编译:深潮TechFlow

你好!

牛顿以发现万有引力而闻名,但在他那个时代,他对另一领域更感兴趣:金融的炼金术,或者说试图将铅转化为黄金的追求。这种追求甚至让他涉足了神学研究。而现代金融似乎与他的兴趣遥相呼应——通过金融工程,我们正处于一个将“铅变成黄金”的时代,只需组合正确的元素即可。

在今天的文章中,Saurabh 详细解读了企业如何通过向资产负债表中添加加密货币来实现其实际价值的溢价。以 MicroStrategy 为例,这家公司季度营收仅略高于 1 亿美元,却持有价值近 109 亿美元的比特币。全球已有 80 家企业探索如何将加密货币纳入其资产负债表。传统金融机构对此表现出极大的兴趣,并为这种股票的波动性和潜在收益支付了溢价。

Saurabh 还分析了可转债的崛起,这种金融工具帮助创造了这一繁荣的生态系统,同时探讨了其中的风险以及那些尝试将其他加密货币纳入资产负债表的企业。

让我们进入正题吧!

一家季度营收仅 1.11 亿美元的软件/商业智能公司,其市值却高达 1090 亿美元。这是如何实现的?答案是:它用别人的钱买了比特币。而市场现在为其持有的比特币估值溢价高达 73%。这背后到底是怎样的“炼金术”?

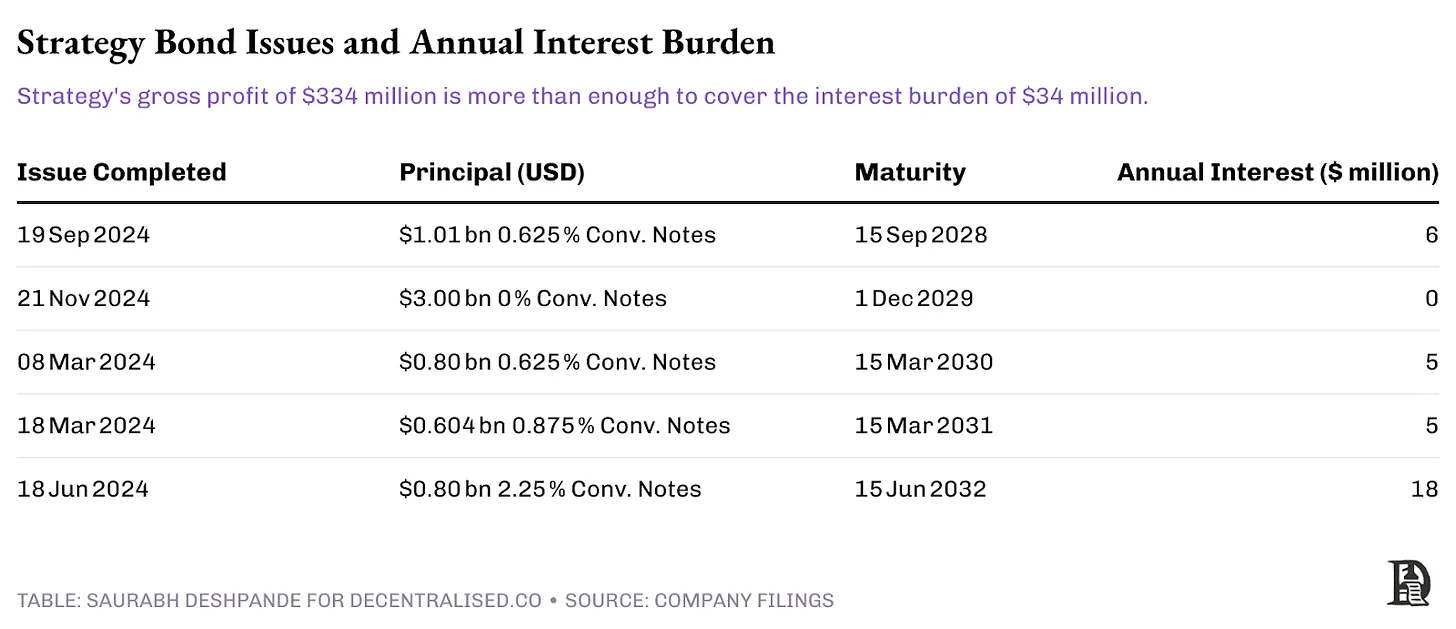

MicroStrategy(现称 Strategy)创造了一种金融机制,使其几乎可以零成本借款来购买比特币。以其 2024 年 11 月发行的 30 亿美元可转债为例,以下是其运作方式:

