撰文:深潮 TechFlow

稳定币,无疑是最近一周加密市场的热门话题。

前有美国GENIUS稳定币法案通过参议院程序投票,后有香港立法会三读通过《稳定币条例草案》,稳定币如今已成为全球金融体系中的重要变量。

在美国,稳定币的未来发展不仅关乎数字资产市场的繁荣,更可能对国债需求、银行存款流动性以及美元霸权产生深远影响。

而在 GENIUS 法案通过前的一个月,美国财政部的“智囊团”——财政借款咨询委员会(Treasury Borrowing Advisory Committee,简称 TBAC),用一份报告深入探讨了稳定币的扩张对美国财政和金融稳定的潜在影响。

作为财政部制定债务融资计划的重要组成部分,TBAC 的建议不仅直接影响着美国国债的发行策略,还可能间接塑造稳定币的监管路径。

那么,TBAC 如何看待稳定币的增长?这一智囊团的观点是否会影响财政部的债务管理决策?

我们将以 TBAC 的最新报告为切入点,解读稳定币如何从“链上现金”演变为左右美国财政政策的重要变量。

TBAC,财政智囊团

首先简介一下 TBAC。

TBAC 是一个向财政部提供经济观察和债务管理建议的咨询委员会,其成员由来自买方和卖方金融机构的高级代表组成,包括银行、经纪交易商、资产管理公司、对冲基金和保险公司。也是美国财政部制定债务融资计划的重要组成部分。

TBAC会议

TBAC会议主要是向美国财政部提供融资建议,是美国财政部制定债务融资计划的重要组成部分。从融资计划的流程看,美国财政部季度融资流程包括三个环节:

1)国库债务管理者向一级交易商征求建议;

2)与主要交易商会议之后,国库债务管理者向TBAC征求建议;针对财政部提出的问题和讨论材料,TBAC会向财政部长发布正式报告;

3)国库债务管理者根据研究分析和从私营部门收到的建议对债务管理政策的变化做出决定。

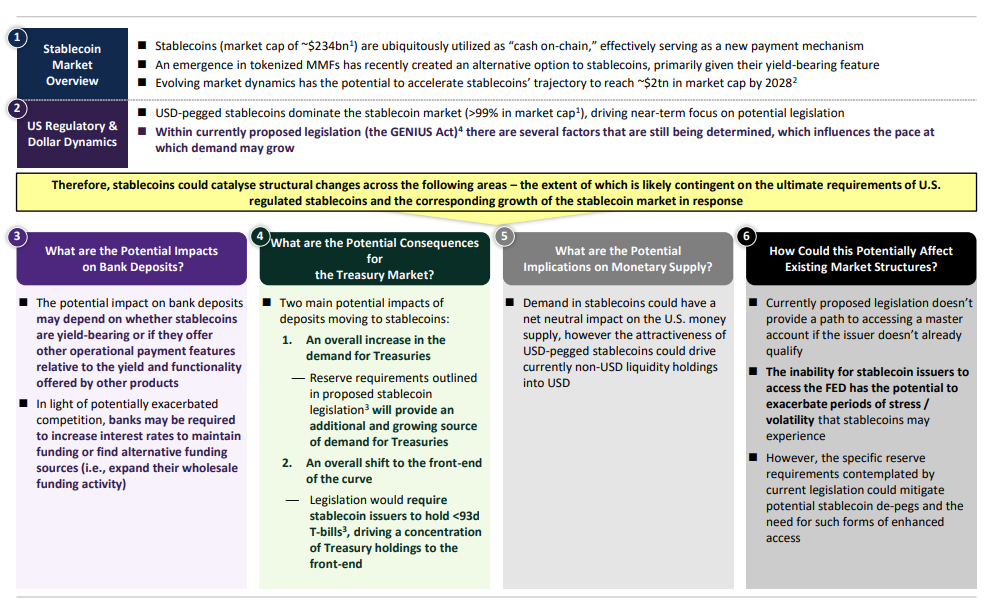

报告摘要:对美国银行、国债市场、货币供应的影响

-

银行存款:稳定币对银行存款的影响取决于其是否具备收益功能,以及相较于其他金融产品的操作支付特性。在竞争加剧的背景下,银行可能需要提高利率以维持资金,或寻求替代融资来源。

