On April 29, two bills of the "Arizona Strategic Bitcoin Reserve Act" successfully passed the final vote in the House and are awaiting the signature of Democratic Governor Katie Hobbs, making Arizona the first state in the U.S. to require public funds to invest in Bitcoin. Among them, Bill SB 1373 proposes the establishment of a digital asset strategic reserve fund managed by the state treasurer, allowing up to 10% of the fund to be invested in Bitcoin and other digital assets each fiscal year; Bill SB 1025 allows the state treasury and pension systems to invest up to 10% of available funds in virtual currencies, focusing on Bitcoin.

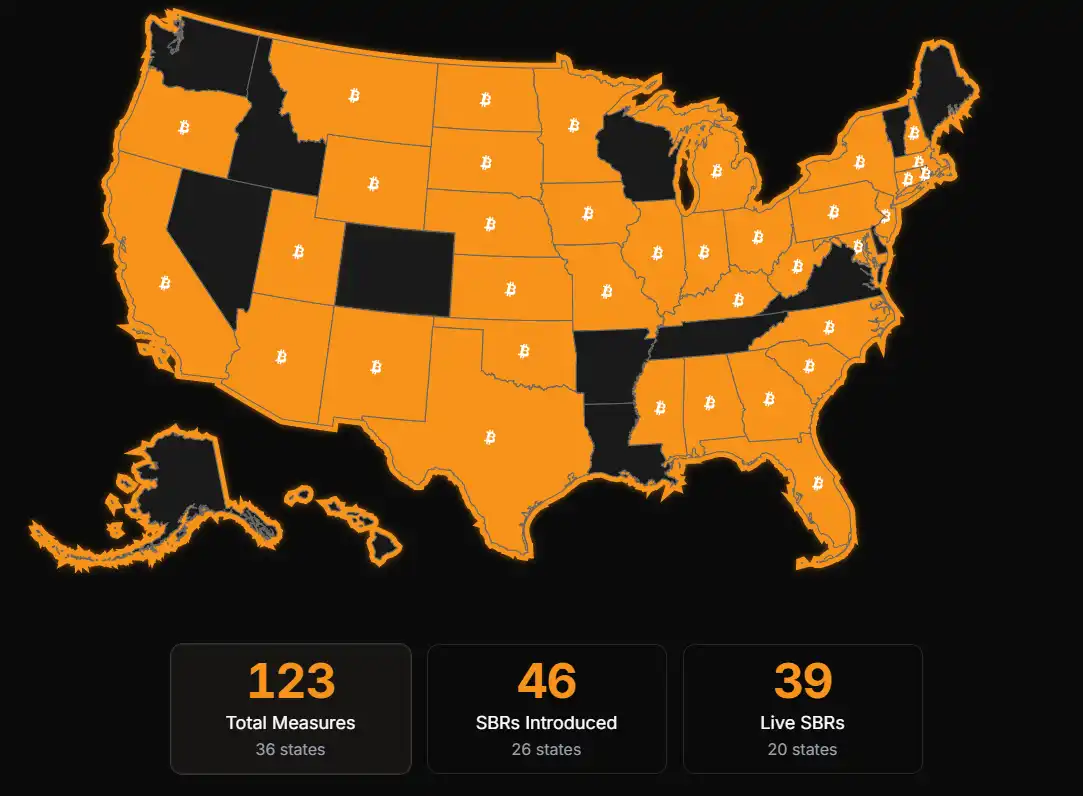

At the federal level, Trump signed an executive order in March requiring the establishment of a strategic Bitcoin reserve and digital asset inventory. The Arizona state government’s inclusion of cryptocurrency in public financial management reflects the growing mainstream acceptance of digital assets. According to the bill tracking website Bitcoin Laws, 26 states in the U.S. have proposed creating Bitcoin reserves, and below are the progress updates of other states besides Arizona.

States with Clear Support

In addition to Arizona, which has passed the bill, Texas, Alabama, and Minnesota are also making steady progress in their legislative agendas.

