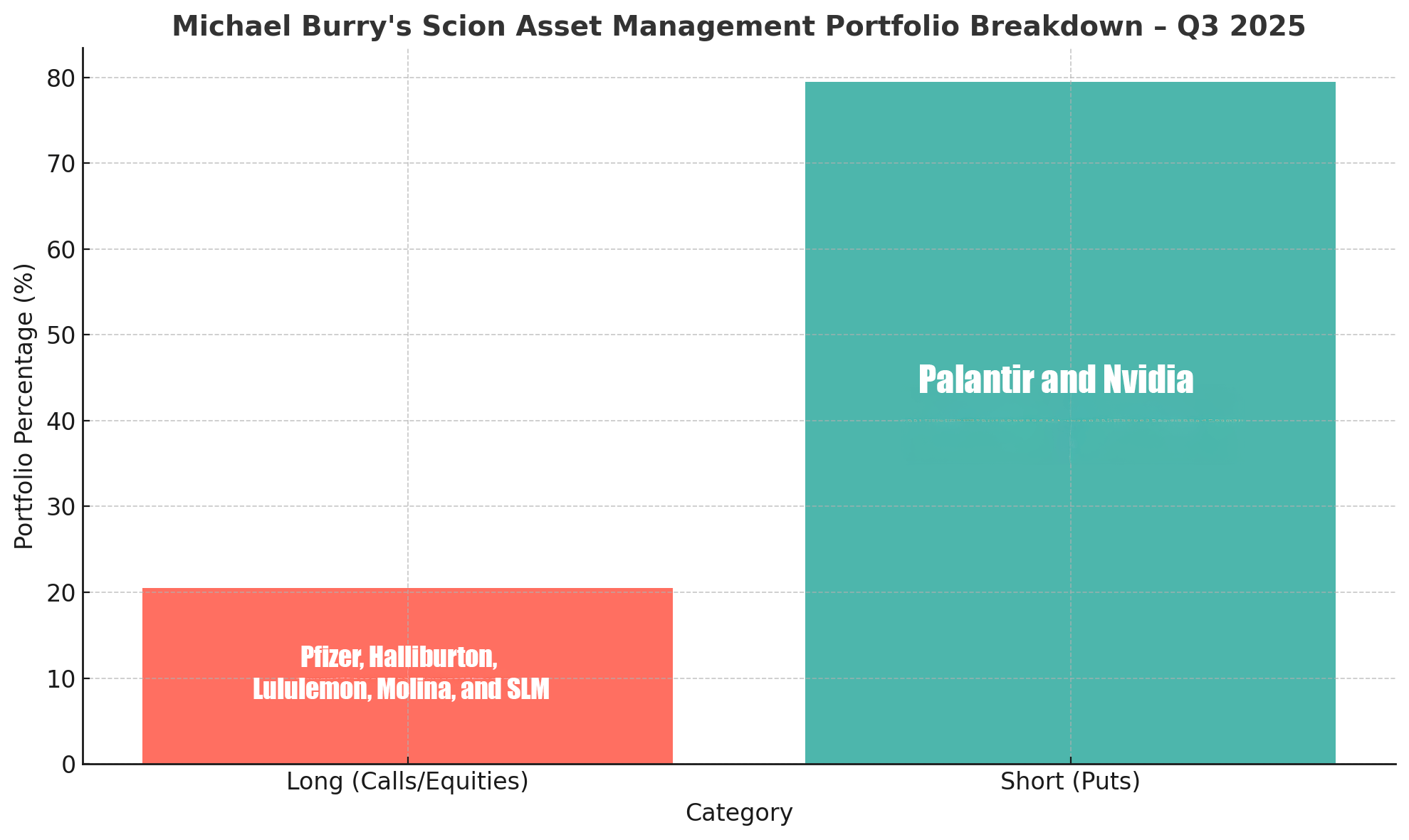

Scion’s latest 13F, released around Nov. 3, shows a contrarian tilt: bearish options aimed at marquee AI names while fresh bullish bets appear in health care and energy services. The firm’s stance is classic Michael Burry—skeptical of consensus narratives and willing to concentrate risk when valuations look stretched.

