来源:Monthly Outlook: The Great Ethereum vs Solana Debate

作者:David Duong, CFA - Global Head of Research

编译:Lenaxin,ChainCatcher

ChainCatcher 小编提要

本文整理自 Coinbase 最新发布的月度展望研究报告。报告指出,随着加密市场逐渐回暖,机构投资者的关注焦点开始从比特币转向以太坊和 Solana 等其他加密资产。尽管关注度有所提升,短期内以太坊和 Solana 的价格走势仍将更多地受到技术因素影响。

概括

机构资金持续流入BTC市场,比特币当前市值占比达加密货币总市值的63%。但近期市场关注点正转向ETH、SOL等主流代币,这些资产在比特币创历史新高的背景下显现估值优势。

影响下季度行情的关键因素包括:

美国证交会对现货ETF的审批进展。

质押功能纳入ETF产品的可能性。

以及机构资金的持续入场。

值得注意的是,加密社区长期存在将ETH与Solana对立比较的倾向,但事实上,二者的技术路线与投资逻辑正呈现差异化发展,具备并行发展的市场空间。

当前加密社区普遍将以太坊与Solana的竞争简化为“二选一”命题,但事实上,两者的技术架构与投资逻辑正呈现差异化发展,存在并行发展的可能性。

例如,机构参与者越来越多地使用 ETH 作为更大的现实世界资产 (RWA) 主题的代理——涵盖稳定币、支付和代币化等更广泛的领域。

Solana 的投资理念集中在其网络在速度、用户参与度和创收方面相对于竞争对手的优势。虽然其活动主要集中在 memecoin 交易上,但它在其他领域也获得了关注。

短期内(2025 年第三季度),在整体市场向好的背景下,这两种代币的市场势头将更多地受到技术因素(即供需因素)而非基本面的驱动,网络技术升级的实质性影响可能相对有限。

错误的二分法

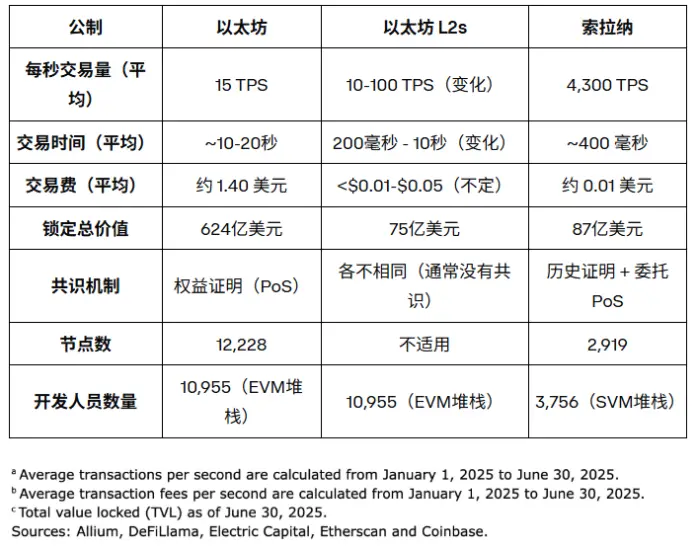

以太坊(ETH)与Solana(SOL)的技术路线之争长期影响着机构投资者对区块链平台的价值评估。市场观点呈现明显分化:传统机构投资者普遍看重以太坊的安全性与去中心化特性,这使其成为现实世界资产(RWA)代币化领域的重要基础设施;而支持者则认为Solana凭借更高的交易速度和更低成本占据竞争优势。随着以太坊二层扩展解决方案(L2)的持续发展,这一技术讨论正变得更加复杂。

表 1. 以太坊与 Solana 网络指标比较

这些论点是一种错误的二分法,这并不是因为技术之间的差异不真实或不重要,而是因为在任何特定时间接触 ETH、SOL 或两者的原因对市场条件更为敏感。

这些论点是一种错误的二分法,这并不是因为技术之间的差异不真实或不重要,而是因为在任何特定时间接触 ETH、SOL 或两者的原因对市场条件更为敏感。

山寨币季什么时候到来?

