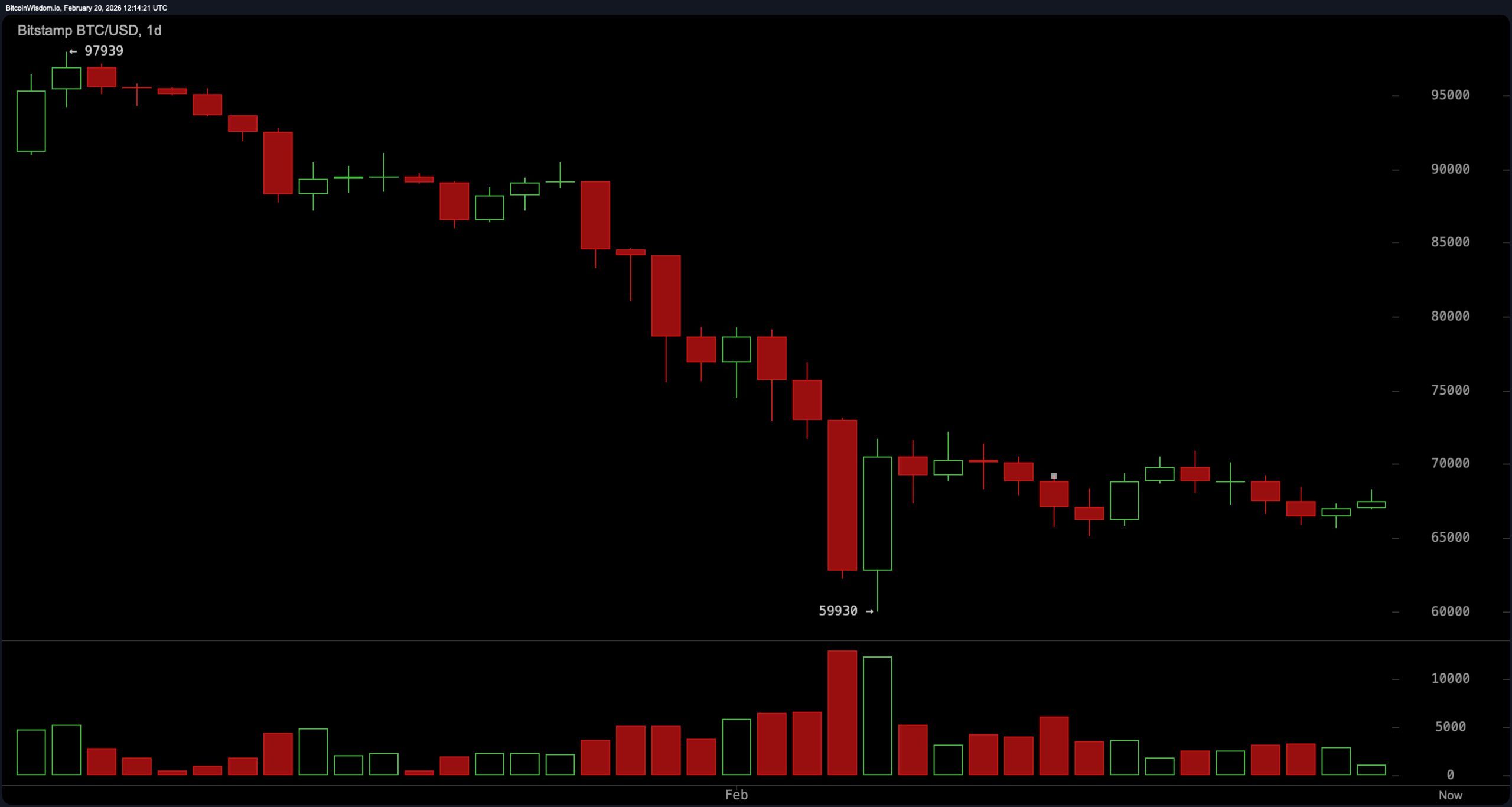

The daily chart tells a disciplined but unforgiving story. Bitcoin remains in a clear downtrend from the roughly $97,000 high to the $59,930 swing low, followed by a sharp bounce on heavy volume into the current $65,000 to $70,000 consolidation band.

