撰文:Nathan Ma,DMZ Finance 联合创始人

当黄金价格在 2025 年突破每盎司 4000 美元时,许多人才惊觉:这个被认为「保守」的资产,正在上演一场令人瞠目的暴涨行情。

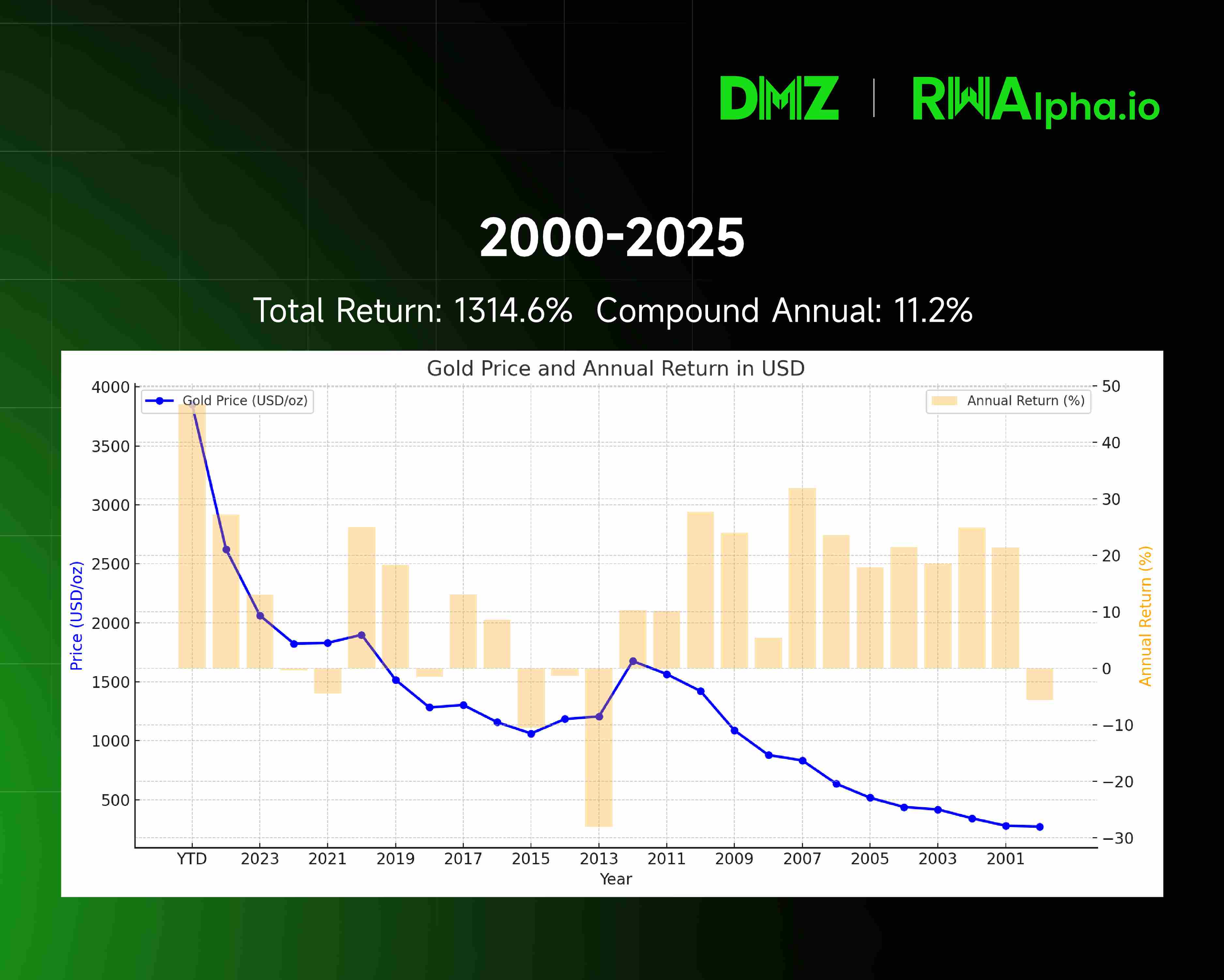

2001-2025 年黄金价格走势与年度回报率 回顾历史数据,黄金的上涨轨迹清晰可见。

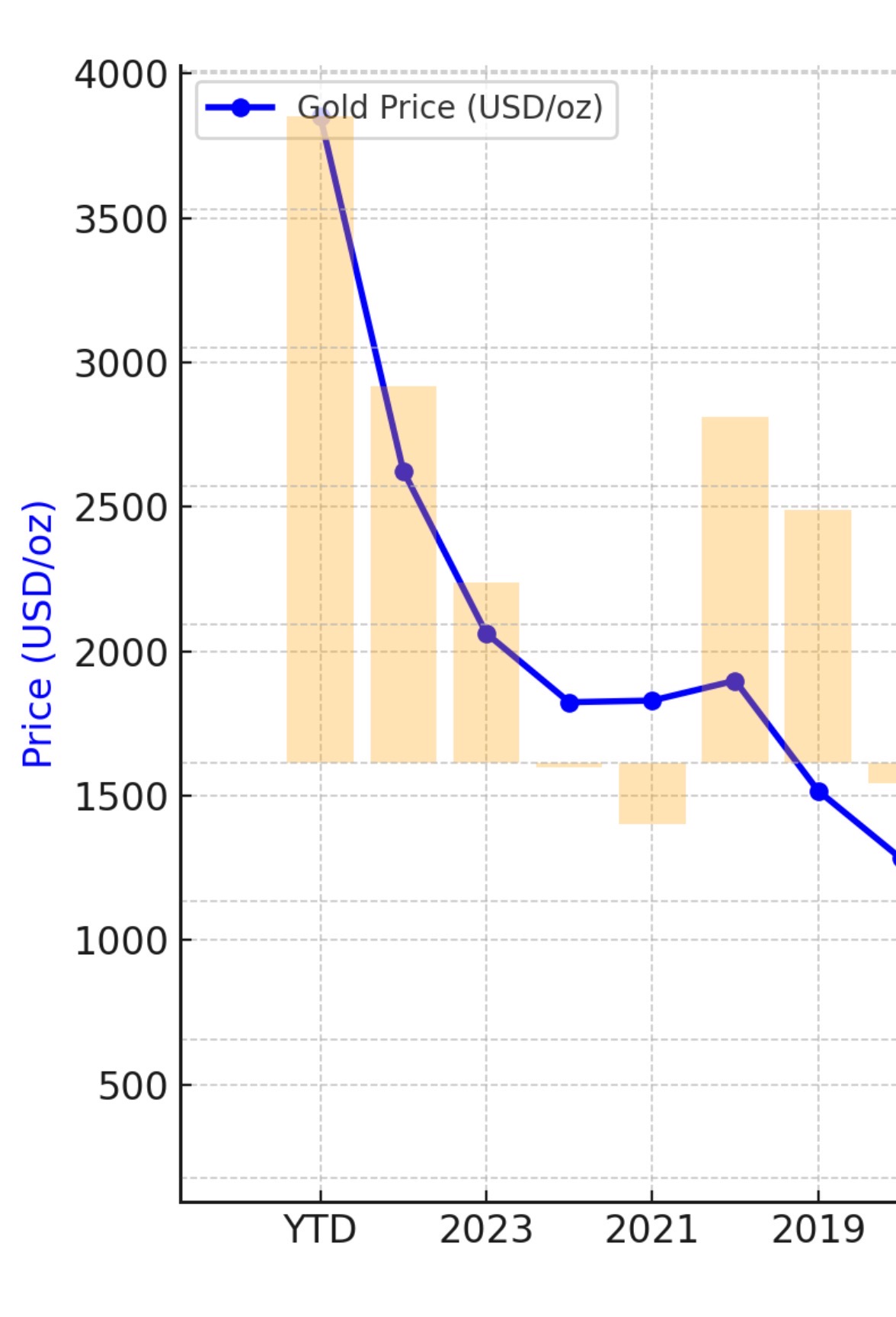

2019-2025 年黄金价格加速上涨趋势

而聚焦 2019 年开始的数据,不难发现从 2019 年的 1500 美元到 2025 年的 4000 美元,复合年化收益率超过 18%,远超大多数传统资产类别。

这波涨势并非偶然,而是四大核心因素共同作用的必然结果。

一、2019 年 - 制度变革:巴塞尔协议(三)重新定义黄金价值

黄金命运的转折点,始于一份名为「巴塞尔协议三」的国际银行业监管文件。

这份 2008 年金融危机后推出的监管框架,在 2019 年左右于全球主要经济体全面落地实施。它的核心目标很明确:确保银行持有足够多的高质量资本来抵御风险。正是在这套新规下,黄金的地位发生了根本性变化。