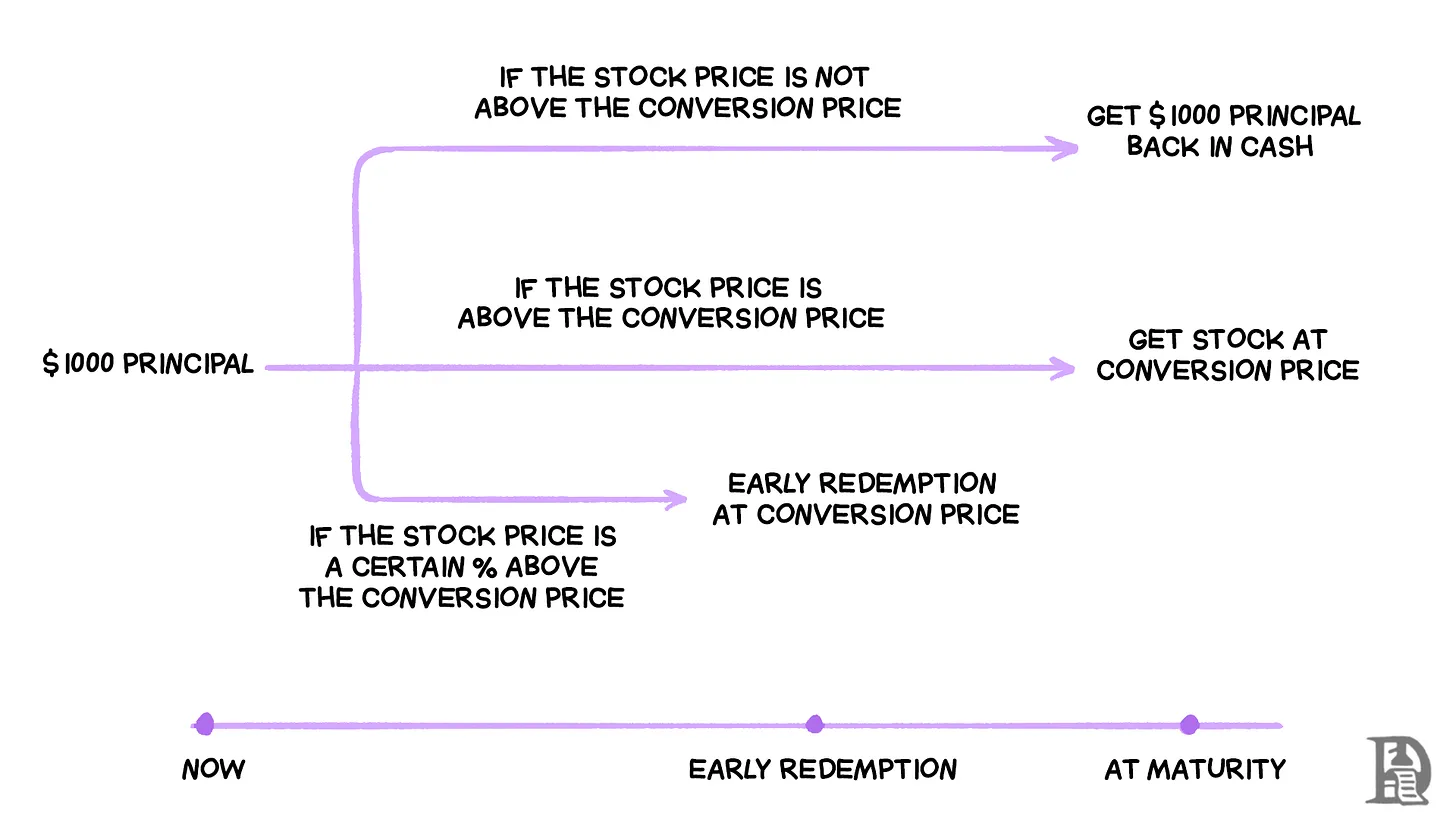

公司发行了票息为 0% 的可转债,这意味着债券持有人不会收到定期支付的利息。相反,每张 1,000 美元的债券可以转换为 1.4872 股 Strategy 的股票,但前提是其股价在到期前上涨至 672.40 美元或更高。

发行这些债券时,Strategy 的股价为 433.80 美元,因此股价需要上涨 55% 转换才会有利可图。如果股价从未达到这一水平,债券持有人将在五年后拿回 1,000 美元。但如果 Strategy 的股价飙升(通常在比特币价格上涨时会发生),债券持有人可以转换为股票并获取全部上涨收益。

这个机制的巧妙之处在于,债券持有人实际上是在押注比特币的表现,同时享有直接持有比特币所没有的下行保护。如果比特币暴跌,他们仍能拿回本金,因为债券在破产清算中优先于股票。而与此同时,Strategy 可以以零成本借到 30 亿美元,并立即用这些资金购买更多比特币。

然而,这一机制的关键触发点在于:从 2026 年 12 月起(发行仅两年后),如果 Strategy 的股价在一段时间内超过 874.12 美元(转换价格的 130%),公司可以强制提前赎回这些债券。这一“赎回条款”意味着,如果比特币推动股价足够高,Strategy 可以迫使债券持有人转换为股票或提前赎回资金,从而以更优条件进行再融资。

这一策略之所以奏效,是因为比特币在过去 13 年间实现了约 85% 的年均增长率,而过去 5 年的年均增长率也高达 58%。公司押注比特币的增长速度将远超触发债券转换所需的 55%股价增幅。他们已经证明了这一策略的成功,通过成功提前赎回早期发行的债券,节省了数百万美元的利息支出。

