2024 is a milestone year for the Web3 industry. The market capitalization of crypto and the adoption of industry infrastructure have reached unprecedented heights, while at the same time, the criminal industry has begun to increasingly utilize crypto infrastructure to optimize its operations or create new criminal paradigms. This report statistically analyzes and discloses the scale of major types of crypto crimes and clarifies the impact of compliance facilities on the scale of the criminal industry, calling for the industry and government to pay attention to the harm caused by crypto crime.

Due to space limitations, this article only presents part of the report's conclusions and data. You are welcome to visit the Bitrace official website to download the full version.

https://bitrace.io/en/blog

The Situation of Cryptocurrency Crime Remains Severe

High-Risk Addresses Receiving Stablecoins

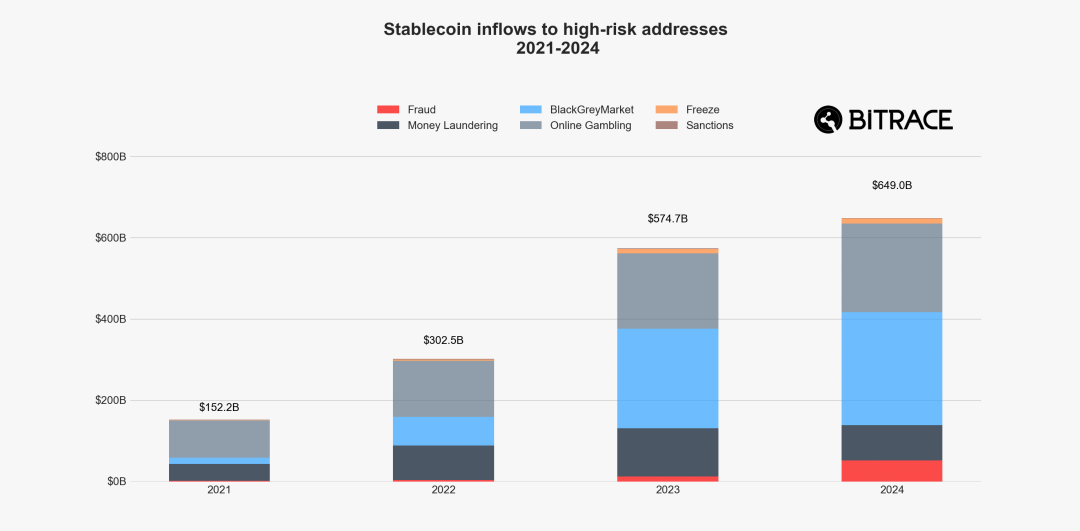

Considering that risky activities mainly occur on the Ethereum and Tron networks, Bitrace defines blockchain addresses used by illegal entities to receive, transmit, and store stablecoins (erc20usdt, erc20usdc, trc20usdt, trc20usdc) on these two networks as high-risk addresses. In the past year of 2024, the total amount received by these high-risk addresses reached $649 billion, slightly higher than the previous year.