-

国债市场:国债需求的整体增加,稳定币立法中的储备要求将为国债提供额外且不断增长的需求来源;国债持有期限的整体前移,立法要求稳定币发行者持有期限小于93天的国库券,导致国债持有集中于短期。

-

货币供应:稳定币的需求可能对美国货币供应产生净中性影响。然而,与美元挂钩的稳定币吸引力可能会将当前非美元流动性持有转向美元。

-

现有市场结构影响:当前的立法提案未能为不符合资格的发行者提供进入主账户的途径。稳定币发行者无法访问美联储,可能加剧稳定币在压力或波动时期的风险。

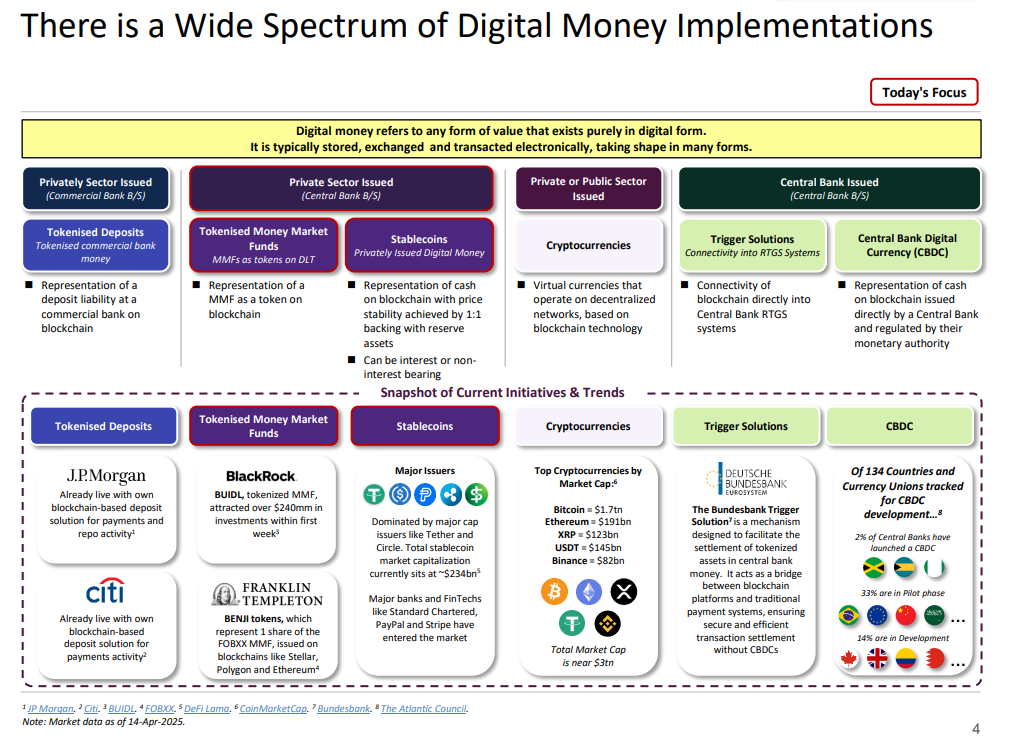

数字货币当前的多样化实现:从私人到央行的全景

这张图为我们提供了数字货币全景视图,展示了其多样化的实现路径及其在各领域的实际应用。

-

数字货币的分类

-

私人部门发行(商业银行资产负债表)

-

Tokenised Deposits(代币化存款):代表商业银行存款责任的区块链化。

-

Tokenised Money Market Funds(代币化货币市场基金):基于区块链的货币市场基金代币化。

-

-

私人部门发行(央行资产负债表)

