作者:Zz,ChainCatcher

编辑:TB,ChainCatcher

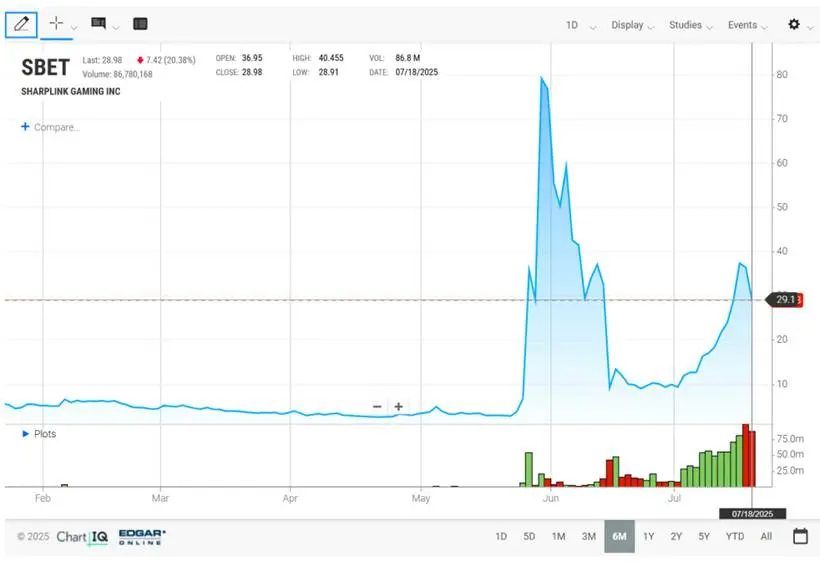

2025年7月15日,一个惊人的消息引爆市场:濒临退市的游戏公司SharpLink宣布,将一周内筹集到的4.13亿美元全部买入以太坊。资本市场对此给出了最狂热的回应——根据Investing和Nasdaq的数据,其股价在六个月内暴涨528%,单月飙升超过150%。

然而,SharpLink的逆袭故事只是冰山一角。几乎在同时,一场更广泛的资本炼金术正在不同行业悄然上演:一家传统的消费品公司(Upexi),通过精巧的债券设计,兵不血刃地将SOL代币纳入储备;一家加密矿业巨头(Bitdeer),成功对接了华尔街的传统资本;一家加拿大的前沿科技公司(BTQ),则利用监管规则的缝隙,从美国投资者手中募集到了数千万资金。

从濒临退市的“垃圾股”到稳健的消费品牌,从加密原生企业到跨境科技新贵。当人们试图寻找幕后推手时,这次聚光灯并未照向高盛或摩根大通,而是一家此前在公众视野中并不显赫的中型投资银行:A.G.P.(Alliance Global Partners)

作为所有这些交易的操盘手或关键参与者,A.G.P.将这一模式玩出了花。仅在SharpLink一个项目上,根据其佣金率,它就在一周内赚取了可能超过800万美元的佣金,而这仅仅是其主导的总值60亿美元庞大计划的开端。

当华尔街巨头们在为机构客户搭建合规桥梁时,A.G.P.用了一条更为激进的赛道:将形形色色的上市公司批量改造为“加密货币代理股”,并坐上牌桌,成为那个设计游戏规则的人。

批量操盘SharpLink等美股上市公司加密金库建设

A.G.P.通过四个案例展示操盘手法。其模式并非标准化策略,而是高度定制化:判断客户痛点和市场热点,灵活运用ATM协议等工具,为每笔交易设计出最大化自身利益的收费方案。

最典型的案例当属SharpLink。2025年5月27日,SharpLink公布消息:完成4.25亿美元私募融资,Consensys领投,以太坊创始人Joseph Lubin担任董事长。根据8-K文件,A.G.P.担任独家配售代理,赚取5-7%承销费。不过,真正的主菜是接下来的ATM协议。

这里需要解释一下ATM协议的精妙之处。传统股票增发就像把一大桶水猛地倒进市场,结果必然是股价大跌。ATM协议完全不同,它相当于给公司安装了一个智能水龙头:股价高涨时投行加速开龙头,单日可卖出数百万股;股价回调时立即关龙头或减缓发行,等待更好时机;公司管理层可随时决定暂停或重启整个计划。

具体而言,ATM协议的核心是分批定向发行。与传统增发需要一次性确定价格和数量不同,ATM让公司可以在最佳市场条件下分批融资。每次发行量控制在日交易量的1-2%以内,几乎不会引起市场注意。这种高抛低停策略既保护了股价,又最大化了融资效率。

