原创 | Odaily星球日报(@OdailyChina)

作者|Golem(@web3_golem)

7月22日,据知情人士透露,加密预测市场平台 Polymarket 正在评估推出自有稳定币的可能性,目的是掌控由 Circle 的 USDC 支撑的高额储备资金所带来的收益。虽然Polymarket 官方并未做出最终决定,但结合近期美国司法部结束对Polymarket的调查及该平台完成对美国合规交易平台 QCX的收购等一系列动作,许多用户猜测Polymarket发币也在路上,于是又加紧了交互的频率。

Polymarket将要发币的传闻从2024年提及,以至于已经有工作室批量交互了长达一年时间。那么,如果作为此前从未交互过Polymarket或频率较低的用户,现在开始撸Polymarket还有必要并且来得及吗?

美国大选后Polymarket平台依旧具有竞争力

在考虑现在开始交互Polymarket是否来得及之前,我们要先了解Polymarket目前平台的运营情况。Polymarket的火爆源自于2024年美国总统大选,因成功预测特朗普胜选及期间高达80亿美元的投注资金而名声鹤起。不过自从美国大选结束后,Polymarket在媒体上被提及的次数开始下降,因此有观点认为失去美国大选这个预测话题后,Polymarket用户将大量流失。但事实可能会让他们失望,以下从数据角度揭示了在美国大选炒作过后及政治领域之外,Polymarket仍是一个日处理数10万笔交易、每天服务数万用户的热门平台。

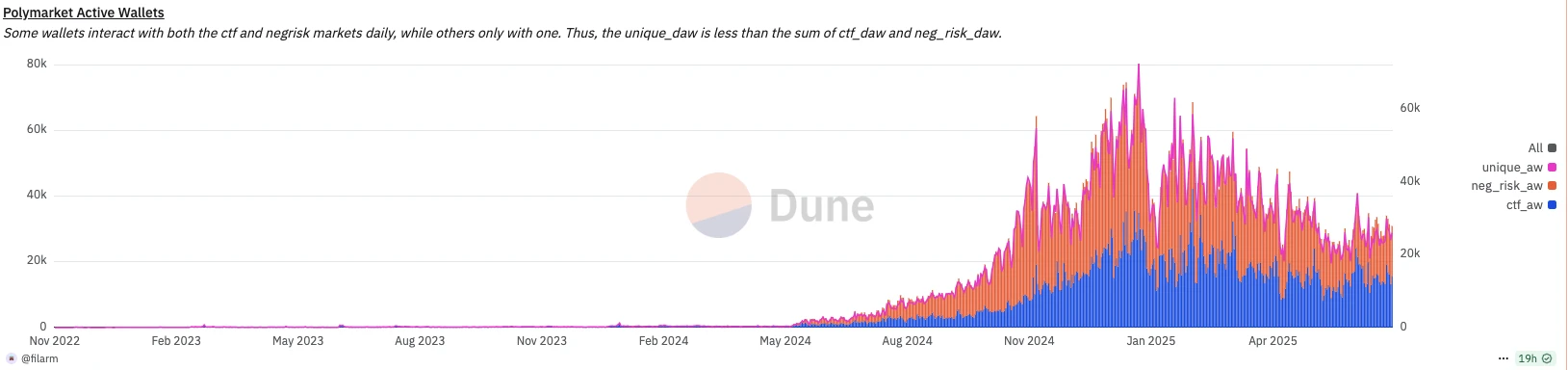

日钱包活跃数

据Dune数据,从2024年5月开始,Polymarket日钱包活跃数经历半年时间几乎从0至7万,虽然在2025年1月末至2月初因特朗普正式就职该平台钱包活跃度有所下降,但随后依旧回升。目前Polymarket日钱包活跃数保持在2-3万,虽与Pump.fun等Meme发射平台日活无法相比,但仍领先于Starknet、ZKsync等L2。在热潮过后仍保持较高的钱包活跃度也验证了Polymarket具有坚实的产品市场契合度。

