This article comes from: Penn Blockchain Co-Investment Director Kevin (@kevinlhr88)

Compiled by Odaily Planet Daily (@OdailyChina); Translator: Azuma (@azuma_eth)

Although the crypto community has long been enthusiastic about bringing traditional assets onto the chain in a tokenized form, the most significant recent progress actually comes from the reverse integration of crypto assets into traditional securities. The recent public market's enthusiasm for "crypto asset treasury" stocks perfectly illustrates this trend.

Michael Saylor was the first to adopt this strategy through MicroStrategy (MSTR), pushing the company's market value past $100 billion, with growth even surpassing Nvidia during the same period. We conducted a detailed analysis in our special report on MicroStrategy (an excellent learning resource for newcomers in the treasury field). The core logic of such treasury strategies is that listed companies can obtain low-cost, unsecured leverage that ordinary traders cannot access.

Recently, the market's focus has shifted from BTC treasuries to ETH treasuries, such as Sharplink Gaming (SBET) led by Joseph Lubin and BitMine (BMNR) headed by Thomas Lee.

But is the ETH treasury really reasonable? As we argued in the MicroStrategy analysis report, treasury companies are essentially trying to arbitrage the difference between the long-term compound annual growth rate (CAGR) of the underlying assets and the cost of capital. In an earlier article, we outlined our views on the long-term CAGR of ETH: As a programmable scarce reserve asset, ETH plays a fundamental role in maintaining on-chain economic security as more assets migrate to blockchain networks. This article will explain the bullish logic of ETH treasuries in a broad sense and provide operational advice for companies adopting this strategy.

Liquidity Acquisition: The Cornerstone of Treasury Companies

One of the main reasons tokens and protocols seek to create these treasury companies is to open up pathways for tokens to acquire traditional financial (TradFi) liquidity—especially against the backdrop of shrinking liquidity in altcoins. These treasury companies primarily acquire liquidity to increase their asset holdings through three methods. Notably, this liquidity/debt is all unsecured, meaning it cannot be redeemed early.

Convertible Bonds: Raising funds through issuing debt that can be converted into equity, with the proceeds used to purchase more cryptocurrencies;

Preferred Equity: Financing through issuing preferred shares that pay fixed annual dividends;

At-the-Market (ATM) Issuance: Directly selling new shares in the public market to obtain flexible real-time funds for purchasing cryptocurrencies.

Advantages of ETH Convertible Bonds

In our previous research on MicroStrategy, we pointed out that convertible bonds offer two major conveniences for institutional investors:

Downside protection and upside opportunity: Allowing institutions to gain exposure to underlying assets (such as BTC or ETH) under the inherent protective characteristics of bonds;

Volatility-driven arbitrage opportunities: Hedge funds often profit from the volatility of the underlying assets and their securities through gamma trading strategies.