Price is pressing against daily resistance between $70,000 and $72,000, while key daily support remains $59,930, with interim footing near $64,000 to $65,000. Structurally, the pattern of lower highs is intact, keeping the higher timeframe bias neutral to bearish unless $72,000 is reclaimed with authority and volume expansion. This is not trend reversal territory — yet.

BTC/USD 1-day chart via Bitstamp on Feb. 20, 2026.

On the four-hour chart, bitcoin is compressing within a tightening range after forming a local bottom at $65,620. Price has carved slightly higher lows but faced rejection at $70,937 and again in the $68,500 to $69,500 zone. Current support sits between $65,500 and $66,000, while resistance is layered between $68,500 and $69,500. This type of compression, following a bounce, often precedes expansion. Whether that expansion resolves higher toward $70,937 and $72,000, or rotates lower toward $63,000 and potentially $59,930, will depend on momentum and participation. For now, the range rules the tape.

BTC/USD 4-hour chart via Bitstamp on Feb. 20, 2026.

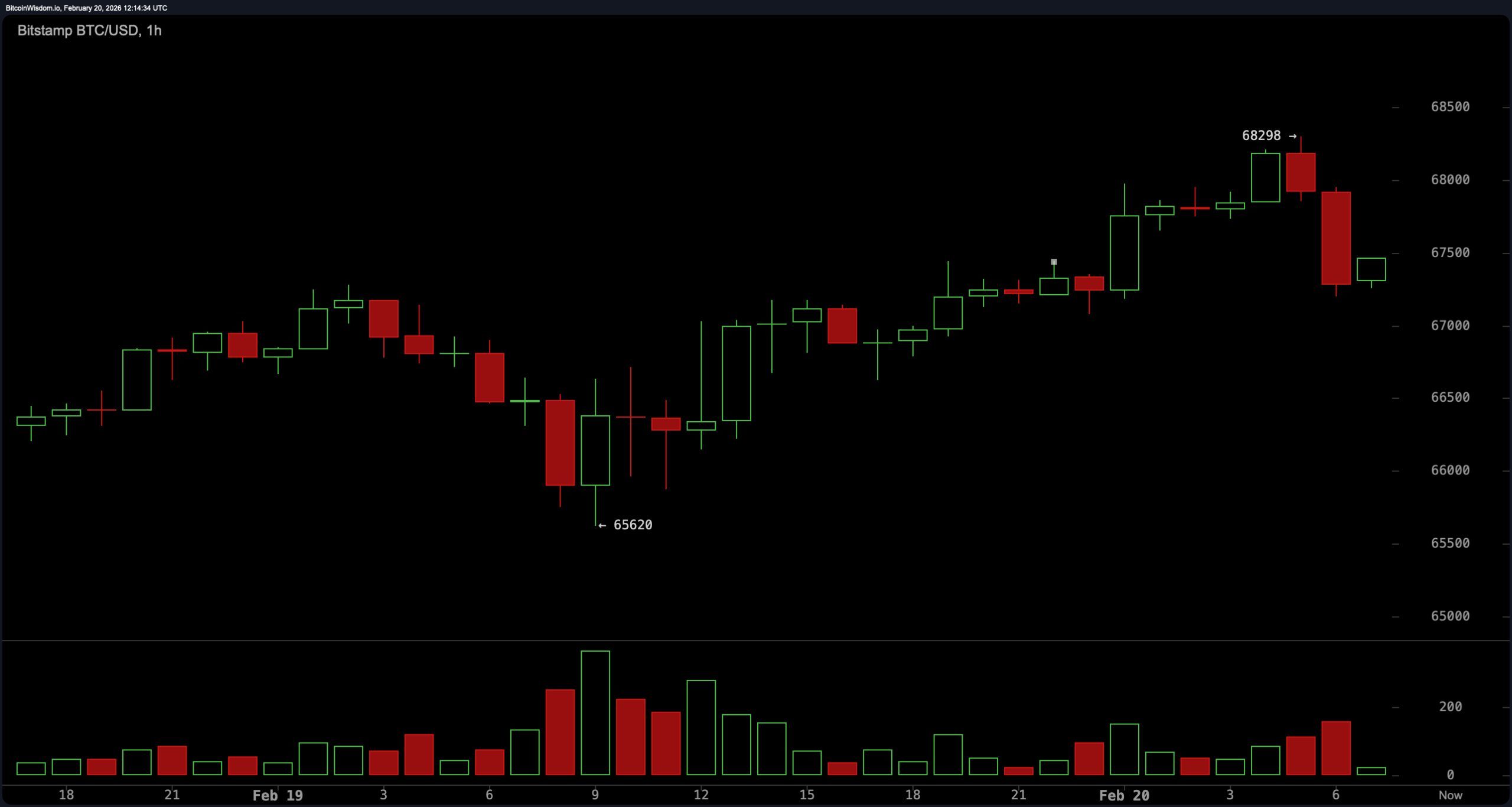

The one-hour chart shows a short-term uptrend from $65,600 to $68,300, followed by a clear rejection near $68,300. A pullback candle signals slowing momentum, and volume does not reflect aggressive breakout conviction. In other words, the market tested the ceiling and found it sturdier than expected. Without a decisive close above the $69,000 to $69,500 region on a strong four-hour structure, upside attempts risk fading back into the mid-range. Intraday traders may enjoy the volatility, but breakout traders are still waiting for confirmation that has yet to arrive.

BTC/USD 1-hour chart via Bitstamp on Feb. 20, 2026.

Oscillators paint a nuanced picture. The relative strength index ( RSI) reads 36, neutral and not yet in oversold territory. The Stochastic oscillator stands at 46, also neutral. The commodity channel index (CCI) registers −56, maintaining a neutral posture, while the average directional index (ADX) at 58 suggests trend strength but without directional clarity in this context.

The Awesome oscillator prints −9,884, neutral, and momentum shows −1,392 with upside bias. The moving average convergence divergence ( MACD) level at −4,308 reflects upward crossover momentum within a broader corrective environment. Oscillators, in short, are not panicking — but they are not celebrating either.

