17 世纪初,荷兰东印度公司发明了股票;400 多年后,代币化带来了股票 2.0。

6 月 30 日,美国知名互联网券商 Robinhood(NASDAQ: HOOD)宣布推出 Robinhood Stock Tokens,允许欧盟客户在区块链上交易美股和 ETF。同日,瑞士金融工具发行商 Backed 推出的代币化股票产品 xStocks 在加密交易平台 Kraken 和 Bybit 同时上线。

据 PANews 梳理,目前已有 8 家加密机构宣布进军代币化股票市场,它们通过不同技术路线(Arbitrum、Solana、Base、Ondo Chain)与托管方案(自托管、xStocks、BitGo 等)满足全球投资者对灵活交易、链上转让和合规保障等多重需求,成为 RWA 的重要落地场景之一。

代币化股票这块市场蛋糕会有多大?会成为继稳定币之后 RWA(现实世界资产)的下一个显性赛道吗?

Robinhood:经纪商兼交易平台,拟推出自有 L2

作为一家互联网券商,Robinhood 早在 2018 年就在其平台上推出了 BTC 和 ETH 交易。此后,Robinhood 因加密货币价格波动过大及其他问题多次短时间暂停过加密交易,也遭遇过 SEC 的审查和罚款,但一直未停止对加密业务的探索,包括:

2021 年收购加密聚合交易平台 Cove Markets;

2022 年推出 Web3 钱包 Robinhood Wallet,目前支持以太坊、Polygon、Arbitrum、Optimism 和 Base 网络;

2025 年 5 月收购加拿大加密运营商 WonderFi(旗下有 Bitbuy 和 Coinsquare 2 个受监管交易平台);

2025 年 5 月从立陶宛中央银行获得了经纪许可证,该许可允许其在整个欧盟范围内提供股票交易和其他投资服务,并使其能够符合欧盟加密市场监管框架MiCA;

2024 年 6 月收购老牌交易所 Bitstamp(在欧洲及全球范围内拥有 50 多个许可证),交易完成后,Robinhood 将能够使用 Bitstamp 的 MiFID 多边交易设施许可证提供加密衍生品业务;

2025 年 7 月 1 日宣布收购 AI 投资建议平台 Pluto。

根据 Robinhood 发布的数据,截至 2024 年 11 月,其托管的加密资产价值为 380 亿美元,过去 1 年的加密货币名义交易量达 1,190 亿美元,实现了对美国所有 50 个州和地区的覆盖,并面向美国客户推出 ETH 和 SOL 质押服务。

