作者:Lex,ChainCatcher

编译:Fairy,ChainCatcher

7 月,一个名为 Graphite Protocol ( GP ) 的项目在短期内获得接近 30 倍的涨幅,流通市值一度触及 1.9 亿美元。从 7 月 23 日起,几乎每天都在达到新的 ATH 。

这个横空出世的 GP 究竟是什么来头?是昙花一现的炒作,还是真正具备价值的潜力股?今天,我们就来深入扒一扒这个项目背后的故事。

图源: coingecko

Graphite Protocol 是 Bonk . fun 的“收税官”?

Graphite Protocol 定位为一个多链基础设施项目,旨在通过无代码( No - code )工具,降低 Web3 应用的开发门槛。

然而,这一宏大愿景还在路上。眼下, Graphite Protocol 的真正“硬通货”,来自于它与 Solana 生态头部 Meme 启动板 Bonk.fun 的深度绑定。

Bonk . fun 在短短 73 天内,凭借爆发式的用户增长和收入表现,迅速超越了曾经称霸一时的 Pump . fun ,占据了 Meme 销售市场55%的份额。

而 Graphite Protocol 则为 Bonk . fun 平台提供底层技术支持,并以此获得其7.6%的协议收入,这部分收益会被自动用于二级市场回购并销毁 GP 代币。

这一设计使 Graphite Protocol 从单纯的工具供应商,进阶为 Bonk 生态的“收税官”。它不再需要自己去构建庞大的用户基础,而是通过寄生于一个已经拥有巨大流量和活跃度的成熟生态,直接分享其增长红利。

GP 的双重底牌:硬核创始人与通缩机制

除了与 Bonk . fun 的深度合作外, Graphite Protocol 背后的团队也是其重要优势。项目领头人 Tom Solport 在 Solana 社区享有良好声誉,是一位实干派创始人和建设者。他最为人熟知的成绩,是收购并成功振兴了 Solana 上的蓝筹 NFT 项目 Taiyo Robotics 。

Taiyo Robotics 于 2021 年11月首次铸造,但在原始开发团队退出后陷入困境。 2021 年12月, Tom Solport 接手该项目,迅速制定并执行详细路线图,包括为 Taiyo Robotics 创建定制市场。

即使在熊市中, Taiyo 项目依然在持续建设,赢得了社区的信任。业内普遍评价 Tom 为“能做事、不跑路”的 Builder ,这种强大的个人 IP 为 Graphite Protocol 带来了强有力的信任背书。

此外, GP 设计了强大的通缩机制:无论是来自 Bonk . fun 的协议分成,还是用户支付的服务费( SOL 、 ETH 、 MATIC ),最终均会兑换为 GP 代币并被销毁。在固定总量的约束下,这一通缩飞轮为 GP 代币价格提供了坚实的数学支撑。

图源: Graphite Protocol 白皮书

风口之上,暗涌之下: GP 的隐忧与悬念

尽管 GP 凭借强势合作与机制设计迅速崛起,但其增长逻辑也存在不容忽视的风险敞口。

当前 GP 的大部分价值,仍高度依赖于与 Bonk . fun 的绑定关系。无论是 Bonk 热度的衰减、合作条款的调整,还是生态裂痕的传闻,任何负面信号都可能直接冲击 GP 的收入基础与市场叙事。

GP 的代币历史也埋下了复杂变量。

GP 的前身是 $ SCRAP ,原计划从 2023 年起在4-5年内完成线性释放。随着 Graphite Protocol 开发完备,$ SCRAP 被淘汰,转由$ GP 接棒。旧持有人可将$ SCRAP 兑换为“ Graphite 碎片”进行质押,分期领取 $ GP ,不过该转换通道已关闭。

截至 2025 年7月下旬,$ GP 的总供应为1.5亿枚,流通仅为3000万枚,占比约20%。这意味着高达80%的代币仍处于未解锁状态,而其解锁时间表和具体分配结构(团队持仓比例、锁仓机制等)尚未全面公开,潜在的抛压难以估算。