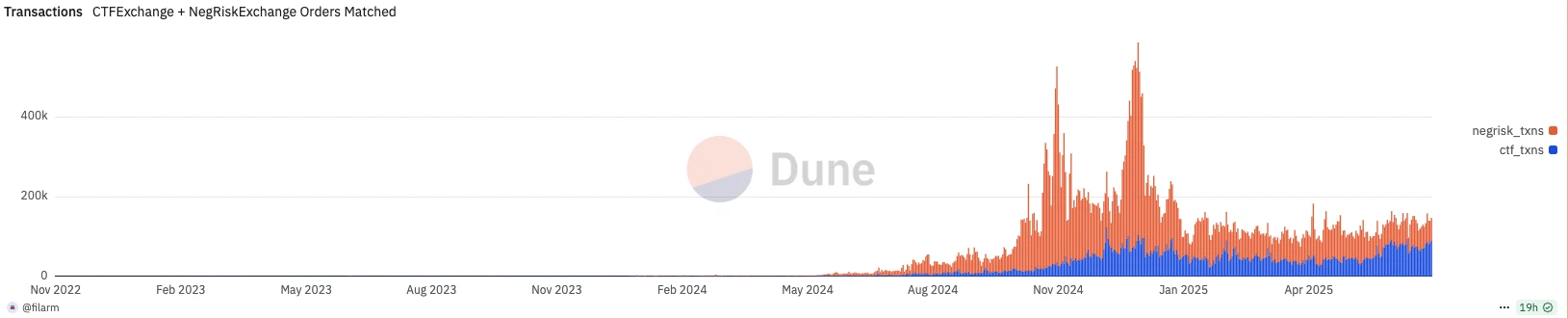

日交易数

同样,Polymarket的日交易笔数在2024年美国大选期间达到顶峰,峰值接近50万笔。但目前即使在大选降温后,Polymarket平台交易数仍保持在10万笔上方。这意味着Polymarket在大选虽然使用率有所下降,但与2024年之前相比仍留存了一大批忠实用户。

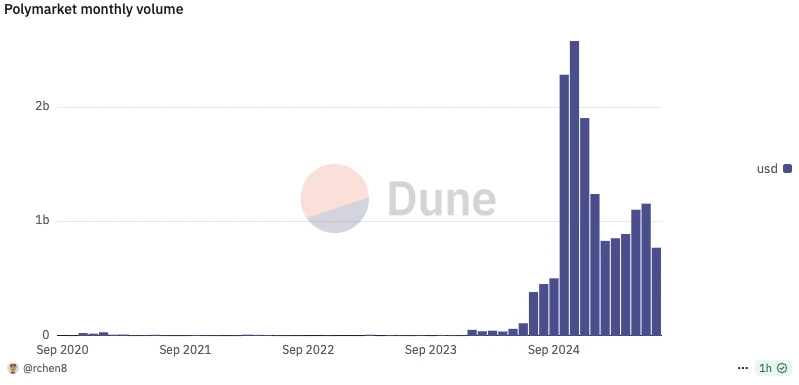

月交易量

据Dune数据,2024年11月Polymarket平台月交易量达至顶峰,峰值为25亿美元。但大选结束后,2025年2月至今,Polymarket平台每月仍有7-11亿美元的交易量。据DeFiLlama数据,过去30天,Polymarket交易量排名第40位,领先于Sushi、GMX等老牌DEX。