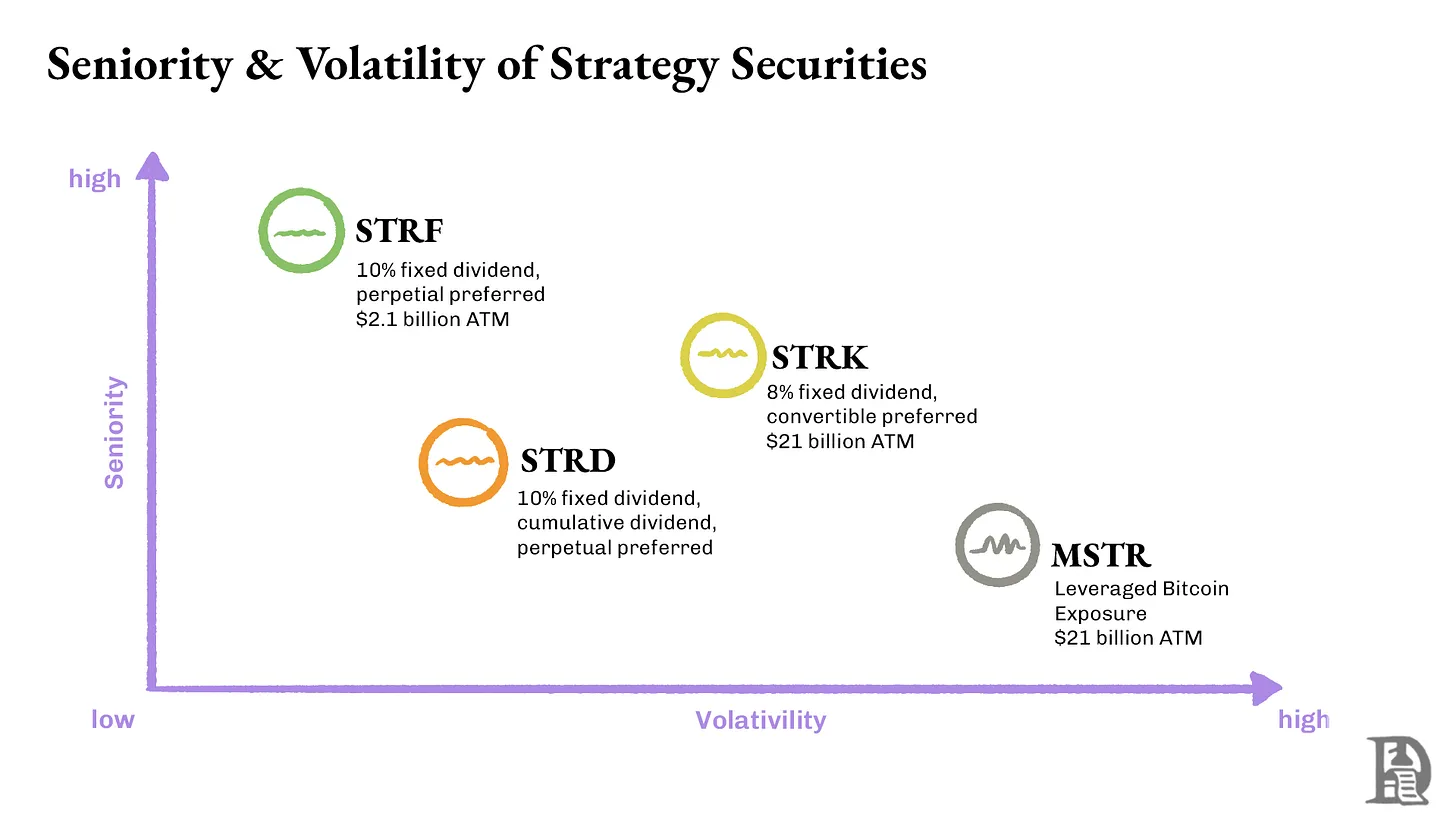

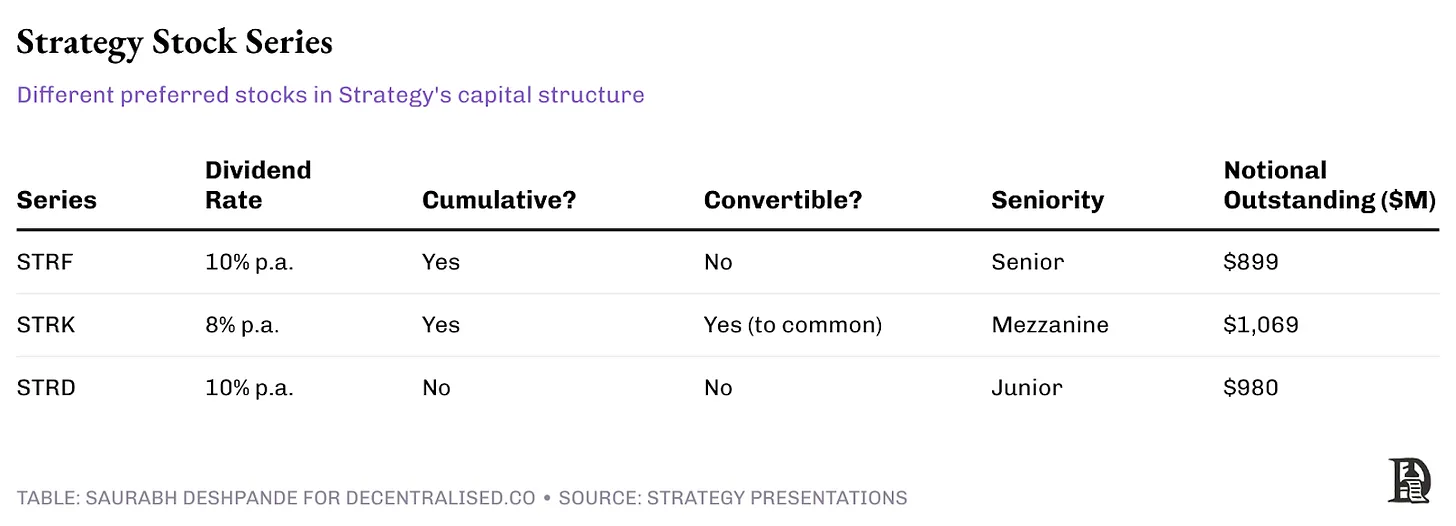

在这一结构的核心是三种不同的永久优先股系列:STRF、STRK 和 STRD,每种都针对不同的投资者类型量身定制。

STRF:永久优先股,提供 10% 的累积股息,并具有最高的优先级。如果 Strategy 未能支付股息,公司必须在向其他股东支付之前,先支付所有未付的 STRF 股息。此外,作为惩罚,股息利率会随之提高。