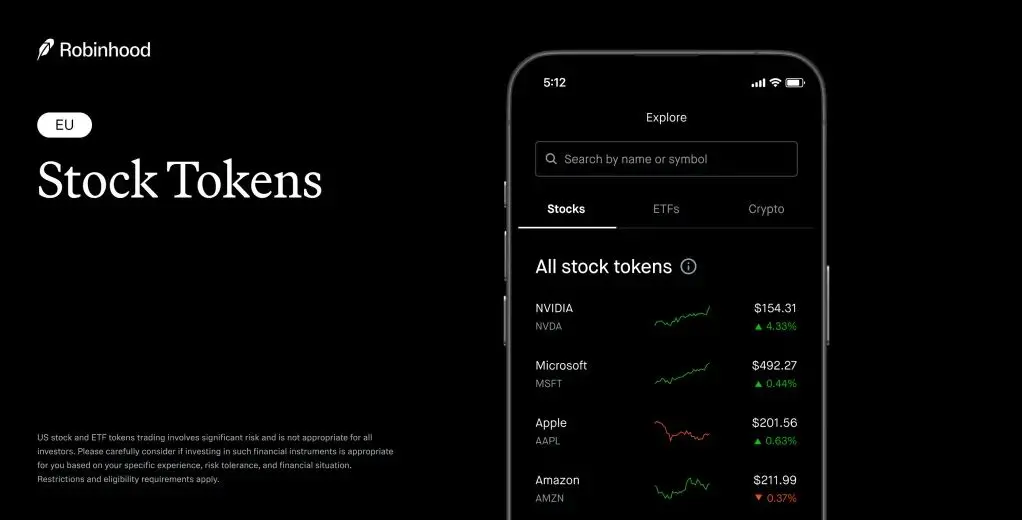

2025 年 6 月 30 日,Robinhood 宣布面向欧盟市场推出股票代币,客户可交易代表 200 多家公司的股票代币,每周 5 天、每天 24 小时交易。这些代币由 Robinhood 持有真实股票 1:1 支持,可在链上自由转移,持有人可获得股息分红。

这些股票代币最初在 Arbitrum 链上发行,后续将迁移至 Robinhood 自有的 Layer2 区块链(暂定名 Robinhood Chain)。

此外,Robinhood 还允许欧洲客户交易加密货币永续期货。至此,Robinhood 已实现现货、合约、质押、钱包、RWA、AI 策略分析全面覆盖,并将推出自己的 L2 应用链。

Starlabs Consulting 注意到,Robinhood 还一直在美国倡导代币化立法,已向 SEC 提交了一份关于建立代币化 RWA 国家框架的提案,并计划推出一个名为 Real World Asset Exchange 的平台,用于链下交易和链上结算。

Coinbase:已获经纪牌照,代币化股票申请待批

6 月 17 日,据路透社报道,美国加密交易所 Coinbase 正在寻求 SEC 的批准,以推出基于区块链的代币化股票服务。一旦获批,Coinbase 将与零售经纪公司 Robinhood 和 Charles Schwab 直接竞争。

据 Starlabs Consulting 了解,Coinbase 早在 2018 年就获得了证券经纪牌照(broker-dealer license),但一直未开展实际业务。

xStocks:代币化股票已上线 Kraken、Bybit 和 Jupiter

xStocks 是由瑞士金融工具发行商 Backed 推出的代币化金融产品。这些产品将公开交易的证券(如股票)代币化,使投资者能够通过区块链访问传统金融市场的资产,并受到瑞士金融市场管理局(FINMA)监管。

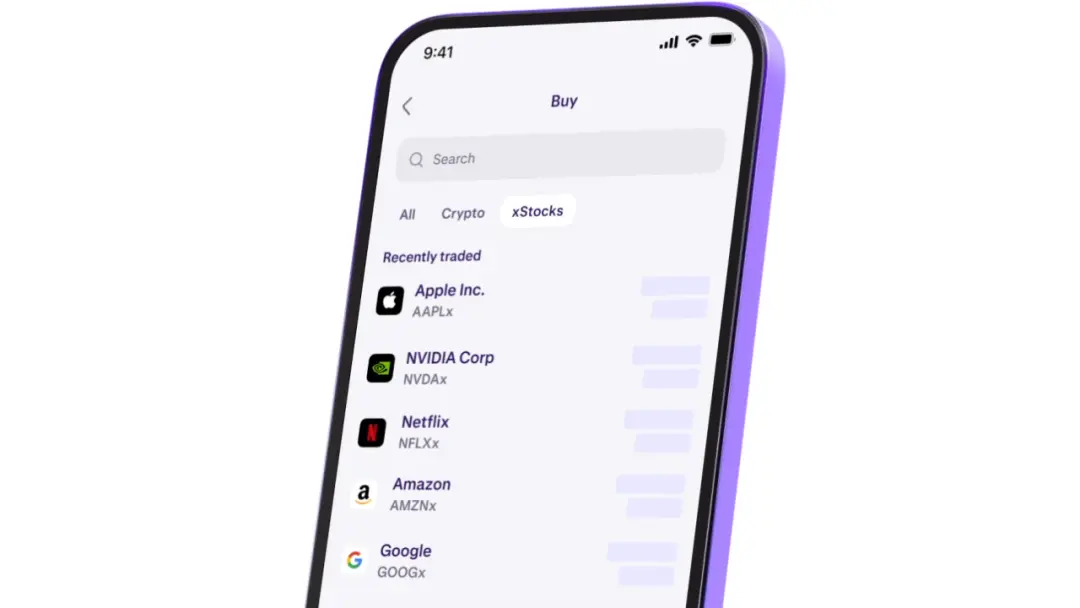

xStocks 在 Solana 链上发行,并被整合到了 Solana 的 DeFi 协议,用户不仅可通过去中心化交易平台 Jupiter 交易,还可通过中心化交易所(如 Kraken 和 Bybit)交易。