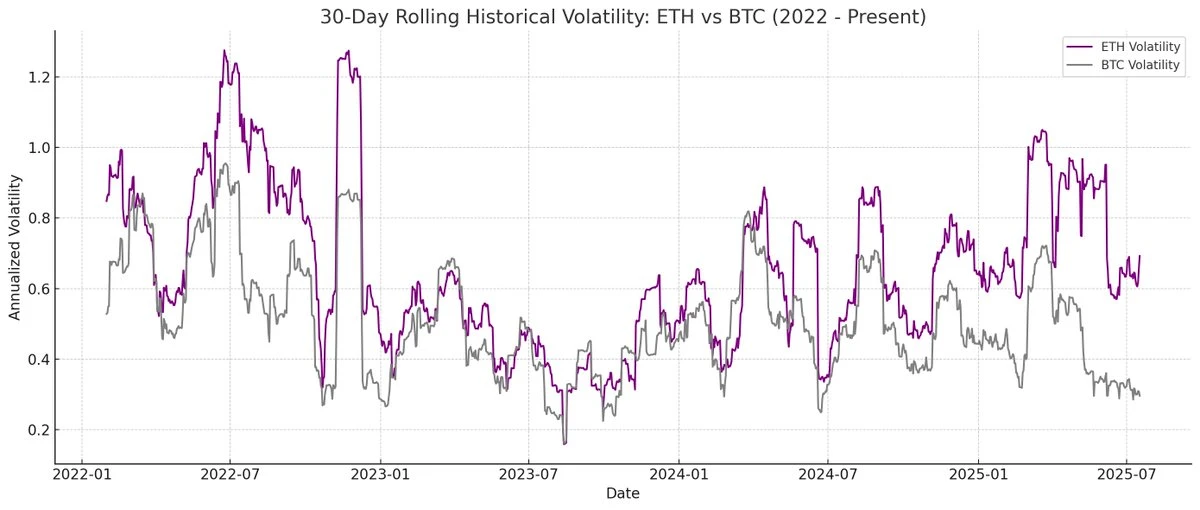

Among them, gamma traders (hedge funds) have become the dominant force in the convertible bond market, with ETH having higher historical volatility and implied volatility compared to BTC. The convertible bonds (CB) issued by ETH treasury companies naturally reflect this high volatility in their capital structure, making them more attractive to arbitrageurs and hedge funds. More importantly, this volatility allows ETH treasury companies to issue convertible bonds at higher valuations, obtaining more favorable financing conditions.

Odaily Note: Comparison of historical volatility between ETH and BTC.

For convertible bondholders, higher volatility means increased opportunities to profit through gamma strategies. In short, the greater the volatility of the underlying asset, the more substantial the gamma trading profits, making ETH treasury convertible bonds more advantageous than BTC treasuries.

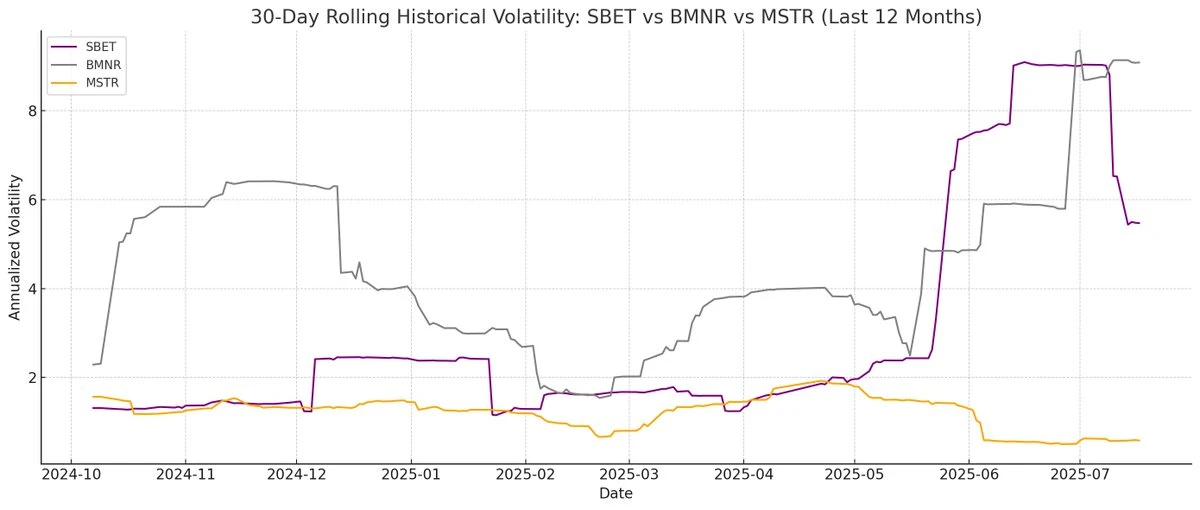

Odaily Note: Comparison of historical volatility between SBET, BMNR, and MSTR.

