本报告所提及市场、项目、币种等信息、观点及判断,仅供参考,不构成任何投资建议。

本周,加密资产经历了“机构资金托底、衍生品警戒上升、地缘风险瞬时放大”的三重交织。

BTC继续在102000-109000美元区间试探,并在周末受美国对伊朗核设施发动突袭而出现短暂恐慌性下挫,随后部分修复。

加密市场内部结构性力量保持完整,成为稳定价格的重要支撑,但受地缘政治冲突加剧影响,短线交易者对BTC进行了向下定价。

后继,在内部结构稳定情况下,BTC后继走势完全取决于伊以冲突会否继续升级,如伊朗直接供给美国军事基地、舰船,乃至封锁霍尔木兹海峡。如果冲突逐步恢复,BTC大概率将重回105000美元一线。

政策、宏观金融及经济数据

本周伊以冲突呈螺旋式升级。

6 月 16 日至 18 日,以色列继续发动“外科手术式”空袭,针对伊朗境内导弹阵地与什叶派民兵指挥中心;伊朗随后以弹道导弹和无人机进行报复,区域火力往复拉高了战场温度。市场随即进入防御模式:布伦特原油当周累计拉升近 7%,一度突破 78 美元关口;黄金同步上探,最高触及 33452.37 美元每盎司。

6 月 19 日,白宫首次公开称“正评估军事选项”,标志着美国从幕后协调转向公开介入的临界点。消息公布当日,布伦特原油期货再收涨 2.8%,报 78.85 美元,创五个月新高;VIX 波动率指数抬升,而美债收益率出现避险式下行。

短暂缓和出现在6 月 20 日——市场揣测华盛顿可能以追加制裁而非动武收场,油价小幅回吐,全球股指亦出现技术性反弹。

然而仅过一天,这种“制裁替代打击”的乐观被彻底击碎:美国总统特朗普在美东时间 6 月 21 日凌晨下令,三架 B-2 隐形轰炸机携带 GBU-57“巨型钻地弹”对伊朗福尔多、纳坦兹和伊斯法罕三处浓缩铀设施实施精确轰炸。特朗普在电视讲话中宣称“关键核心能力已被重置于零”,暗示如果伊朗愿意谈判,行动可告一段落。

此举立即激起剧烈外交震荡。联合国秘书长古特雷斯形容局势“危如累卵”,欧盟与英国在谴责伊朗拥核野心的同时亦敦促各方克制。伊朗外长则指控美国“公然违反《联合国宪章》”,誓言采取“对等或非对称报复”,并放话不排除在霍尔木兹海峡实施“选择性封锁”,随后伊朗议会通过决议可以关闭霍尔木兹海峡(将会影响全球20%的出口石油运输),最终决策则由伊朗国家最高安全委员会决定。

由于空袭发生于周末闭市期,主流金融市场的定价尚待周一揭晓,但衍生品与离岸交易已给出前瞻信号:能源与军工ETF 夜盘竞价走高;CME 原油期权 OI 在 90 美元以上执行价段显著放量;而属性高风险的加密资产率先出现抛压,BTC 跌约 1.14%,ETH 盘中跌幅超过2.96%。

上周周报中,我们提出:短期BTC走势取决于“地缘政治冲突”的进展状况。如果冲突加剧乃至升级,包括BTC在内的风险资产将保持震荡甚至向下定价;如果冲突缓和,则权益资产可能逐步收复跌幅。

本周美国的直接介入,令冲突升级,推动BTC全周下跌4.36%计4602.38美元,后继伊朗的报复行动如若涉及供给美军基地,或“封锁”霍尔木兹海峡,将进一步影响全球美股及加密资产的向下定价。

本周事件已把中东局势推向“可控对峙”与“代理人升级”之间的灰色地带,市场进入典型的“原油通胀—美债避险—科技回调—贵金属受捧”模式。倘若未来数周内伊朗报复受限于国内政治与军事能力,那么行情或许在高波动中消化;但若冲突进一步外溢至海上能源航线或美军驻点,全球资产重新定价的幅度和节奏都将显著加剧。

历史数据显示,BTC 在地缘危机初期常先行回撤、随后与黄金呈弱负相关复苏;但若冲突演变为对全球流动性与资金成本的双重挤压,比特币与以太坊的敏感度将明显放大。

加密市场

本周,加密资产经历了“机构资金托底、衍生品警戒上升、地缘风险瞬时放大”的三重交织。BTC继续在102000-109000美元区间试探,并在周末受美国对伊朗核设施发动突袭而出现短暂恐慌性下挫,随后部分修复。

周初,市场对伊以冲突“可控化”的预期带来小幅复苏:BTC 最高反弹至 109000美元,比特币现货 ETF 八个交易日连续净流入。这一资金面数据在宏观噪音中为价格提供关键支撑。在场内资金冷却背景下,机构买力成为将BTC价格维持在10万美元之上的主要力量。

随后,6 月 19 日公布的 FOMC 结果“按兵不动+点阵减速”并未打乱 BTC 的震荡节奏,但期货市场显示对冲规模在增大。

周五盘后数据显示,ETH ETF 出现 6 月迄今最大单日净流出(1,130 万美元),机构减仓引发连环去杠杆,ETH 美元报价一度急泻至 2,372 美元,成交量放大,并带动 SOL、DOGE 等高 β 资产同步回撤。