Texas

Texas has shown bipartisan support for Bitcoin reserve legislation. The Senate has passed the "Strategic Bitcoin Reserve Act" (SB-21), allowing the use of public funds to purchase Bitcoin and other high-market-cap cryptocurrencies, with a target holding size of $500 billion, and plans to allocate $250 million from the Economic Stabilization Fund. Additionally, the House has proposed Bill HB4258, which further authorizes local governments to invest in cryptocurrencies, demonstrating the comprehensiveness of its legislative framework. Currently, the bill has been submitted to the state's Government Efficiency Delivery Committee, and if it successfully passes both houses, it will take effect on September 1 of this year.

Texas has long shown support for cryptocurrency. In 2021, the Texas Legislature established the "Texas Working Group," focusing on blockchain development and attracting numerous Bitcoin mining companies due to Texas's abundant and cheap energy. For example, Riot Blockchain's Whinstone facility in Rockdale has become the largest single Bitcoin mining center in North America.

Lieutenant Governor Dan Patrick has stated, "Bitcoin is digital gold, and its limited supply and decentralized nature will become a key asset for Texas's future." According to Bitcoin Magazine, Texas currently has eight bills related to Bitcoin or cryptocurrencies proposed, among which HB4258 is the fifth bill submitted for committee review. Four of these bills (HB4258, HB1598, SB21, and SB778) call for Texas to establish a strategic Bitcoin reserve.

Alabama

Alabama Republican Senator April Weaver submitted Senate Bill 283 (SB 283) in early April, alongside House Bill 482 (HB 482), which has been proposed since March 2025. By setting a "market cap of $750 billion" (currently only Bitcoin qualifies), it indirectly locks Bitcoin as a reserve asset. Additionally, the crypto assets must be directly managed by the state treasurer and cannot exceed 10% of the state budget. If the bill passes, it will take effect on October 1, 2025.

Minnesota

Minnesota Republican Representative B. Olson submitted House Bill 2946 (HF 2946) on April 1, 2025, known as the Minnesota Bitcoin Act. The corresponding Senate Bill SF 2661 has been submitted since March 2025. Both bills are identical, allowing the state investment board to allocate public funds to Bitcoin, accept BTC as a payment method for taxes and government transactions, and amend 12 existing laws, including tax codes, retirement plans, and investment regulations to integrate cryptocurrencies. If the bill passes, it will take effect on January 1, 2026.

States Making Steady Progress

New Hampshire

New Hampshire's bill, HB302, was proposed by Republican Representative Keith Ammon and has received bipartisan support. The bill allows the state treasurer to invest up to 5% of state public funds (based on the general fund, revenue stabilization fund, etc.) in eligible digital assets or precious metals (such as gold and silver). The initial proposal was for 10%, but it was reduced to 5% due to safety considerations. On April 10, 2025, the bill passed the full House vote with 192 votes in favor and 179 against. State Treasurer Monica Meza-Pel stated that if the bill takes effect, a pilot investment will be initiated, with an initial scale potentially reaching $180 million.

Ohio

Senator Sandra O'Brien proposed Ohio's Bitcoin Reserve Bill SB57 on January 28, 2025, authorizing the state treasury to directly invest in Bitcoin, requiring Bitcoin to be held for at least five years, and mandating state agencies to accept cryptocurrency payments. It also allows state residents, institutions, and universities to donate Bitcoin to the reserve fund. On January 29, it was submitted to the Senate Finance, Insurance, and Technology Committee, where it remains under review with no further progress.

Utah

At the beginning of 2025, Utah State Representative Jordan Teuscher proposed a bill called HB0230, the "Blockchain and Digital Innovation Amendment," on January 21. The bill initially allowed the state treasurer to invest up to 10% of public funds in digital assets, including Bitcoin, non-fungible tokens (NFTs), and stablecoins, but required regulatory approval, market capitalization, and liquidity conditions. On March 10, 2025, the Utah Senate passed HB0230 but removed the key provision allowing state treasury investment in Bitcoin, instead providing residents with digital asset custody protection, mining rights, operating nodes, and participation in staking.

The provision for direct state investment in Bitcoin was removed, reflecting lawmakers' concerns about market risks. Senator Kirk A. Cullimore stated in a March 7 meeting that the removal of the reserve provision was due to "numerous concerns about the early adoption of these policies." As of now, Utah has not established a state-level Bitcoin reserve but has shifted its legislative focus to the regulation and innovation protection of digital assets.