6 月 30 日,Kraken 宣布,xStocks 已在 Kraken 上线,面向非美国客户推出首批 60 只代币化美股产品,每周 5 天、每天 24 小时交易。据华尔街日报此前报道,Kraken 的代币化股票将首先在欧洲、拉丁美洲、非洲和亚洲地区推出。

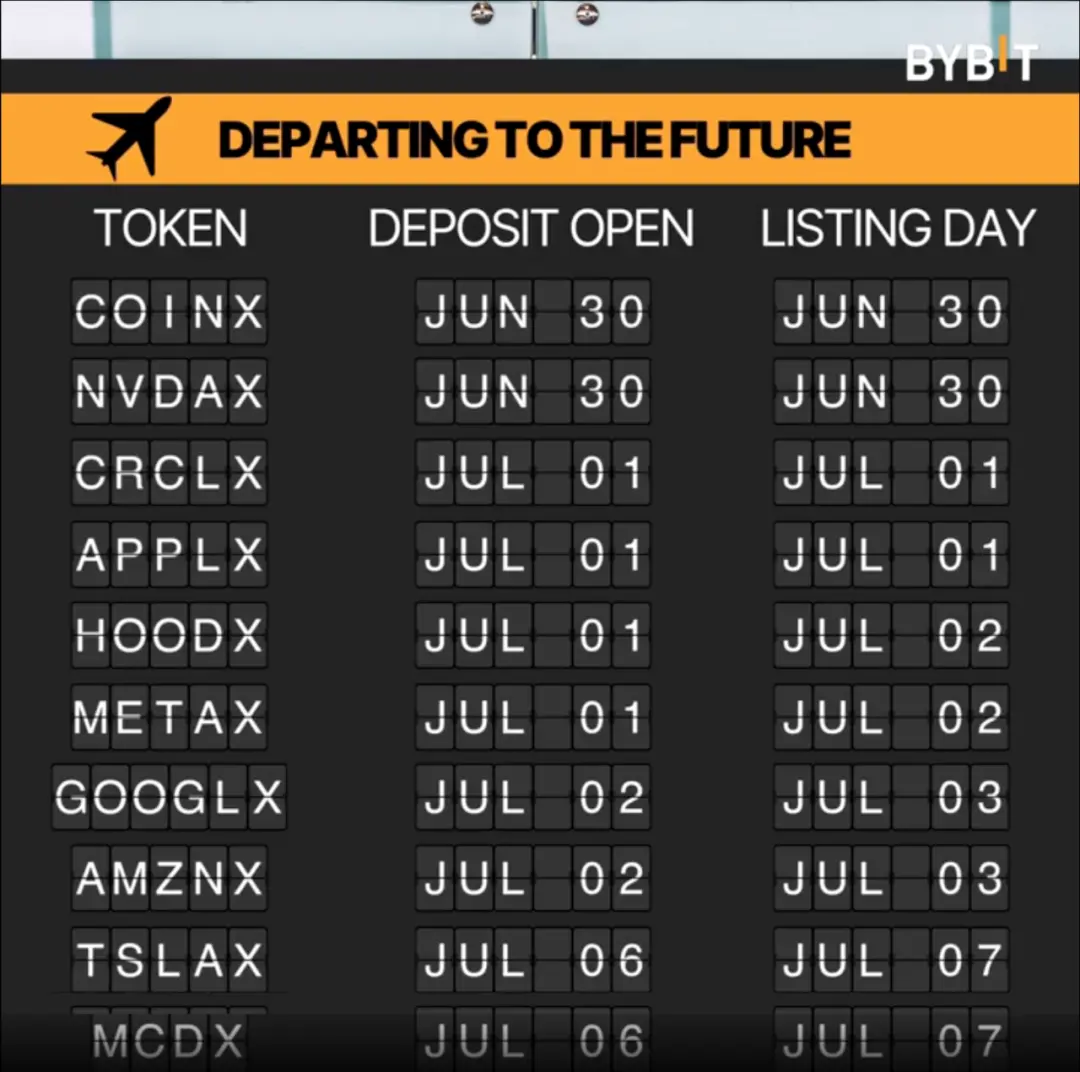

同日,Bybit 也宣布与 Backed 达成战略合作,在其现货平台陆续上线 xStocks 代币化美股和 ETF 产品,并支持 24/7 全天候交易,更加符合 Web3 用户的交易习惯。首次上线包括 10 种最热门的美国股票。

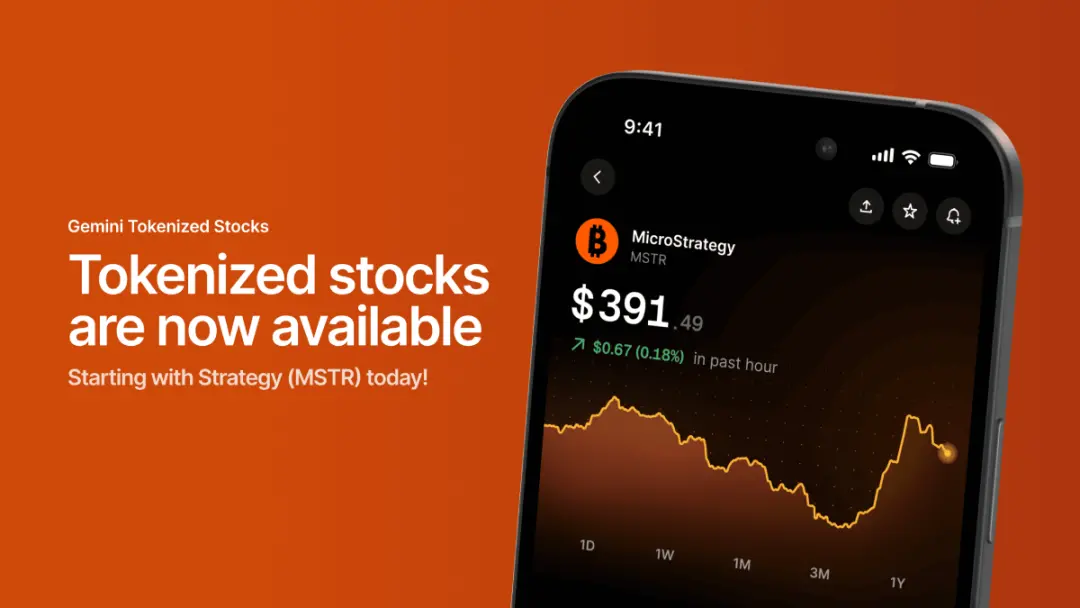

Dinari:已在 Gemini 上线首支代币化股票微策略

6 月 27 日,加密交易所 Gemini 宣布与美国代币化股票提供商 Dinari 合作,利用 Dinari 的按需代币化模型推出代币化的微策略(NASDAQ: MSTR),支持欧盟用户交易,有望在未来几个月内扩展到美国用户。未来还将推出更多代币化股票和 ETF。MSTR 目前在 Arbitrum 链上推出,并将很快支持其他网络。

据 Starlabs Consulting 了解,Dinari 已获得来自 VanEck Ventures、Hack VC、F-Prime Capital、Blockchange Ventures 和 Balaji Srinivasan 的 2,265 万美元融资。Dinari 旨在通过大规模代币化现实世界股票,为全球投资者提供无缝接入超过 100 种代币化的美国股票和金融资产的渠道。