从收费结构来看,根据6月14日的S-3/A文件,A.G.P.将60亿美元ATM额度分三档收费:前10亿美元收2.5%,次10亿美元收2.0%,后续收1.75%。按平均2.1%计算,A.G.P.可从中赚取约1.26亿美元。这种机制创造出利益捆绑:A.G.P.有动力维护股价以便持续发行,SharpLink则获得长期稳定的融资来源。

除了SharpLink,A.G.P.的另一个创新案例是Upexi。7月17日,A.G.P.为消费品公司Upexi设计1.5亿美元可转换债券。投资者用SOL代币抵押购买债券,享受2.0%年利率,同时获得以4.25美元转换成股票的权利。这样一来,对Upexi来说,这相当于用低成本获得SOL储备,既筹集资金又搭上加密快车。持有SOL的加密基金则锁定传统股市上涨机会。A.G.P.作为独家配售代理,从这笔交易中赚取承销费。

同样值得关注的是,6月18日,A.G.P.作为联席经办人参与加密矿业公司Bitdeer Technologies 3.3亿美元可转换债券发行。通过服务行业企业,A.G.P.不仅赚取直接承销收入,更在加密矿业融资细分市场确立地位。

BTQ Technologies这家后量子密码学公司的情况更显示出A.G.P.的监管套利能力。7月11日,通过运用加拿大LIFE豁免机制(允许小额融资简化审批的通道),A.G.P.为这家公司从美国投资者筹集4000万加元。作为回报,A.G.P.获得7%现金佣金,还拿到相当于融资额2.5%的认股权证。这种跨境监管套利带来的总收益率接近10%,远超传统IPO业务5-7%佣金水平。

A.G.P.有一根金手指

A.G.P.的商业模式并非简单粗暴的复制粘贴,而是如同经验丰富的猎手,针对不同类型的“猎物”及其所处的环境,选择最精准有效的“武器”。每一个案例的选择,都与其独特的金融方案设计紧密耦合。

SharpLink已濒临绝境。其业务收入暴跌,股价低迷,是一家典型的、急需“猛药”续命的公司。对于这样的目标,管理层和股东对激进方案的接受度最高,愿意用高额的佣金换取一线生机,这为A.G.P.提供了最大的操作和盈利空间。

SharpLink的转型需要一个持续的、能自我强化的故事。一次性的传统增发无法实现这一点。ATM(At-The-Market)协议的灵活性,让A.G.P.能将融资行为变成一场连续剧:“宣布买币推高股价,然后立刻在二级市场高位出售股票;融到钱后再买币,再推高股价”个“融资-买币-股价上涨”的循环,只有可以随时、随量发行的ATM才能完美实现,它将公司变成了A.G.P.控制下的一台“永动提款机”。

Upexi是一家传统的消费品公司,并非绝境企业。选择它是为了证明A.G.P.的模式可以赋能给任何渴望“加密叙事”的稳健型公司,从而极大地拓宽了其业务边界。

传统公司对直接动用现金储备购买高波动性加密资产心存顾虑。A.G.P.设计的SOL代币抵押可转换债券:简单说,就是A.G.P.找来了一批有钱的加密基金,让他们用 1.5亿美元现金来买Upexi公司的债券。妙就妙在,这些基金还必须拿出自己的SOL代币作为额外抵押。

对Upexi来说,账上多了1.5亿现金,还能对外说“我们有SOL储备了”,股价的故事一下就好听了,而自己没花一分钱。对加密基金来说:它们的算盘是“稳赚利息,坐等暴涨”。先拿着2%的稳定年息保底,真正的目标是等Upexi股价起飞后,用4.25美元的约定低价把债券换成股票,再高价卖掉赚大钱。

而A.G.P.呢?它就是那个“攒局”的人。无论Upexi股价是涨是跌,它作为中间商,都先把一笔不菲的承销费稳稳揣进了自己兜里。

Bitdeer Technologies本身就是加密矿业的巨头,不缺加密故事。A.G.P.选择它,是为了证明自己不仅能改造“圈外人”,更能服务“圈内人”,担当起连接加密世界与华尔街传统资本的“桥梁”。

对于Bitdeer这样的加密原生企业,其融资需求的核心痛点是获得传统金融市场的“信任背书”。A.G.P.以联席经办人的身份参与其可转换债券发行,相当于用自己作为持牌投行的信誉为Bitdeer增信,使其更容易获得主流机构投资者的认可和资金。此举旨在确立A.G.P.在加密基础设施融资这一核心赛道的权威地位。