STRK:永久优先股,提供 8% 的累积股息,优先级居中。未支付的股息会累积,必须在普通股股东获得任何收益之前全额支付。此外,STRK 还包括转换为普通股的权利。

STRD:永久优先股,提供 10% 的非累积股息,优先级最低。较高的股息率是对更高风险的补偿——如果 Strategy 跳过支付,这些股息将永远丢失,不需要补偿。

永久优先股使 Strategy 能够筹集类似股权的资本,同时支付类似债券的永续股息。每个系列都根据投资者的风险偏好进行了定制设计。累积股息功能保护了 STRF 和 STRK 的持有人,确保最终能够收到所有未付股息,而 STRD 则提供了更高的当前收益,但没有对未支付股息的保障机制。

Strategy 的成绩单

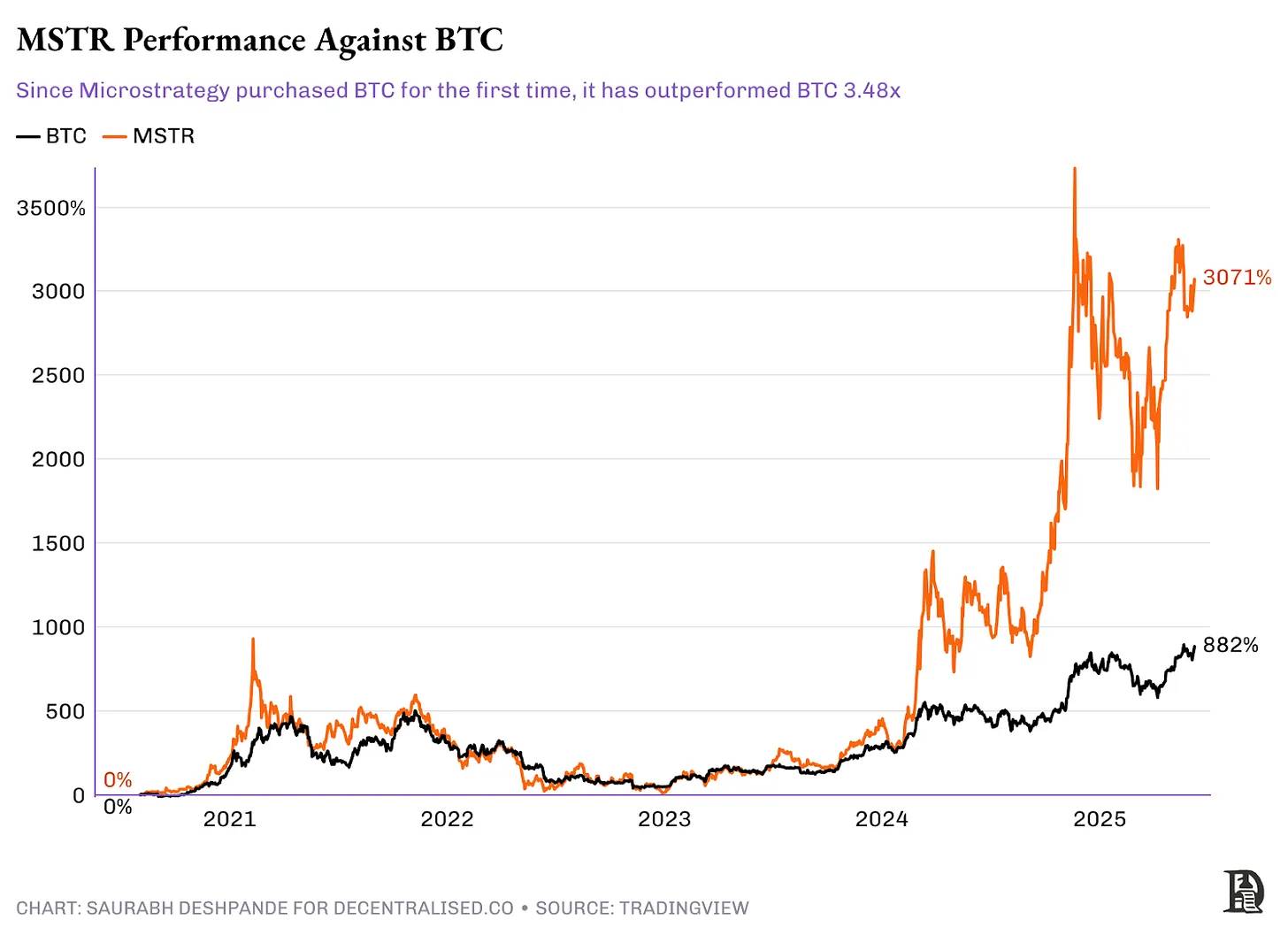

