「能上链」到「用起来」,成为「可用于交易的活资产」,释放美股代币的流动性。

撰文:Web3 农民 Frank

6 月底以来,Crypto 行业掀起了一场「美股上链」热潮,Robinhood、Kraken 等相继推出代币化版本的美国股票和 ETF 交易服务,甚至上线了针对这些代币的高杠杆合约产品。

从 MyStonks、Backed Finance(xStocks)到 Robinhood Europe,都是通过「实股托管 + 代币映射」的方式,允许用户链上交易美股资产——理论上,用户只需一个加密钱包,就能在凌晨 3 点交易特斯拉、苹果股票,无需通过券商开户或满足资金门槛。

不过,伴随着相关产品的铺开,插针、溢价、脱锚的相关新闻也屡见报端,其背后的流动性问题迅速浮出水面:用户虽然能买到这些代币,却几乎无法高效做空、对冲风险,更遑论构建复杂交易策略。

美股代币化,本质上仍停留在「只能买涨」的初始阶段。

一、「美股 ≠ 交易资产」的流动性困境

要理解这波「美股代币化」热潮的流动性困境,首先需要穿透当前「实股托管 + 映射发行」模式的底层设计逻辑。

这种模式目前主要分为两种路径,核心差异仅在于是否拥有发行合规资质:

一类是以 Backed Finance(xStocks)、MyStonks 为代表的「第三方合规发行 + 多平台接入」模式,其中 MyStonks 与富达合作实现 1:1 锚定真实股票,xStocks 通过 Alpaca Securities LLC 等购入股票并托管;

另一类则是 Robinhood 式的持牌券商自营闭环,依托自身券商牌照完成从股票购入到链上代币发行的全流程;

两种路径的共同点则是都将美股代币视为纯现货持仓资产,用户能做的只有买入持有待涨,从而使其成为「沉睡资产」,缺乏可扩展的金融功能层,难以支撑活跃的链上交易生态。

且由于每一枚代币背后都需实际托管一只股票,链上交易仅是代币所有权转移,无法影响美股现货价格,天然导致链上链下「两张皮」问题,不大规模的买卖资金就能引发链上价格剧烈偏离。