BTQ Technologies这家加拿大后量子密码学公司的关键特征在于其“非美国”的司法管辖区。A.G.P.选择它,意在展示其驾驭复杂跨境监管的能力,这是一项门槛极高的专业技能。

因为直接让美国资本投资一家加拿大小型科技公司流程繁琐。A.G.P.精准地利用了加拿大LIFE豁免机制这一监管捷径,它可以绕过完整的招股书要求,快速、低成本地为BTQ引入美国资本。这本质上是一次精妙的“监管套利”,A.G.P.凭借对不同国家金融规则的精通,创造了传统IPO无法比拟的超额收益和效率。

点金背后:是华尔街的金钱渴望与激进求变

在后疫情时代的宏观经济环境下,传统的中小市值公司普遍面临增长瓶颈。当改善主营业务的传统路径变得异常艰难时,它们迫切需要一个能瞬间点燃市场热情的新故事。而加密货币,尤其是以太坊和比特币,提供了当下最性感、最容易被资本市场理解的“增长叙事”。

与其投入数年时间进行艰难的业务转型,不如直接宣布购入加密货币——这种激进的“资产负债表革命”,能在一夜之间将一家平庸的公司重塑为科技先锋,这正是币股联动模式兴起的根本驱动力。

当前市场的核心矛盾在于,监管机构(如美国SEC)的行动,与市场的投机速度之间存在着巨大的时间差。

SEC等机构确实已多次就大规模股东稀释、误导性营销和潜在市场操纵等问题表达“严重关切”。然而,这些警告在2025年上半年,更多地停留在风险提示和框架讨论层面,尚未转化为能够全面禁止此类操作的具体、可执行的法规。

从发出警告到立法、再到有效执行,存在漫长的过程。正是这个监管真空期,被A.G.P.等投行敏锐地捕捉到,成为它们眼中稍纵即逝的黄金窗口。与其说是“顶风作案”,不如说是“抢在风暴来临前,收割最后一波红利”。

市场参与者的策略完美印证了所有人都在这股浪潮窗口关闭前加速狂奔:

作为先行者,A.G.P.深知这场盛宴有时限。因此,它正以前所未有的速度扩张其ATM协议业务,将客户从科技公司拓展到零售、制造、生物科技等更广泛的传统行业。其逻辑非常清晰:在监管的“闸门”落下之前,尽可能多地完成交易,将利润落袋为安。

当B. Riley Securities、TD Cowen等机构纷纷组建专门团队入场时,这恰恰说明整个华尔街都看清了当前是“法无禁止即可为”的特殊时期。先发优势正在消失,佣金率虽然会因竞争而下降,但这波浪潮的确定性红利吸引着所有人。

升级与风险:风暴来临时的“诺亚方舟”?

当加密市场进入熊市,或监管重拳最终落下,这场由杠杆和叙事支撑的狂欢将迎来终结。届时,融资渠道枯竭、资产大幅减值、股价崩盘和集体诉讼将形成一场“完美风暴”。

将A.G.P.的未来简单押注于当前币股联动的成败,或许低估了这家投行的核心能力。复盘其操盘案例可以发现,A.G.P.真正的“金手指”并非点石成金的魔法,而是一套可复制的、高度灵活的方法论

对于A.G.P.而言,真正的“诺亚方舟”并非某一项具体的资产或业务,而是这套方法论本身。当“币股联动”的浪潮退去,它几乎必然会将这套打法应用到下一个风口,无论是真实世界资产代币化(RWA)、碳信用,还是任何其他具备“叙事潜力”和“监管模糊性”的新领域。

S3 Partners的数据显示,SharpLink的做空利息在过去一月内飙升300%,这表明“聪明钱”已经嗅到了危险的气息,它们正在倒计时结束前悄然撤离,并押注于这场狂欢的最终破灭。

写在最后

A.G.P.的故事是华尔街在新时代寻找生存空间的缩影。这家中型投行通过市场定位和旱涝保收盈利模式,在巨头环伺中开辟独特赛道。

然而,币股联动模式游走在机遇与风险、创新与投机边缘。对投资者而言,理解谁是真正赢家,比参与游戏本身更重要。

正如华尔街的铁律所示:在金融市场上,真正稳赚不赔的,永远是设计游戏规则的人。

推荐阅读:

RootData:2025 上半年 Web3 行业投资研究报告

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。