-

稳定币:以1:1储备资产支持的区块链现金表现形式,可为计息或非计息。

-

-

私人或公共部门发行

-

加密货币:基于去中心化网络的虚拟货币。

-

央行发行

-

Trigger Solutions(触发解决方案):区块链与央行实时全额结算系统(RTGS)的连接。

-

CBDC(央行数字货币):央行直接发行并监管的区块链现金表现形式。

-

-

-

当前的市场趋势

-

代币化存款

-

J.P. Morgan 和 Citi 已经推出基于区块链的支付与回购活动解决方案。

-

-

代币化货币市场基金

-

BlackRock 推出的 BUIDL 吸引了超过2.4亿美元投资。

-

Franklin Templeton 推出 BENJI 代币,支持 Stellar、Polygon 和 Ethereum 区块链。

-

-

稳定币

-

市场由 Tether 和 Circle 等主要发行商主导,总市值约为2340亿美元。

-

-

加密货币

-

总市值接近3万亿美元,主流币种包括比特币(1.7万亿美元)和以太坊(1910亿美元)。

-

-

触发解决方案

-

德国央行推出的机制促进了区块链资产与传统支付系统的结算。

-

-

CBDC

-

在被跟踪的134个国家和货币联盟中,25%已推出,33%处于试点阶段,48%仍在开发中。

-

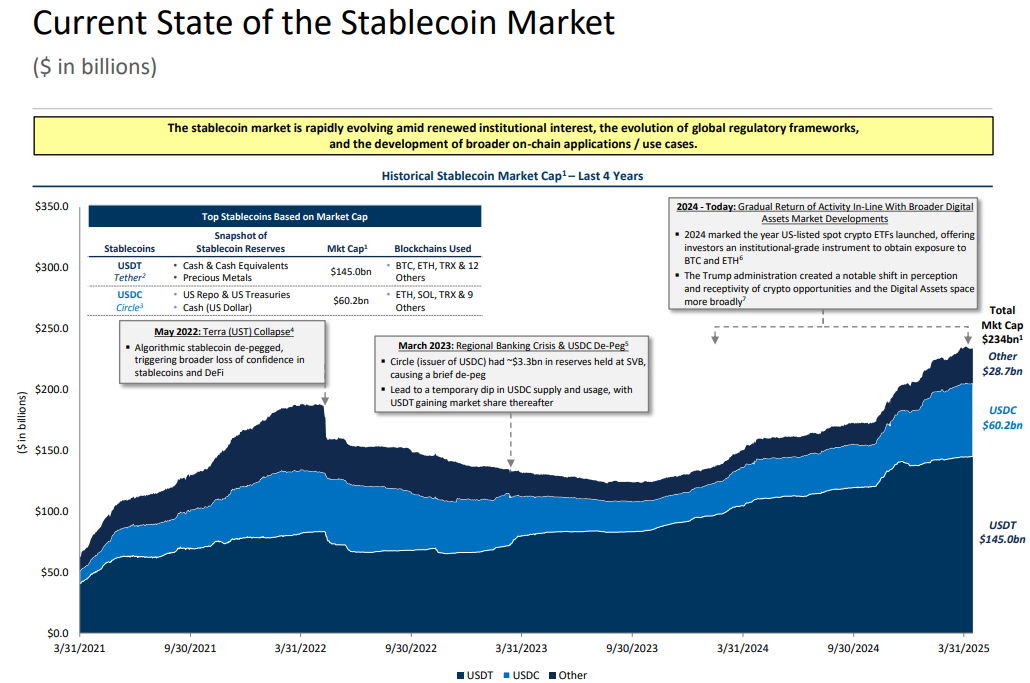

稳定币市场现状:市值与关键事件一览

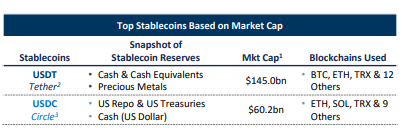

稳定币市场近年来经历了显著的波动与发展。截至2025年4月14日,整个市场的总市值已达到2340亿美元,其中USDT(Tether)以1450亿美元的规模占据主导地位,而USDC(Circle)则以602亿美元紧随其后,其他稳定币的总市值为287亿美元。