当前加密货币周期与以往周期的一个显著区别在于,山寨币季的缺失。数据显示,过去一年,许多散户投资者在交易模因币和长尾山寨币时遭受了重创,导致其资金不足或观望情绪浓厚。在此背景下,尽管近期有一些山寨币的表现优于 ETH 和 SOL,但价格走势仍使许多机构投资者倾向于持有大盘股。

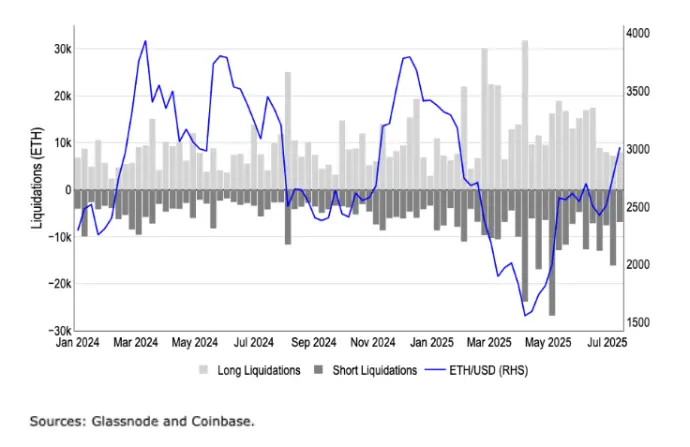

ETH 的转机

5月初ETH市场出现大规模空头平仓现象,清算规模显著攀升。图 1 显示,5 月份约有 8.97 亿美元(37.4 万 ETH)的 ETH 空头被清算,而 4 月份仅为 5.75 亿美元,3 月份为 4.67 亿美元。这引发了一轮技术面驱动的飙升,凸显了 ETH 中大量的越位持仓,引发了空头回补和随后的补仓。其结果是,这也开始限制 ETH 作为融资货币对抗长尾山寨币的能力,而这曾是过去 12-18 个月中许多市场参与者采用的策略。

图 1. 5 月份 ETH 空头期货清算量有所回升

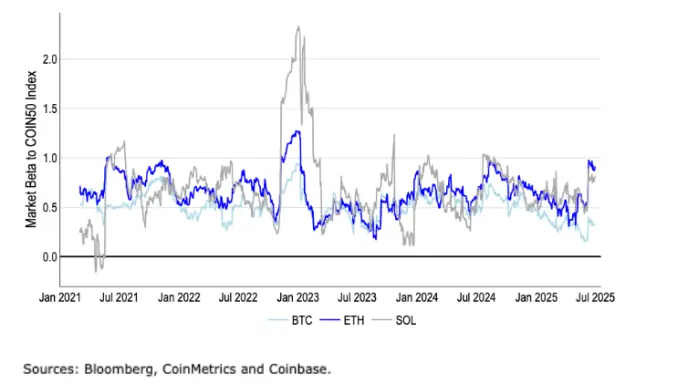

事实上,ETH 相对于加密货币市场的贝塔系数(以市值排名前 50 位的加密资产的COIN50 指数为代表)在 6 月中旬回升至 1 附近。(ETH 的贝塔系数在 7 月份已回落至 0.92,尽管仍高于 SOL 的 0.81 和 BTC 的 0.32)。换句话说,ETH 的回报率目前与整体加密货币市场的表现同步。参见图表 2。因此,这使得 ETH 成为一种有吸引力的选择,可用于杠铃策略,以对抗风险曲线上更远处的代币,因为这些 ETH 多头头寸可以帮助锚定那些具有更高风险敞口、且上涨空间不对称的代币。

图 2. ETH 相对于加密货币市场的贝塔系数非常接近 1

与此同时,诸如EIP-9698(将以太坊的 Gas 上限从 3600 万提高到 36 亿)和EIP-7983(对每笔交易的最大 Gas 量进行限制)等拟议升级对 ETH 性能提升效果有限。这些技术改进主要着眼于提高交易吞吐量与区块执行效率。当前市场更显著的变化在于,机构投资者对代币化股票和风险加权资产 (RWA) 的兴趣日益浓厚,相关基础设施代币正获得更多资金关注,因为投资者正在对这些资产可能存在的平台进行投机。