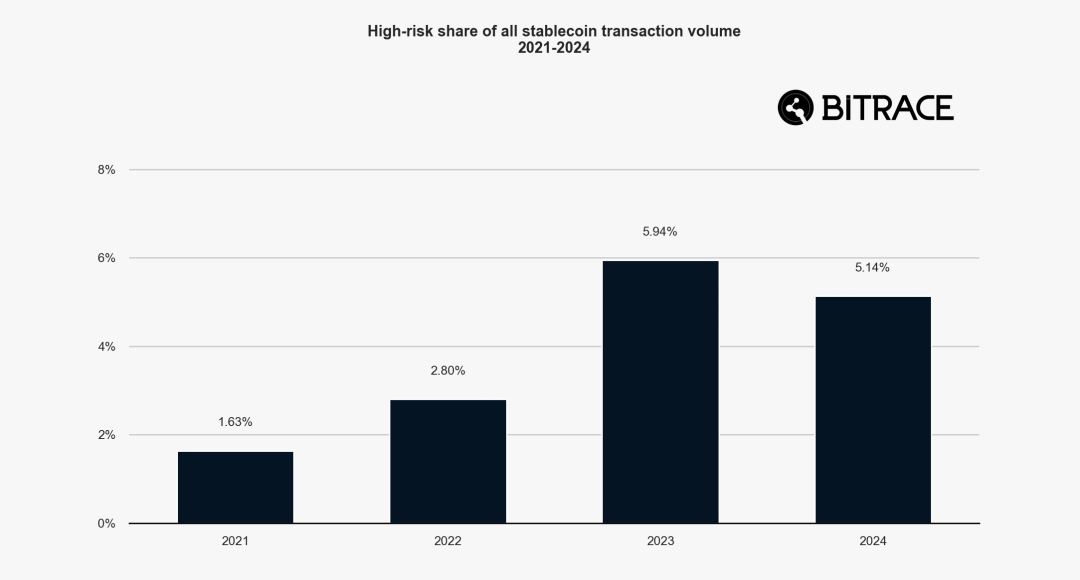

Proportion of High-Risk Activities in Total Stablecoin Transaction Volume

Based on transaction volume, this portion of high-risk activities accounted for 5.14% of the total stablecoin transaction activities for the year, a decrease of 0.80% compared to 2023, but still significantly higher than in 2021 and 2022.

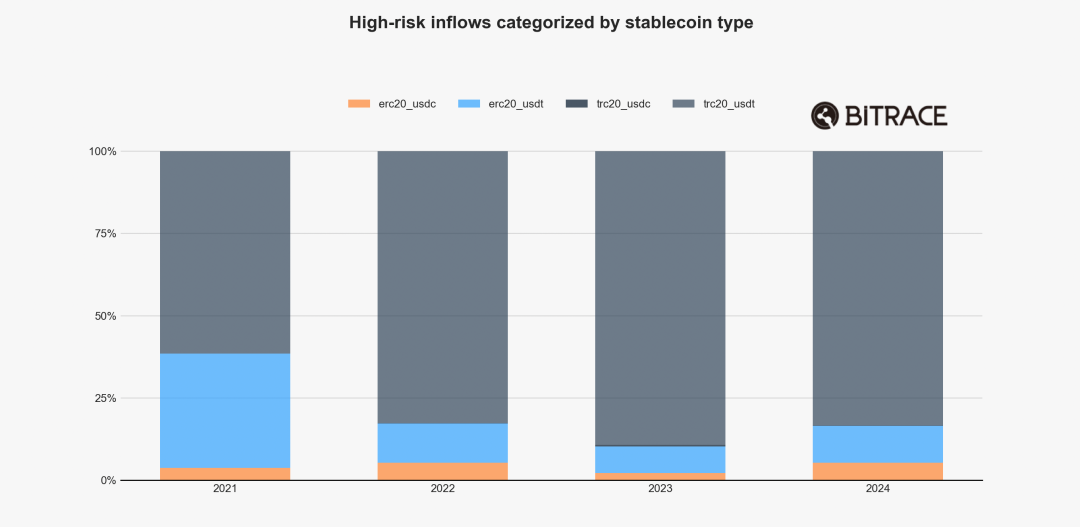

Classification of Stablecoins Received by High-Risk Addresses

By stablecoin type, from 2021 to 2024, USDT on the Tron network accounted for the largest share. However, in 2024, the shares of USDT and USDC on the Ethereum network both increased.

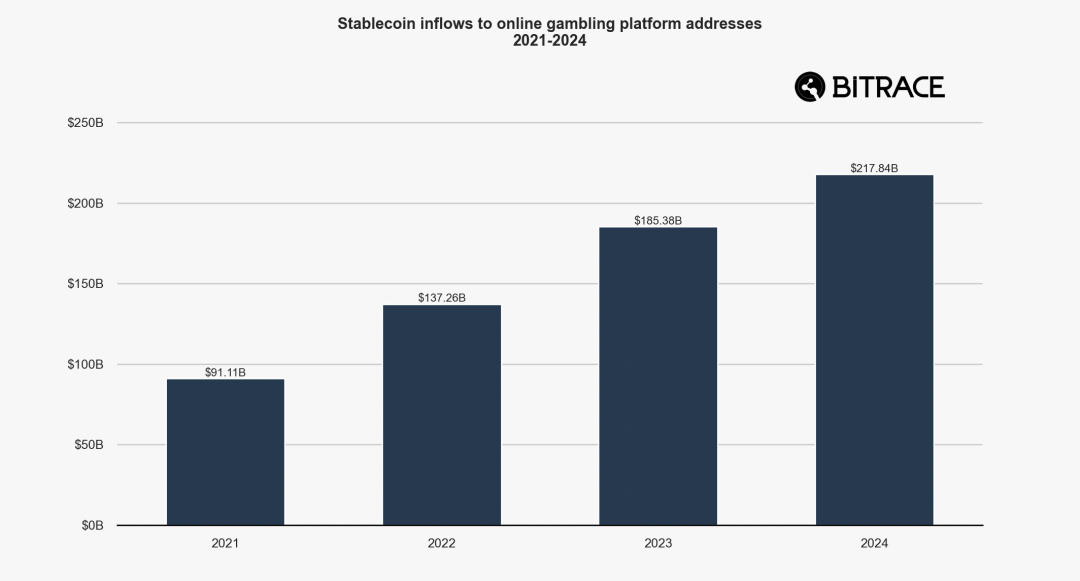

The Scale of Online Gambling Continues to Grow

Stablecoins Received by Online Gambling Platforms

In 2024, the funding scale of online gambling platforms and the payment platforms providing deposit and withdrawal services for them reached $217.8 billion, an increase of over 17.50% compared to 2023.

