Huma Finance's Jupiter presale is essentially an experiment about the future form of DeFi.

Written by: Lawrence

Introduction: When PayFi Meets Solana, the Prelude to Value Reconstruction

In May 2025, the Launchpad battlefield of the Solana ecosystem is filled with smoke. Amidst the tussle between Pump.Fun and Raydium over meme tokens and liquidity mining, Jupiter breaks the deadlock with a strategic partnership—Huma Finance, the world's first PayFi protocol, announces the launch of its IDO (Initial DEX Offering) on its new platform TGE (Token Generation Event).

This collaboration is not only about the competition for token issuance traffic but is also seen as a milestone in the deep integration of PayFi (Payment Finance) and DeFi. Huma Finance injects a long-awaited value anchor into the Solana ecosystem with a cumulative trading volume of $4.3 billion, an annualized stable return of 14%, and a narrative of "real assets + blockchain." Jupiter, with its community momentum of 400,000 monthly active users, attempts to push this presale towards a "Web3 financial infrastructure" faith battle.

1. Huma Finance: The "Disruptor" of the PayFi Track and Data Surge

Founded in 2023, Huma Finance positions itself as a blockchain solution provider for cross-border payments and capital turnover. Its core logic is to leverage stablecoins and smart contract technology to bring traditional financial scenarios such as trade financing, credit card clearing, and cross-border remittances on-chain, achieving real-time settlement and profit distribution of capital flows. According to the latest disclosures, Huma has achieved a total trading volume of $4.3 billion, with total platform revenue reaching $4.09 million, active liquidity assets exceeding $104 million, and nearly 49,000 deposit users (a 9-fold increase from the previous month). This data is considered "dominant" within the Solana ecosystem—its trading volume accounts for over 40% of Solana DeFi's total TVL, even surpassing established protocols like Jupiter and Raydium.

Compared to DeFi protocols that rely on speculative liquidity, Huma's revenue sources are more grounded in reality. Its annualized return of 10%-20% comes from interest rate arbitrage and capital turnover needs in cross-border trade, such as small and medium-sized enterprises obtaining on-chain credit by pledging accounts receivable. This model gives it a first-mover advantage in the "trillion-dollar PayFi market" reported by Messari and has attracted institutional investments totaling $46.3 million from Distributed Global, Circle Ventures, and others in two rounds.

2. Token Economic Model: Pragmatic Design and Circulation Game

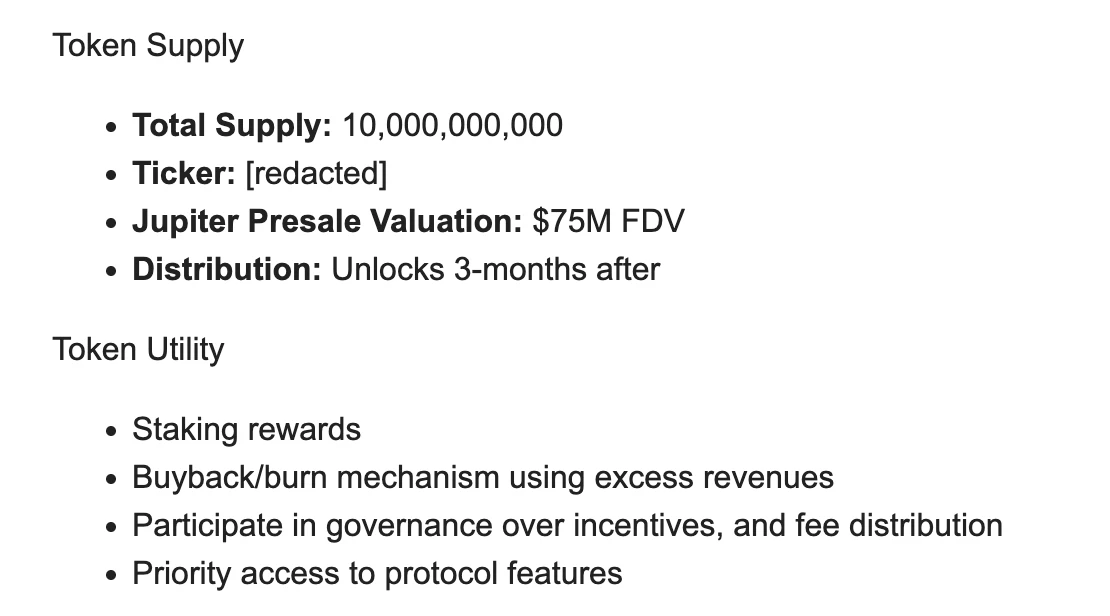

The total supply of Huma tokens (HUMA) is 10 billion, with an initial circulation ratio of 17.33%. Its economic model highlights the dual logic of "profit sharing + deflationary mechanism":

Token Utility: Holders can share staking rewards (distribution of the portion of the 14% annualized return), participate in governance voting, and enjoy buyback and burn of excess protocol revenue. The team emphasizes that Huma's profit sources are stable, with a single-month profit reaching $9 million in April 2024, providing fundamental support for token value.

