作者:Delphi Digital

编译:Glendon,Techub News

自从 Delphi Digital 上一次深入探讨 Sui 的架构、生态系统和代币经济学以来,该网络已在其基础设施和应用堆栈领域完成了一系列关键升级。在这篇后续报告中,我们将分析其生态系统的关键进展,包括比特币金融(BTCfi)基础设施的构建、借贷协议 Suilend 的增长轨迹以及 Aftermath Finance 的版图扩张。

在基础设施方面,Mysticeti v2 的推出为低竞争交易引入了「快速路径」(Fast Path),显著降低延迟并重新平衡验证者工作负载。同时,Move VM 2.0 通过高级可组合性、基于区域的内存管理、模块化架构以及旨在支持更复杂和动态链上逻辑的增强功能,实现了显著的执行改进。

与此同时,Sui 的扩展路线图也随着 Pilotfish 执行分片的推进而不断改进,以实现真正的水平可扩展性和弹性验证器配置。通过实施本地化基于对象的费用市场和 MEV 感知优化(包括优先交易提交和共识区块流),Sui 的这些改进再次得到了强化。

生态系统更新

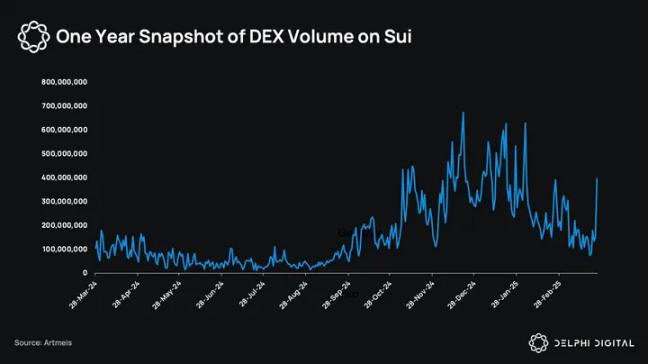

Sui 上的 DEX 交易量已从上一季度的高点回落,但可以看到的是,在去中心化存储协议 Walrus 的 WAL 代币于 3 月 27 日上线后,交易量有所上升。

Sui 上的 BTCfi

BTCfi 最近成为 Sui 上的一个新兴利基市场,为传统上被视为被动抵押品的比特币带来了借贷、质押和收益基础要素。据 DeFiLlama 指出,BTCfi 领域总锁定价值(TVL)已从不足 1 亿美元增长至超过 45 亿美元,涵盖了再质押、锚定和去中心化 BTC 等多种资产。

在 2024 年底,Sui 宣布与 Babylon Labs 和 Lombard Protocol 合作,通过 LBTC 引入原生 BTC 质押。LBTC 是 Lombard 在 Sui 和 Cubist 平台上直接铸造的流动性质押代币,旨在帮助用户进行存款、铸造、跨链和质押的管理。几周后,即 2024 年 12 月,Sailayer 与 LBTC 和 WBTC 达成合作,为 LBTC 和 WBTC 启动了 BTC 的再质押机会。在此之前,Lorenzo 协议在 Sui 上推出了 stBTC,这是一款由 Babylon 驱动的流动性质押代币,旨在聚合 BTC 收益,并与 Cetus 和 Navi 等 DeFi 协议集成。2025 年 2 月初,Sui Bridge 增加了对 WBTC 和 LBTC 等包装 BTC 资产的支持,自那时起,已有超过 587 枚 BTC 流入 Sui DeFi 平台。

到目前为止,已有超过 1.11 亿美元的包装 BTC 存入 Suilend、Navi 和 Cetus 等 Sui 原生协议。

Sui 上的 DeFi 协议

Suilend

Suilend 为 Sui 生态借贷协议,在运营不到一年的时间里,其年化收入在 2024 年 2 月达到 1500 万美元,其中 70% 流入 SEND 的金库。该金库最初从「mdrop」中获得 120 万枚 SUI。