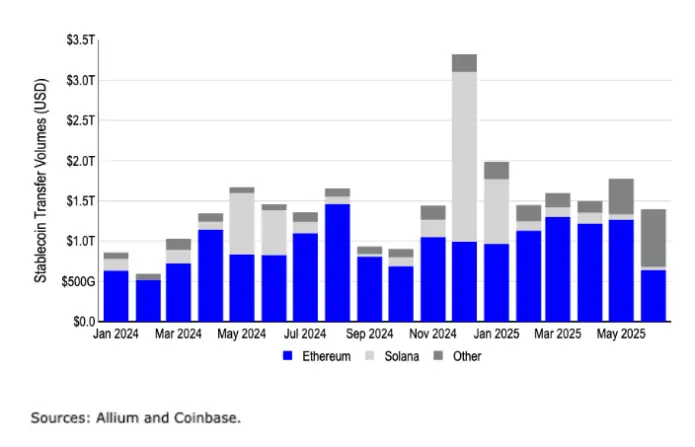

图 3. 稳定币网络转账量(美元)

Solana生态扩张

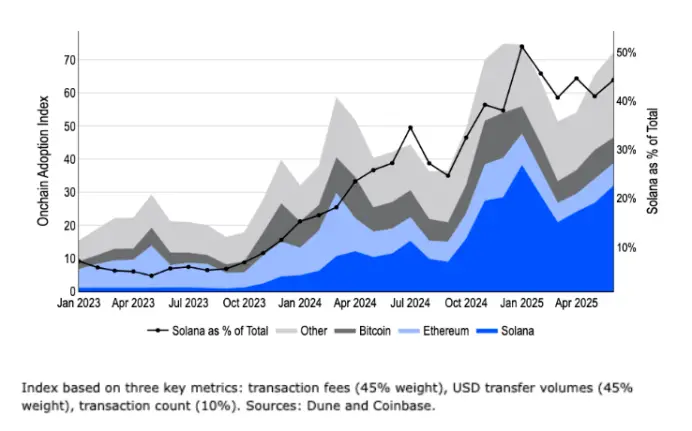

另一方面,Dune Analytics指数显示,自 2024 年第二季度末以来,以太坊在链上活动中的份额持续下滑,而Solana当前占据区块链总活动的44%。图 4 展示了该指数数据,该数据通过跟踪区块链的综合采用情况,结合了三个关键指标:交易费(权重 45%)、美元转账量(权重 45%)和交易数量(权重 10%)。费用和转账的权重更高,因为与交易数量相比,它们更能反映有意义的活动。这一趋势表明,过去一年区块链采用模式已发生根本性转变。

图 4. 链上采用情况的综合视图

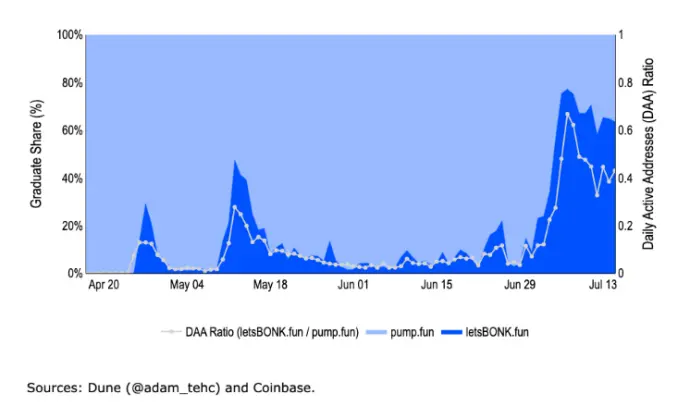

Solana网络活动主要由memecoin交易驱动,尤其是 2024 年 1 月 pump.fun 上线,这成为 Solana 扩张的主要驱动力。Solana 面临的挑战是,人们对 memecoin 的兴趣可能在 2025 年初达到顶峰,数据显示,当前超过60%的成熟memecoin项目源自letsBONK.fun平台。市场观察显示,memecoin交易热潮可能在2025年初见顶,但预计仍将保持一定市场活跃度。随着7月12日PUMP代币首次发行等事件推进,投资者已可通过多种渠道参与memecoin市场,不再局限于单纯做多SOL代币。

