在比特币强势突破历史高点之后,加密市场的注意力正悄然转向以太坊、Solana等高Beta 资产。多个链上数据与资金流向信号显示,一轮由山寨币主导的行情,可能已经悄然启动。

以太坊和Solana表现强劲,主力资金加速入场

近期,以太坊和Solana的市场表现尤为抢眼。据火币HTX平台行情数据显示,截至当前,以太坊(ETH)自7月初从2474 USDT最高涨至3857 USDT,涨幅超过55%。

这波显著的涨势并非偶然,链上监测平台Lookonchain 数据显示,自7月1日至21日,已有23个巨鲸或机构合计买入681,103枚以太坊,金额约合26亿美元,显示ETH正成为市场主力资金加仓的核心标的。

与此同时,ETF市场也释放出积极信号。据Trader T监测,7月21日当天,ETH现货ETF净流入高达2.97亿美元,创历史最高单日流入记录,占比特币ETF交易量的80%,也是持续 12 日净流入,资金倾斜态势十分明显。

在另一边,曾被誉为“以太坊杀手”的Solana也同样表现不俗。火币HTX平台行情数据显示,Solana(SOL)从157.8 USDT最高冲至204.6 USDT,涨幅亦达29.6%。与此同时,Solana 生态代币普涨,截至7月22日10时,RAY近24小时上涨 21.01%;PENGU近24小时上涨20.5%;JUP近24小时上涨 17.14%;AI16Z 近24小时上涨 14.73%。

ETH 与 SOL 的走强,不只是个别主流资产的单点爆发,更像是一个结构性信号——资金正在从比特币向更具波动性和成长性的山寨币板块转移,“山寨季”的序幕或已正式拉开。

BTC市占持续回落,山寨币季节指数走强

在ETH和SOL轮番上涨的同时,市场结构也悄然发生变化。比特币的市场主导地位正逐步被侵蚀,为资金流入山寨资产提供了空间。

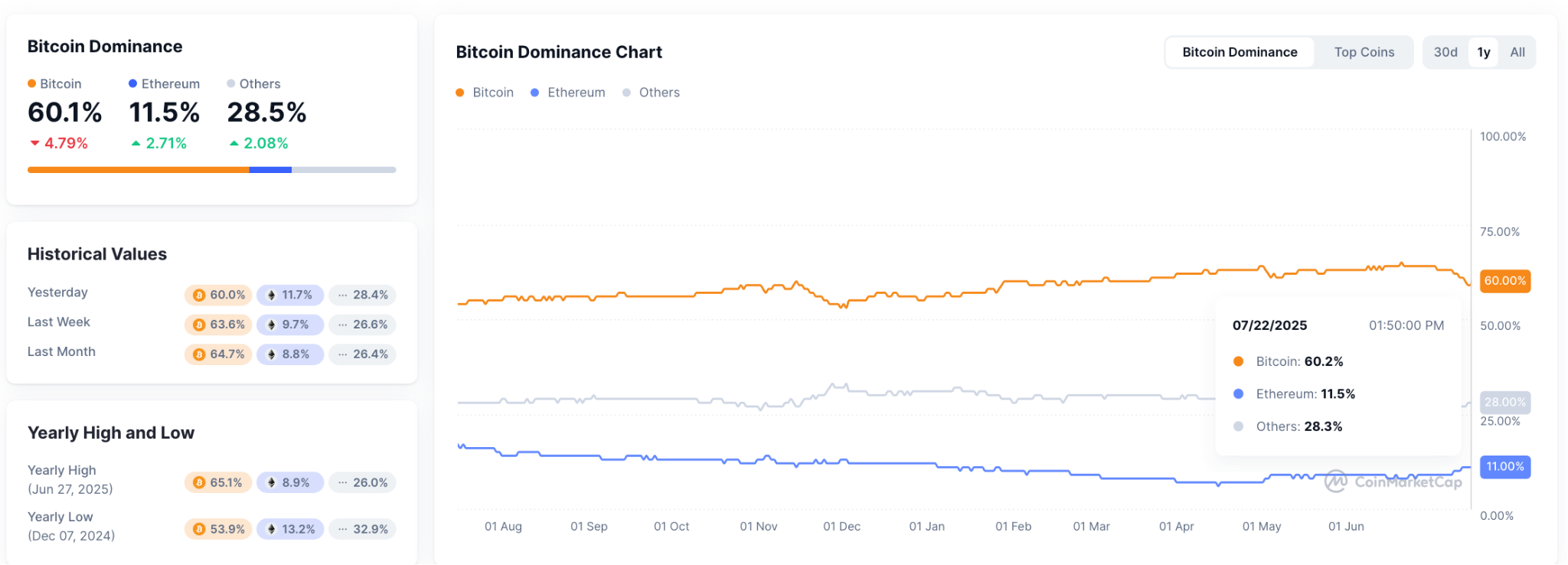

Coinmarketcap数据显示,比特币市占率出现持续回落,现报60.1%,创下今年3月以来新低。与此同时,山寨币季节指数(Altcoin Season Index)上涨,7月21日最高涨至55,现报 50。该指数显示在过去 90 天内,市值前 100 加密货币中约 50 个项目涨幅超越比特币。

数据来源:CoinMarketCap

数据来源:CoinMarketCap

HTX DeepThink专栏作者、HTX Research研究员Chloe(@ChloeTalk1)分析认为,比特币强势突破历史新高,激发市场对“山寨激活季“的普遍预期。比特币此轮上涨得益于其避险属性与美元信用资产标签,而在日本国债收益率上升、全球利率结构可能迎拐点之际,结合期权市场结构偏多,这构成资金从 BTC 向山寨资产切换的重要结构性基础。

市场观点:真正的山寨牛市或还在后面

QCP Capital在其最新研报中指出,多个指标显示,山寨季或已悄然开启。山寨币季节指数已突破 50,创下自去年 12 月以来新高。《GENIUS 法案》的通过,为稳定币发行提供了明确监管框架,促使企业财务部门将 ETH、SOL、XRP、ADA 等视为新一代加密储备资产。此外,若质押型以太坊现货 ETF 获批,有望进一步推动机构从比特币 ETF 向 ETH 配置转移。上周 ETH 现货 ETF 连续两天净流入超过 BTC,贝莱德等机构信心显著增强。期权市场亦呈现强烈看涨信号,第四季度行情预期乐观。

合约巨鲸James Wynn认为7月底BTC可能会达到14.5万美元左右。随后,预计会出现一次剧烈回调,回落至11万美元。接下来的1至2个月,将迎来一波强劲的山寨币牛市,也就是大家真正开始FOMO的阶段。他还预测,比特币的主导地位已经维持太久,山寨币正逐步崛起。等到第四季度,美联储开始降息后,比特币将迎来新一轮上涨,可能涨到16万至24万美元之间。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。