Suilend 还推出了自动做市商(AMM)Steamm,具有集成的货币市场组件,旨在通过将闲置流动性存入借贷市场来最大化资本效率。该协议具有可组合的架构,支持各种报价系统,包括恒定产品报价,稳定币专业报价和基于市场波动的动态收费报价。通过允许闲置资金在借贷市场产生收益,同时仍可用于交易,Steamm 提高了资本效率,并通过其 bToken 机制为流动性提供者提供额外收益。

Aftermath

MetaStables 由 Aftermath 在 Sui 上孵化,作为一个金库系统,其允许用户存入跨链资产或原生资产,以铸造 mUSD(与美元挂钩)和 mETH(与 ETH 挂钩)等稳定币,并计划在未来推出 mBTC 等元代币。它使用基于预言机的汇率(例如 Pyth)在金库资产之间进行无滑点交易,避免了 AMM 滑点带来的低效率,并支持借出已存入的资产以提升收益。MetaStables 的理念是通过推广元代币来应对流动性碎片化问题,并让用户赚取 mPOINTS。

除了 MetaStables 之外,Aftermath 还在测试网上推出了 Perp DEX,这是一个完全基于 Sui 的链上永续合约订单簿。

Walrus 上线

去中心化存储协议 Walrus 于 2025 年 3 月 27 日启动主网,并完成由 Standardcrypto 领投的 1.4 亿美元融资。

Walrus 是一个基于 Sui 构建的去中心化存储网络,旨在存储各种数据,从 NFT 资产、AI 模型权重到区块链档案和网站内容。它还可以充当 rollups 的数据可用性层,类似于 Celestia 或 EigenDA。虽然 Walrus 利用 Sui 进行元数据和治理,但它将存储任务转移到一组单独的节点,从而避免了 Sui 验证器的开销。

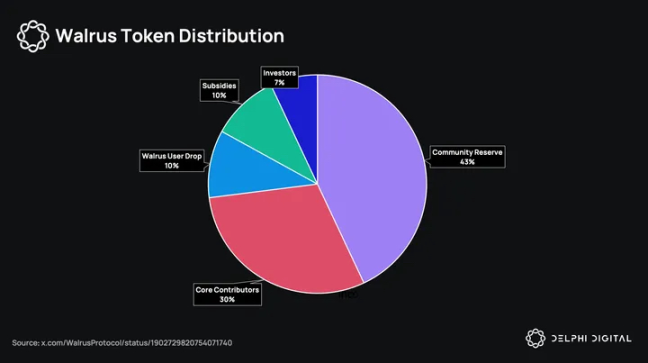

Walrus 的核心是 Red Stuff,这是一种二维编码协议,可实现高效的单次文件编码,并具有强大的数据恢复功能。该系统通过基于质押的 WAL 代币激励模型进行保护,节点会因正常运行时间和正确处理数据而获得奖励,并因出现故障或恶意行为而受到惩罚。WAL 代币经济学的细分如下:

- 社区储备:43%

- 核心贡献者:30%

- Walrus 用户空投:10%

- 补贴:10%

- 投资者:7%

技术更新

Sui Core 发展项目

Mysticeti V2 更新

Delphi Digital 在之前的报告《Sui Network:揭开单体竞争者的神秘面纱》中详细介绍了 Mysticeti v1。它通过将提交规则直接嵌入 DAG 结构,以消除区块认证的需要。这使得每个区块的提交时间理论上延迟最短仅为三轮消息,从而将 Sui 的共识延迟从约 1900 毫秒(Bullshark 测试网)缩短至约 390 毫秒。此外,由于每个区块仅要求一个签名,它降低了验证者的 CPU 负载,从而提高了执行吞吐量和响应速度。

Mysticeti-FPC(v2)基于 Mysticeti-C(v1)进行扩展,为不需要完全共识的交易引入了「快速路径」,尤其适用于代币转移或 NFT 铸造等常见情况,这些情况仅涉及单个地址拥有的资产。Mysticeti-FPC 并非运行单独的协议(例如 FastPay 或 Sui Lutris),而是将快速路径逻辑嵌入到同一个 DAG 中,从而避免了额外的消息传递、冗余的加密操作和共识后检查点。

