鲍威尔演讲引发反应,未提及降息或辞职

大家都希望杰罗姆·鲍威尔的演讲中能提到降息,但他的声明再次在金融界引起了波澜。鲍威尔保持沉默,没有讨论关于美国降息和他辞职的任何内容,这在很大程度上是人们所期待的。

鲍威尔昨日演讲声明,意味着什么?

美联储主席杰罗姆在昨日的演讲中强调了保持银行系统安全、稳健和高效的重要性。他表示,美联储正在密切审查所有主要的监管工具、资本规则、杠杆比率、压力测试和对银行的额外要求。

他更加关注于在快速变化的经济中,使金融部门变得更加严格和具有竞争力。

特朗普称美联储主席为“傻瓜”,预测他将在八个月内离职

在一次令人惊讶且直言不讳的评论中,特朗普总统在周二的新闻发布会上称杰罗姆为“傻瓜”。他批评美联储主席将利率维持在过高的水平,即4.25%-4.5%。

他说,鲍威尔的表现很糟糕,他反正很快就会离开,差不多在八个月内。

尽管如此,在总统的要求下,鲍威尔同意将利率降低到4%,但特朗普再次提出要求,要求将其降至1%。

除了特朗普,许多其他人如首席经济学家和全球战略家彼得·希夫,以及怀俄明州的美国参议员辛西娅·卢米斯也在他们的X账号上表达了失望。

来源: X

对加密市场的影响

当美联储主席没有谈及辞职和降息时,许多虚假报道和预测都未能实现。以及其他金融工作策略的信号。

如果杰罗姆做出上述任何决定,市场可能会出现波动,但市场没有移动一个百分点,这令人震惊。根据Kalshi预测市场,鲍威尔在今年失去职位的机会仅为22%。

来源: X .

当美联储决定降低或提高利率时,市场可能会持续波动,但并没有发生这种情况。因此,市场正在顺其自然。

这对投资者来说可能是一个买入机会吗?

是的,如果利率下降,这可能是一个不错的机会。加密市场也可能面临下行压力,但对一些人来说,这将是一个很好的买入或投资的机会。

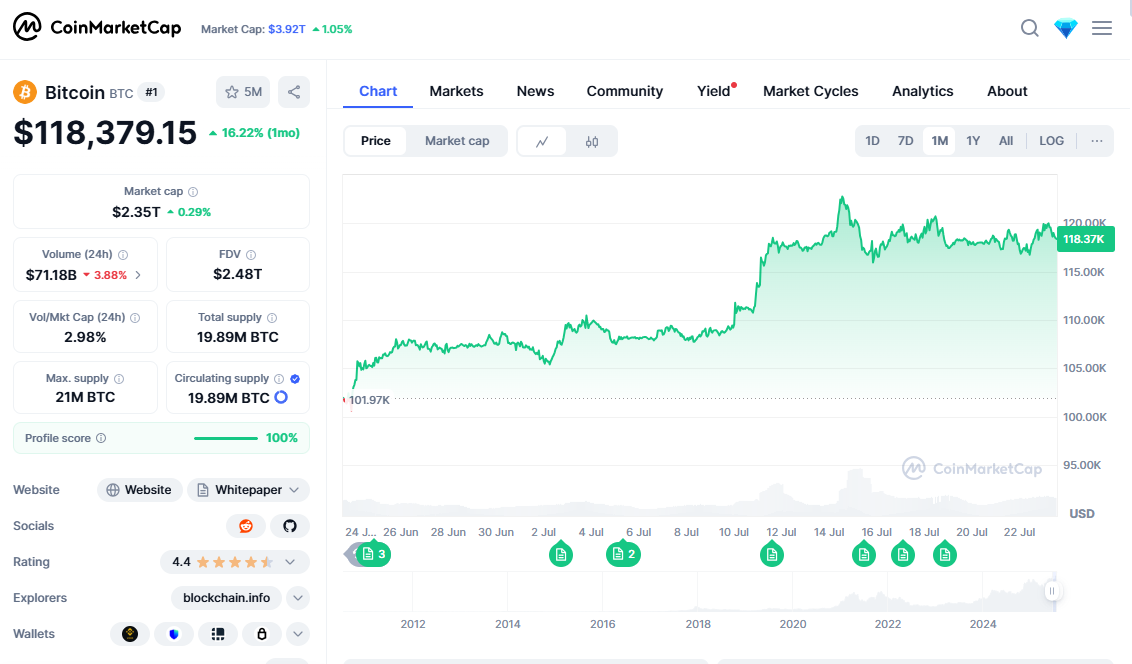

如你所见,历史最高价的比特币正日益昂贵,目前交易价格为118,000美元,而在2025年6月23日的一个月前交易价格为103,000美元。

来源: CoinMarketCap

它上涨了15,000美元,这个幅度很大,同时达到了122,000美元的历史最高价。因此,当这些资产变得更便宜时,专家建议应该多买一些。因为这将有助于未来当这些资产的价格上涨时。

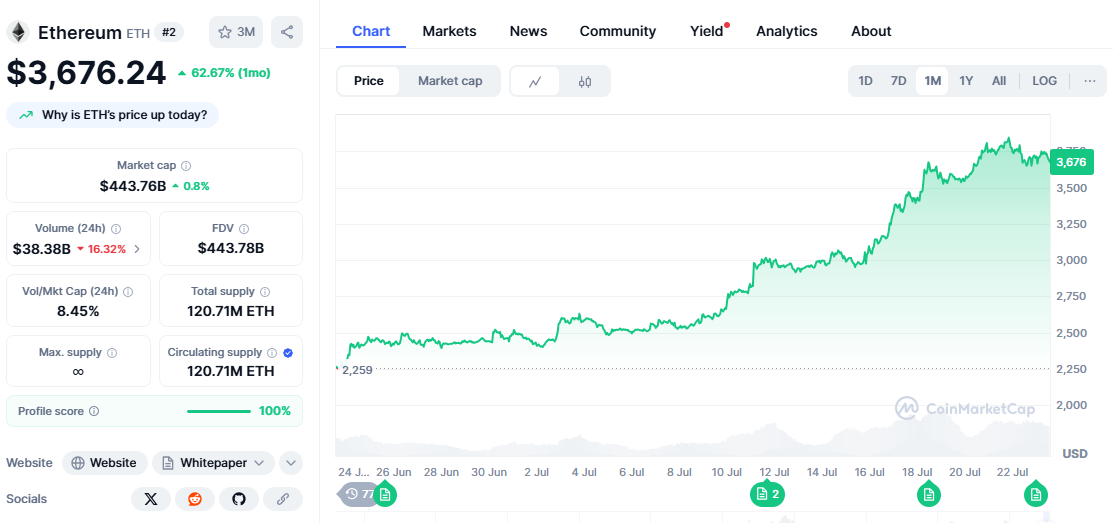

同样,以太坊在过去一个月也显示出上涨,6月23日的交易价格为2,220.23美元,目前交易价格为3,676.20美元(在撰写时),展现出令人印象深刻的涨幅。

来源: CoinMarketCap

结论

尽管有很多炒作,鲍威尔对降息和辞职传闻保持沉默。市场没有动摇,但投资者现在将可能的下跌视为一个新的买入机会。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。