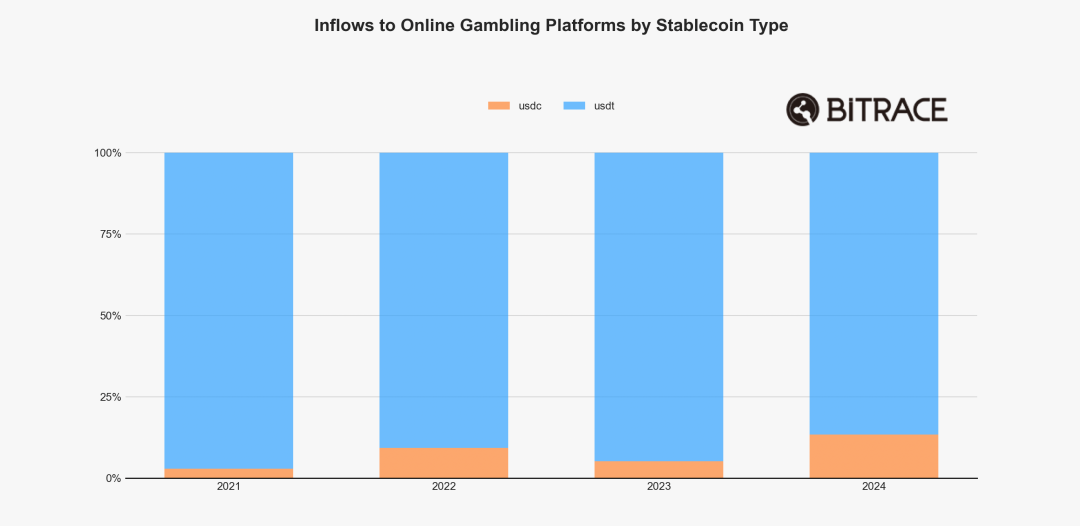

Classification of Stablecoins Received by Online Gambling Platforms

Statistics on the types of stablecoins used by online gambling platforms show a significant increase in the share of USDC in 2024, reaching 13.36%, far higher than the 5.22% in 2023. This indicates that as USDC's market share increases, its adoption in the online gambling sector has also greatly improved, despite being issued and regulated by compliant entities.

