Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.36 trillion, with BTC accounting for 58.3%, which is $1.37 trillion. The market capitalization of stablecoins is $307.9 billion, increasing by 2.16% in the last 7 days, of which USDT accounts for 59.66%.

Among the top 200 projects on CoinMarketCap, half have risen and half have fallen, including: BTC down 1.99% in 7 days, ETH down 1.5% in 7 days, SOL down 3.64% in 7 days, PIPPIN up 229.46% in 7 days, and H up 56.35% in 7 days.

This week, the net outflow of the U.S. Bitcoin spot ETF is $358.9 million; the net outflow of the U.S. Ethereum spot ETF is $161 million.

Market Predictions (February 16 - February 22):

BTC: $66,000-70,000

ETH: $1,880-2,120

SOL: $75-100

The current RSI index is 55.7 (neutral range), and the fear and greed index is 8 (extreme fear, lower than last week), while the altcoin season index is 45 (neutral, higher than last week).

After experiencing a strong rebound triggered by favorable regulations this past Friday, market sentiment is uplifted in the short term, but there is also significant technical resistance above. It is expected that next week the market will undergo a phase of digestion of good news and macro data guidance, moving towards first a consolidation and then a directional choice. Therefore, it is necessary to maintain flexibility strategically, control positions, focus on selling high and buying low, and closely monitor breakthrough signals from macro data.

The market next week is not operating independently; it is essential to pay close attention to the following variables:

- Macro data: Pay attention to U.S. economic data and speeches from Federal Reserve officials; any hints about interest rate policy will affect risk assets.

- ETF fund inflows: Whether Fridays' rebound can attract institutional funds back will be key to the continuation of the rebound. If ETFs continue to see significant outflows next week, the rebound may falter.

- Regulatory dynamics: The speech of the U.S. Treasury Secretary this week is a significant positive, and attention should be paid to the progress of Congress regarding the Digital Asset Market CLARITY Act discussions.

Understanding the Present

Reviewing Major Events of the Week

- On February 8, crypto journalist Eleanor Terrett revealed details of a White House crypto meeting scheduled for next Tuesday. This meeting is part of a series of meetings at the staff level, and CEOs from various companies will not be invited, though senior policy staff from banks will attend;

- On February 8, Liquid Capital (formerly LD Capital) founder Yi Lihua posted after Trend Research sold off ETH, stating, "First, I acknowledge that the market cycle remains valid; in this new stage where U.S. stocks are strong and the crypto treasury (DAT) coexists with ETFs, the consensus in the crypto circle has not been broken, and the market is still prone to manipulation. However, looking at it another way, entering a bear market is also the best layout time, much like the last cycle where we profited from laying out in a bear market. The future is bright, and I remain optimistic about the next round of bull market opportunities in the industry and will continue to build; pessimists are correct, while optimists win.";

- Yi Lihua's Trend Research completely liquidated its ETH holdings, with a total loss of approximately $688 million;

- On February 8, Ethereum network transaction counts surged to 2,896,853 yesterday, setting a new historical high according to Etherscan data;

- On February 10, Ethereum co-founder Vitalik Buterin published an update in the morning regarding his systematic thinking on the intersection of Ethereum and artificial intelligence, emphasizing that AGI should not be pursued through "indiscriminate acceleration," but rather that the values of crypto and AI should be deeply integrated to construct an AI future favorable for human freedom, safety, and decentralized cooperation;

- On February 9, even after Bitcoin rebounded to nearly $70,000, its derivatives market is still sending warning signals. Traders maintain defensive positions, with nearly no signs of new long bets;

- On February 9, even after Bitcoin rebounded to nearly $70,000, its derivatives market is still sending warning signals. Traders maintain defensive positions, with nearly no signs of new long bets;

- On February 11, according to official news, LayerZero announced the launch of the Layer 1 blockchain network Zero;

- On February 11, CoinDesk reported that the CEO of Korean cryptocurrency exchange Bithumb, Le Jae-won, stated that due to a lack of proper internal control measures, the platform mistakenly transferred more than $40 billion worth of Bitcoin into customer accounts, while the intended amount to be distributed was only about $428. Most of the funds have been recovered;

- Bithumb admitted that a serious internal system flaw led to the erroneous transfer of about $40 billion worth of Bitcoin to customers. This error led to a 17% drop in Bitcoin prices on the Bithumb platform and prompted an investigation by the Korean Financial Supervisory Service, exposing flaws in the exchange's asset matching and account isolation controls. Although Bithumb has recovered most of the Bitcoin, 1,786 Bitcoin that were sold before the accounts were frozen have not yet been recovered, exacerbating legislators' concerns about regulatory weaknesses.