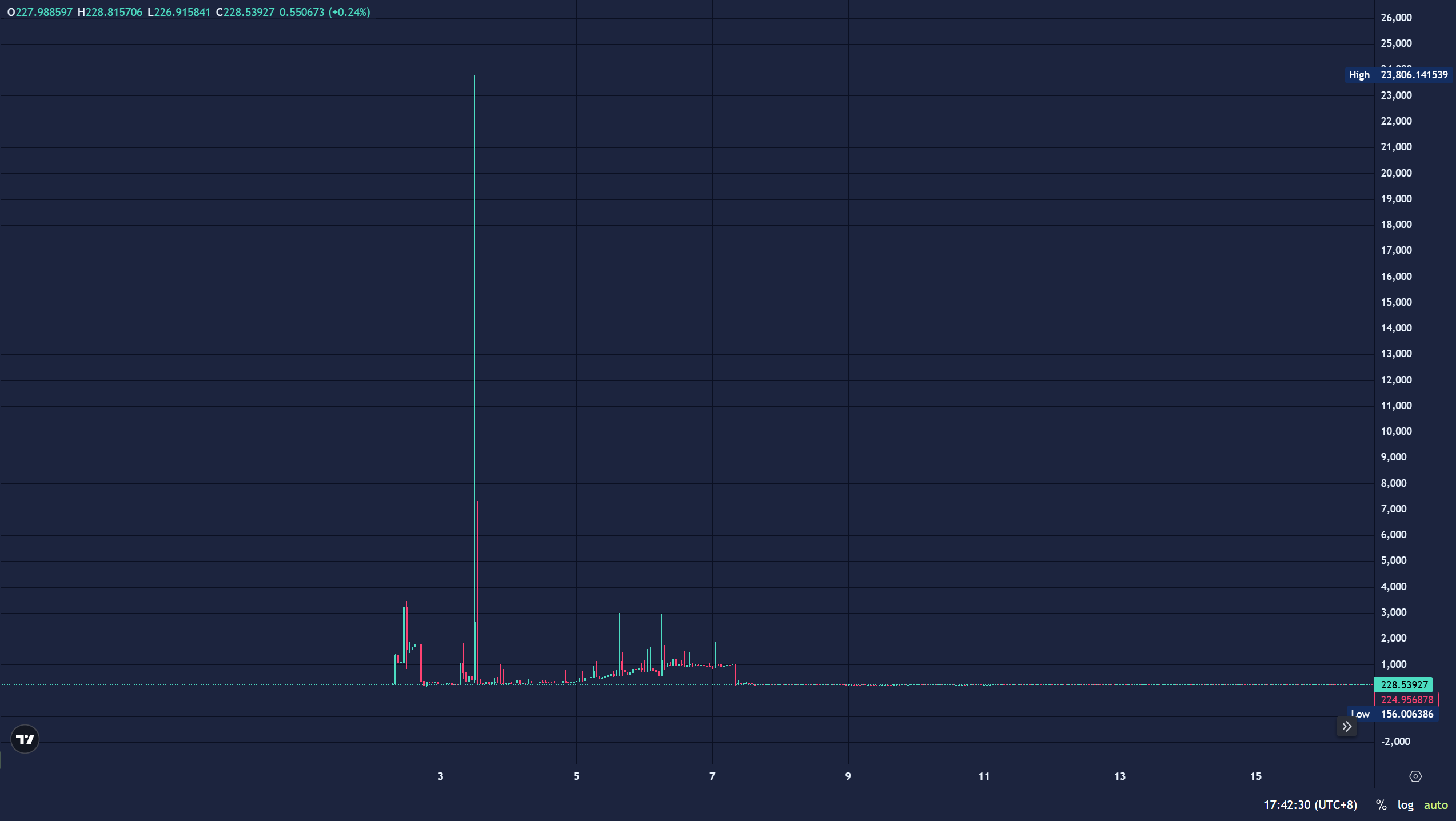

譬如 7 月 3 日,链上 AMZNX(亚马逊股票代币)就被一笔 500 美元的买单推高至 23781 美元,较实际股价溢价超 100 倍,非极端场景下多数代币(如 AAPLX)等也常出现报价偏离,插针现象频发,成为套利者和流动性做市团队设局的理想场景。

其次便是当下美股资产的资产功能被严重阉割,即便是部分平台(如 MyStonks)尝试以空投形式分发分红,但多数平台未开放投票权和再质押渠道,本质上只是「链上持仓凭证」,而非真正的交易资产,没有「保证金属性」。

譬如用户在买入 AAPLX、AMZNX、TSLA.M、CRCL.M 后,既不能用于抵押借贷,也无法作为保证金交易其他资产,更难以接入其他 DeFi 协议(如用美股代币抵押借贷)来进一步获得流动性,导致资产利用率近乎为零。

客观来讲,上一轮周期中,Mirror、Synthetix 等项目的失败已印证仅有价格映射远远不够,当美股代币无法作为保证金激活流动场景,无法融入加密生态的交易网络,再合规的发行、再完善的托管,也只是提供了一个代币壳子,在流动性缺乏的背景下实用价值极其有限。

从这个角度来看,当前的「美股代币化」只做到了把价格搬上链,还停留在数字凭证的初始阶段,尚未成为真正「可用于交易的金融资产」来释放流动性,因此很难吸引更广泛的专业交易者、高频资金。