The Scale of Black and Gray Market Transactions Remains Unabated

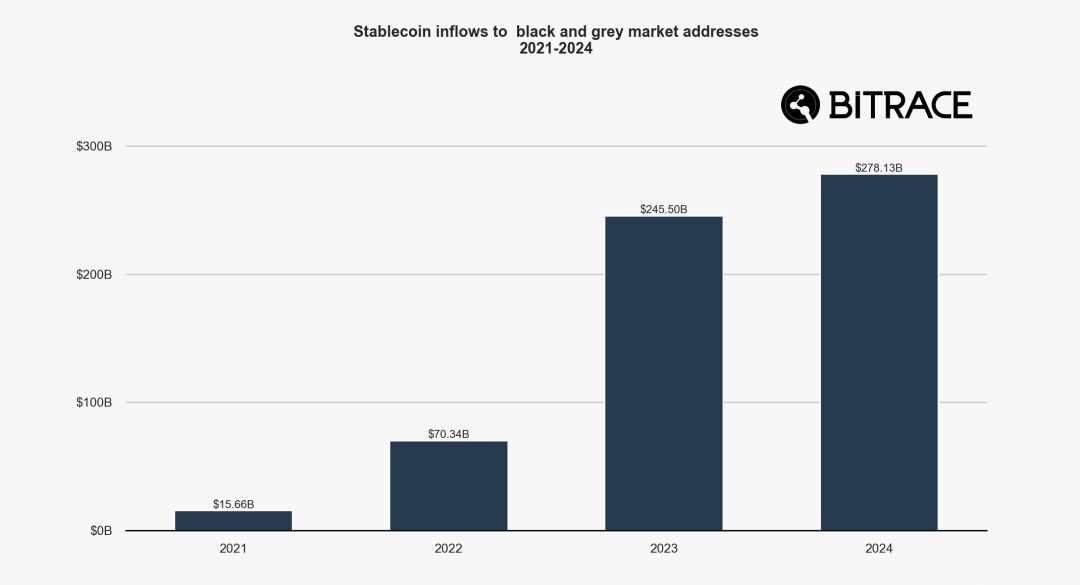

Stablecoins Received by Black and Gray Market Transaction Addresses

In 2024, business addresses related to black and gray market transactions on the Ethereum and Tron networks received over $278.1 billion, slightly higher than in 2023, and the transaction scale for these two years far exceeded that of 2021 and 2022.

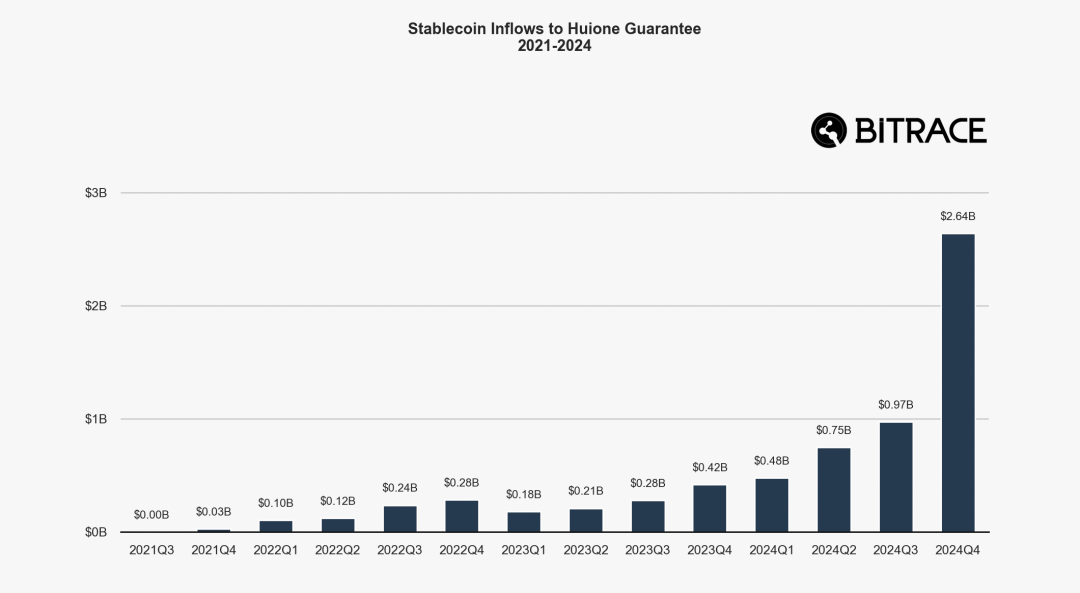

Closely related to the development of the black and gray market is the cryptocurrency collateral trading platforms, which can provide collateral services for nearly all links in the black and gray market supply chain, establishing trust among criminals.

Haowang Collateral Receiving Stablecoins

The rise of Haowang Collateral and its competitors in Southeast Asia has coincided with the gradual popularization of stablecoins in local real economic activities. This trend was particularly evident in 2024, with its business scale expanding to $2.64 billion in the fourth quarter of that year.