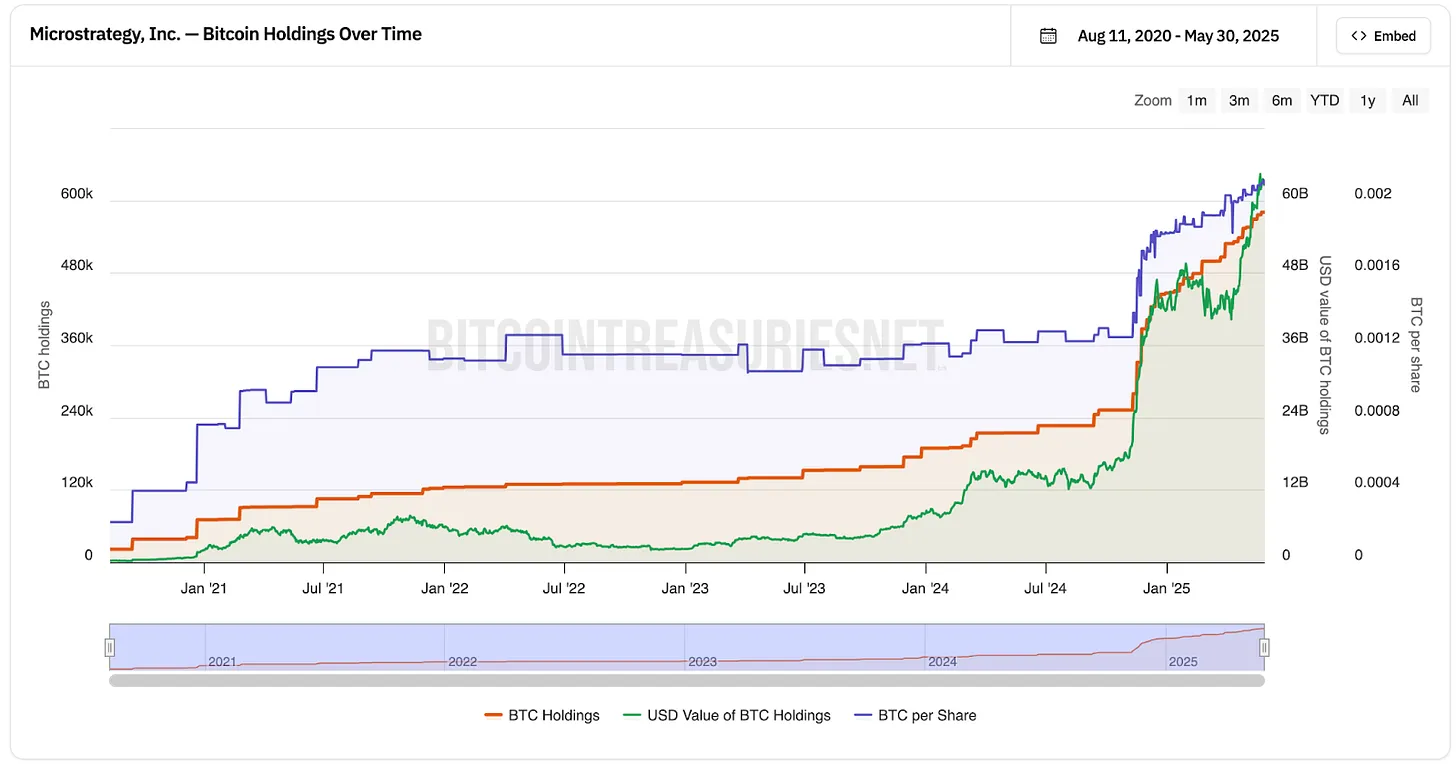

MicroStrategy 从 2020 年 8 月开始筹集资金购买比特币。从那时起,比特币价格从 11,500 美元飙升至 108,000 美元,涨幅约为 9 倍。同时,MicroStrategy 的股价从 13 美元上涨至 370 美元,几乎翻了 30 倍。

值得注意的是,MicroStrategy 的常规业务并未有任何增长。他们的季度收入仍然维持在 1 亿至 1.35 亿美元之间,与过去完全一致。唯一的变化是他们借钱购买了比特币。目前,他们持有 582,000 枚比特币,价值约 630 亿美元。而他们的股票市值约为 1,090 亿美元,比其比特币实际价值高出 73%。投资者愿意支付额外溢价,仅仅是为了通过 MicroStrategy 的股票间接持有比特币。