回顾过去四年,稳定币市场的两次重大事件成为了行业发展的分水岭。

2022年5月,算法稳定币UST的崩盘引发了整个DeFi领域的信任危机。UST的脱锚不仅让市场对算法稳定币的可行性产生质疑,还波及了其他稳定币的市场信心。

紧接着,2023年3月的地区银行危机再次让市场陷入动荡。当时,USDC的发行方Circle有约33亿美元的储备被冻结在硅谷银行(SVB),导致USDC短暂脱锚。这一事件使得市场重新评估稳定币的储备透明度与安全性,而USDT则在此期间进一步巩固了自己的市场份额。

尽管经历了多次危机,稳定币市场在2024年逐步恢复,并与更广泛的数字资产市场发展保持同步。2024年,美国推出了首批现货加密ETF,为机构投资者提供了接触BTC和ETH的工具。

当前,稳定币市场的增长主要得益于三个方面:机构投资兴趣的增加、全球监管框架的逐步完善,以及链上应用场景的不断扩展。

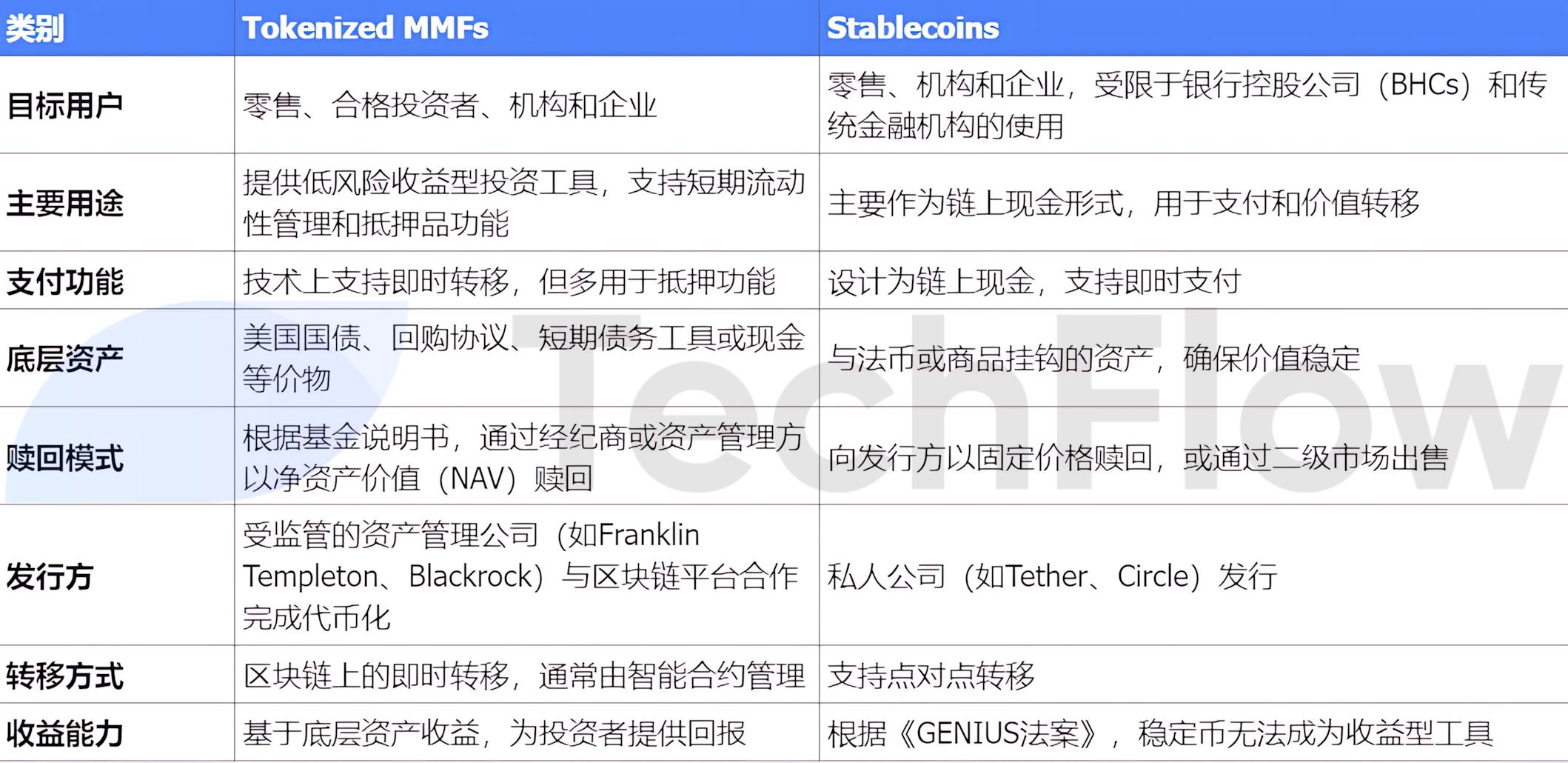

数字货币市场基金与稳定币:两种链上资产的对比

