Trump Powell Rate Cut Note Breakdown: Is Real Data Behind 1% Shift?

In a move that has gone viral online, the U.S. President Donald issued a handwritten letter to Federal Reserve Chair Jerome Powell, criticizing his monetary policies and demanding immediate action.

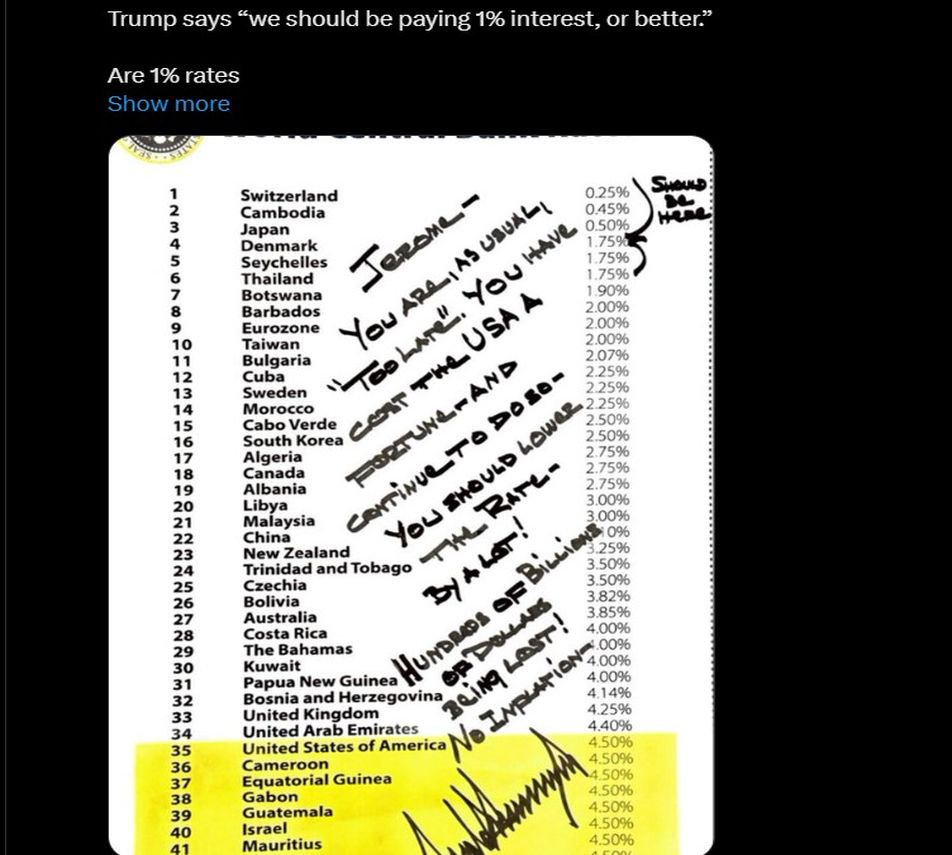

The note, written directly on a global interest yield chart, was shared widely under the tag Trump Powell rate cut note , sending shockwaves through financial and political circles.

In the letter, President wrote:

“Jerome — You are, as usual, too late. You have cost the USA a fortune—and continue to do so. You should lower the rate—by a lot! Hundreds of billions of dollars of opportunity & growth lost! No inflation!”

Source: The Kobeissi Letter Official X Account

This Trump handwritten note has reignited public interest in the ongoing tensions between both of them, making headlines under Trump news today across financial media outlets.

The Global Trump Rate Cut Chart Used as a Weapon

What made the letter stand out wasn’t just the words—but what it was written on. He scribbled his message across a global fed interest chart, drawing attention to how other countries like Switzerland (0.25%) and Japan (0.1%) are maintaining ultra-low interest yield, while the U.S. stands at 4.5%.

This was his way of showing that Jerome’s policies are out of sync with the rest of the world. According to the latest Trump Powell news, he believes the Fed’s high interest yield are holding back economic growth and missing a golden opportunity.

Behind the Note: A Strategy to Replace Jerome and Shift Fed Policy

Beyond the note itself, this appears to be part of a bigger plan. The U.S. celebrity has openly admitted that he’s already interviewing candidates to replace fed chair, whose current term ends in May 2026.

Source: Coin Bureau X

This adds fuel to speculation around Trump Powell termination possibilities and signals a potential political shake-up at the Federal Reserve. So if you're wondering, "Did Trump write a letter to Jerome Powell today?" — the answer is yes, and it's making waves.

Markets React: Crypto Bounce on Liquidity Hope

Earlier today, the crypto market was down, but after the letter went viral, they reversed and moved up by around 0.65%. The sudden optimism stems from hopes of future liquidity easing. Traders believe that even talking about a 1% interest value gives life to bullish bets.

The rate cut crypto impact is real. Lower interest typically make risk assets like Bitcoin, Ethereum, and stocks more attractive. The Jerome Powell rate cut letter is now being viewed as a possible trigger for capital to move out of bonds and into growth sectors like tech and crypto.

Can He Really Force a 1% Rate? Analysts Say “Not So Fast”

While his note is making headlines, market analysts are urging caution. One crypto co-pilot named Alva wrote on X:

“Chance of yield hitting 1% is low unless we see a Fed leadership shakeup or a severe economic shock.”

Experts also point out that the Fed is an independent body, and even with political pressure, it’s unlikely to shift policy dramatically in the short term.

Final Take: If This Shift Come True—What Happens Next?

If Trump rate cut powell note and The Kobeissi Letter 1% rate cut prediction come to fruition it would be historic. The crypto market can react in a positive way and stocks can also see a bullish momentum, however nothing is guaranteed.

So, for now, this interest shift saga is gaining traction, with investors anticipating what comes next. Whether politics or policy, this moment has already shifted the narrative.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。