Florida

Florida's HB 487 bill was proposed in February 2025, allowing the state chief financial officer and the state executive council to invest up to 10% of public funds, including the general revenue fund and budget stabilization fund, in Bitcoin. On April 10, it received unanimous support (with no opposition) from the House Insurance and Banking Subcommittee and has entered the Government Operations Subcommittee for review. It is currently under review by the Government Operations Subcommittee, with no further progress.

In addition, there are 13 other states, including Iowa, Missouri, Georgia, Illinois, Kansas, Kentucky, Maryland, Massachusetts, Michigan, New Mexico, North Carolina, Rhode Island, and West Virginia, where Bitcoin reserve bills are being proposed or advanced, and none have been explicitly rejected or shelved.

States with Rejected or Shelved Bills

Oklahoma

Oklahoma's Cody Maynard proposed Bill HB1203 on January 15, 2025, aiming to allow state reserve funds and retirement funds to invest in Bitcoin and other digital assets, up to 5%. On March 25, the bill passed the House with a vote of 77 to 15 and was sent to the Senate. However, on April 15, it was rejected by the Senate Tax and Revenue Committee with a vote of 6 to 5, resulting in the bill's failure, and there are currently no signs of further progress.

Montana

Montana legislators proposed Bill HB 429 on January 31, 2025, which aimed to allow the state to invest up to $50 million in Bitcoin, digital assets, stablecoins, and precious metals as a diversified investment for state finances. However, the bill was rejected in the House on February 21 with a vote of 59 to 41, failing to pass the first round of voting, and there are no indications that it will be revived. Montana's legislative efforts for a Bitcoin reserve have come to an end.

Pennsylvania

Pennsylvania Representatives Mike Cabell and Aaron Kaufer proposed Bill HB 2664 on November 14, 2024, allowing the state treasurer to invest up to 10% of Pennsylvania's general fund, rainy day fund, and state investment fund in Bitcoin and cryptocurrency-based exchange-traded products, potentially involving investments of up to $970 million. However, according to reports from March 2, 2025, the bill was "effectively terminated" during the legislative process and has not progressed further, with no signs of revival.

North Dakota

North Dakota Representatives Nathan Toman, Josh Christy, and Senator Jeff Barta jointly proposed the Strategic Bitcoin Reserve Bill on January 11, 2025, which aims to allow the state treasury to invest in Bitcoin, but specific investment ratios and details were not clarified. However, the bill has not continued to progress, has failed legislatively, and there are no signs of revival. North Dakota's legislative efforts for a Bitcoin reserve have come to an end.

South Dakota

South Dakota legislators postponed a bill on February 25, 2025, that could allow the state to adopt Bitcoin as a strategic reserve asset. The specific details of the bill were not clarified, but it aimed to allow the state treasury to invest in Bitcoin. The postponement was due to concerns over Bitcoin's price volatility, and the bill has now been terminated, with no further progress possible.

Wyoming

On January 18, 2025, a bill was introduced by Wyoming Senator Cynthia Lummis, supporting the introduction of Bill HB0201, which allows the state treasurer to invest up to 3% in Bitcoin, including the general fund, permanent mineral trust fund, and permanent land fund. Investments can be made through direct purchases or using regulated Bitcoin exchange-traded products, and annual reports are required to ensure transparency. However, the bill has not made further progress and has been classified as a failed bill, marking the end of legislative efforts.

Arizona's breakthrough sets a benchmark for other states in the U.S., with Texas, Alabama, and others following suit by incorporating Bitcoin into public financial frameworks, aiming to diversify asset risks and seize opportunities in the digital economy. States that previously rejected the establishment of Bitcoin reserves due to the volatility of cryptocurrencies and regulatory challenges, as well as others in the process of advancement, may also shift their stance due to Arizona's first step. Despite facing multiple challenges, Bitcoin's positioning as "digital gold" is gradually solidifying through local legislation. Whether it can become a mainstream reserve asset remains to be seen, but there is no doubt that cryptocurrency is increasingly being accepted by the mainstream, and the future path will become broader.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。