来源:bitcointreasuries.net

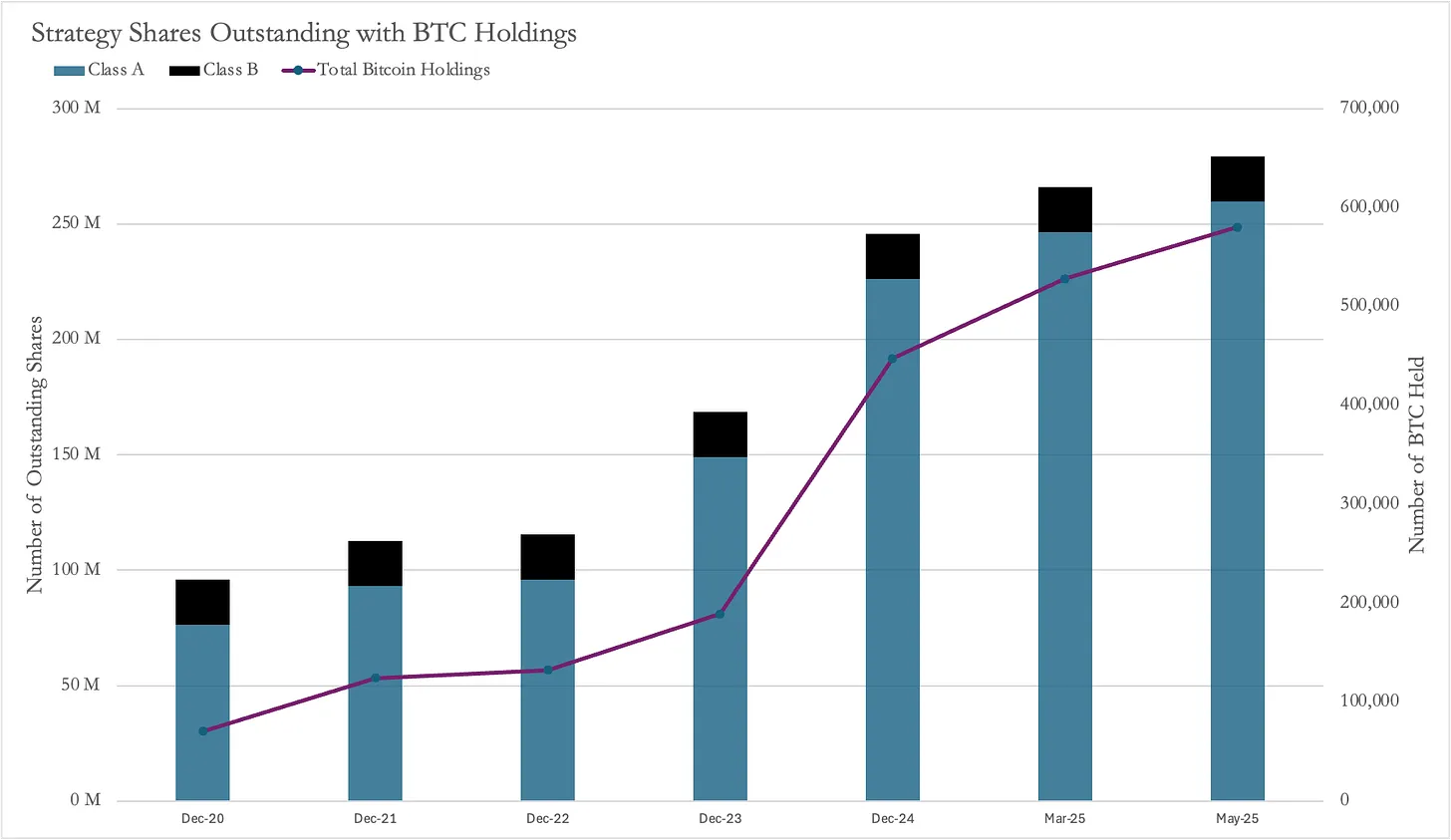

正如之前提到的,MicroStrategy 通过发行新股为其比特币购买提供资金。自从他们开始购买比特币以来,公司股票数量几乎增加了三倍,从 9,580 万股增至 2.795 亿股,增长了 191%。

来源:MicroStrategy 文件

通常情况下,发行如此多的新股会对现有股东造成损害,因为每个人在公司的份额都会被稀释。然而,尽管股票数量增加了 191%,但股价却飙升了 2,900%。这意味着,尽管股东们持有的公司比例变小了,但每股的价值却大幅提升,总体上他们仍然获利。