The Scale of Crypto Fraud Has Increased Dramatically

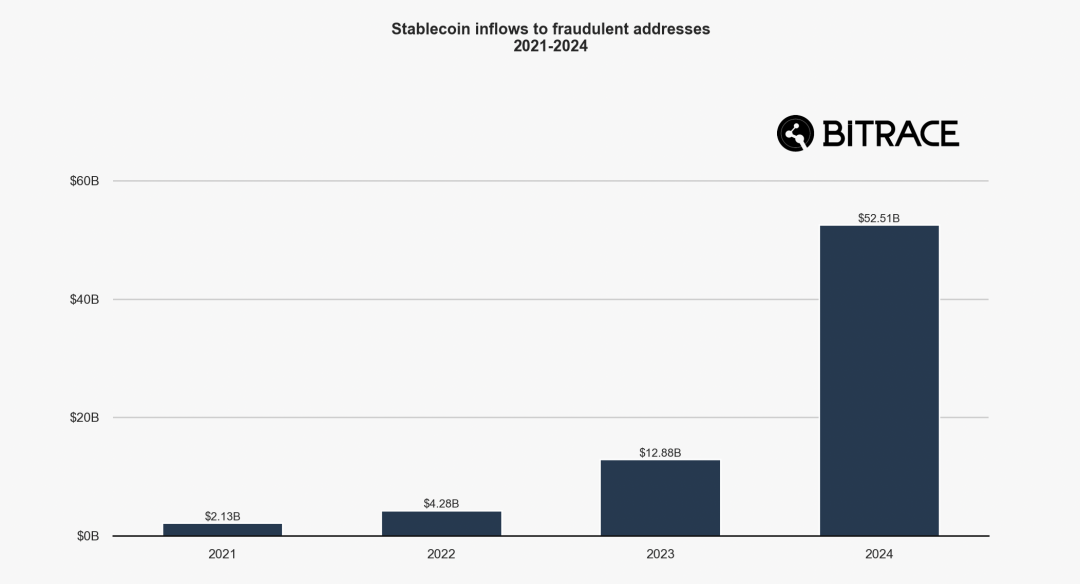

Stablecoins Received by Fraudulent Addresses

In 2024, blockchain addresses associated with fraudulent activities saw an explosive growth in the amount of stablecoins received. Compared to 2021-2023, the funding scale for that year reached $52.5 billion, exceeding the total of previous years.

However, this astonishing growth trend may not be entirely accurate, as the statistical values are limited by the methods used by security firms and the rising level of fraud among illegal entities. For example, as security firms support many new public chains, more criminal incidents are observed, meaning that past incidents may not have been included in the statistics; incidents occurring within centralized institutions and those not voluntarily disclosed by victims also cannot be included.

With improvements in statistical methods and increased case disclosures, this batch of data will further grow in next year's investigative report.

The Scale of Money Laundering Begins to Contract

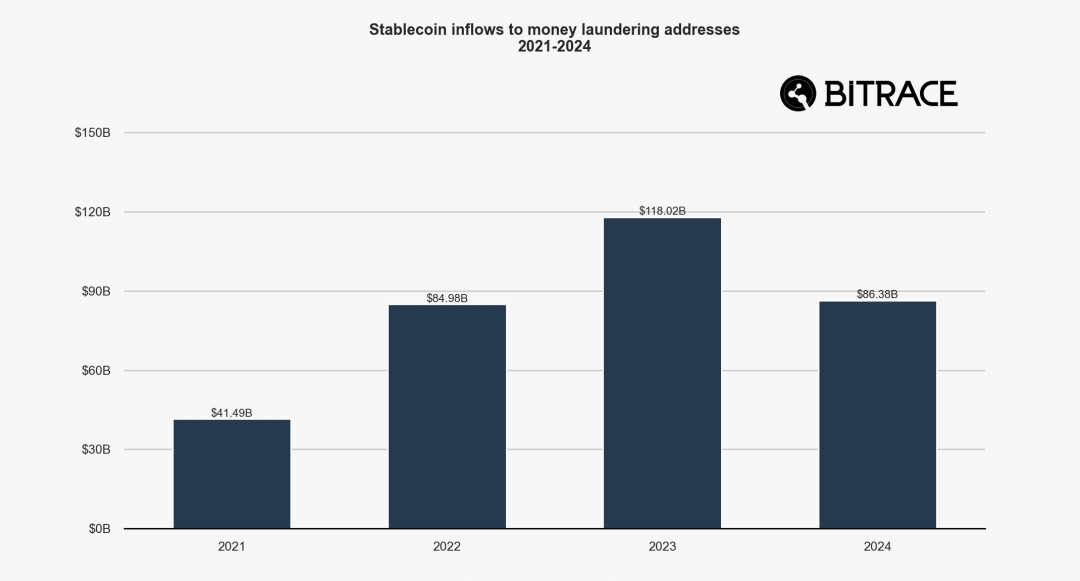

Stablecoins Received by Money Laundering Addresses

In 2024, blockchain addresses related to money laundering activities received a total of $86.3 billion in stablecoins, slightly lower than in 2023 and on par with 2022. This value may indicate that significant law enforcement activities and regulatory legislative actions by major policy entities over the past two years have effectively suppressed the money laundering crime situation in the crypto industry.