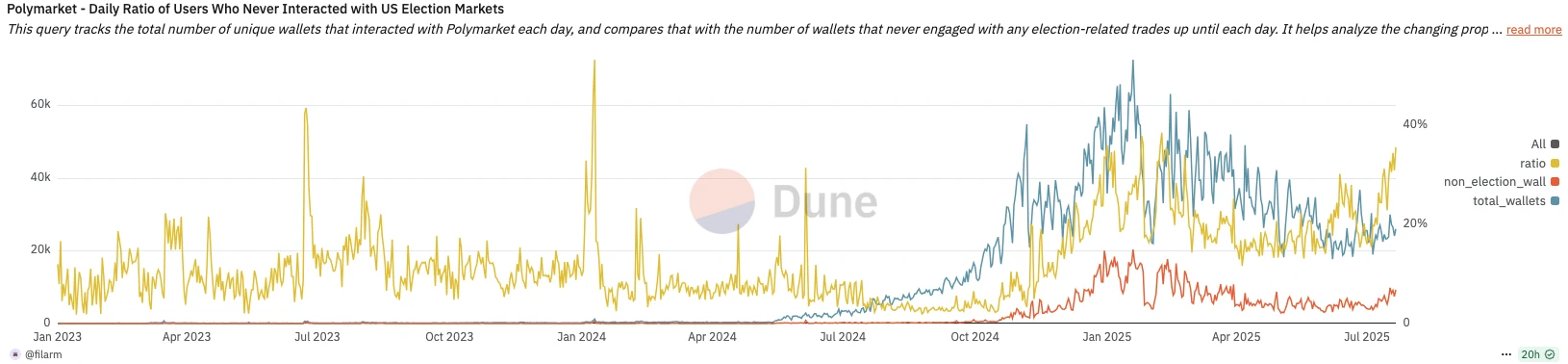

美国选举外的用户比例

以上图标反映的是从未参与美国选举市场的用户比例。从图中可看出,美国大选结束后,总钱包数量在减少,但从未参与过美国选举的钱包数仍保证稳定,这意味着大选结束后Polymakert虽流失了大量短期投机用户,但忠实平台用户并未大幅减少。从未参与美国选举市场的用户比例正在逐渐上升。

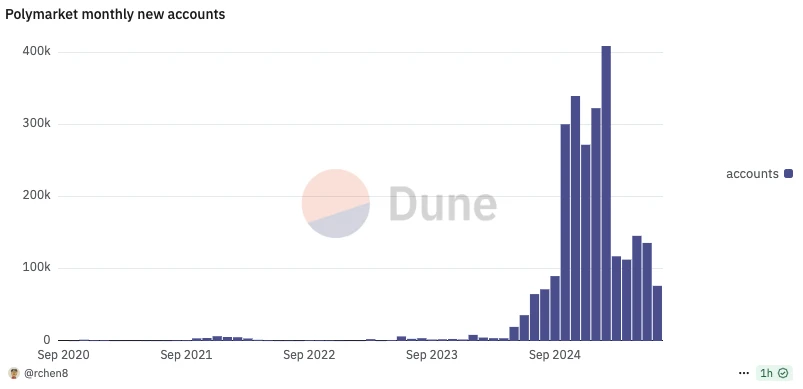

月新增用户

以上图表反映的是Polymarket的月新增用户。美国大选期间是Polymarket月新增用户最多的时期,但是也是Polymarket主要的平台增长期。但美国大选结束后,在因大选而来的投机者纷纷离开时,Polymarket自2025年3月以来,每月仍保持11-14万个账号增长。这表明除去美国大选外,Polymarket的其他预测领域仍在吸引着玩家入场,同时这也是一次Polymarket平台用户构成从短期热点事件投机到长期使用的“大换血”。

以上图表反映的是Polymarket的月新增用户。美国大选期间是Polymarket月新增用户最多的时期,但是也是Polymarket主要的平台增长期。但美国大选结束后,在因大选而来的投机者纷纷离开时,Polymarket自2025年3月以来,每月仍保持11-14万个账号增长。这表明除去美国大选外,Polymarket的其他预测领域仍在吸引着玩家入场,同时这也是一次Polymarket平台用户构成从短期热点事件投机到长期使用的“大换血”。

