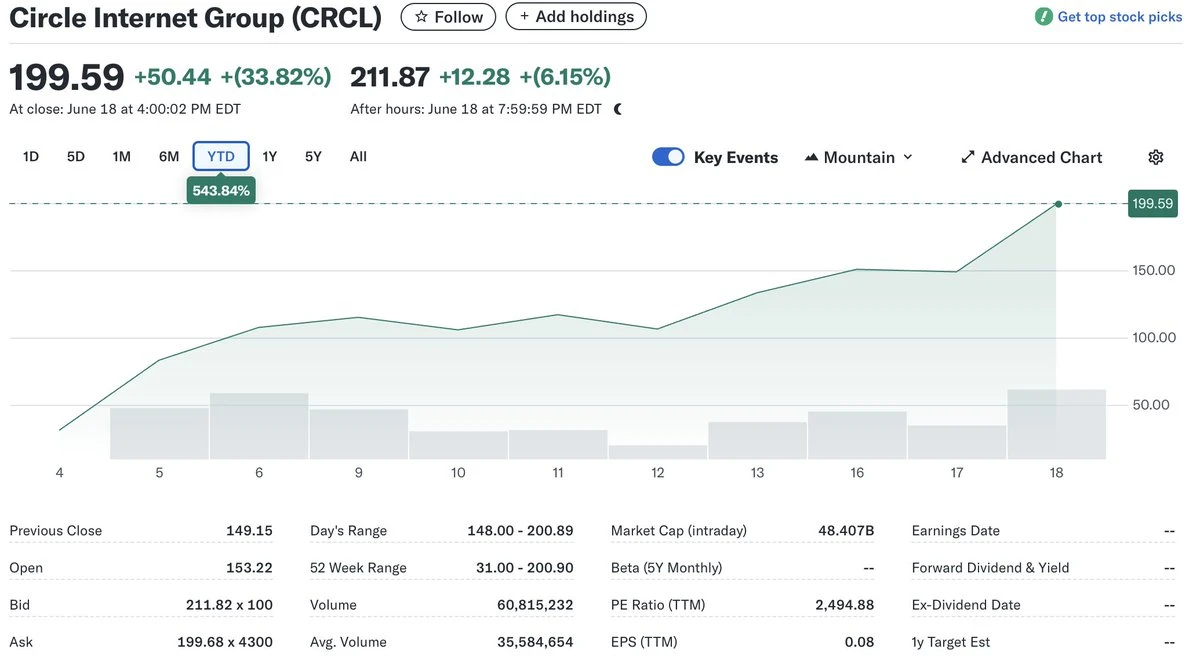

尽管 2025 年被誉为“稳定币元年”,关键立法有望顺利落地、Circle 的 IPO 又录得逾 500% 的惊人涨幅,但细究之下,Circle 的 200 美元股价可能建立在流沙之上。本篇文章聚焦三大核心挑战,从分销困境、利率风险到竞争加剧,透视为何 $CRCL的高估值恐难长久。

1. 分销困境:增长受限

稳定币要想普及,渠道分销至关重要。然而,Circle 在这方面处于尴尬的“中间地带”——既非像 Tether 那样的离岸加密巨头,也未能完全融入美国传统金融体系。

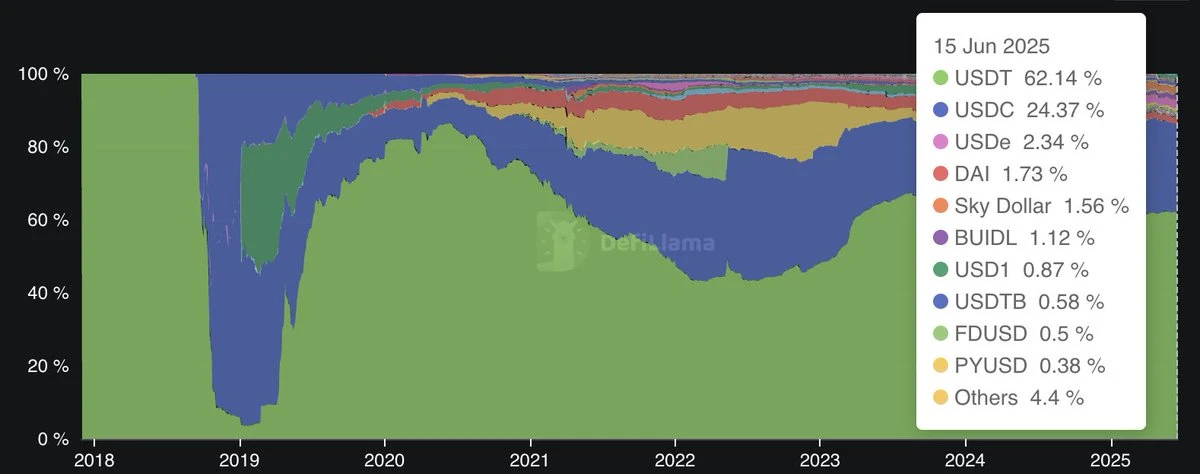

市场份额停

滞截至目前,USDC 仅占稳定币总流通量的 24%,且没有继续扩大份额的明显趋势

(数据来源:DefiLlama)

USDC 不是加密市场的“计价单位”