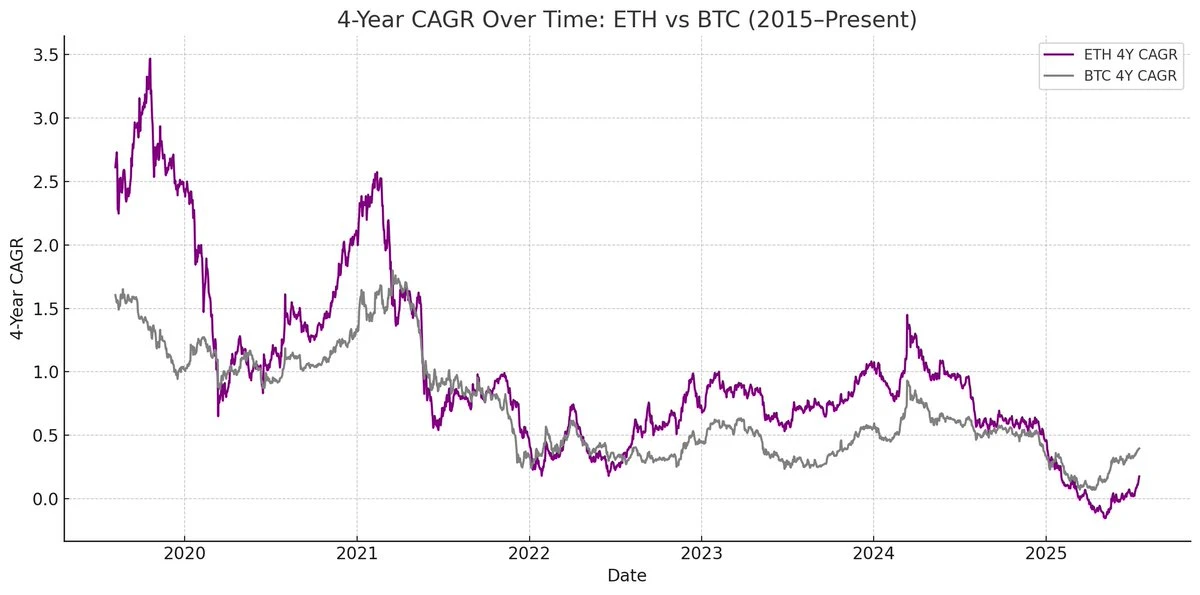

However, it is essential to note a key premise—if ETH cannot maintain long-term annual compound growth, the appreciation of the underlying asset may not be sufficient to meet the conversion conditions before maturity. In this case, the treasury company will face the risk of full repayment. In contrast, BTC, with its more mature long-term performance, has a lower probability of this happening with its convertible bonds—historical data shows that most convertible bonds under this strategy ultimately achieved conversion.

Odaily Note: Comparison of four-year CAGR between ETH and BTC.

The Special Value of ETH Preferred Shares

Unlike convertible bonds, preferred shares are designed for fixed-income investors. While some convertible preferred shares have mixed upside potential, yield remains the primary consideration for most institutional investors. The pricing of these instruments is based on credit risk—whether the treasury company can reliably pay interest.

The key advantage of the MicroStrategy strategy lies in using ATM issuance to pay interest. Since this typically only accounts for 1-3% of market value, the dilution risk is minimal, but this model still relies on the market liquidity and volatility of BTC and MicroStrategy's underlying securities.