二、补贴激励,or「套利通道」打补丁

所以对代币化的美股来说,亟需加深自己的链上流动性,为持有者提供更实际的应用场景与持仓价值,吸引更多专业资金入场。

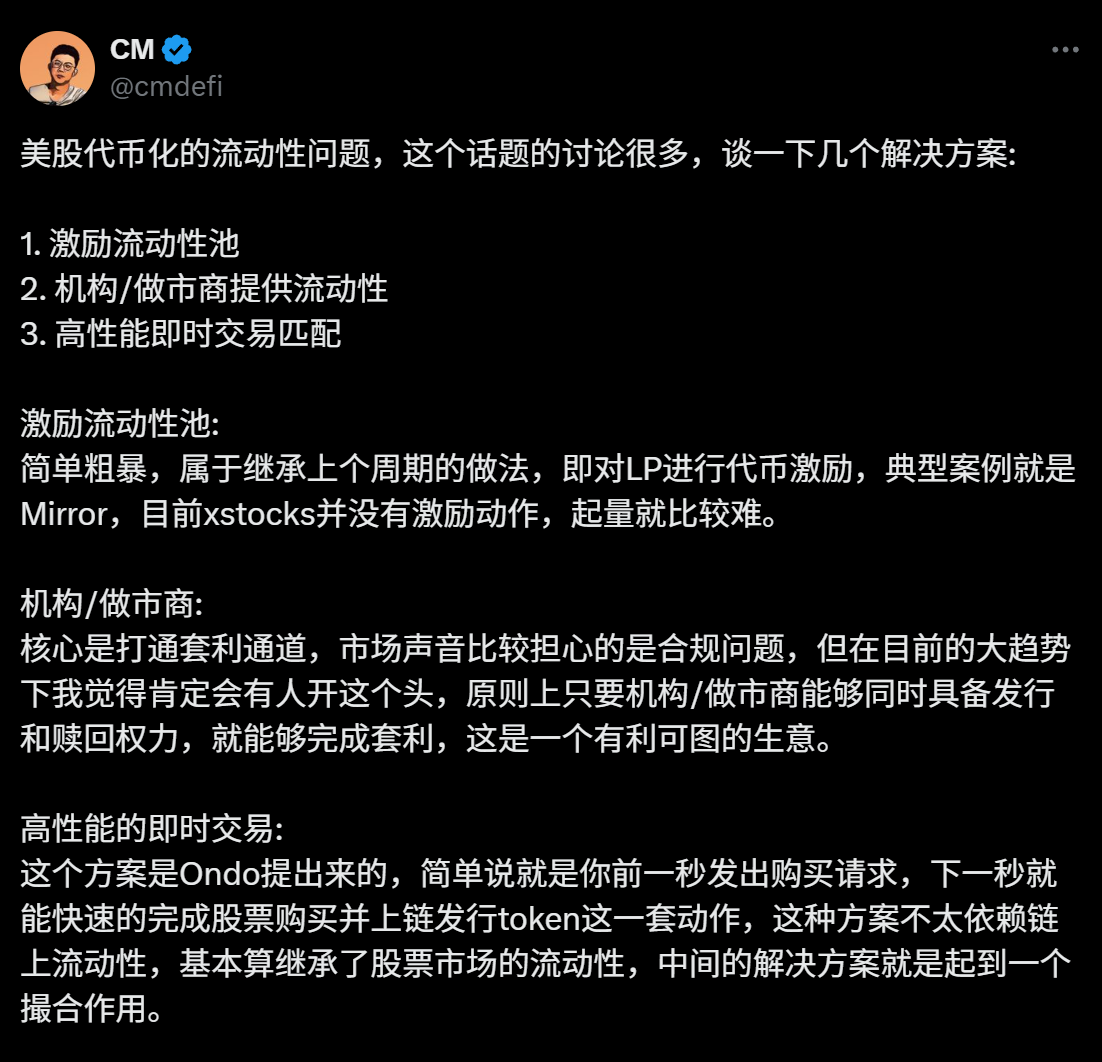

而目前市场讨论的多种主流解决思路,除了 Web3 常见的「激励吸引流动性」模式,便是在尝试打通「链上-链下」套利通道,通过优化套利路径效率来提升流动性深度。

1.激励流动性池(如 Mirror)

以 Mirror Protocol 为代表的「激励池模式」,曾是上一轮代币化美股的主流尝试,其逻辑是通过发行平台代币(如 MIR),奖励为交易对提供流动性的用户,试图用补贴吸引资金入场。

但这种模式存在致命缺陷,即激励依赖代币通胀,无法形成可持续的交易生态,毕竟用户参与流动性挖矿的核心动力是获取补贴代币,而非真实交易需求,一旦激励力度减弱,资金便会迅速撤离,导致流动性断崖式下跌。

更关键的是,这种模式从未想过「让美股代币自己产生流动性」—— 用户存入的美股代币仅作为交易对的一部分,无法被用于其他场景,资产依然沉睡。

2.做市商主导流动性(如 Backed / xStocks)

Backed Finance(xStocks)、MyStonks 等采用的「做市商主导模式」,试图通过合规通道打通链上 - 链下套利。以 xStocks 为例,其通过盈透证券购入对应股票,做市商可在链上代币价格偏离现货时,通过「赎回代币→卖出股票」或「买入股票→铸造代币」抹平价差。

但这套逻辑的落地成本极高,合规流程、跨市场结算、资产托管的复杂度,让套利窗口常被时间成本吞噬,譬如盈透证券的赎回流程需 T+N 结算,托管商的资产划转也往往存在延迟,当链上价格出现溢价时,做市商往往因无法及时对冲而放弃介入。