Move VM 2.0 增强功能

Sui 的 Move VM v2 是一项专注于执行效率和系统可组合性的基础优化。核心改进包括内存区域分配(Arena Allocation)、程序包缓存(Package Caching)和低锁争用(Low Lock Contention),旨在降低负载下的延迟。通过跨程序包的指针引用(包括系统级访问),内部调用速度目前显著提升。

此外,该虚拟机还引入了用于验证、优化和执行的多阶段抽象语法树(AST),以及跨包虚拟表解析和更新的链接逻辑,从而简化了模块化开发。早期基准测试显示,各个执行路径的速度提升了 30% 至 65%。这将使 Sui 能够借助 Move VM v2 扩展到更复杂、高吞吐量的用例。

使用 PilotFish 进行执行分片

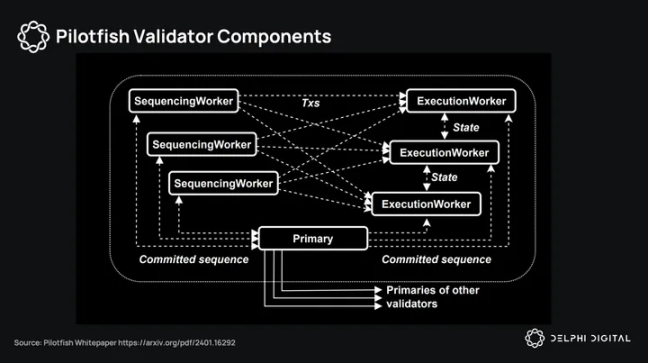

Pilotfish 是一个水平可扩展的执行引擎,它打破了 Sui 原有单机执行模型的瓶颈。传统上,Sui 验证器是单片式的,在单台机器上处理共识、数据获取和状态执行,受到计算、内存和存储方面垂直扩展的限制。

Pilotfish 将这个整体分解为三个不同的层:

- Primary:处理交易排序和共识的中央协调者;

- SequencingWorkers(SWs):负责提取和路由交易的可扩展节点;

- ExecutionWorkers(EWs):水平分布的机器,存储链上状态的碎片并执行实际执行。

Pilotfish 的分片工作负载分布:

- 每个交易都会被路由到特定的测序工作器。

- 每个链上对象(即状态)都映射到一个特定的执行器。

需要跨多个分片访问对象的交易则通过协调数据交换(coordinated data exchange)来解决,这是一种基于 pull 的模型,其中执行器按需请求远程状态。这在不牺牲并行执行的情况下保持了一致性,并与 Sui 的惰性共识设计紧密结合,该设计基于批量元数据而非完整交易数据达成共识。

这可以在没有共享内存的情况下实现并行性,使计算密集型工作负载能够随着可用硬件的增加而线性扩展。基准测试显示,与基准执行引擎相比,Pilotfish 使用 8 个 EWs 即可实现高达 10 倍的吞吐量提升。

水平扩展可以为验证者基础设施的真正弹性铺平道路。与垂直扩展不同,垂直扩展会受到硬件成本和配置延迟的严格限制,而水平扩展则允许验证者弹性地启动通用服务器(例如 AWS 或 GCP 上的 32 核服务器)来应对需求高峰。如果流量持续存在,验证者可以迁移到更具成本效益的裸机服务器。

其影响有三个方面:

- 验证者操作变得与硬件无关:不需要特殊的高端配置;

- 基础设施配置变得有弹性和程序化:根据需求自动扩展;