更重要的是,短期内的剧烈上涨已聚集了大量获利盘,市场情绪一旦转向,价格回调可能异常剧烈。

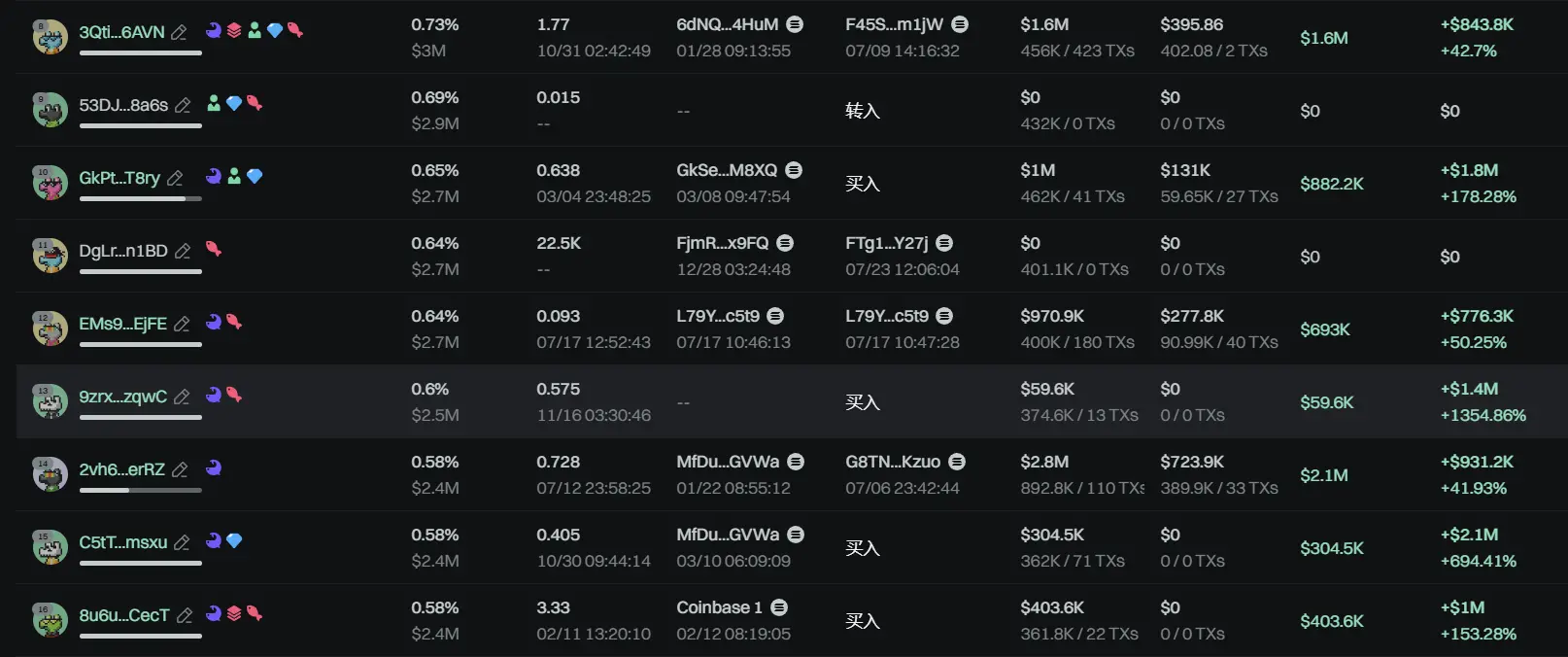

GP 代币持仓前 20 收益图,图源: GMGN

Graphite Protocol 拥有硬核创始人、真实收入与通缩机制三重支撑,但从一级市场黑马到长期蓝筹,它仍面临诸多挑战。

如何降低对单一生态的依赖、逐步披露更透明的代币经济结构、拓展多元增长引擎,将决定它能否真正走出下一阶段的成长曲线。

(本文仅供参考,不构成投资建议)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。