这种模式下,美股代币始终是「被套利的标的」,而非能主动参与交易的资产,结果是 xStocks 的多数交易对日均交易量较低,价格脱锚成为常态。

这也是为何 7 月 AMZNX 能出现 100 倍溢价却无人套利的核心原因。

3.高速链下撮合 + 链上映射

Ondo Finance 等探索的「链下撮合 + 链上映射」模式,其实就类似于 Mystonks 已采用的 PFOF(订单流支付模式),通过将交易核心环节放在中心化引擎完成,仅将结果上链记录,理论上能对接美股现货深度。

但这种模式技术、流程门槛较高,而且传统美股交易时间与链上 7×24 小时的交易属性也需要匹配。

这三种流动性解决思路各有千秋,不过无论是激励池、做市商还是链下撮合,其实都默认用外部力量「注入」流动性,而非让美股代币自身「产生」流动性,但实话实说,仅靠链上 - 链下套利或激励补贴,很难填满持续增长的流动性缺口。

那有没有可能跳出「链上-链下」的传统套利框架,直接在链上原生环境中构建交易闭环?

三、让美股代币成为「活资产」

在传统美股市场,流动性之所以充沛,根源不在于现货本身,而是由期权、期货等衍生品体系所构建的交易深度——这些工具支撑着价格发现、风险管理与资金杠杆的三大核心机制。

它们不仅提高了资金效率,更创造了多空博弈、非线性定价与多样化策略,吸引了做市商、高频资金、机构持续入场,最终构成了「交易活跃 → 市场更深 → 用户更多」的正向循环。

而当下的美股代币化市场,恰恰缺失了这一层结构,毕竟 TSLA.M、AMZNX 等代币可持有,但无法被「使用」,既不能抵押借贷,也不能作为保证金交易其他资产,更遑论构建跨市场策略。

这像极了 DeFi Summer 之前的的 ETH,彼时它不能借出、不能做担保、不能参与 DeFi,直到 Aave 等协议赋予其「抵押借贷」等功能,才释放出千亿级流动性,而美股代币要突破困局,必须复刻这种逻辑,让沉淀的代币成为「可抵押、可交易、可组合的活资产」。

如果用户可以用 TSLA.M 做空 BTC,用 AMZNX 押注 ETH 走势,那么这些沉淀资产便不再只是「代币壳子」,而是被用起来的保证金资产,流动性,自然会从这些真实交易需求中生长出来。