Moving averages, however, remain firmly overhead. The exponential moving average (EMA) and simple moving average (SMA) (10) sit at $68,247 and $67,769, respectively, both above the price. The EMA and SMA (20) stand at $71,201 and $69,683, reinforcing near-term resistance. Higher still, the EMA and SMA (30) at $74,176 and $75,404 extend the ceiling, followed by the EMA and SMA (50) at $78,637 and $82,188. The EMA and SMA (100) at $85,870 and $85,876, along with the EMA and SMA (200) at $92,807 and $99,393, point to the broader downtrend. Until price begins reclaiming these dynamic levels, rallies risk looking more like relief than reversal.

Bull Verdict:

Bitcoin must decisively clear $69,500 on a strong four-hour close and reclaim $70,937, with expanding volume, to build momentum toward the $72,000 daily structure break. A confirmed move through $72,000 would invalidate the series of lower highs on the daily chart and shift the higher timeframe bias away from neutral-to- bearish, opening the door for a broader structural recovery rather than another short-lived relief bounce.

Bear Verdict:

Failure to hold the $65,500 to $66,000 support zone would expose $63,000 as the first downside objective, with a high-probability retest of the $59,930 major swing low if momentum accelerates. With price still trading below all key exponential moving averages (EMA) and simple moving averages (SMA) from the 10-period through the 200-period, and daily structure defined by lower highs, the macro posture continues to favor downside risk unless proven otherwise.

- What is bitcoin’s price on Feb. 20, 2026? Bitcoin is trading at $67,411, consolidating within a $65,000 to $70,000 range after a sharp bounce from $59,930.

- What are the key resistance levels for bitcoin right now? Immediate resistance sits between $68,500 and $69,500, with major daily resistance at $70,937 and $72,000.

- What are the critical support levels for bitcoin? Strong support is located between $65,500 and $66,000, with major downside risk toward $59,930 if that zone fails.

- Is bitcoin in a bullish or bearish trend? The daily structure remains neutral-to- bearish, as price trades below key exponential moving averages (EMA) and simple moving averages (SMA) despite short-term momentum stabilization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。