Distribution Structure: 5% is allocated for the initial airdrop (targeting early deposit users), 31% for ecosystem incentives, 20.6% for early investors, and 19.3% for the team and advisors. Notably, the presale accounts for only 1% of the total supply (100 million tokens) and requires a 3-month lock-up. This "low circulation + high lock-up" design not only provides discount opportunities for early participants but also attempts to alleviate selling pressure in the initial phase of the token listing.

Compared to the previous round of financing with a fully diluted valuation (FDV) of $171 million, this presale is valued at $75 million, offering a discount of over 56%. This strategy clearly aims to attract retail power from the Jupiter community, but its 1% supply has also sparked controversy—many users in community proposals are calling for an increase in the presale ratio to balance the entry costs for institutions and retail investors.

3. Jupiter's Ambition: From Traffic War to Ecological Alliance

As the traffic entry point of the Solana ecosystem, Jupiter has surpassed 400,000 monthly active users, but its Launchpad business has long faced pressure from Pump.Fun (which has over 500,000 daily active addresses). The collaboration with Huma marks Jupiter's transformation from a "trading aggregator" to an "ecosystem incubator":

Strategic Synergy: The $250,000 asset swap between Jupiter and Huma (based on a $75 million FDV) is not only a financial investment but also a declaration of ecological synergy. Huma's payment clearing capabilities can enhance Jupiter's stablecoin liquidity, while Jupiter's user base will accelerate Huma's adoption rate.

Community Co-Governance: The presale is only open to JUP stakers, with no minimum threshold but allocation based on staking amount. This design incentivizes JUP lock-up while transferring token distribution rights to the community, differentiating it from Pump.Fun's "indiscriminate new issuance."

Additionally, both parties plan to co-build a DAO alliance to expand influence through meme dissemination and joint events. Jupiter co-founder meow revealed in a lengthy article that his decade-long friendship with Huma founder Erbil Karaman laid the trust foundation for the collaboration—from their early acquaintance on Quora, to Bitcoin evangelism within Facebook, to jointly planning the JUP token burn event, their relationship has transcended commercial interests, becoming an "emotional bond" for ecological linkage.

4. Opportunities and Challenges of PayFi: Between Idealism and Real Barriers

Although Huma's PayFi narrative is full of imagination, the challenges it faces cannot be ignored:

Competitive Red Sea: Traditional payment protocols like Ripple and Stellar have already laid out on-chain solutions, while Parcl and Kamino within the Solana ecosystem are also exploring the real asset track. Huma needs to establish barriers through technological openness (supporting multi-chain asset access) and Solana's high-performance advantages.

Compliance Risks: Cross-border payments involve KYC, anti-money laundering, and other regulatory frameworks, and Huma's "partially centralized" architecture (such as credit assessment modules) may become a regulatory focus. The team claims to achieve zero defaults by 2024, but it needs to continuously prove its risk control capabilities.

Token Liquidity Game: The 3-month lock-up period may reduce selling pressure but could also weaken short-term speculative enthusiasm. If systemic risks arise in the market during the same period (such as a recurrence of Solana network congestion), the price pressure after token unlocking will increase sharply.

5. Presale Strategy and Community Sentiment: A Tug of War Between Rationality and FOMO

For ordinary investors, participating in the Huma presale requires weighing three key factors:

Cost Assessment: Based on a $75 million FDV, the initial price of HUMA is approximately $0.0075. If benchmarked against the previous round's $171 million valuation, the potential upside is about 128%, but the 3-month lock-up's capital cost must be deducted (assuming an annualized return of 15%, the opportunity cost is about 3.75%).

Community Governance Rights: HUMA holders can participate in key decisions such as protocol fee distribution, which holds strategic value for long-term investors. If Huma can continue to attract real business demand, the governance rights premium will gradually emerge.

Ecological Dividends: As the first Launchpad project of Jupiter, HUMA may receive additional incentives such as ecological airdrops and liquidity mining. Historical data shows that JUP stakers have averaged over 3 times returns in previous projects like JTO and WEN.

In community discussions, supporters believe that Huma's combination of "real returns + undervaluation" is a rare target in a bear market; opponents question whether the lock-up mechanism suppresses liquidity and argue that the PayFi track still needs time for validation. X platform user @DeFiGuru commented: "This is a turning point for Solana DeFi from a casino to a bank, but banks need a century of credit, while the crypto market only gives 3 months of patience."

Conclusion: The "Coming of Age" of the Solana Ecosystem

Huma Finance's Jupiter presale is essentially an experiment about the future form of DeFi. If successful, PayFi will prove that blockchain can create real value without relying on Ponzi models; if it fails, it means that the narrative of "real assets on-chain" still needs to lie dormant. For Solana, this battle is not only a traffic competition for Launchpad but also a coming-of-age ceremony for the ecosystem to transition from "rapid expansion" to "value accumulation."

As Jupiter founder meow said: "We need to let capital flow on-chain to create jobs, not just paper wealth." Regardless of the outcome, the collaboration between Huma and Jupiter has already written a tension-filled prologue for the crypto world in 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。