尽管如此,对 Solana 管理海量交易量的能力进行实战测试,或许能够使其未来与日益壮大的加密生态系统的其他领域实现产品与市场的契合。事实上,Solana 最近推出了 Solana 鉴证服务 (Solana Attestation Service),作为 KYC/AML 层,以服务于资本市场机会。Solana 基金会也在 5 月发布了一份白皮书,题为《Solana 上的代币化股票:资本市场的新范式》,进一步明确了其在传统金融资产数字化领域的布局方向。。

图 5. “毕业”代币占比及活跃地址对比

不过,就目前而言, SOL 价格将更多地受到技术因素的驱动,例如企业资金管理工具日益增长的需求以及来自美国现货 SOL ETF 的资金流入,监管信息显示,这些 SOL ETF 最早可能在本季度获得批准。(REX-Osprey Solana + Staking ETF 并非SEC正式批准的产品,而 SEC 透露了一个新框架,可能会缩短未来 ETF 的审批时间。)技术层面,一些有意义的升级可能即将到来,例如 Solana 的Alpenglow提案——这是一项变革性的升级,将取代当前的共识机制,通过本地计时器和链下投票机制加快共识速度。这旨在提高网络性能并降低验证者成本。但市场分析表明,当前 SOL 价格波动与这些技术升级的关联性有限。

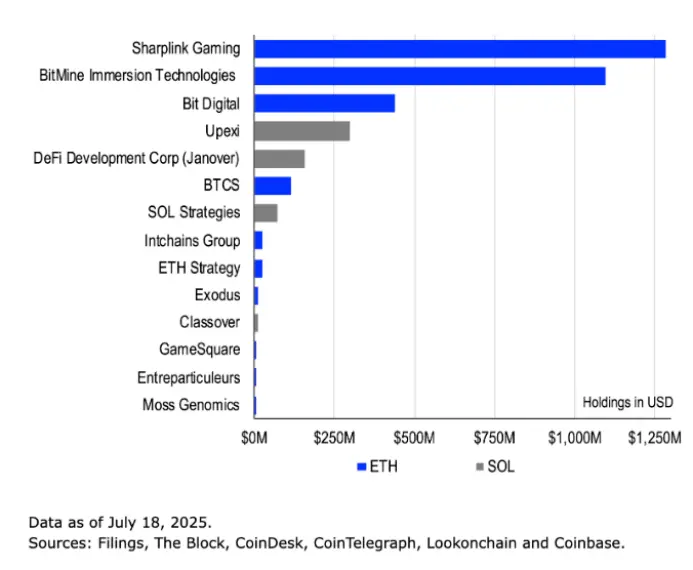

企业需求

2025 年,企业财务工具大幅增加了其加密货币持有量,在 14 家专门的购买实体中增加了超过 82.5 万个 ETH(截至 7 月 18 日为 30 亿美元)和 295 万个 SOL(5.31 亿美元)。见图 6。此外,许多此类公司已承诺质押其 ETH 和SOL以获取收益,有些公司甚至通过 DeFi 集成锁定其供应,显示出从短期交易向长期资产配置的战略转型。事实上,这些工具对 ETH 和 SOL 的偏好部分是由于它们的收益产生潜力,而媒体对稳定币和代币化证券的报道进一步放大了这种潜力。根据之前的月度展望报告,企业资产负债表仍将是 2025 年下半年加密货币市场需求的主要驱动力。

图 6. 顶级 ETH 和 SOL 企业财务工具

结论

虽然机构投资者在本轮周期的大部分时间里都青睐 BTC,但投资者正逐渐转向 ETH 和 SOL 等精选山寨币,这些山寨币相对而言似乎被低估了。受益于《GENIUS 法案》在国会的通过, ETH 越来越被视为蓬勃发展的现实世界资产主题的代表。即便如此,ETH 和 SOL 都得到了机构投资者的兴趣及其对其他加密货币综合体的 beta 值的支持。尽管 Solana 在 memecoin 驱动的活动有所放缓,但它正在展示其高交易量和探索新领域的能力。短期来看,技术性因素可能主导价格走势,包括资金流动、市场情绪等指标。

免责声明

本文内容不代表 ChainCatcher 观点,文中的观点、数据及结论均代表原作者或受访者个人立场,编译方保持中立态度且不为其准确性背书。不构成任何专业领域的建议或指导,读者应基于独立判断审慎使用。本编译行为仅限于知识分享目的,请读者严格遵守所在地区法律法规,不参与任何非法金融行为。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。