Macro Economy

- On February 10, the U.S. retail sales month-on-month rate for December recorded 0%, expected 0.4%.

- On February 11, the U.S. unemployment rate for January was 4.3%, slightly lower than the expected 4.40%, previously 4.40%.

- On February 12, the number of first-time jobless claims in the U.S. for the week ending February 7 was 227,000, expected 222,000, and the previous value was revised from 231,000 to 232,000.

- On February 13, the U.S. non-seasonally adjusted CPI year-on-year rate for January fell from 2.7% to 2.4%, marking the lowest level since May 2025, with the market median expectation at 2.5;

- On February 13, according to CME "Federal Reserve Watch" data, the probability of a 25 basis point rate cut by the Federal Reserve in March is 8.4%, while the probability of maintaining the current rate is 91.6%.

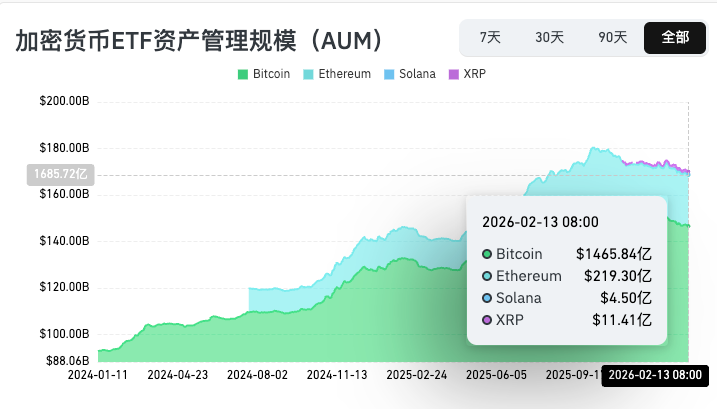

ETF

According to statistics, during the period from February 9 to February 13, the net outflow of the U.S. Bitcoin spot ETF reached $358.9 million; as of February 13, GBTC (Grayscale) had a total outflow of $25.909 billion, currently holding $10.713 billion, while IBIT (BlackRock) currently holds $52.522 billion. The total market capitalization of the U.S. Bitcoin spot ETFs is $90.458 billion.

The net outflow of the U.S. Ethereum spot ETF is $161 million.

Envisioning the Future

Industry Conferences

- ETHDenver 2026 will be held from February 17 to 21 in Denver, USA;

- EthCC 9 will be held from March 30 to April 2, 2026, in Cannes, France. The Ethereum Community Conference (EthCC) is one of the largest and longest-running annual Ethereum events in Europe, focusing on technology and community development;

- The Hong Kong Web3 Carnival 2026 will take place from April 20 to 23, 2026, in Hong Kong, China.

Project Progress

- Bitcoin mining company Bit Origin's compliance deadline is extended to February 16, 2026. If Bit Origin fails to regain compliance before this period, NASDAQ will notify Bit Origin in writing that it will be delisted;

- Upbit will delist the Groestlcoin token GRS, but will continue to support withdrawals for 34 days (until February 19, 2026) after the trading support is terminated.

Important Events

- Belgium's KBC Bank announced that starting the week of February 16, it will provide cryptocurrency trading services for private investors through its online investment platform Bolero;

- On February 19 at 21:30, the U.S. will announce the number of initial jobless claims for the week ending February 14 (in ten thousand people);

- On February 20 at 21:30, the U.S. will release the year-on-year core PCE price index for December.

Token Unlocking

- Starknet (STRK) will unlock 127 million tokens on February 15, valued at approximately $5.97 million, accounting for 4.61% of the circulating supply;

- Sei (SEI) will unlock 55.55 million tokens on February 15, valued at approximately $4.12 million, accounting for 1.03% of the circulating supply;

- Arbitrum (ARB) will unlock 92.65 million tokens on February 16, valued at approximately $10.08 million, accounting for 1.82% of the circulating supply;

- YZY (YZY) will unlock 62.5 million tokens on February 17, valued at approximately $20.96 million, accounting for 17.24% of the circulating supply;

- LayerZero (ZRO) will unlock 25.7 million tokens on February 20, valued at approximately $48.33 million, accounting for 5.98% of the circulating supply;

- KAITO (KAITO) will unlock 32.53 million tokens on February 20, valued at approximately $10.25 million, accounting for 10.64% of the circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is committed to turning professional analysis into your practical tool. We analyze market trends for you through "Weekly Insights" and "In-depth Research Reports"; with our exclusive column "Hotcoin Select" (AI + expert dual screening), we help you identify potential assets and reduce trial and error costs. Each week, our researchers also meet with you through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Disclaimer

The cryptocurrency market is highly volatile, and investments carry risks. We strongly advise investors to conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure fund safety.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。