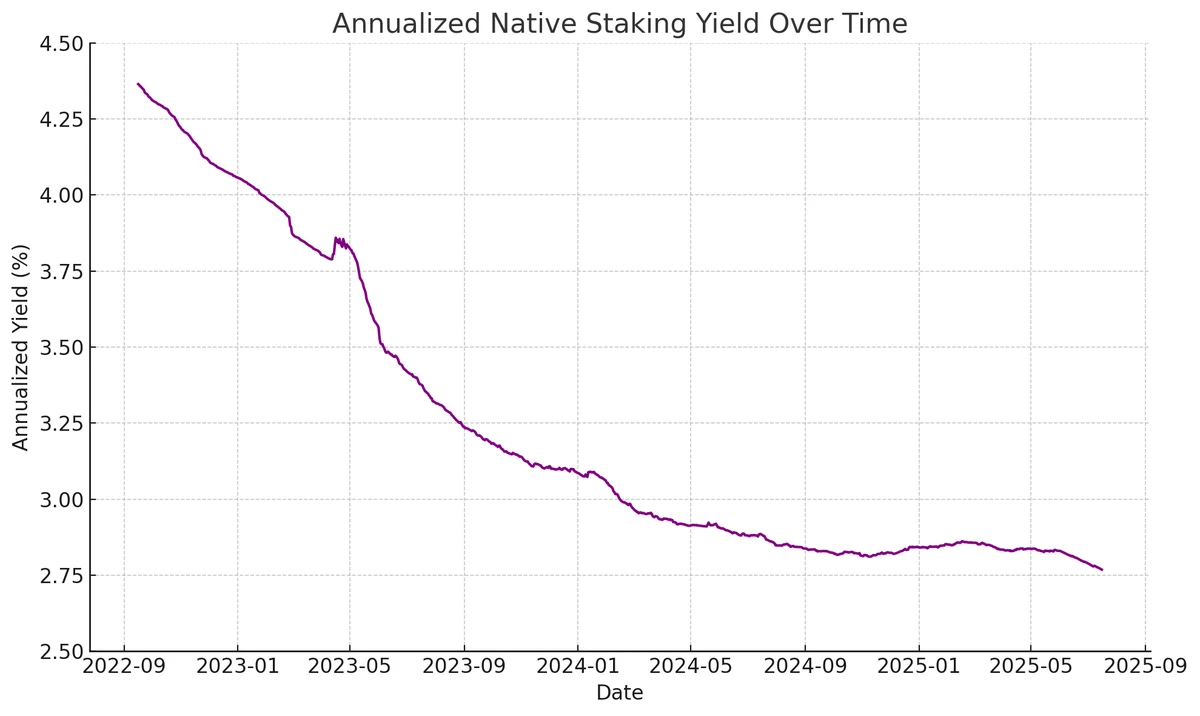

ETH, on the other hand, can generate native yields through staking, re-staking, and lending, providing stronger certainty for preferred share interest payments, theoretically warranting a higher credit rating. Unlike BTC, which relies solely on price appreciation, ETH's returns combine long-term annual compound growth expectations with native yields at the protocol level.

Odaily Note: Annualized yield situation of ETH native staking.

My innovative idea is: ETH preferred shares can serve as a non-directional investment tool, allowing institutions to participate in network security maintenance without bearing ETH price risk. As we emphasized in the ETH report, maintaining at least 67% honest validators is crucial for network security. As more assets go on-chain, it becomes increasingly important for institutions to actively support Ethereum's decentralization and security.

Many institutions may be unwilling to go long on ETH directly, but ETH treasury companies can act as intermediaries—absorbing directional risks while providing institutions with similar fixed-income returns. The on-chain preferred shares issued by SBET and BMNR are designed as fixed-income staking products, making them more attractive to investors seeking stable returns without wanting to bear all market risks through bundling protocol layer incentives.

Special Advantages of ATM Issuance for ETH Treasuries

The key valuation metric for treasury companies, mNAV (market value to net asset value ratio), conceptually resembles the price-to-earnings ratio and reflects the market's pricing of future growth per share of assets. ETH treasuries naturally enjoy a higher mNAV premium due to their native yield mechanisms—these activities can generate ongoing "yields" or increase the corresponding ETH per share without additional capital. In contrast, BTC treasury companies must rely on synthetic yield strategies (such as issuing convertible bonds or preferred shares), making it difficult to justify any yield rationality when market premiums approach NAV.

More importantly, mNAV is reflexive—higher mNAV allows treasury companies to raise capital more value-effectively through ATM issuance. They issue shares at a premium and increase their underlying asset holdings, enhancing the per-share asset value, creating a positive feedback loop. The higher the mNAV, the stronger the value capture ability, making ATM issuance particularly effective for ETH treasury companies.

Capital acquisition is another key factor. Companies with deeper liquidity and broader financing capabilities naturally achieve higher mNAV, while companies with limited market access tend to trade at a discount. Therefore, mNAV typically reflects liquidity premiums—an indication of the market's confidence in the company's ability to effectively acquire more liquidity.