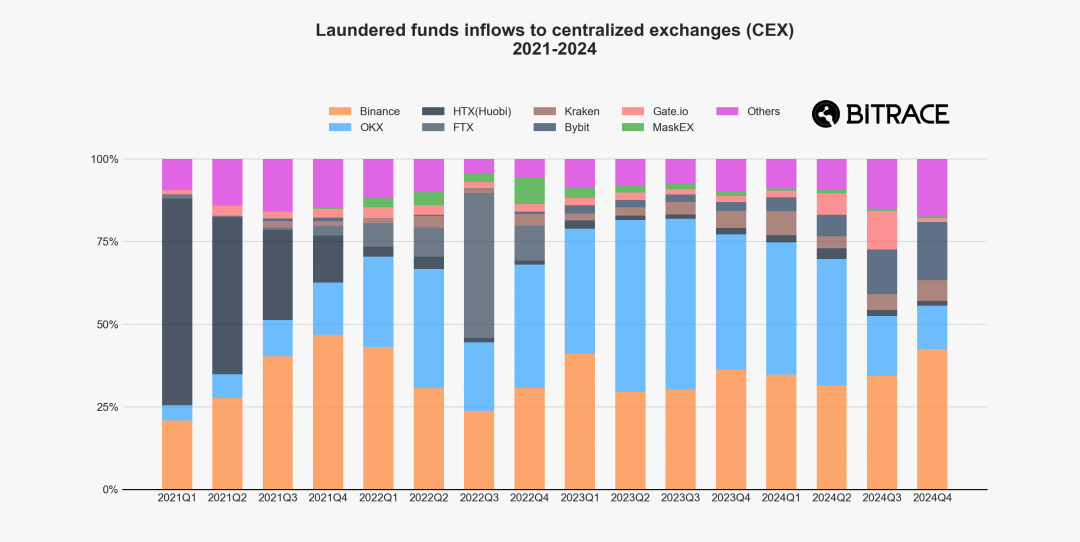

Proportion of Stablecoins Received for Money Laundering by Major Centralized Exchanges

Considering that centralized exchanges have a unique advantage in cashing out funds compared to other entities, making them more likely to be favored by money laundering groups, Bitrace conducted a fund audit of the hot wallet addresses of major centralized cryptocurrency exchanges.

The results were similar to the investigation in the fraud section, where the scale of funds received for money laundering generally correlates with the business scale of the platforms. However, OKX's proportion has significantly decreased in recent quarters, which may be a result of its compliant operations.

Significant Increase in On-Chain Freezing Activities of Stablecoins

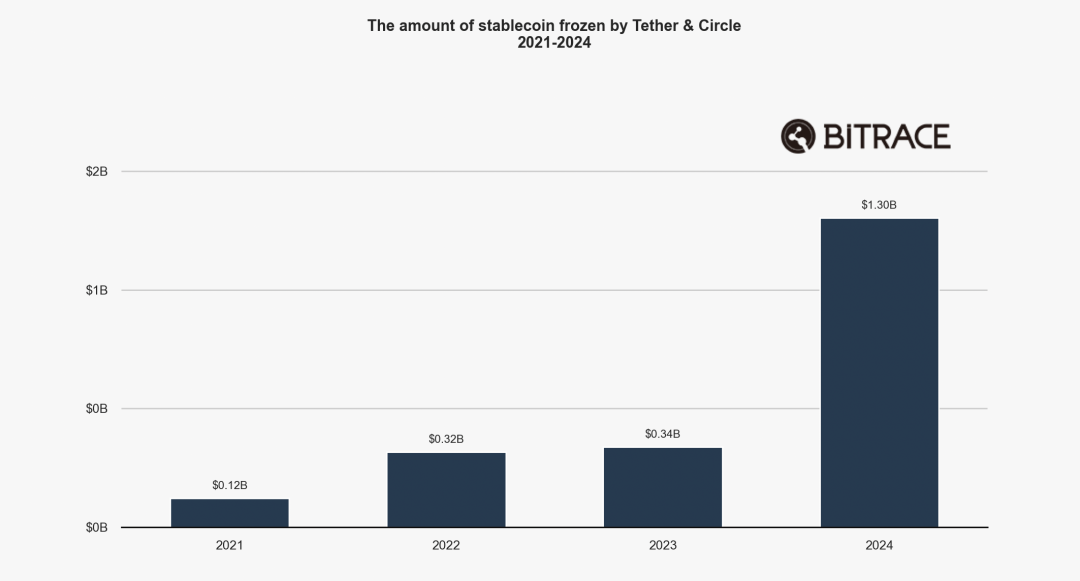

Stablecoins Frozen by Tether and Circle

2024 was a year when stablecoin issuers actively cooperated with law enforcement. Tether and Circle froze stablecoins worth over $1.3 billion on the Ethereum and Tron networks, double the amount frozen in the previous three years.