- 设计空间为 Sui 原生创新开辟了空间,例如特定于「包」(Package)的费用市场或优先级队列,这些创新由 Sui 以对象为中心的状态模型实现。

这将使 Sui 成为少数几个能够吸收消费者级交易吞吐量,而不会增加集中度或影响延迟的执行环境之一。

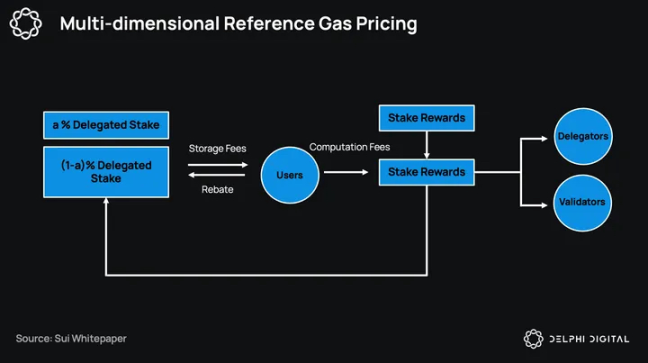

实施基于对象(Object-Based)的本地费用市场

Sui 使用多维参考 Gas 定价机制,将费用分为两个主要部分:计算费用和存储费用。那么,Sui 的本地费用市场是如何在 Sui 对象环境下运作的?

Sui 实现了一个基于对象(Object-Based)的本地费用市场机制,其与以太坊不同,更类似于 Solana 的费用结构。Sui 根据与单个对象或资产相关的特定需求来设定费用。Sui 上的每项资产或应用都拥有独立的费用市场,从而实现本地调整,而不会对整个网络造成影响。

相比之下,以太坊运营着一个统一的全球费用市场,其中每笔交易都会导致整体网络拥堵,在需求增加期间导致整个链上的费用增加。同样,Solana 使用本地化的费用市场系统,围绕特定的有争议的状态对象或账户调整费用。

Sui 通过将费用直接与「对象」而非「状态」关联,进一步扩展了本地化概念。通过将费用与特定对象关联,Sui 可以并行处理涉及不同资产的交易,避免费用交互或拥堵溢出。这种隔离意味着即使 Sui 上的其他应用程序已经非常活跃,新的应用程序的活动也能达到高度活跃的状态。例如,DEX 上的热门交易对可以根据自身需求独立调整费用。这样一来,Sui 具有对象级粒度的本地费用市场对其用户群更加公平,对其开发者群体也更加高效。

标准平衡累加器

Sui 的「标准平衡累加器」(Canonical Balance Accumulators)采用基于对象的设计,余额是链上 Move 对象。这些对象并非合约内部的抽象概念,而是独立的、可验证的状态对象。这种设置实现了交易级别的并行性,因为执行仅依赖于对特定对象的访问,而非共享的全局存储。

以太坊在 ERC-20 合约中使用中心化映射来追踪余额。每次传输都会触发共享状态,这会阻碍并行性,并将可组合性与合约特定的逻辑绑定在一起。每个代币都有其自身的实现,通常存在集成边缘情况。

而 Solana 通过代币账户处理余额,这有助于并行执行。但开发者需要预先为每笔交易指定所有账户。这给构建模块化系统带来了阻力,并限制了动态条件下的灵活性。

Sui 简化了这一过程。标准化的余额对象和类似「BalanceManager」的管理器,为协议提供了一种清晰的方式来跟踪和修改余额,而无需拥有状态。执行在默认情况下是水平伸缩的,平衡逻辑可以跨模块移植,而不用包装在自定义接口中。在没有协调开销的情况下,使用对象级的费用市场、隔离和可组合性来构建和解锁会更清晰。

多重签名账户实现

Sui 的多重签名实现基于加权的 k-of-n 签名模型。每个签名者都被分配一个权重,当所有权重的总和达到或超过预设阈值时,交易就会执行。这允许灵活的签名策略,例如要求 3 个签名者中的 2 个,或者强制一个密钥始终与其他密钥一起签名,以实现类似双因素身份验证(2 FA)的设置。

