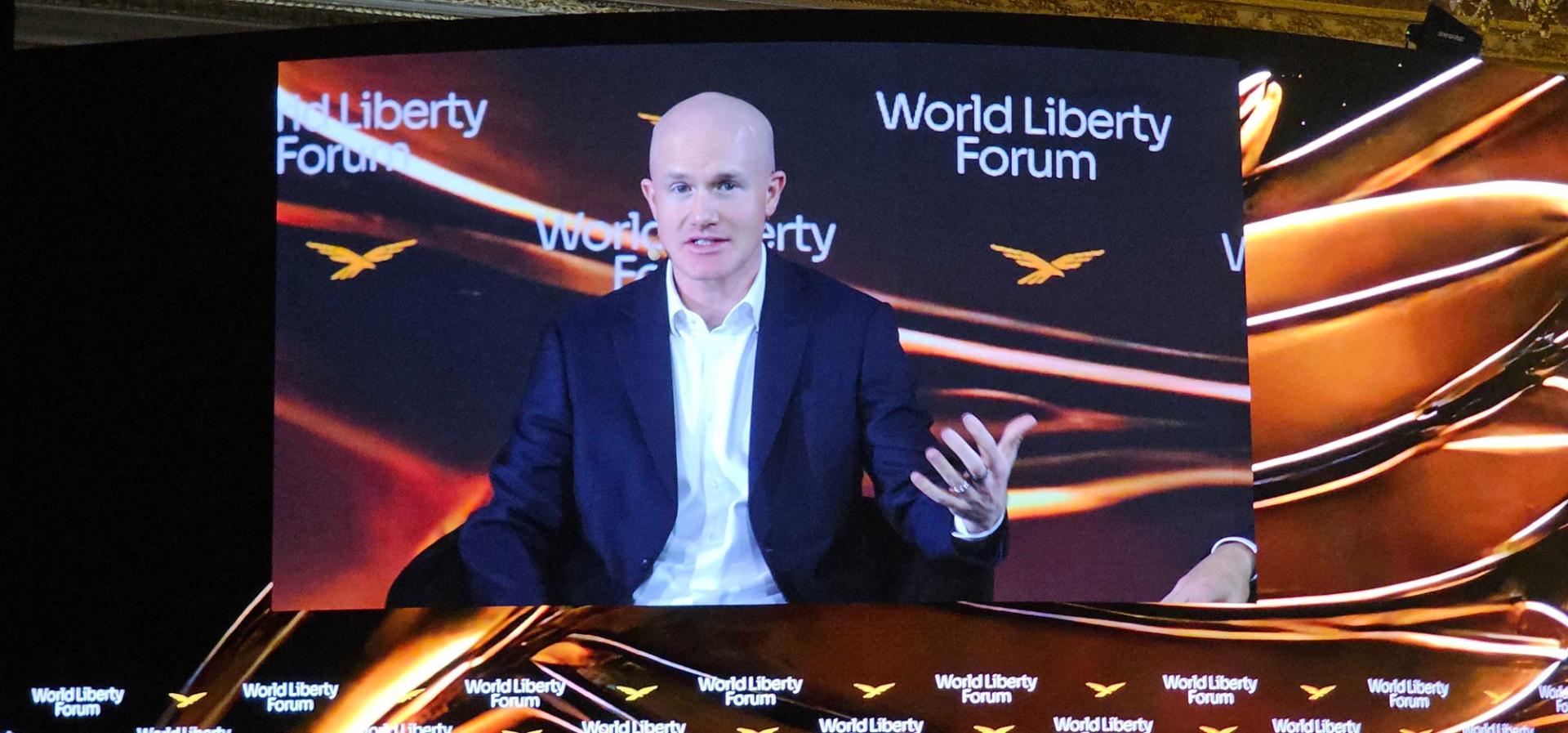

PALM BEACH, Fla. — Banking trade groups, rather than individual banks, are chiefly responsible for stalled negotiations on crypto market structure legislation, Coinbase CEO Brian Armstrong said.

Banks themselves are looking at crypto as an opportunity, he said Wednesday at the World Liberty Forum hosted at Mar-a-Lago.

"For whatever reason, sometimes incumbent industries have trade groups, and they view the world with a zero-sum mindset [where they believe] for the banks to win, crypto has to lose," he said. "They're not viewing this as a positive [step]."

Banking trade groups have represented the industry in meetings with the crypto industry hosted by the White House since the Senate Banking Committee's push to advance market structure legislation last month fell apart. The latest such meeting, which took place last week, saw the banking industry holding the line on its demands that the bill block stablecoin rewards.

The next meeting is set to take place Thursday morning, individuals familiar with the plan told CoinDesk.

Read more: Crypto's banker adversaries didn't want to deal in latest White House meeting on bill

Armstrong said he did expect some sort of compromise where banks would have new benefits under a fresh draft market structure bill, though he did not elaborate. When the Digital Asset Market Clarity Act stalled the night before a Senate Banking Committee hearing, it was after Armstrong publicly withdrew his company's support.

In the current talks, the Coinbase co-founder argued that individual small and medium-sized banks did not really fear deposit flight to stablecoin issuers, but rather said their more urgent concerns were with deposit flight to larger banks.

Major banks are leaning into crypto as well, he said, adding that Coinbase is supporting crypto infrastructure for "five of the largest banks in the world."

Other banks are hiring for blockchain or crypto-focused employees on LinkedIn.

"We now live in this world where we have regulated U.S. stablecoins with rewards," he said. "You have to accept that as a reality and decide if you want to treat that as an opportunity or as a threat."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。