随着数字货币市场基金(Tokenized Money Market Funds,简称MMFs)的快速增长,一种替代稳定币的叙事逐渐形成。尽管两者在使用场景上存在相似之处,但一个显著的差异是稳定币无法根据当前的《GENIUS法案》成为收益型工具,而MMFs则可以通过底层资产为投资者带来收益。

市场潜力:从 2300 亿到 2 万亿美元

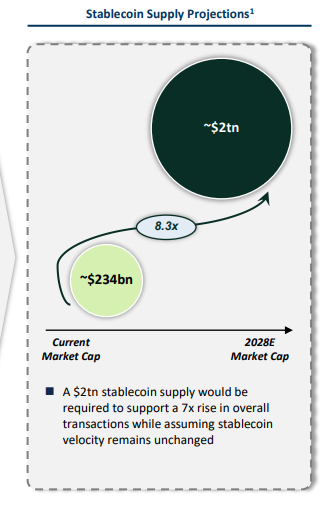

报告认为,稳定币的市值有望在 2028 年达到约 2 万亿美元。这一增长轨迹不仅依赖于市场需求的自然扩张,也受到多种关键驱动因素的推动,这些因素可以归纳为采用、经济和监管三大类。

-

采用:金融机构的参与、批发市场交易的链上迁移,以及商户对稳定币支付的支持,正逐步推动其成为主流支付和交易工具。

-

经济:稳定币的价值存储功能正在被重新定义,尤其是利息型稳定币的兴起,为持有者提供了收益生成的可能性。

-

监管:稳定币若能被纳入资本与流动性管理框架,并获得银行在公链上服务的许可,将进一步增强其合法性和可信度,

(注:报告发出时稳定币法案尚未通过,此时已进入投票程序阶段)