Ondo:将推出代币化证券平台 Ondo Global Markets

聚焦于 RWA 的去中心化金融协议 Ondo Finance 计划推出 Ondo Global Markets,该平台将传统的股票、债券和 ETF 代币化,使得全球非美国投资者能够进入美国金融市场,并支持全天候即时结算、与 DeFi 协议无缝集成。

Ondo Finance 表示,正如稳定币通过解决高昂费用、供应渠道受限和转账摩擦等痛点,拓宽了美元的获取渠道一样,Ondo Global Markets 也将同样的原则应用于证券市场。

6 月 17 日,Ondo Finance 宣布成立全球市场联盟(Global Markets Alliance),共同致力于改善互操作性、投资者保护以及对代币化 RWA 的访问,成员包括:

Solana 基金会

BitGo(托管机构)

Fireblocks(Web3 安全公司)

Jupiter、1inch(DEX 聚合器)

Trust Wallet、Bitget Wallet、Rainbow Wallet

Alpaca(证券经纪商)

联盟成员各尽其能:钱包提供商整合 Ondo 的代币化资产标准,聚合器预计将支持以程序化方式访问代币化资产,由 BitGo 和 Fireblocks 提供机构托管和基础设施,Alpaca 负责针对代币化证券的经纪和监管服务。

INX Digital:上线代币化私募股权

6 月 18 日,美国代币化资产交易平台 INX Digital 宣布与瑞士区块链初创公司 Aktionariat AG 合作,在其 INX Marketplace 上线代币化股权 $DAKS,开放全球投资者交易。

据 Starlabs Consulting 了解,INX Digital 提供受监管的证券型代币和代币化 RWA 交易,拥有美国大多数州的完全合规许可证和汇款许可证,以及 SEC 和 FINRA(金融业监管局)授予的经纪商和另类交易系统许可。

Aktionariat AG 专注于提供基于区块链的创新代币化解决方案,自 2021 年上线以来,已促成超过 5,000 万瑞士法郎的交易量,服务超过 3 万名用户,帮助全球 70 多家私营公司实现了股权代币化,其代币化公司的总市值达 4 亿瑞士法郎。

机构:代币化股票市值可能突破万亿美元

据 RWA.xyz 数据,截至 6 月 30 日,代币化现实资产总市值达 244.7 亿美元,其中代币化美国国债市值 73.85 亿美元,而代币化股票市值仅 3.41 亿美元。

尽管代币化股票在整个 RWA 市场的占比还很小,但由于机构投资者看重更快速、更低成本进入美股市场的机会,其受关注度正在快速上升。

据 Cointelegraph 报道,专注于提供证券代币化(STO)和资产代币化服务的卢森堡金融科技公司 STOKR 的 CEO Arnab Nask 在今年 4 月 16 日的一场小组讨论中表示,代币化股票的潜在市场总规模虽然难以准确预测,但「绝对是一个超万亿美元的市场」。

Dinari 的首席商务官 Anna Wroblewska 表示,2025年,Web3 钱包、数字银行、传统金融服务公司等各类机构对这类金融工具的需求已经「爆发式增长」,「我们收到了来自比想象中更广泛的潜在合作伙伴的大量需求」。

「市场对美国公开市场股票有着巨大的需求……即使是全球个人投资者也都希望参与美国资本市场。代币化使这一过程变得快速且低成本」。Wroblewska 表示,基于类似原因,代币化美国国债的需求已经很高。

Starlabs Consulting 注意到,近日美股三大指数中的纳指、标普 500 再创历史新高,道指距历史新高也仅 1.3% 的涨幅。截至 6 月 30 日,美股总市值达 61.94 万亿美元,美国联邦债务规模也已突破 36 万亿美元。相比之下,代币化股票总市值还不到 4 亿美元,代币化美国国债市值也才 70 多亿美元,未来市场想象空间巨大。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。