在旧的监管框架中,黄金被归类为「三级资产」——银行持有黄金需要付出昂贵的资本成本。这块千年金属,在现代金融体系中竟成了负担。

然而,巴塞尔协议(三)做出了革命性的决定:将实物黄金的风险权重正式设为零。这意味着,在银行的风险评估中,黄金如今与现金、顶级主权债务站在了同一队列。

这一变化直接降低了银行持有黄金的成本,促使银行将黄金纳入优质流动性资产组合。黄金重新回到了金融体系的中心,为后续的价格上涨奠定了制度基础。

二、2022 年 - 俄乌战争:3000 亿美元冻结引发的去美元化浪潮

如果说 2019 年巴塞尔协议三为黄金上涨铺平了道路,那么 2022 年的俄乌战争则直接点燃了引擎。

俄罗斯约 3000 亿美元外汇储备被冻结,让全世界目睹了「信用」的另一种崩塌形式——即使是以主权国家信用背书的国债和存款,在政治风险面前也可能一夜之间消失。

这一事件促使全球央行重新审视储备资产的安全性。根据国际货币基金组织数据,美元在全球外汇储备中的占比已从 2000 年的 72% 下降至 2025 年的 58%,创下近三十年新低。与此同时,超过 20% 的央行在 2024 年表示将在未来两年内继续增持黄金。