Filtering Treasury Companies Based on First Principles

ATM issuance can be seen as financing for retail investors, while convertible bonds and preferred shares are typically aimed at institutional investors. Therefore, the success of an ATM strategy hinges on establishing a strong retail base, which often requires credible and charismatic spokespersons, as well as ongoing transparent strategic disclosures to earn the long-term trust of retail investors. In contrast, convertible bonds and preferred shares require robust institutional sales channels and relationships with capital markets departments. Following this logic, I believe SBET has a stronger retail-driven advantage (thanks to Joe Lubin's leadership and the team's ongoing transparency in increasing per-share ETH), while BMNR, with Tom Lee's deep connections in traditional finance, is more likely to access institutional liquidity.

The Ecological Significance and Competitive Landscape of ETH Treasuries

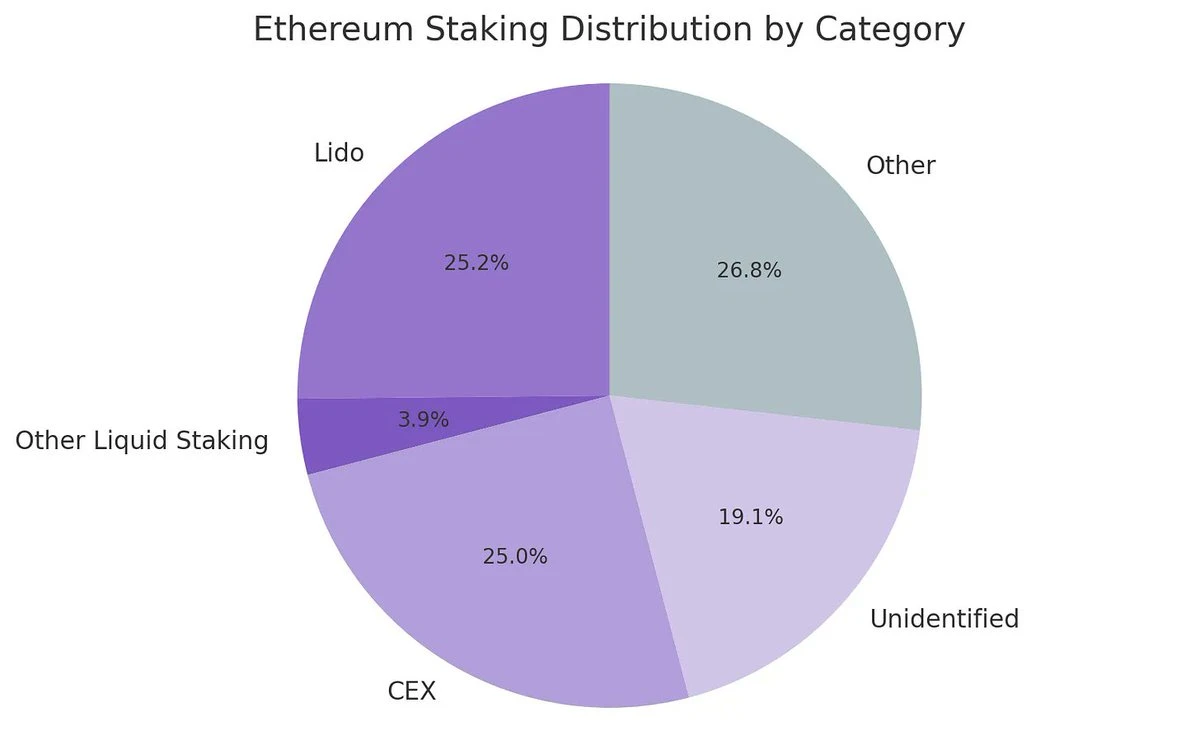

One of the biggest challenges facing Ethereum is the increasing centralization of validators and staked ETH (mainly in liquidity staking protocols like Lido and centralized exchanges like Coinbase). ETH treasuries help counter this trend and promote validator decentralization. To enhance long-term resilience, these companies should diversify their ETH across multiple staking service providers and operate their own validator nodes when possible.

Odaily Note: Distribution of Ethereum's staking categories.