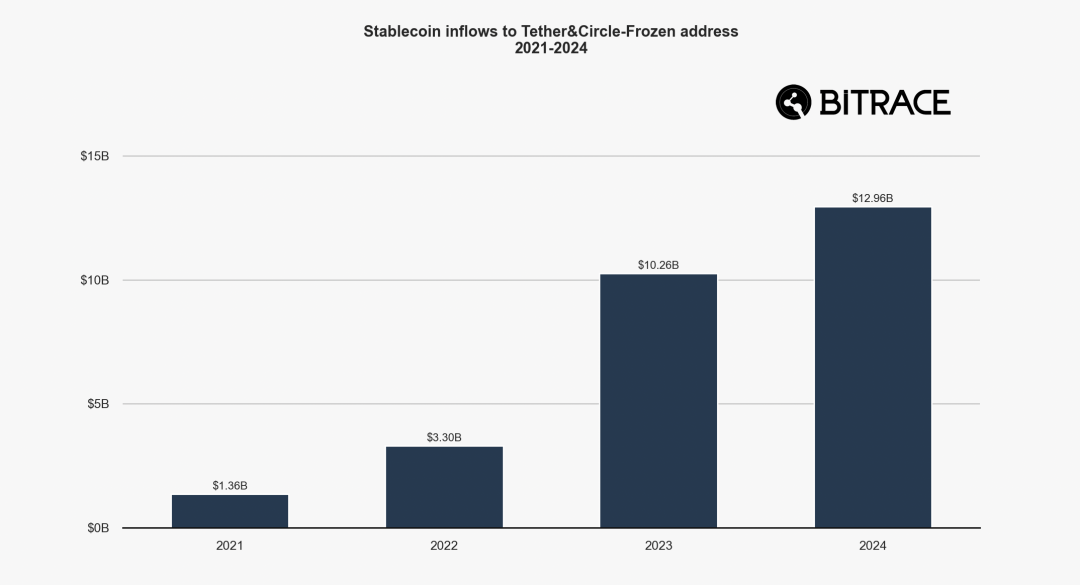

Stablecoins Received by Frozen Addresses in the Year

Statistics on the fund transfer activities of frozen addresses show that the transaction scale in 2024 reached $12.9 billion, remaining basically flat compared to 2023. This indicates that on-chain crypto crime activities began to become active several years ago, but effective crackdowns only started in 2024.

*It is worth emphasizing that not all driving factors for frozen addresses are related to cases. In this statistic, Bitrace did not exclude this part, so the actual scale may be slightly smaller.

Trends in Sanctions by OFAC and NBCTF

Stablecoins Received by Addresses Associated with OFAC and NBCTF Sanctioned Entities

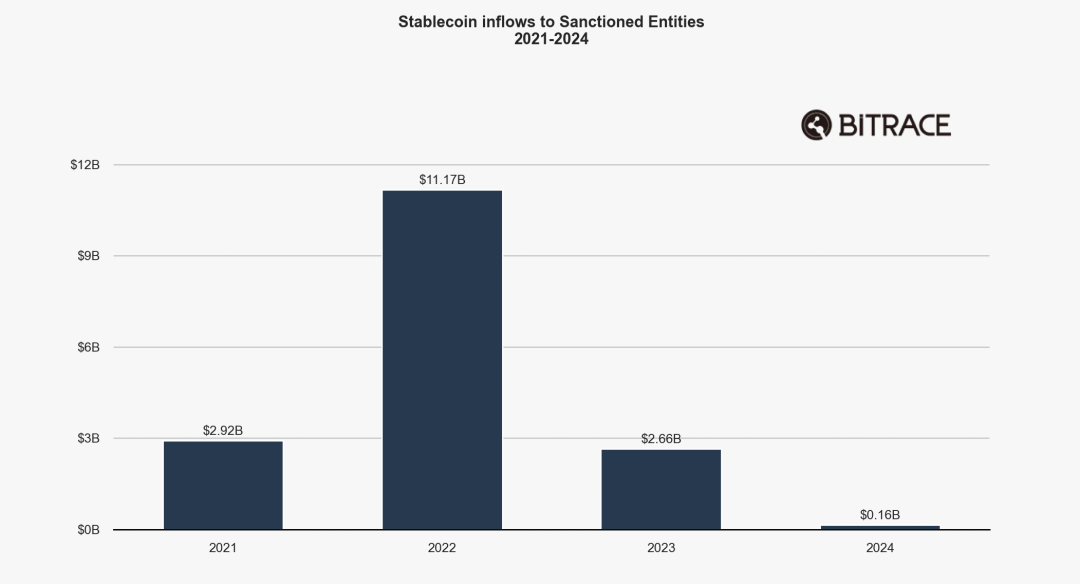

The Office of Foreign Assets Control (OFAC) under the U.S. Department of the Treasury and the National Bureau for Counter Terrorism Financing (NBCTF) in Israel are two agencies related to sanctions and counter-terrorism financing. They have collaborated extensively in combating terrorist financing and financial networks associated with terrorist organizations (such as Hamas). The overall funding scale related to blockchain addresses disclosed by these two organizations reached its peak in 2022 and has declined year by year since then.