MicroStrategy 的成功模式走红

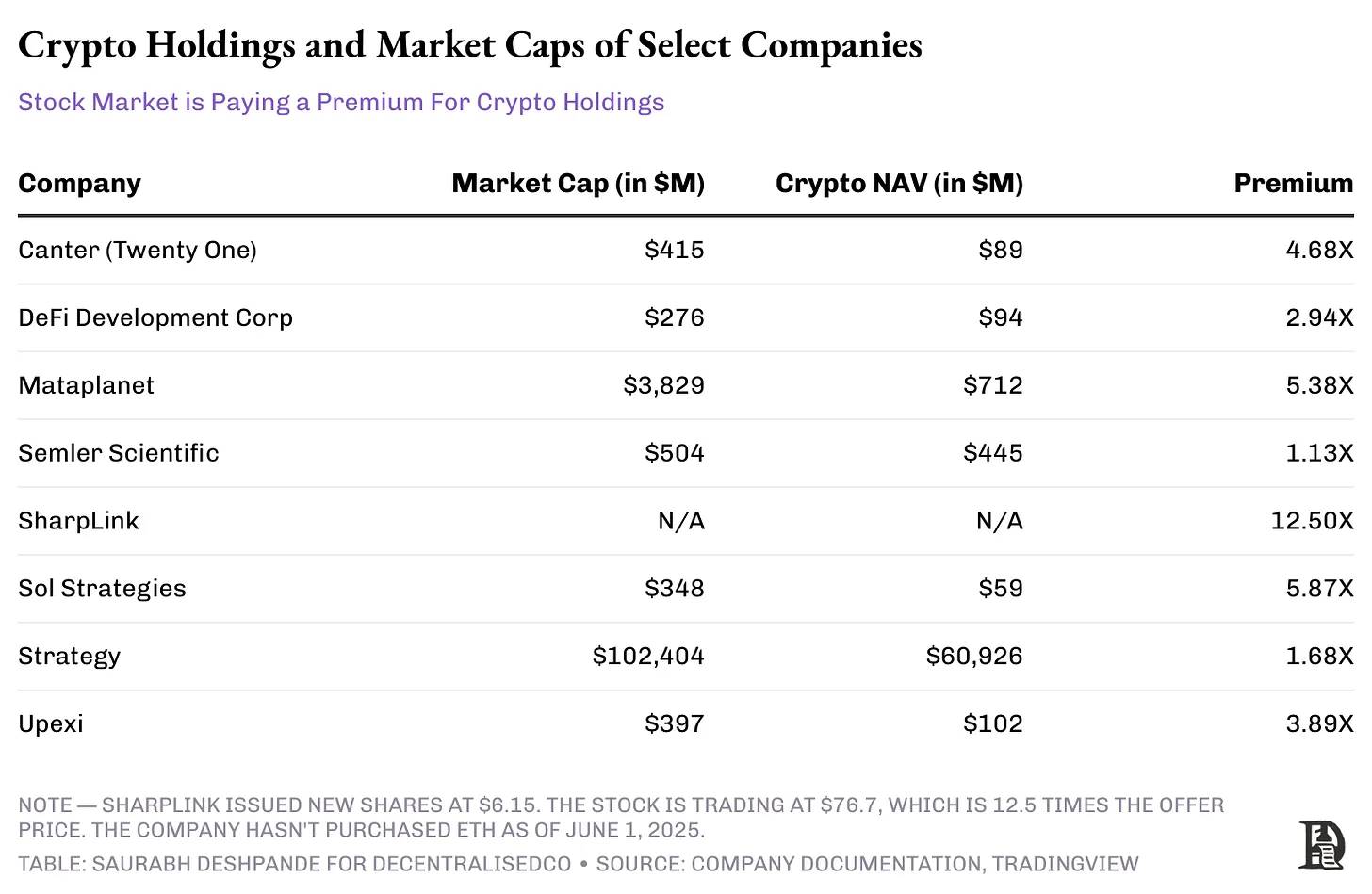

多家公司开始效仿 MicroStrategy 的成功模式,持有比特币作为公司资产。其中一个最近的案例是 Twenty One (XXI)。这是一家由 Jack Mallers 领导的特殊目的收购公司(SPAC),背后有 Brandon Lutnick(美国商务部长之子)的 Cantor Fitzgerald、Tether 和软银(SoftBank)的支持。与 MicroStrategy 不同,Twenty One 并未上市。唯一能通过公开市场参与的方式是通过 Cantor Equity Partners (CEP),后者以 1 亿美元的资金换取了 XXI 2.7% 的股份。

Twenty One 持有 37,230 枚比特币。由于 CEP 拥有 Twenty One 的 2.7% 股份,这实际上意味着 CEP 控制了大约 1,005 枚比特币(按每枚比特币 108,000 美元计算,价值约 1.085 亿美元)。

然而,CEP 的股票市值却高达 4.86 亿美元,是其比特币实际价值的 4.8 倍!在其比特币关联性公布后,CEP 的股价从 10 美元飙升至约 60 美元。

这种巨大的溢价意味着,投资者为 9,200 万美元的比特币敞口支付了 4.33 亿美元。当越来越多类似公司出现并增加比特币持有量时,市场力量最终将使这些溢价回归到更合理的水平,尽管目前没人知道这会在何时发生,或“合理水平”究竟是多少。

一个显而易见的问题是:为何这些公司会有溢价?为什么投资者愿意支付溢价购买这些公司的股票,而不是直接从市场上购买比特币来获得敞口?答案可能在于“选择权”(optionality)。谁在为 MicroStrategy 的比特币购买提供资金?主要是那些通过交易债券寻求“无风险套利”(delta-neutral strategies)的对冲基金。

如果仔细思考,这种交易与 Grayscale 的比特币信托(Bitcoin Trust, GBTC)非常相似。过去,Grayscale 的比特币信托也曾以高于比特币的溢价交易,因为它是封闭式的(投资者无法提取比特币,直到它被转换为 ETF)。

因此,投资者会将比特币存入 Grayscale,并出售其公开交易的 GBTC 股份。正如之前提到的,MicroStrategy 的债券持有人可以享受超过 9% 的年均复合增长率(CAGR)。

但这种风险有多大呢?MicroStrategy 的年度利息负担总计为 3,400 万美元,而 2024 财年的毛利润为 3.34 亿美元,足以偿还债务。MicroStrategy 发行了与比特币四年周期相关的可转换债券,其到期时间足够长,以减轻价格下跌风险。因此,只要比特币在四年内上涨超过 30%,新股票发行就可以轻松支付赎回费用。

在赎回这些可转换债券时,MicroStrategy 可以简单地向债券持有人发行新股。债券持有人将根据发行时的参考股票价格获得支付,该价格比发行债券时的股票价格高出约 30-50%。这只有在股票价格低于转换价时才会成为问题。在这种情况下,MicroStrategy 必须返还现金,可以通过以更优惠的条款筹集新一轮债务来偿还早期债务,或者通过出售比特币来筹集现金。

价值链

这一过程显然始于公司试图获取比特币,但最终他们使用了交易所和托管服务。例如,MicroStrategy 是 Coinbase Prime 的客户,它通过 Coinbase 购买比特币,并将比特币存储在 Coinbase Custody、Fidelity 以及自己的多重签名钱包中。虽然很难准确估算 Coinbase 从 MicroStrategy 的比特币执行和存储中赚取了多少,但我们可以进行一些猜测。

假设交易所如 Coinbase 对代表 MicroStrategy 购买比特币的场外交易执行收取 5 个基点的费用,以平均执行价格 70,000 美元购买 50 万枚比特币,他们从执行中赚取了 1,750 万美元。比特币托管机构收取 0.2% 至 1% 的年费。假设采用范围的低端,以 108,000 美元的价格存储 10 万枚比特币,托管机构每年通过为 MicroStrategy 存储比特币赚取 2,160 万美元。

