and certainty are being replaced by increasing doubt and caution. The constantly fluctuating red numbers on screens, the gradually cooling discussions on social platforms, and the silent assets in investors' accounts all point to the same fact: market sentiment is changing. According to data from Alternative.me, the cryptocurrency fear and greed index today stands at 27, indicating a "fear state," while yesterday's index was 23, indicating "extreme fear."

However, if one only focuses on price fluctuations, they miss the true eye of the storm. Balancer has been attacked again, xUSD has unexpectedly depegged, Huajian Medical has suspended cryptocurrency acquisitions, and U.S. listed company Sequans has sold 970 Bitcoins to reduce debt, coupled with the macro-level "hawkish rate cuts" from the Federal Reserve and the U.S. federal government entering its 36th day of "shutdown"—these seemingly isolated events are actually key pieces scattered across the chessboard. Once connected, a clear reality emerges: the crypto market is simultaneously facing a triple cold wave impact of technical trust, capital confidence, and macro environment.

DeFi Trust Crisis—When "Financial Legos" Show Cracks Again

The market's panic is spreading from the most fundamental level of technical security. On November 3, the established DeFi protocol Balancer was attacked, resulting in a loss of approximately $128 million. According to the Balancer team's preliminary report, the vulnerability stemmed from a minuscule rounding error in a function within its V2 composable stable pool. The attacker exploited this "ant hole" in conjunction with batch swap functionality to leverage massive funds. Although the team responded quickly and recovered some assets, this incident revealed a harsh reality: in the precise and complex mathematical world of DeFi, any minor code flaw can become the starting point for system collapse.

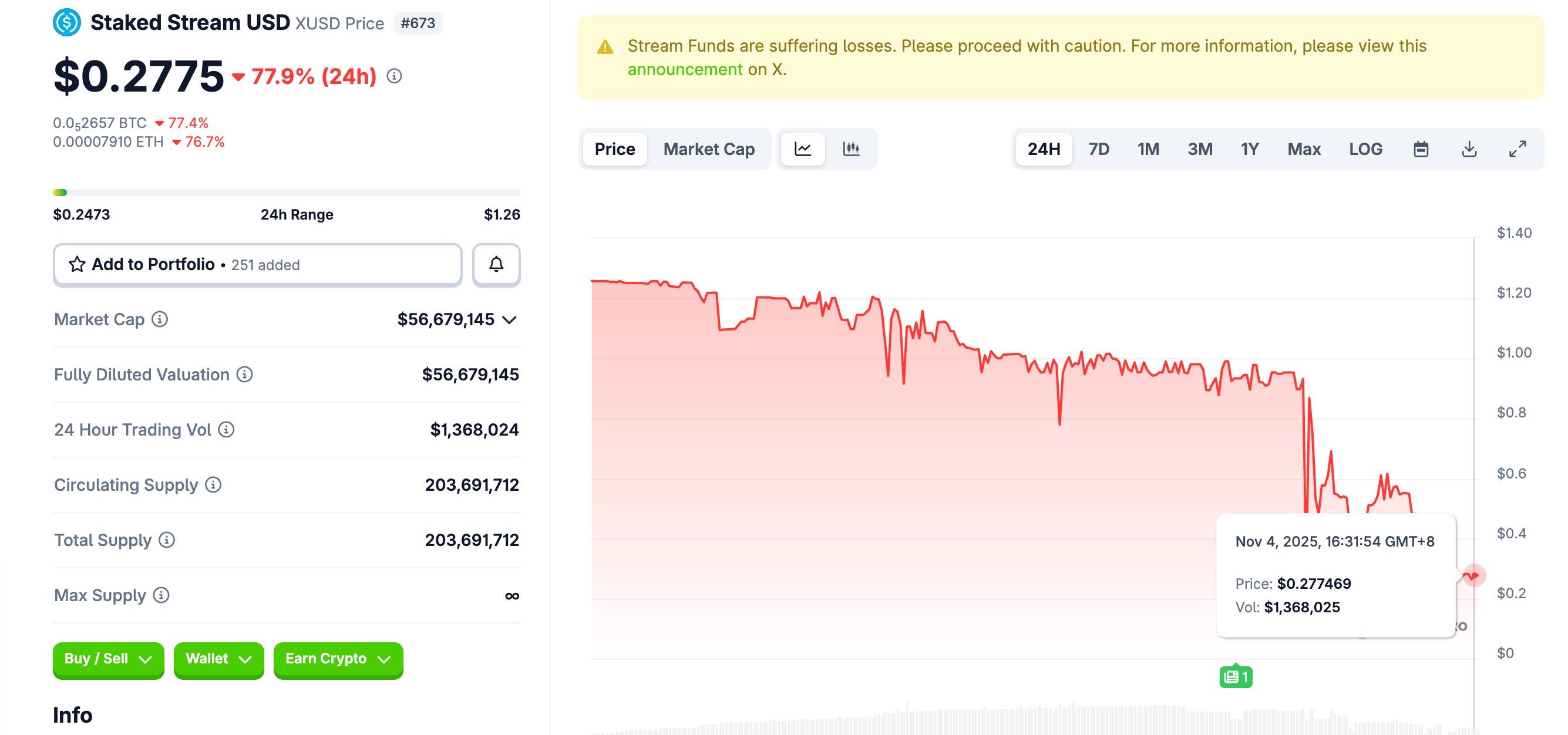

The severity of this hacking incident goes far beyond the numerical loss of funds; the real crisis lies in the contagion of risk. Following the Balancer incident, the stablecoin xUSD issued by Stream Finance plummeted from $1 to $0.27 within 24 hours, severely depegging.