Although government regulatory measures can have a significant impact on the operations of sanctioned entities, they have little effect on criminal groups using these infrastructures for illegal activities, as the anonymity and non-requirement characteristics of crypto technology make it difficult for such entities to be sanctioned and highly replaceable. Regulatory authorities should conduct more in-depth investigations into crypto crime and take corresponding law enforcement actions against criminal groups.

Regulation Brings Positive Effects to Hong Kong

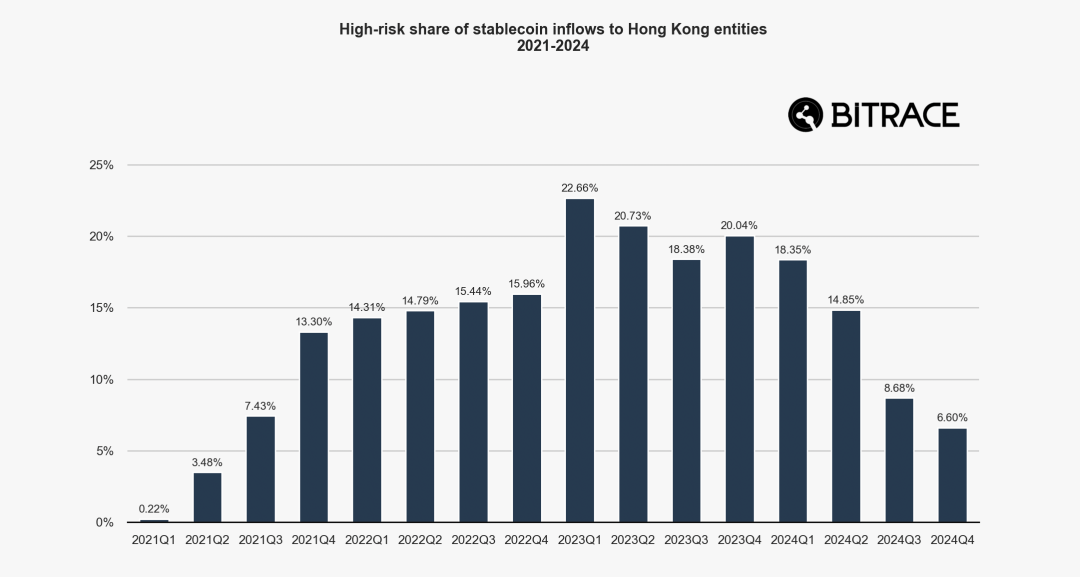

2024 is a year of accelerated compliance for the cryptocurrency industry. Globally, major regulatory agencies have shifted their attitudes towards cryptocurrencies from a wait-and-see approach to more active involvement, promoting the industry towards a more regulated and transparent direction. Taking Hong Kong as an example—

Hong Kong's compliance policies have established a safer and more controllable crypto ecosystem through clear legal requirements, customer fund protection, combating illegal activities, attracting institutional funds, and aligning with international standards. This not only reduces direct financial losses caused by hacking, platform bankruptcies, or legal penalties but also lowers indirect risks by enhancing market trust and stability. For crypto entities, while compliance costs may increase in the short term, they significantly reduce the likelihood of funds being exposed to uncontrollable risks in the long run.

Proportion of High-Risk Funds in Stablecoin Revenue of Hong Kong Web3 Entities

Analysis of funds flowing into VATP and VAOTC addresses serving Hong Kong clients shows that after the third quarter of 2023, the proportion of risk-related stablecoins flowing into the local market has sharply decreased. This indicates that following the release of compliance policies and several landmark cryptocurrency-related cases, local stablecoin trading activities associated with risk have been effectively suppressed.

Conclusion

2024 is a year of comprehensive revival for the industry and a significant year for major economies to begin to face the importance of the sector. Although the scale of crypto crime remains unchanged, top-down compliance regulatory policies, along with bottom-up industry self-discipline, have already brought positive effects to the crypto industry in certain countries or regions.

The industry is set to welcome a safer and more trustworthy future, which we believe is self-evident.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。