Burry is an American investor and founder of Scion Capital, renowned for predicting and profiting from the 2008 housing crisis, a story popularized by the book and film “The Big Short.” The headline wager is simple and loud: puts tied to 5 million Palantir shares and 1 million Nvidia shares.

In a portfolio this compact, that concentration isn’t a whisper; it’s a loud bullhorn. The filing frames the positions as strong conviction against AI-linked equities at elevated prices. Burry didn’t just play defense. Scion added call options on Pfizer and Halliburton, signaling interest in Big Pharma’s cash flows and oilfield services’ cyclical muscle.

Those calls offer upside exposure if pipelines deliver and drilling demand holds steady. On the equity side, Scion doubled its Lululemon Athletica stake, and opened new positions in student-lender SLM Corporation and managed-care player Molina Healthcare.

That trio reads like a bet on select U.S. consumer and health care resilience, with a nod to stable revenue streams. Just as notable are the exits: Scion liquidated prior holdings tied to Chinese e-commerce and stepped away from U.S. health insurers, cutting exposure to regulatory and macro risk abroad and at home.

The house view: avoid policy overhangs and geopolitical drag, redeploy to areas with cleaner catalysts. The portfolio now mixes three core equity positions with four options bets, but options dominate the value. In other words, directionality is the story, and timing matters. This is not a set-it-and-forget-it allocation; it’s a chessboard built for volatility.

Read geographically, the filing shows Scion dialing back China risk while leaning into U.S. opportunities from New York pharma halls to Houston’s oil patch and West Coast retail. That rotation tracks a broader investor impulse to sift for value beyond the AI crowd.

Of course, being early and being wrong can look the same for a while. If AI momentum keeps running, puts can wither; if earnings or enthusiasm cool, the payoff can be outsized. The calls and cash-flow names provide balance, but this is still a high-beta posture by design.

In short, Scion’s Q3 is Burry in full: skeptical of market darlings, opportunistic where valuations look reasonable, and utterly unafraid to make big, visible statements with concentrated trades. For readers tracking positioning rather than punditry, the filing offers a crisp map of where Burry thinks gravity will reassert itself.

What Changed in Q3—and Why It Matters

- AI on notice: Palantir and Nvidia puts dominate, signaling an expectation that euphoric multiples eventually meet math.

- Health care tilt: Pfizer calls and a fresh Molina stake show a bias toward defensible cash flows and policy-linked demand.

- Energy as a hedge: Halliburton calls nod to cyclical upside if global supply tightens or capex rises.

- Consumer/credit picks: Lululemon doubled, SLM added—targeted U.S. names over broad beta.

The Bottom Line

Scion’s concentrated structure amplifies both risk and reward. It’s a portfolio that reads like a thesis, not a market basket—bearish where the hype is loudest, constructive where cash flows and cycles still have room to breathe.

While he called the 2008 crisis with precision, Burry’s track record following that event isn’t perfect and there have been several occasions where the market humbled him.

And while Burry’s contrarian instincts made him a household name, his track record since then has been mixed. Some of his macro wagers—like past short positions on Tesla and broad market indexes—fizzled before paying off, leaving critics to argue that his timing can be early enough to hurt.

With AI stocks still posting strong earnings and institutional inflows, his current puts could misfire if enthusiasm and profits hold. In markets driven as much by narrative as by numbers, even the man who once shorted the housing bubble isn’t immune to being right too soon—or just plain wrong.

- Where is the focus of Scion’s new bets? Primarily U.S. sectors—health care, energy services, and select consumer names—after trimming China exposure.

- What makes this filing notable for North American investors? The portfolio concentrates 80% in AI-related puts while adding U.S. call exposure in Pfizer and Halliburton.

- How many core equity positions remain in the U.S. book? Three: Lululemon, Molina Healthcare and SLM Corporation.

- Why did Scion exit Chinese e-commerce and U.S. health insurers? The filing points to geopolitical and regulatory headwinds and a pivot toward cleaner U.S. catalysts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。