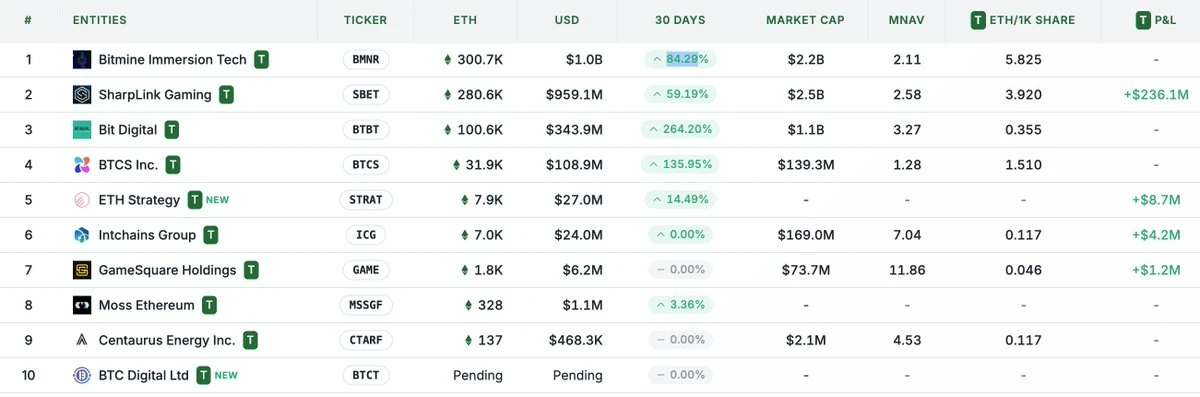

In this context, I believe the competitive landscape for ETH treasury companies will fundamentally differ from that of BTC treasury companies. The Bitcoin ecosystem has formed a winner-takes-all situation (MicroStrategy's holdings are more than 10 times that of the second-largest corporate holder), dominating the convertible bond and preferred share markets due to its first-mover advantage and strong narrative control. In contrast, ETH treasuries are starting from scratch, with no single dominant entity and multiple projects developing in parallel. This lack of first-mover advantage is not only healthier for the network but also fosters a more competitive and accelerated development environment. Given that the ETH holdings of leading companies are similar, SBET and BMNR are likely to form a duopoly.

Odaily Note: Comparison of ETH treasury company holdings.

Valuation Framework: A Combination of MicroStrategy and Lido

Broadly speaking, the ETH treasury model can be seen as a fusion of MicroStrategy designed for traditional finance and Lido. Unlike Lido, ETH treasury companies can capture a larger proportion of asset appreciation due to their holdings of underlying assets, significantly outperforming the former in terms of value accumulation.

Here is a rough valuation reference: Lido currently manages about 30% of staked ETH, with an implied valuation exceeding $30 billion. We believe that within a market cycle (4 years), SBET and BMNR could potentially surpass Lido in scale, driven by the speed, depth, and reflexivity of traditional financial capital flows (as demonstrated by MicroStrategy's growth strategy).

To add some background data, Bitcoin's market capitalization is $2.47 trillion, while Ethereum's is $428 billion (accounting for 17-20% of Bitcoin). If SBET and BMNR achieve 20% of MicroStrategy's $120 billion valuation, their long-term value would be approximately $24 billion. Currently, their combined valuation is less than $8 billion, indicating significant growth potential as ETH treasuries mature.

Conclusion

The emergence and development of digital asset treasuries represent a significant evolution in the further integration of the crypto market with traditional finance, with ETH treasuries becoming a strong new force. Ethereum's unique advantages (including higher volatility in convertible bonds and native yields from preferred shares) create differentiated growth opportunities for treasury companies, and their ability to promote validator decentralization and stimulate competition further distinguishes them from the BTC treasury bond ecosystem.

The combination of MicroStrategy's capital efficiency and ETH's embedded yields can unlock tremendous value and push the on-chain economy deeper into traditional finance. Rapid expansion and growing institutional interest signal transformative impacts on the crypto and capital markets in the coming years.

Related Reading

Has the Sharplink narrative bubble burst? The ETH version of Strategy is still undecided

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。