6 月 20 日美盘时段,一轮场内高杠杆挤压使 BTC 快速跌破 103000美元,其中九成以上为多头头寸;ETH、SOL 等跌幅高达 6-9%。这次“秒杀”事件印证了衍生品端过高杠杆的脆弱性,也标志着市场自 5 月快速上行后的第一次大规模系统性清算。

周末风险波峰出现在美东时间6 月 21-22 日凌晨:美国 B-2 轰炸机精准打击伊朗三座浓缩铀设施的消息打破了周末流动性真空。加密市场作为全球 24/7 唯一实时交易的大类资产,BTC一度跌破10万美元,但收跌-1.14%,表现相对强劲,但ETH在连续两日下跌近10%基础上,再度下跌2.96%,显示高风险资产流动性非常脆弱。

以技术指标来看,地缘政治冲突导致BTC暂时跌破了第一上升趋势线,但仍运行于90000~110000美元区间。我们认为,场内结构化张力保存完整,资金支持变化不大,BTC本周的向下定价是地缘政治冲突升级引发的恐慌情绪所致。如若冲突再升级,这种影响将逐渐消除,但冲突继续升级,则将考验10万和9万美元的关键支撑位。

资金进出

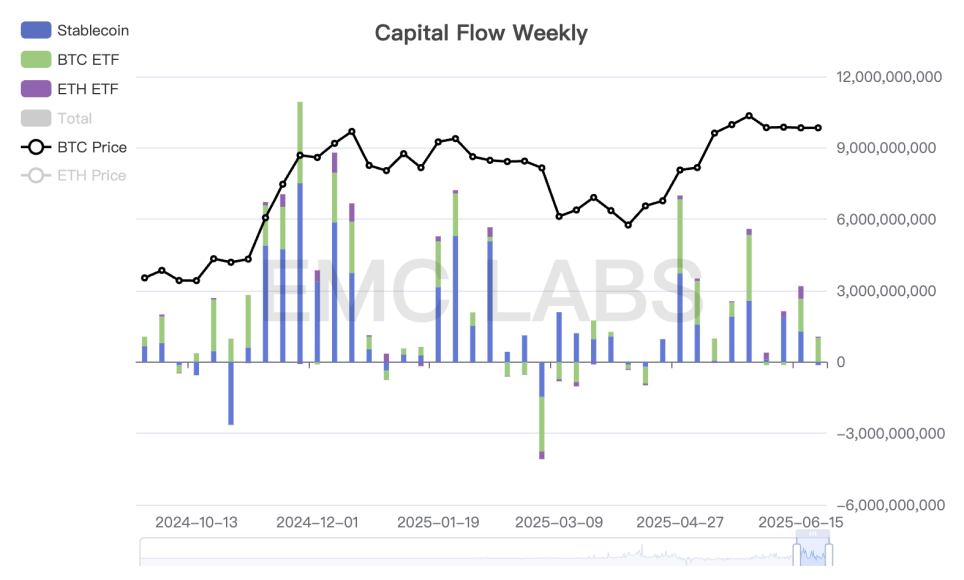

四五月大反弹之后,资金流入出现分化,稳定币通道资金开始减弱,而BTC Spot ETF通道资金则相对旺盛且稳定。

本周BTC Spot ETF通道资金流入10.22亿美元,较上周的13.84亿明显减弱,但仍维持在较高水平。但下周这一数据可能会面临较大挑战,地缘政治冲突如果继续冷却美股,BTC Spot ETF通道资金料难以走出独立走势。

加密市场资金进入统计(周)

稳定币通道上周流入12.73亿,本周则转为流出1.32亿。这种迅速遇冷与我们在合约市场和借贷市场所关注到的趋势保持了一致。

本周ETH Spot ETH流如4077万美元,前半周流入规模缩减,至周五则转为流出超过1亿美元。ETH资金流入规模的减少可能导致高β资产承压。一旦出现闪跌则会对市场形成较大伤害。

抛压与抛售

在降息拖后,地缘政治峰起的背景中,BTC价格维持在10~12美元的高位之中,决定性力量来自机构配置和场内结构性张力。

本周长手持仓继续增加28920枚,短手持仓继续减少24650枚,中心化交易所存量继续减少。因为恐慌抛售和投机热情减弱,本周交易所流出规模大幅减少至1555.9枚。

以上数据可能表明,长期持有者对BTC的信心正在持续增强,但短线交易者的热情冷却地更快,而BTC的短线定价权在场内短线交易者和BTC Spot ETF通道资金共同决定。目前两者都出现了冷却现象,后市如果伊以冲突尽快化解,BTC可能转危为安重回105000一线,如果恶化大概率会跌破10万美元一线,甚至考验90000美元(概率较低)。

EMC Labs认为BTC中长期价格走势的逻辑并未改变,除非伊以冲突演化为美国介入的区域战争。

周期指标

据eMerge Engine,EMC BTC Cycle Metrics 指标为0.625 ,处于上升期。

EMC Labs

EMC Labs(涌现实验室)由加密资产投资人和数据科学家于2023年4月创建。专注区块链产业研究及Crypto二级市场投资,以产业前瞻、洞察及数据挖掘为核心竞争力,致力于以研究和投资方式参与蓬勃发展的区块链产业,推动区块链及加密资产为人类带来福祉。

更多信息请访问:https://www.emc.fund

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。