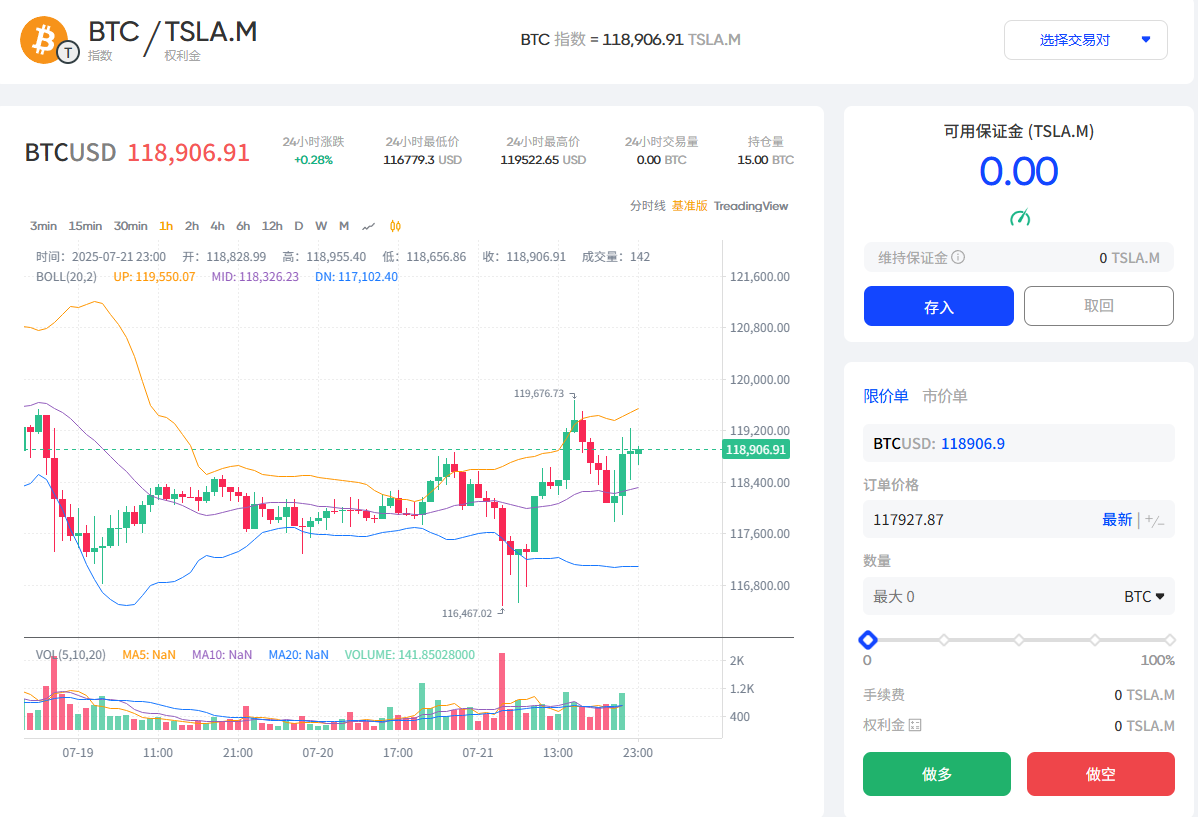

美股代币化产品服务商也确实在探索这条路径,MyStonks 本月就与 Fufuture 联合在 Base 链上线特斯拉股票代币 TSLA.M/BTC 指数交易对,核心机制是通过「币本位永续期权」,让美股代币真正成为「可用于交易的保证金资产」。

譬如允许用户将 TSLA.M 作为保证金,参与 BTC/ETH 的永续期权交易,据悉后续 Fufuture 还计划拓展支持超过 200 种代币化美股作为保证金资产,那持有小市值美股代币的用户,将来就可将其作为保证金押注 BTC/ETH 涨跌(如用 CRCL.M 抵押做 BTC 多单),从而为其注入真实交易需求。

且相比 CEX 的中心化合约限制,链上期权可以更自由地组合出「TSLA × BTC」、「NVDA × ETH」等资产对策略。

当用户能用 TSLA.M、NVDA.M 作为保证金参与 BTC、ETH 的永续期权策略,交易需求自然会吸引做市商、高频交易者、套利者入场,形成「交易活跃→深度提升→更多用户」的正向循环。

有意思的是,Fufuture 的「币本位永续期权」机制不仅是一种交易结构,更天然具备激活美股代币价值的做市能力,尤其在当前尚未形成深度市场的早期阶段,可直接作为场外做市与流动性引导工具使用。

其中项目方可以将 TSLA.M、NVDA.M 等代币化美股作为初始种子资产注入流动性池,搭建起「主池 + 保险池」,在这一基础上,持有者也可将手中美股代币存入流动性池,承担部分卖方风险并赚取交易用户支付的权利金,相当于构建了一种新的「币本位增值路径」。

举个例子,假设某用户长期看好特斯拉股票,已在链上买入 TSLA.M,传统路径中,他的选择只有:

继续持有、等待上涨;

或在 CEX/DEX 上交易换出;

但现在他可以有更多玩法:

做卖方赚权利金:将 TSLA.M 存入流动性池,一边等待上涨,一边赚取权利金收入;

做买方释放流动性:将 TSLA.M 作为保证金参与 BTC、ETH 的跨资产期权交易,押注加密市场波动;

组合策略:一部分持仓做市,另一部分参与交易,实现双向收益路径,提升资产使用效率;

在这个机制下,美股代币不再是孤立资产,而真正融入了链上的交易生态,被重新使用了起来,打通「资产发行 → 流动性构建 → 衍生交易闭环」这一完整路径。

当然,目前不同路径仍处探索阶段,本篇仅探讨其中一条可能性。

写在最后

这一轮 MyStonks、Backed Finance(xStocks)到 Robinhood Europe 的实股托管模式,意味着美股代币化彻底解决了「是否能发得出来」的初始问题。

但也表明新周期的竞争,其实已经来到「是否能用得起来」的环节——如何形成真实交易需求?如何吸引策略构建与资金复用?如何让美股资产在链上真正活起来?

而这不再依赖于更多券商入局,而是链上产品结构的完善——只有当用户能自由做多做空、构建风险组合、组合跨资产头寸时,「代币化美股」才具备完整的金融生命力。

客观来讲,流动性的本质不是资金堆积,而是需求匹配,当链上能自由实现「用 TSLA 期权对冲 BTC 波动」时,美股代币化的流动性困局,或许才会迎刃而解。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。