On the surface, Stream Finance and Balancer have no direct connection, but the panic has quietly triggered a chain reaction. When users began to withdraw funds from various protocols, Stream Finance's complex “circular nesting” structure exposed its fatal weakness—user funds were layered within multiple lending protocols like Euler and Morpho, forming a fragile chain of interconnections.

To make matters worse, Stream Finance subsequently released a statement on Twitter, claiming that an "external fund manager" responsible for managing funds reported approximately $93 million in assets "missing." This vague announcement instantly became the last straw that broke the market's confidence.

The depegging of xUSD is essentially not a technical flaw but a pure collapse of confidence triggered by the Balancer incident and exacerbated by its own high-leverage model. This series of events paints a disturbing picture: Balancer's vulnerability exposed the fragility of the foundational protocol layer, while the depegging of xUSD revealed the systemic risks within the DeFi Lego ecosystem. The failure of one component can rapidly transmit through complex financial connections, ultimately triggering a comprehensive trust crisis among the user base. When the cornerstone of "code is law" shows cracks, the entire financial edifice built upon it also begins to teeter.

DAT Companies Start Selling Coins, Is the Frenzy at a Turning Point?

As the crisis of technical trust continues to spread, the DAT model, once highly anticipated by the market, is also facing severe tests.

The most direct signal comes from the Hong Kong-listed company Huajian Medical. Its $3 billion cryptocurrency acquisition plan announced in August was officially halted after two and a half months of silence. The shift from a clearly defined "massive entry" to vague wording about "future purchases and disclosures in the market" clearly reflects the real dilemmas faced by the DAT model in regulatory scrutiny and shareholder communication.

While giants like Strategy continue to lay out their plans, some DAT companies are struggling to withstand the downward pressure of the market. On November 4, the U.S. listed company Sequans Communications confirmed the sale of 970 Bitcoins to reduce debt; the Ethereum treasury company ETHZilla chose to sell $40 million worth of Ethereum at the end of October to facilitate stock buybacks. The CEO's statement about "continuing to sell until the stock price and net asset value return to normal" further exposes the internal contradictions of the DAT model: when the capital market does not recognize its valuation logic, companies are forced to sell crypto assets to support their stock prices.

These cases collectively reveal the dual dilemmas of the DAT model: the complexity of regulatory compliance and the misalignment of capital market valuation logic. When the narrative of "holding cryptocurrency" fails to boost stock prices and instead increases risk, the enthusiasm of listed companies for this model naturally wanes. While this does not signify a complete collapse of the entire crypto capital market, it undoubtedly marks a turning point for this key branch as it enters a phase of slowdown and reflection under real pressures.

Macroeconomic Headwinds Continue

As the crypto market bears internal pressures, larger external forces are forming a siege, casting a thick shadow over all risk assets, especially cryptocurrencies.

On October 30, the Federal Reserve announced a 25 basis point rate cut, but this long-anticipated easing signal came with a distinctly "hawkish" tone. In his post-meeting remarks, Fed Chair Powell emphasized that "a December rate cut is far from a done deal" and admitted that there are "significant differences" within the committee regarding the future policy path. This statement undoubtedly extinguished market optimism about the onset of a long-term rate-cutting cycle.

At the same time, a political deadlock is exacerbating economic uncertainty. As of November 5, the U.S. federal government has entered its 36th day of "shutdown," setting a new record for the longest shutdown in history. The ongoing political deadlock has made it difficult to pass several temporary funding bills, increasing uncertainty about the economic outlook. According to estimates from the U.S. Congressional Budget Office, depending on the duration of the federal government's "shutdown," the annual growth rate of U.S. real GDP is expected to decline by one to two percentage points in the fourth quarter of this year. This means that if the "shutdown" lasts for four weeks, the U.S. economy will lose $7 billion; if it lasts for six weeks, the loss will rise to $11 billion; and if it lasts for eight weeks, the loss could reach as high as $14 billion.

Additionally, it is worth noting that the once most fervent South Korean crypto market is cooling down. In November 2025, South Korea's largest cryptocurrency exchange Upbit had an average daily trading volume of only $1.78 billion, a staggering 80% drop from $9 billion in December 2024, and has declined for four consecutive months. Similarly, Bithumb's average daily trading volume in November is only about $890 million, compared to $2.45 billion last year.

Against the backdrop of monetary policy easing falling short of expectations and fiscal policy being constrained by political deadlock, market risk aversion is rising. The pressure faced by highly volatile crypto assets in this environment is particularly evident.

Conclusion

The cracks in technical trust, the cooling of the DAT model, and the macroeconomic headwinds—these three "cold waves" do not exist in isolation; they are interwoven into a complex test for the crypto world. The market's growing pains force people to lift their heads from the short-term clamor of price fluctuations and re-examine the core proposition of this industry: when the tide of speculation recedes, what truly underpins its long-term value?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。