预计到 2028 年,稳定币市场规模将从当前的 2340 亿美元增长至 2 万亿美元。这一增长需要交易量显著提升,并假设稳定币的流通速度保持不变。

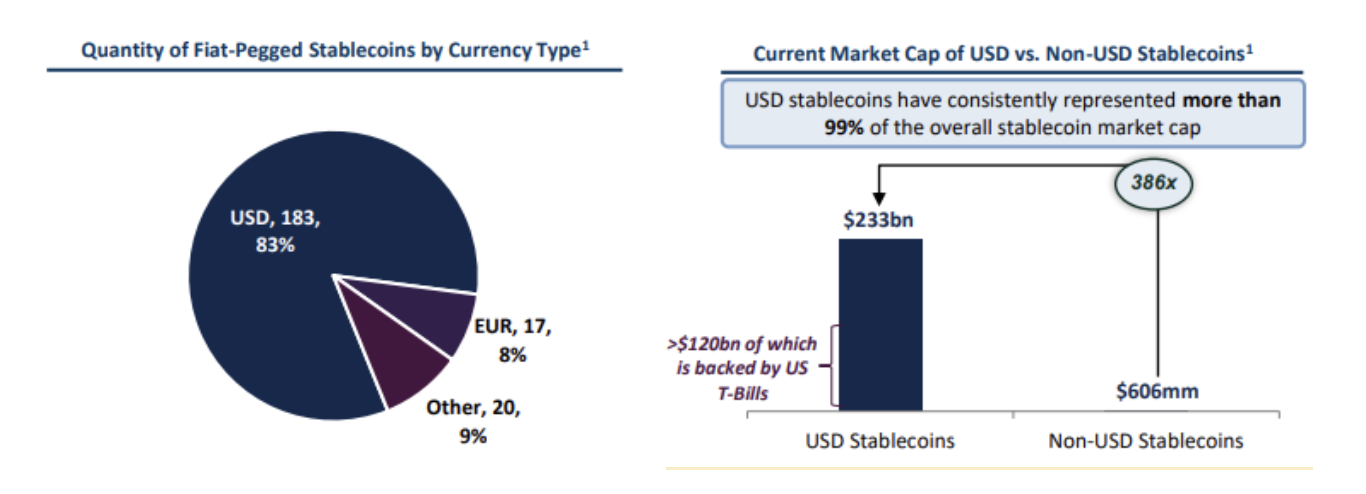

美元稳定币的市场主导地位

-

USD 稳定币占法币挂钩稳定币总量的 83%,远高于其他货币(EUR 占 8%,其他占 9%)。

-

在整体稳定币市值中,USD 稳定币的占比超过 99%,市值达 2330 亿美元,其中约 1200 亿美元 由美国国债支持。非 USD 稳定币市值仅为 6.06 亿美元。

-

USD 稳定币的市场规模是非 USD 稳定币的 386 倍,表明其在全球稳定币市场中的绝对主导地位。

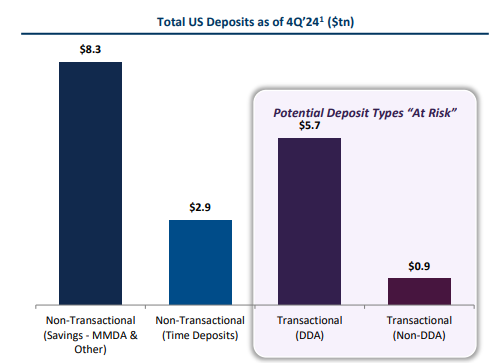

稳定币增长对银行存款的潜在影响

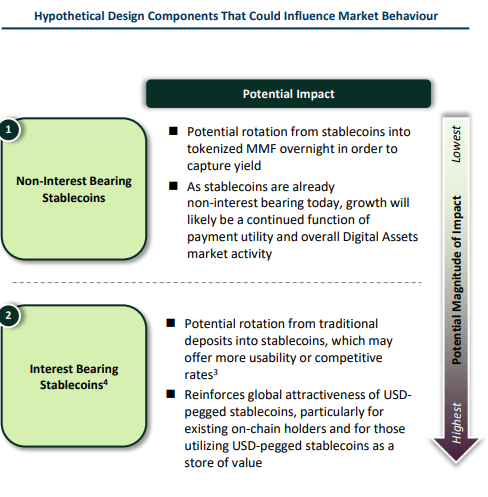

稳定币的增长可能对银行存款产生显著影响,特别是其设计是否支付利息将成为关键因素。

截至 2024 年第四季度,美国的总存款规模达到 17.8 万亿美元,其中非交易型存款(包括储蓄账户和定期存款)占据主要部分,分别为 8.3 万亿美元 和 2.9 万亿美元。交易型存款则包括活期存款(5.7 万亿美元)和其他非活期交易存款(0.9 万亿美元)。

在这些存款中,交易型存款被认为最“脆弱”,即更容易受到稳定币的冲击。原因在于,这类存款通常不支付利息,主要用于日常活动,且易于转移。而未投保的存款在市场不确定性期间,往往会被持有人转移至收益更高或风险更低的工具,如货币市场基金(MMFs)。

如果稳定币不支付利息,其增长将主要依赖支付功能和数字资产市场的整体活跃度,因此对银行存款的冲击有限。然而,如果稳定币开始支付利息,特别是提供更高的收益率或使用便利性,传统存款可能会大规模转移至此类稳定币。这种情况下,USD 挂钩的利息型稳定币不仅会吸引链上用户,还会成为价值存储的重要工具,从而进一步强化其全球吸引力。

