Author: Blockworks

Translation: ShenChao TechFlow

ShenChao Introduction: Strategy holds nearly 680,000 bitcoins, but its financing model is quietly changing. From zero-interest convertible bonds in 2024 to costly preferred stocks and dilutive stock issuances in 2026, the bitcoin content per share is being diluted. This article breaks down the actual impact of this structural change on BTC prices—worth noting is that its buying will shift from continuous to intermittent.

Strategy Executive Chairman Michael Saylor | DAS 2025 New York Summit, photo: Mike Lawrence for Blockworks

Strategy has become a visible treasury buyer in the bitcoin market again, but the financing background is vastly different compared to 2024-2025.

At the end of December last year, Strategy completed a round of financing, but hardly deployed the funds into bitcoin. From December 29 to 31, the company sold 1,255,911 shares of MSTR, raising $195.9 million, yet only bought 3 bitcoins. In January, deployment was restarted: from January 1 to 4, it sold another 735,000 shares, raising $116.3 million and purchased 1,283 bitcoins at an average price of $90,391 per bitcoin, costing $116 million, thus raising the total holdings to 673,783 bitcoins.

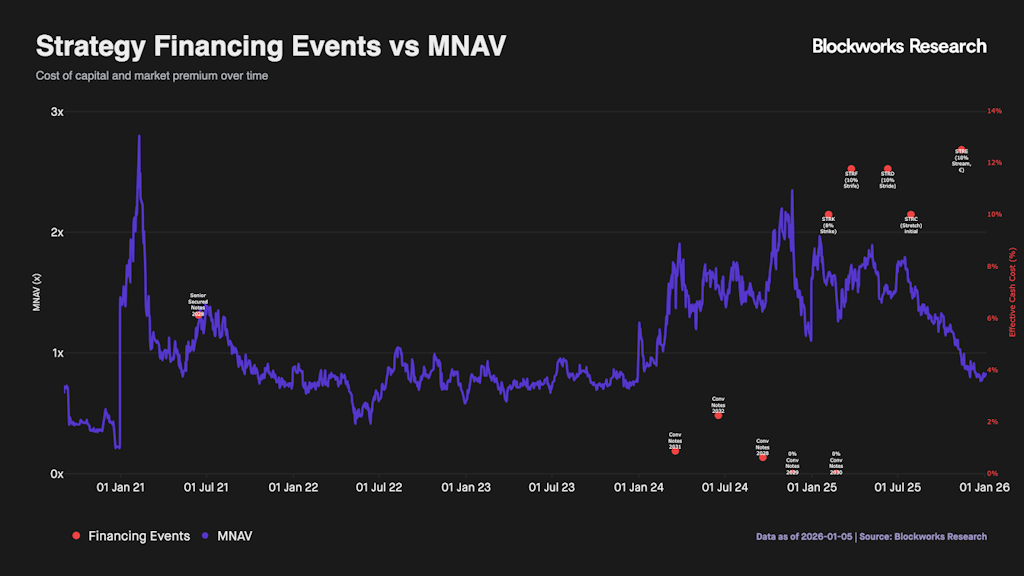

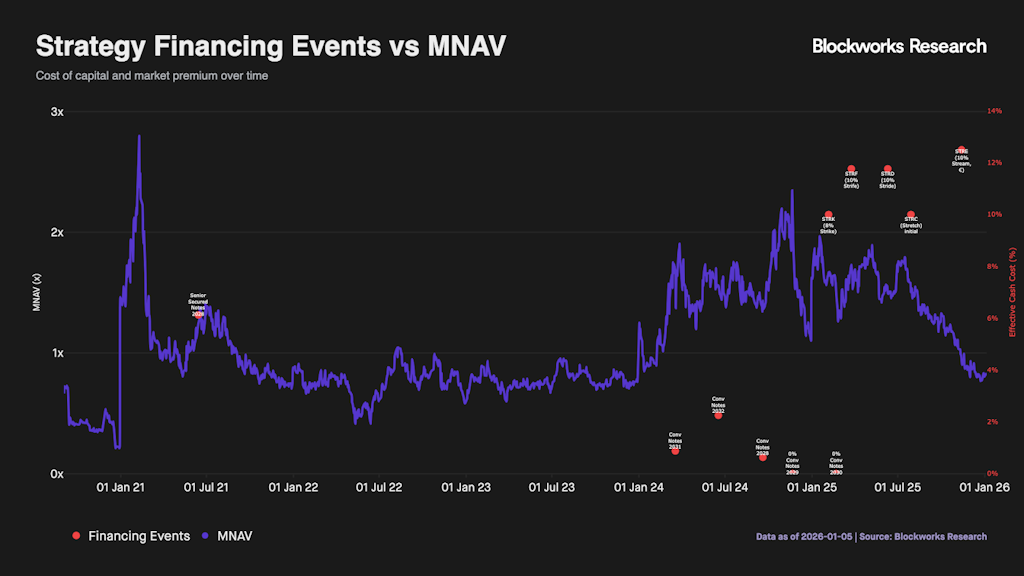

More crucial signals lie in the changes in the financing structure. From 2024 until early 2025, Strategy financed at low cost through convertible bonds—with cash coupon rates only at 0.625% to 2.25%, and subsequently issued multiple zero-interest convertible bonds. This strategy works best when MSTR is trading at a premium to bitcoin NAV (mNAV > 1) because the value of equity options itself is attractive.

Looking at a longer time frame, the marginal buying in 2025 is basically two horses running: spot ETFs and Strategy. From the cumulative buy-in chart, Strategy was on par with ETF fund inflows for a significant time throughout the year, indicating that at certain stages, its influence on price can be compared to that of the ETF group.

The conditions in 2026 are evidently weaker. As the mNAV narrows, financing methods shift to costly preferred stocks with double-digit rates and dilutive ATM common stock issuances, making it difficult for Strategy to continue large-scale purchases without worsening the bitcoin content per share. Strategy remains a barometer of market sentiment, but its buying pressure will be more moderate and intermittent; ETF fund flows and overall crypto market risk appetite will become more reliable price determining forces.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。