这一趋势在全球范围内表现明显。印度央行在 2023-2025 年间增持了超过 200 吨黄金,使其黄金储备占比提升至 8%;波兰央行同期增持约 130 吨,并表示「地缘政治风险是增持决策的关键因素」;新加坡金管局也在 2024 年宣布将黄金储备提升 15%,以增强金融体系韧性。

各国央行的这一系列行动,标志着全球正经历一场深刻的储备资产重构。当主权信用风险显现,无需任何对手方承诺的黄金,正成为各国央行在新的地缘政治环境下的必然选择。

三、3 年疫情 - 货币超发:美元购买力的持续稀释

黄金的暴涨,也反映了法币特别是美元的购买力稀释。

理论上,作为稀缺的实物资产,黄金在一定程度上可以作为对抗通货膨胀的保值工具。当政府大量发行货币导致购买力下降时,黄金因其内在的稀缺性,能够以更多的货币单位来计价。

疫情三年期间,全球主要央行实施了史无前例的货币宽松政策。美联储资产负债表从 2020 年初的约 4 万亿美元急剧扩张至 2022 年高峰时的近 9 万亿美元,增幅超过 125%。与此同时,美国 M2 货币供应量在 2020-2022 年间从 15 万亿美元激增至 21 万亿美元,增幅达 40% 以上,这是二战以来最快的货币增速。

回顾历史,黄金在抗通胀方面的表现虽非始终有效,但在特定时期确实发挥了显著作用。整个 70 年代,美国饱受「滞胀」困扰,CPI 年均涨幅高达 7.1%。同期,黄金价格从 1970 年的约 35 美元 / 盎司,飙升至 1980 年的高点约 670 美元 / 盎司,涨幅超过 1800%。

2021-2023 年,新冠疫情后的供应链瓶颈、大规模财政刺激推高了全球通胀。美国 CPI 在 2022 年 6 月达到 9.1% 的 40 年新高。尽管期间美联储迅猛加息对金价构成压力,但高通胀环境仍为黄金提供了重要支撑。

数据显示,自 2000 年以来,美元实际购买力已下降了约 40%,这种长期的價值稀释,使得寻求保值的投资者,不得不寻找美元信用之外的替代品。

四、中国换仓 - 储备重构:全球央行的战略性调整

中国的外汇储备管理策略,正成为影响黄金市场的重要变量。

与 2019 年末相比,中国对外储备结构呈现出明显的「降债增金」趋势:美债持有自 1.0699 万亿美元降至 0.7307 万亿美元(截至 2025 年 7 月),净减 3392 亿美元,跌幅达 -31.7%;而官方黄金储备由 1948 吨增至 2303.5 吨(截至 2025 年 9 月),净增 355 吨,涨幅达 +18.2%。这一减一增的背后,是中国央行深刻的战略考量。

中国的外汇储备规模庞大,但在这一庞大储备背后,是资产配置的结构性变化——适度减持美债,稳步增持黄金。

截至 2025 年 9 月末,中国官方国际储备资产中黄金的占比仅为 7.7%,明显低于 15% 左右的全球平均水平。这意味着未来中国央行继续增持黄金仍有充足空间。

这一趋势并非中国独有。根据世界黄金协会的数据,全球央行的购金潮自 2022 年创下历史纪录(1136 吨)后持续高涨。市场普遍预计,2026 年全年央行净购金量将连续第五年稳居 1000 吨以上这一历史高位。 俄罗斯自 2006 年起从黄金净出口国转变为净进口国,黄金储备持续增加。

各国央行购金潮的背后,是深刻的战略考量:黄金作为全球广泛接受的最终支付手段,能够增强主权货币的信用,为推进货币国际化创造有利条件

五、未来展望:黄金未来 10-15 年继续增值十倍的逻辑支撑

基于当前的基本面分析,黄金在未来 10-15 年内实现十倍增值并非天方夜谭。这一判断基于以下核心逻辑:

首先,全球央行「去美元化」进程刚刚开始。目前美元在全球外汇储备中仍占近 60% 的份额,而黄金仅占约 15%。如果这一比例在未来十年内实现再平衡,仅央行购金需求就将为黄金市场带来数万亿美元的资金流入。

其次,全球货币供应量的持续扩张与黄金存量的有限增长形成鲜明对比。过去二十年,全球主要经济体的 M2 货币供应量增长了近五倍,而黄金储量年均增速不足 2%。这种供需失衡将在长期内继续支撑金价上涨。

第三,地缘政治风险的常态化将推动黄金的避险属性持续凸显。在美元信用受损、新兴储备货币尚未成熟的过渡期,黄金作为中立储备资产的价值将得到进一步重估。

结语:把握历史性的机遇

黄金的暴涨,并非单一因素驱动,而是「制度变革、地缘政治、货币超发与储备重构」四大核心因素共同作用的结果。

展望未来,包括高盛在内的多家机构对金价持乐观预期,高盛甚至将 2026 年 12 月金价预估上调至 4900 美元 / 盎司。

「黄金是钱,其他的都只是信用」,在信用货币价值面临考验的今天,黄金提供了历经千年检验的财富保障。能让人睡得踏实的配置,才是穿越周期的真正底气。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。