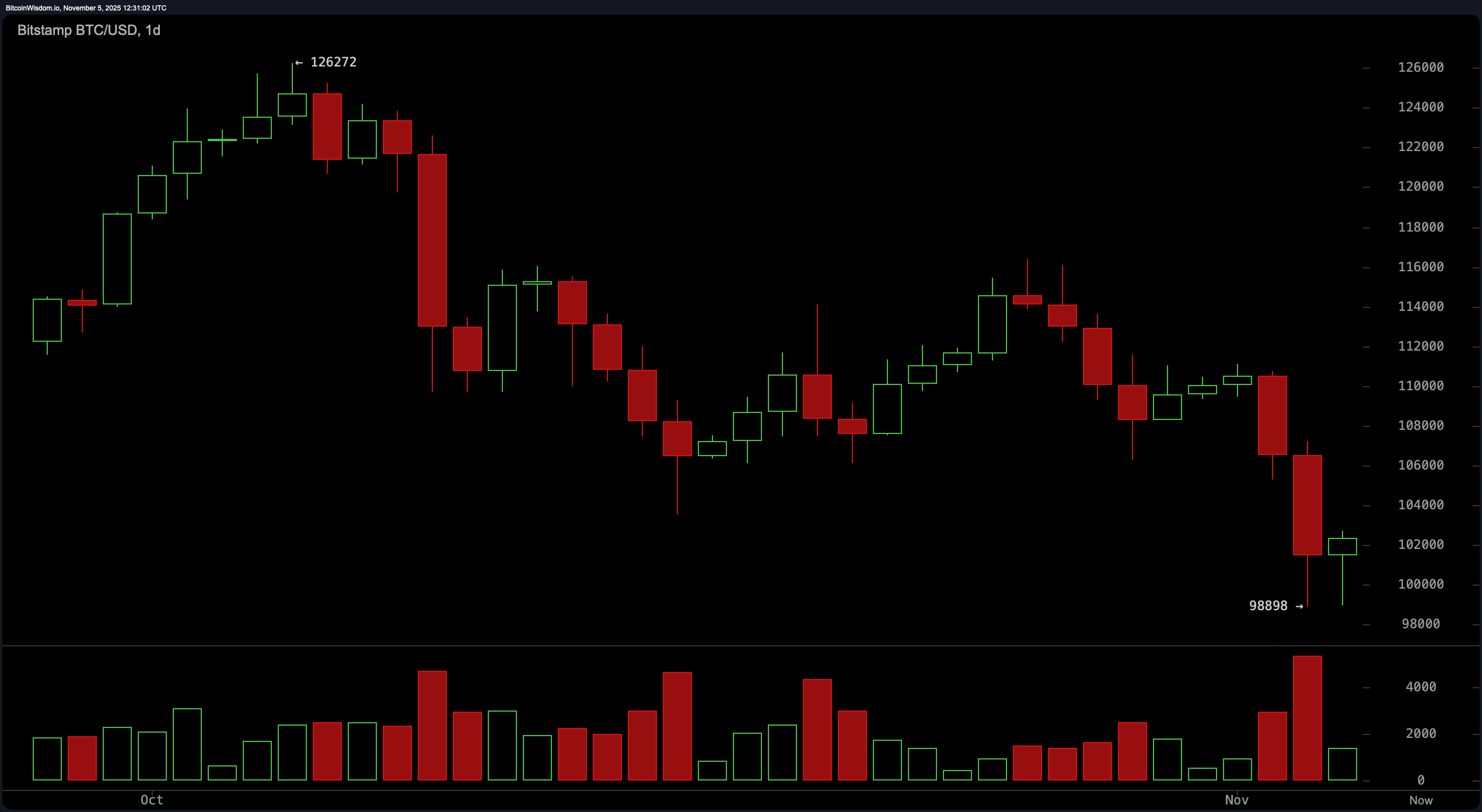

在日线图上,比特币像一位饱经风霜的斗牛士一样拖着一条红色斗篷。从126,000美元的高点急剧下跌至98,898美元的局部低点,伴随着沉重的红色蜡烛和恐慌抛售量——这是典型的投降信号。底部附近的十字星暗示着潜在的稳定,但还不必急于庆祝。

平均方向指数(ADX)为20,表明趋势疲软,而相对强弱指数(RSI)为35,仍处于中性区域。随着所有关键时间段(从10到200)的指数移动平均线(EMA)和简单移动平均线(SMA)都显示出下行压力,趋势悬挂在脆弱的希望线上。

BTC/USD 1日图,数据来源于Bitstamp,日期为2025年11月5日。

放大到4小时图,从111,000美元到98,000美元的血腥屠杀似乎找到了情感支持小组。价格已开始在101,000美元和103,000美元之间整合,同时看空交易量明显下降。这可能表明空头正在喘息或只是暂时退场。随机振荡器在16,处于中性状态,既没有大声喊出超卖,也没有庆祝复苏。关注短期机会的交易者可能会密切关注103,500美元的水平——突破这一水平可能会标志着动能的回归。

BTC/USD 4小时图,数据来源于Bitstamp,日期为2025年11月5日。

在1小时图上,情绪更加安静乐观——仿佛比特币在经历了一场恐慌攻击后慢慢地在呼气。98,898美元水平的反复防守,加上圆形底部形态,指向积累行为。交易量保持低位,但稳步回升至102,000美元区间带来了希望的曙光。动量指标可能在-12,046处闪烁红灯,但MACD(移动平均收敛发散)水平在-2,225,暗示看空动能可能正在失去动力——尽管是勉强的。如果比特币坚定地突破103,000美元,可能会重新测试105,000美元到107,000美元的日内目标。

BTC/USD 1小时图,数据来源于Bitstamp,日期为2025年11月5日。

所有振荡器的信号各不相同。尽管商品通道指数(CCI)在-214处偏向反向和乐观,但强势振荡器在-6,374处中性,表明犹豫不决。市场既没有超买,也没有舒适的超卖——它漂浮在潜力的炼狱中。动量和MACD继续对币价施加压力,但并非没有来自技术形态的抵抗,暗示可能的反转在望。

尽管情绪低迷,比特币的技术姿态并非完全绝望。多时间框架分析描绘出一个微妙的画面:市场在遭受重击后仍在站立。需要关注的关键水平仍然是98,000美元作为生死支持,以及103,500美元作为犹豫与短期复苏之间的分界线。有一点是肯定的——比特币可能下跌,但远非无聊。

牛市判决:

如果比特币保持在99,000美元的支撑位之上,并在成交量确认的情况下重新夺回103,500美元,多时间框架的设置暗示着潜在的反弹。1小时图上的圆形底部和4小时图上减弱的卖压可能会推动价格向110,000美元进发,前提是动量指标稳定。多头可能还有足够的火花来进行短期反弹——但他们需要迅速而果断地行动。

熊市判决:

全面的看空动能占据主导地位,每个主要的指数和简单移动平均线从10到200周期都在大声喊出下行信号,这一点不容忽视。动量和MACD指标均处于负区间,任何价格上涨都有可能是死猫反弹。未能捍卫99,000美元可能会打开更深修正的大门——这一次,安全网可能会低得多。

- 比特币目前的交易价格是多少?比特币目前交易价格约为102,423美元,接近其日内区间的中点。

- 需要关注的关键支撑位是什么?99,000美元的水平在多个时间框架中充当关键支撑。

- 什么价格突破可能暗示短期反转?在成交量支持下强势突破103,500美元可能表明看涨动能。

- 比特币是否处于确认的趋势中?不,技术指标显示出整合,动能疲弱且指标混合。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。