综上,稳定币设计的利息属性将直接影响其对银行存款的潜在冲击程度:

非利息型稳定币的影响相对较小,而利息型稳定币可能显著改变存款格局。

稳定币增长对美国国债的潜在影响

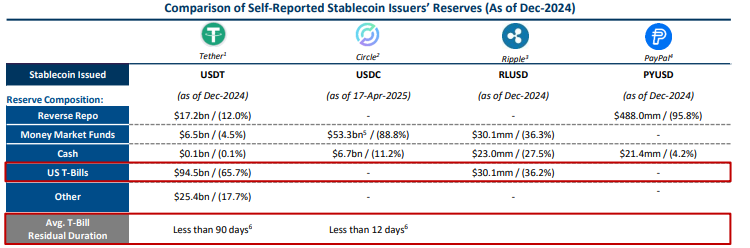

根据公开的储备数据,主要稳定币发行方目前持有超过 1200 亿美元 的短期国债(T-Bills),其中 Tether(USDT)占比最高,约为 65.7% 的储备配置在 T-Bills 中。这一趋势表明,稳定币发行方已成为短期国债市场的重要参与者。

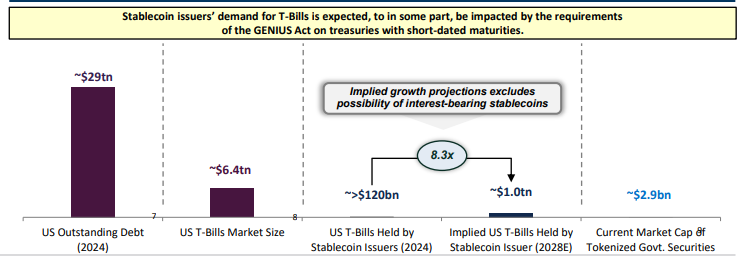

预计未来,稳定币发行方对 T-Bills 的需求将与整体市场工具的扩张密切相关。

未来几年,这种需求可能会额外推高约 9000 亿美元 的短期国债需求。

稳定币的增长与银行存款之间存在此消彼长的关系。大量资金可能从银行存款流向稳定币支持的资产,尤其是在市场波动或信任危机(如稳定币脱锚)期间,这种转移可能被进一步放大。

美国《GENIUS 法案》对短期国债的要求可能进一步推动稳定币发行方对 T-Bills 的配置。

从市场规模来看,2024 年稳定币发行方持有的 T-Bills 规模约为 1200 亿美元,而到 2028 年,这一数字可能增长至 1 万亿美元,增长幅度达到 8.3 倍。相比之下,当前代币化政府证券的市场规模仅为 29 亿美元,显示出巨大的增长潜力。