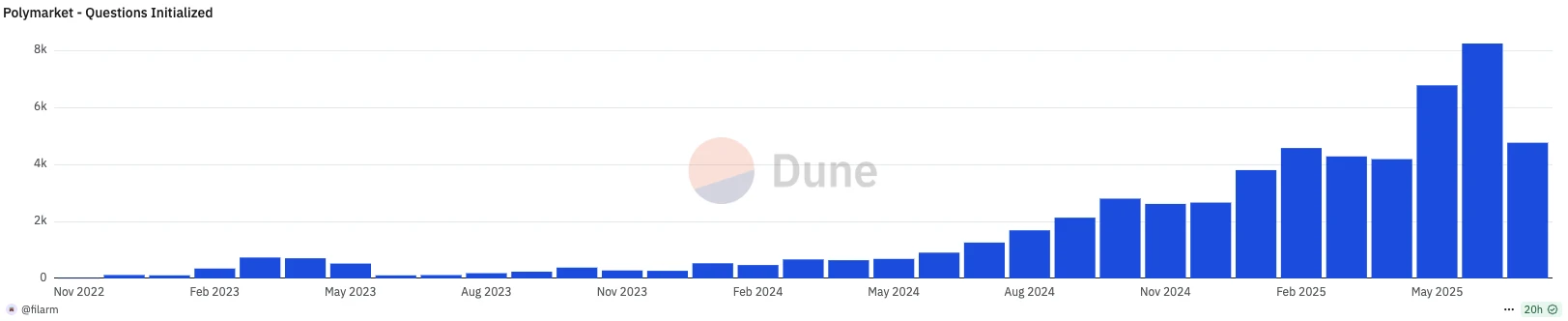

预测池数量

以上图表反映的是Polymarket平台每月的预测池数量。从上图中可看出,2025年以来,Polymarket每月的预测池数量均多于2024年美国大选期间,2025年5月和6月,预测池还突破了5000,分别达到6771和8238。这意味着Polymarket平台的预测投注领域正在不断扩大,有望吸引更多喜好不同领域的玩家加入。

现在撸Polymarket来得及吗?

从以上数据来看,Polymarket平台仍未过时,这类具有产品市场契合度的项目也是融资市场上的香饽饽。据Rootdata数据,Polymarket目前共完成3轮融资,总金额达7400万美元,同时据6月份消息,Polymarket 还在以超 10 亿美元的估值寻求融资近 2 亿美元。

对于Polymarket这样影响了传统政治媒体并将加密带出去的应用来说,10亿美元估值其实并不高,倘若真发币,即使是将10%的代币供应量空投给平台用户也可能是一个大毛。那么,考虑现在撸Polymarket是否来得及,实际是在考虑平台用户内卷程度,以及各种交易成本。

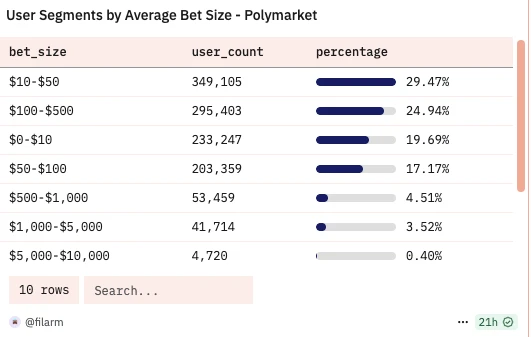

撸Polymarket并不卷

以上图表反映的是Polymakert用户的投注资金分布。如上图显示,90%以上的用户投注资金在500美元以下,投注5000美元-10000美元的鲸鱼仅占0.4%。因此若Polymarket空投条件中有交易排名,那么目前来看跻身前10%的难度并不大,这也侧面反映了当前撸Polymarket并不卷,大多数人仍停留在小额低频的刷交易量和交易次数上。

