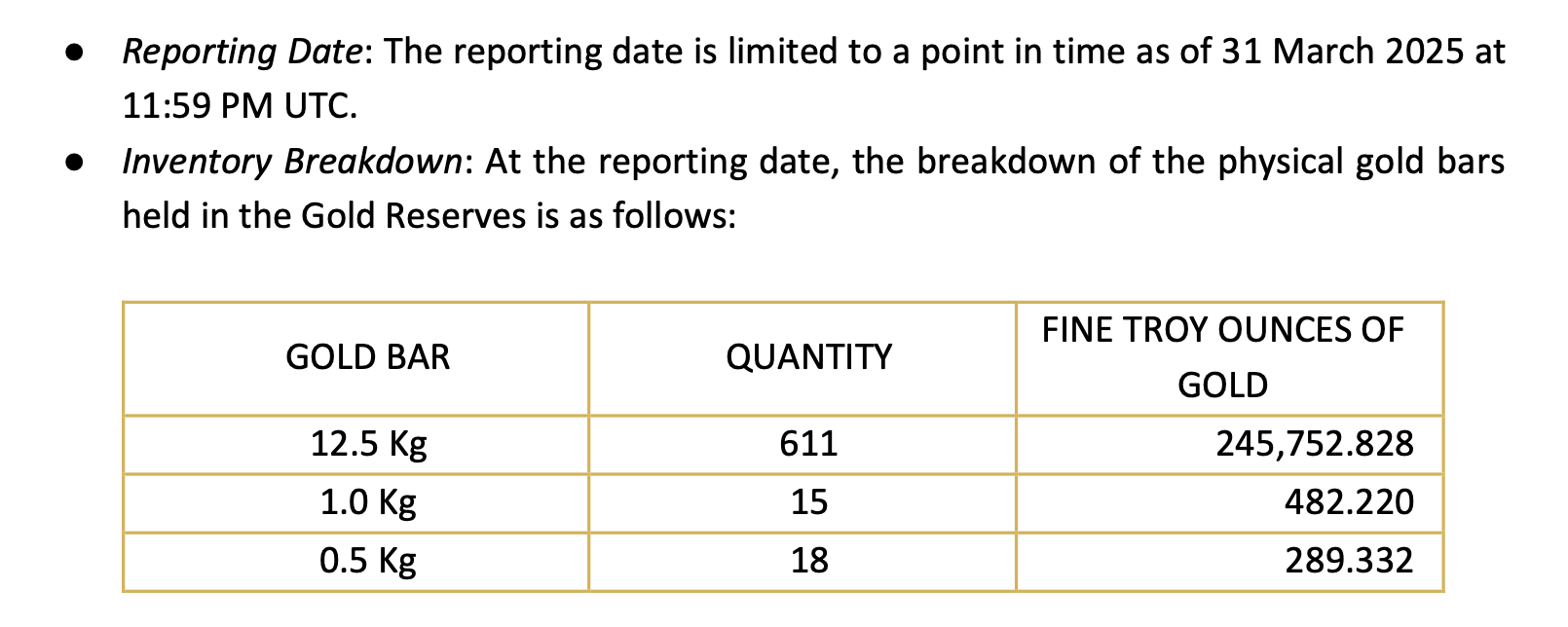

Tether的认证报告由BDO Italia S.p.A.完成,独立验证截至2025年3月31日,保管中持有246,524.33盎司精细金。根据报告,每个XAUT代币都由存放在瑞士金库中的等量黄金以1:1的比例支持。

认证指出,截至第一季度末,Tether黄金(XAUT)的累计市场价值为7.7亿美元,每个代币的价格为3,123.57美元。证词还确认已售出180,777.07个XAUT代币,而65,747.26个代币仍可供出售。

Tether认证的截图。

XAUT的发行方TG Commodities S.A. de C.V.在1月从英属维尔京群岛迁至萨尔瓦多后,现已根据萨尔瓦多的数字资产发行法进行监管。该公司在美国财政部金融犯罪执法网络注册为货币服务业务。

报告强调,Tether的黄金储备由伦敦金银市场协会(LBMA)认证的金条组成,并定期接受独立第三方的质量检测。管理层的政策指出,黄金的估值基于持续经营假设下的公平市场价格。

Tether还强调了影响黄金作为价值储存(SoV)角色的宏观经济趋势,提到中央银行黄金购买的增加和通胀压力的上升。根据世界黄金协会的数据,2024年,中央银行向其储备中增加了超过1,044公吨的黄金。

独立报告强调,Tether黄金(XAUT)为用户提供了一种由可验证的实物黄金支持的数字资产,使其与依赖纸黄金或面临监管不确定性的非合规代币化产品区分开来。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。