总结来看,稳定币发行方对 T-Bills 的需求正在重塑短期国债市场的生态,但这种增长也可能加剧银行存款和市场流动性之间的竞争。

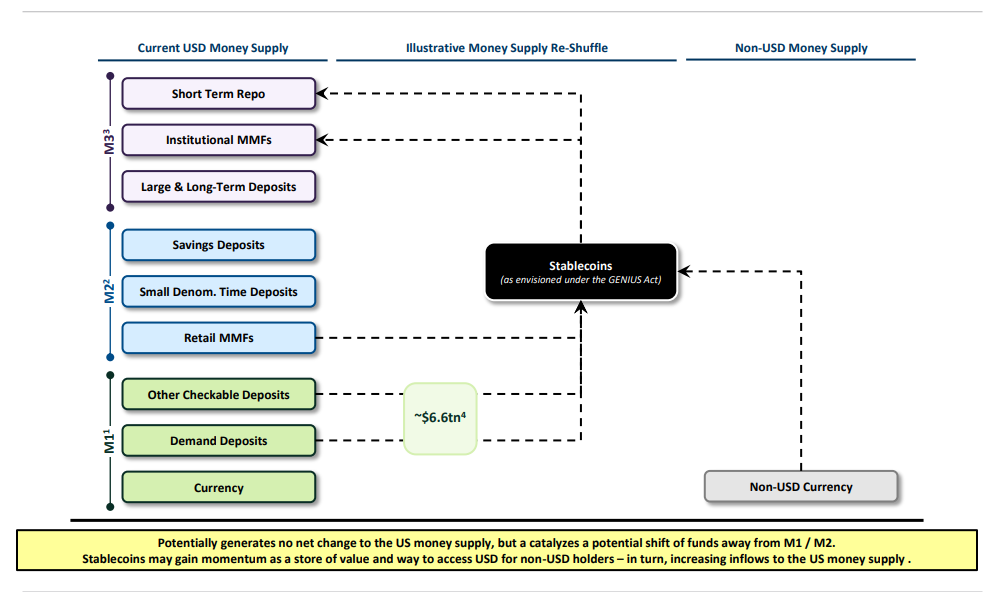

稳定币增长对美国货币供应增长的潜在影响

稳定币的增长对美国货币供应(M1、M2 和 M3)的影响主要体现在资金流动的潜在转移上,而不是总量的直接变化。

-

当前货币供应结构:

-

M1 包括流通中的货币、活期存款和其他可支票存款,总计约 6.6 万亿美元。

-

M2 包括储蓄存款、小额定期存款和零售货币市场基金(MMFs)。

-

M3 包括短期回购协议、机构 MMFs 和大额长期存款。

-

稳定币的角色:

-

稳定币被视为一种新的价值储存手段,特别是在《GENIUS 法案》的框架下。

-

稳定币可能会吸引部分资金从 M1 和 M2 中流出,转向稳定币持有者,尤其是非美元持有者。

潜在影响

-

资金的转移:

稳定币的增长可能不会直接改变美国货币供应的总量,但会导致资金从 M1 和 M2 中转移。这种转移可能会影响银行的流动性和传统存款的吸引力。

-

国际影响:

稳定币作为一种获取美元的方式,可能会增加非美元持有者对美元的需求,从而增加对美国货币供应的流入。这种趋势可能会促进稳定币在全球范围内的使用和接受。

稳定币的增长虽然不会立即改变美国的货币供应总量,但其作为价值储存和货币获取方式的潜力,可能会对资金流动和国际美元需求产生深远影响。这一现象需要在政策制定和金融监管中加以关注,以确保金融体系的稳定性。

未来稳定币监管的可能方向

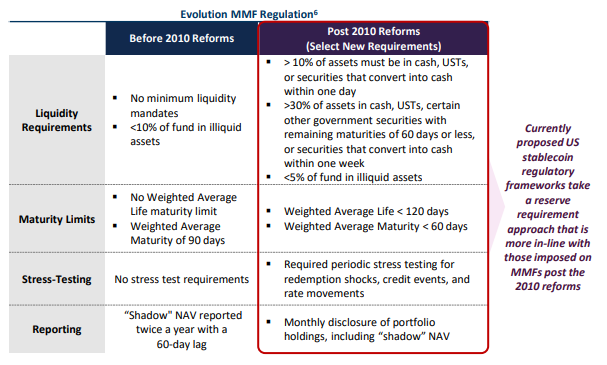

美国当前提出的稳定币监管框架与 2010 年后 MMF 的改革要求类似,重点包括:

-

储备要求:确保稳定币储备的高流动性和安全性。

-

市场准入:探讨稳定币发行方是否可以获得美联储(FED)支持、存款保险或 24/7 回购市场的准入。

这些措施旨在降低稳定币脱锚风险,并增强市场的稳定性。

总结

-

市场规模潜力

稳定币市场有望在持续的市场和监管突破下,到 2030 年增长至约 2 万亿美元。

-

美元锚定的主导地位

稳定币市场主要由美元锚定的稳定币组成,这使得近期的重点集中在潜在的美国监管框架及其立法对稳定币增长的加速影响上。

-

对传统银行的冲击与机遇

稳定币可能通过吸引存款对传统银行造成冲击,但同时也为银行和金融机构创造了开发创新服务的机会,并能从区块链技术的使用中获益。

-

稳定币设计与采用的深远影响

稳定币的最终设计和采用方式将决定其对传统银行体系的影响程度,以及对美国国债需求的潜在推动力。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。