Sui 方法的独特之处在于,它支持在同一个多重签名中使用异构密钥方案。用户可以在单个身份验证对象中混合使用 Ed25519、secp256 k1 和 secp256 r1 密钥,从而开启更多可组合的钱包和托管设计,而无需专门的工具。

与将批准压缩为单个不透明签名的阈值签名不同,Sui 的多重签名会公开哪些密钥签署了哪些批准。这提高了可审计性和跨方协调性,而无需复杂的多方计算(MPC)设置。因此,它更容易推理,更容易轮换参与者,并且与 Sui 交易模型原生兼容。

Sui 上 MEV 发展

优先交易提交

在执行层面,Sui 通过基于 Gas 的优先级机制解决共享对象上的冲突。优先级 Gas 拍卖(PGAs)充当主要的协调层。由于 Sui 的执行以对象为中心,并且修改同一对象的交易必须序列化,因此 PGAs 充当了一种拥塞定价机制,在对象热点或 DEX 波动的情况下尤其有用。

SIP-19 引入了软捆绑机制,将链下组装的交易组作为一个单元提交。这使得反向拍卖(例如通过 Shio)成为可能,搜索者可以竞价将其交易附加到具有高执行概率的捆绑包中。

SIP-45 增加了共识放大功能。Gas 价格超过 kx RGP 的交易将由不同的验证者多次提交,从而有效地放大其在共识中的存在感。这减少了由验证者不同步或领导者轮换引起的波动,并确保 Gas 价格准确反映纳入优先级,从而抑制垃圾邮件并提高公平性。

Mysticeti 区块流式传输

Sui 正在进行的最有趣的升级之一是区块流式传输(Block Streaming)。全节点将能够直接订阅共识区块,从而在交易最终确定之前,以低于 200 毫秒的延迟访问待处理交易。这降低了同地搜索者的优势,并使 MEV 机会的获取更加民主化。

与链下中继不同,它是无需许可且开放的。它还为第三方节点提供了交易排序的确定性视图,从而允许投机执行、套利和回购逻辑近乎实时地运行。

时间锁加密正在规划中,旨在帮助 Sui 应对有害的 MEV,MEV 收入分配模型也正在探索中。激励措施将惠及验证者、应用程序和用户,而不仅仅是搜索者。

DevX 更新

Sui 有一些 DevX 的改进。Move Registry 通过支持链上软件包的命名和版本化导入,消除了基于地址的脆弱链接,从而使依赖关系管理正式化。关键框架和库正在开源并提供注册表支持,使开发者能够安全地编写和升级应用程序。此外,Sui 还提供了可编程交易块(PTB)重放和 Move 跟踪功能,以提供深度调试支持,使开发者能够逐步执行交易执行并精确定位多调用流程中的故障状态。

结论

Sui 在上个季度有不少亮点。Mysticeti v2 和 Pilotfish 并非只是常规升级,它们将改变 Sui 在负载下处理交易的方式以及验证器运行其基础设施的方式。Move VM 2.0 也为构建模块化应用的开发者带来了许多改进。这些改进共同推动 Sui 朝着能够真正支持高频用例且不会增加协调开销的方向发展。

在生态系统方面,BTCfi 显然正在成为一个楔子,并且可能受到机构的青睐。Suilend 和 Aftermath 等协议正在尝试与 Sui 架构原生兼容的新原语,例如基于对象的稳定币、AMM 借贷混合体、元代币等。现在有趣的部分是观察费用市场在需求激增时的表现,软捆绑或区块流等 MEV 工具是否会被搜索者采用,以及像 Pilotfish 这样的基础设施如何在实践中改变验证者经济学。

除此以外,Delphi Digital 注意到机构兴趣的增加,Canary Capital 已于第一季度提交 Canary SUI ETF 的申请。此前有消息称,Grayscale、富兰克林邓普顿、VanEck、Libre 和蚂蚁金服等金融机构也参与其中,他们都在 Sui 网络上推出了相关投资产品,从代币化基金到交易所交易票据(ETNs)。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。