头部交易所(如 Binance)普遍以 USDT 报价并撮合交易,USDT 借首发优势与网络效应占据 67% 市占率;USDC 仅 27%,难以撼动其地位。

对 Coinbase 的高度依赖

Circle 需将 50% 净利息收入分给 Coinbase 以换取其分销网络,利润空间被严重压缩。一旦双方合作削弱,Circle 便将面临巨大风险。

难以渗透非美市场

总部位于波士顿的 Circle 与大中华区及“全球南方”市场缺乏深度链接,而 Tether 在这些地区已深耕多年,天然拥有分销优势。

潜在对手虎视眈眈

社交媒体巨头(Meta、X 等)及传统银行正研发自有稳定币解决方案;一旦落地,Circle 的渠道空间将进一步被挤压。

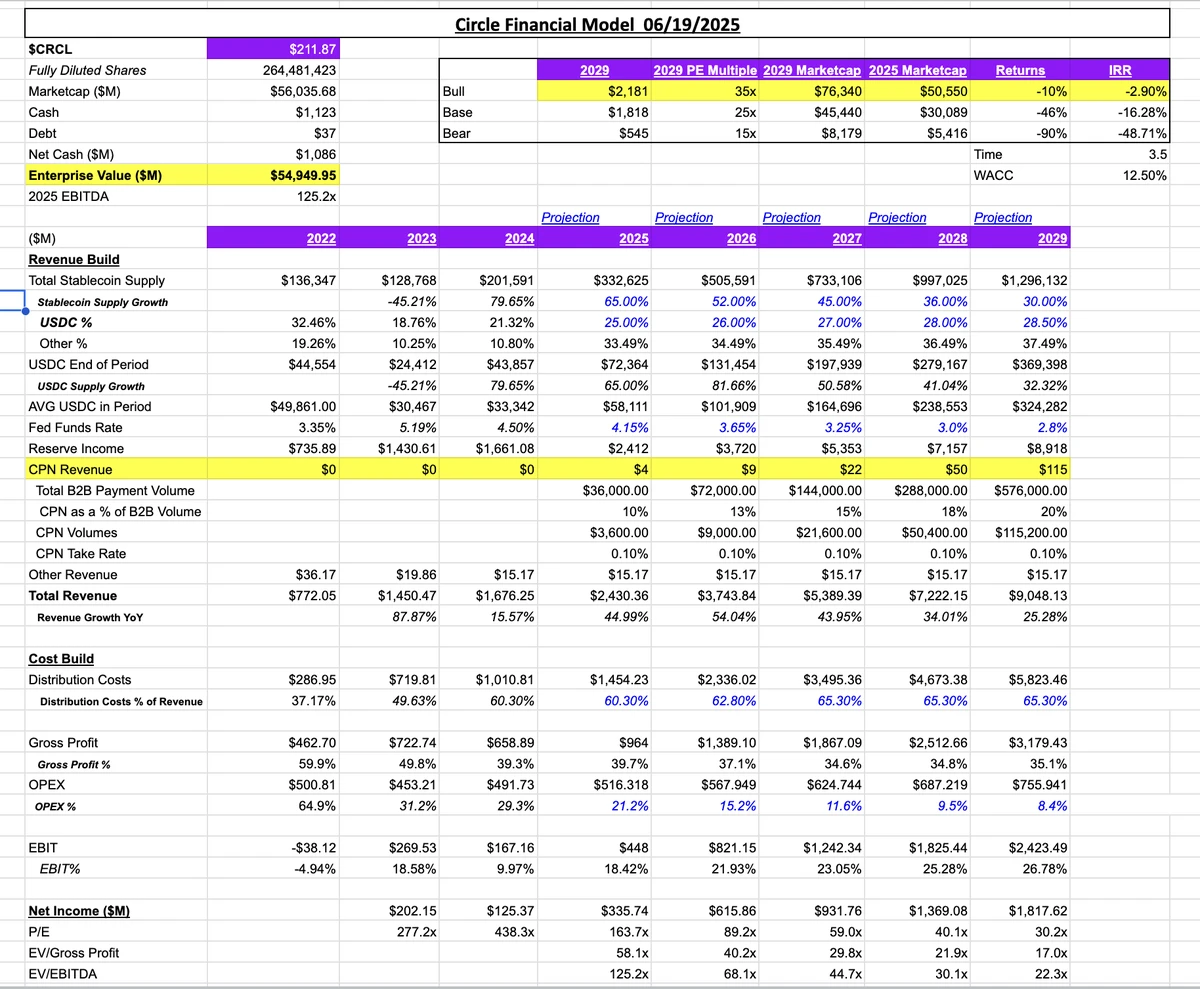

2. 美联储降息带来的利差压力

Circle 的商业模式极度依赖 USDC 储备金所产生的利息收入。

储备利息是“命脉”

2024 年 Circle 报告显示,公司 99.1%(16.61 亿美元)收入来自储备金的利息。

对降息高度敏感

未来两年,美联储被普遍预期会进入降息周期。一旦短端收益率下滑,Circle 的净利息收益率(NIM)将被压缩,盈利能力大打折扣。

缺乏多元化收入

目前 Circle 尚未建立足以对冲利率风险的多元化业务线,对降息环境的脆弱度尤为突出。

3. 估值过高:高倍数能否持续?

IPO 后,Circle 的估值指标已高到令人咋舌:

如此激进的倍数意味着市场已把“高增长”全部计价进去;在分销受限、利差承压、竞争加剧的大背景下,要实现对应的增长难度极高。

数据来源:Artemis

结语:谨慎对待高估值

Circle 的 IPO 虽然声势浩大,但截至 2025 年 6 月 20 日的 200 美元股价,很可能已透支未来预期。公司深陷分销困境,过度依赖 Coinbase,且在关键市场缺位;美联储潜在降息将重创其主收入来源;在此背景下,市场又给予了极高的估值倍数——风险被进一步放大。

对于投资者而言,介入 CRCL之前务必充分评估上述隐忧,并保持资产配置多元化与长期视角,以应对加密与金融科技赛道的剧烈波动。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。