BTC之外

迄今为止,设计能在资本市场中提供比特币(BTC)敞口的金融工具表现不俗。2025 年 5 月,SharpLink 通过一轮由 ConsenSys 创始人乔·卢宾(Joe Lubin)主导的上市公司私募(PIPE)融资筹集了 4.25 亿美元,卢宾还成为了公司执行董事长。本次融资以每股 6.15 美元的价格发行了约 6,900 万新股,资金将用于购买约 12 万枚以太坊(ETH),并可能随后参与质押。目前,ETH 交易所交易基金(ETF)尚不允许进行质押。

这种提供 3%-5%收益的金融工具比 ETF 更具吸引力。在此消息发布前,SharpLink 的股价为 3.99 美元,总市值约为 280 万美元,流通股仅 69.9 万股。而此次融资的发行价较市场价格溢价 54%。消息公布后,其股价一度飙升至 124 美元。

值得注意的是,新发行的 6,900 万股相当于当前流通股数量的约 100 倍。

另一家公司 Upexi 计划在 2025 年第四季度前收购超过 100 万枚 Solana(SOL),同时保持现金流中性。该计划始于一轮由 GSR 主导的私募融资,Upexi 通过出售 4,380 万股股票筹集了 1 亿美元。Upexi 预计通过 6%-8% 的质押收益及最大可提取价值(MEV)返利来支付优先股股息,并为未来的 SOL 购买提供自筹资金。消息发布当天,其股价从 2.28 美元飙升至 22 美元,随后收于约 10 美元。

Upexi 在融资前的流通股为 3,720 万股,因此新发行的股票对旧股东造成了约 54% 的稀释,但股价暴涨近 400% 足以弥补稀释带来的损失。

Sol Strategies 是另一家通过资本市场融资购买 SOL 的公司。该公司运营 Solana 验证节点,其收入超过 90% 来自质押奖励。目前,该公司已质押 39 万枚 SOL,另有约 316 万枚 SOL 由第三方委托给其节点。2025 年 4 月,Sol Strategies 与 ATW Partners 达成了一项可转换债券协议,获得了高达 5 亿美元的融资额度,其中首批 2,000 万美元已用于购买 122,524 枚 SOL。

最近,Sol Strategies 提交了一份货架式招股说明书,计划通过普通股(包括“随时市场发行”)、认股权证、认购收据、单位、债务证券或任意组合的方式再融资 10 亿美元。这为公司提供了多样化的融资灵活性。

与 MicroStrategy 的可转换债券模式不同,SharpLink 和 Upexi 通过直接发行新股融资。个人认为,MicroStrategy 的模式更适合目标不同的投资者群体。相比直接购买 ETH 或 SOL,通过购买股票间接获得敞口的投资者需要承担额外的风险,例如中间商可能会加杠杆超出投资者的风险承受能力。因此,除非有额外的服务附加价值,否则采用可转换债券且有足够的运营利润缓冲来支付利息的模式更为合理。

当音乐停止

这些可转换债券主要面向寻求不对称风险回报机会的对冲基金和机构债券交易员,而非零售投资者或传统股票基金。

从他们的角度来看,这些金融工具提供了“赢了赚大钱,输了损失有限”的选择,非常契合其风险管理框架。如果比特币在两到三年内实现预期的 30%-50%涨幅,他们可以选择转换债券;如果市场表现不佳,他们仍能收回 100%本金,尽管可能会因通胀损失部分价值。

这种结构的优势在于它解决了机构投资者的实际问题。许多对冲基金和养老金基金缺乏直接持有加密货币的基础设施,或因投资限制无法直接购买比特币。这些可转换债券为他们提供了一种合规的“后门”进入加密市场,同时保持了固定收益资产所需的下行保护。

然而,这种优势注定是暂时的。随着监管逐步清晰、更直接的加密投资工具(如托管解决方案、受监管的交易所及更明确的会计标准)出现,对这些复杂的绕道方式的需求将逐渐减少。目前投资者为通过 MicroStrategy 获得比特币敞口所支付的 73% 溢价可能会随着更直接替代方案的出现而缩减。

我们曾见过类似的情况。过去,机会主义管理者曾利用 Grayscale 比特币信托(GBTC)的溢价——购买比特币并存入 Grayscale 的信托中,然后在二级市场以高于净资产价值(NAV)20%-50%的溢价出售 GBTC 股份。然而,当越来越多人开始效仿时,到 2022 年底,GBTC 的溢价从峰值转为创纪录的 50%折价。这一循环表明,如果缺乏可持续的收入支持反复融资,以加密货币为支撑的股票玩法最终会被市场套利掉。

关键问题是,这种情况还能持续多久,以及当溢价崩塌时谁能屹立不倒。拥有强劲业务基础和保守杠杆率的公司可能会经受住这种转变,而那些缺乏持久收入来源或竞争壁垒、仅追逐加密货币资产的公司则可能在投机热潮退去后面临因稀释导致的抛售。

目前,音乐还在播放,所有人都在起舞。机构资本涌入,溢价扩大,越来越多的公司每周宣布比特币及加密货币资产策略。然而,聪明投资者知道这是一场交易,而非长期投资逻辑。能够存活下来的公司将是那些利用这一窗口创造超越其加密货币持有的持久价值的企业。

企业财务管理的转型可能是永久性的,但今天我们看到的非凡溢价却并非如此。问题是,你是否准备好从这一趋势中获利,还是只是另一个希望在音乐停止时找到座位的玩家。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。