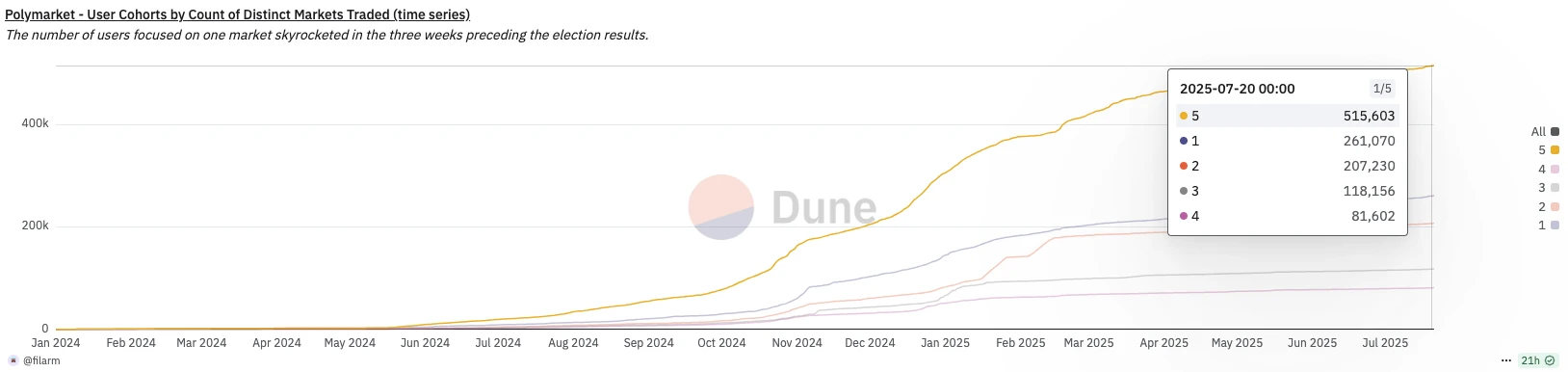

同时在Polymarket平台约120万个钱包中,参与5个以上不同市场的钱包数约51万,不到50%。参与不同的市场也被认为是交互Polymarket的重要维度之一,该指标侧面反映的也是撸Polymarket空投的钱包数量,在结合上文Polymarket日活跃钱包为2-3万的数据,可想而至全网持续撸Polymarket的钱包也仅几万个。这与公链动辄几十万的交互地址相比,已属于“宝藏协议”。

散户现在应该如何撸?

早年间,就有用户推测Polymarket发币空投可能参考的维度:

交易量

交易次数

交易频率

参与不同市场数

交易方式(市价、限价、AMM)

持仓时间

单笔交易量(如至少有一笔交互金额大于500美元)

以上维度也仅仅是一个参考,作为一个散户目前也许最应该注重的交易量、交易次数与频率、持仓时间这几个维度,同时控制投入的成本。对于持仓时间,玩家可投注于“2028年美国总统选举”,因为该预测池较大,且距离结算时间长不容易剧烈波动,并且官方还有4%的持仓年化奖励。

对于刷交易量,为了减少磨损,加密博主SIiipy分享了自己的打法,即寻找一个流动性较差的预测池,使用两个钱包来回刷量,具体操作如下图。

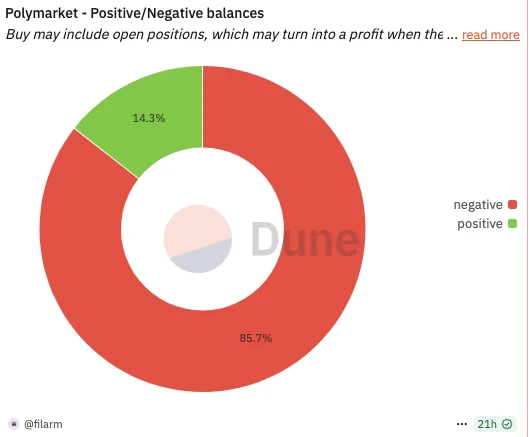

除了以上小额高频刷量外,用户也可以选择当一个真实用户,在Polymarket平台上进行真实投注,同时博取未来空投机会。但“十赌九输”的道理在Polymarket上也是适用的,根据Dune数据,只有14.3%的Polymarket 用户处于盈利状态,而约86%的用户账户为负余额。

Polymarket正负账户余额比例

因此,为了减少交互成本,一种使用期权套利的Polymarket玩法也诞生了。这种玩法仅限于Polymarket上的Crypto市场,如“BTC在7月28日是否会跌破118000美元”这样的预测池,具体操作为在交易所购买7月28日到期的118000看跌期权,然后在Polymarket上购买“否”头寸(下注7月28日BTC不会跌破118000美元),如此便会自己提供的对冲,但玩家也需注意交易所和Polymarket结算时间不一致引发的时差风险。(相关阅读:Polymarket有新玩法?使用期权套利)

相关阅读

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。