The crypto venture capital machine that once powered explosive token launches is losing momentum. According to recent data highlighted by Galaxy Research, roughly 85% of tokens launched in 2025 are currently trading below their launch price. Even projects backed by top-tier venture firms are struggling to deliver meaningful returns, with many barely breaking even and some deep in the red.

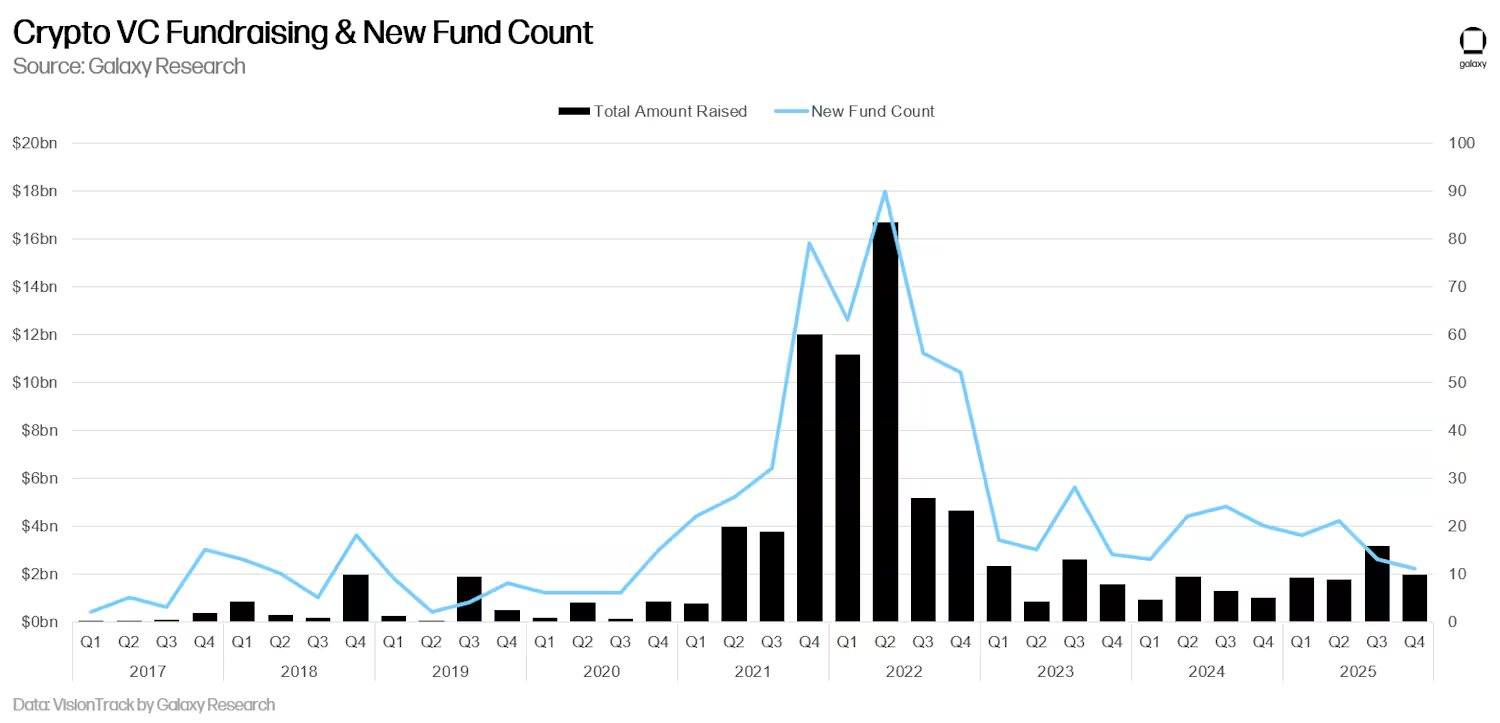

The contrast with 2022 is stark. In Q2 2022 alone, crypto VCs raised nearly $17 billion across more than 80 new funds. Institutional investors flooded the space, often backing projects with little more than a token roadmap and a pitch deck.

Fast forward to today, and the tide has turned. VC return on investment has been declining steadily since 2022. The number of new crypto funds has dropped to a five-year low. Fundraising last quarter amounted to just 12% of the capital raised during the Q2 2022 peak.

While venture firms reportedly invested $8.5 billion last quarter, an 84% quarter-over-quarter increase, analysts note this is largely capital raised during the 2022 boom. In fact, total capital deployed between 2023 and 2025 roughly matches what was raised in 2022 alone.

Yet there may be a silver lining. As easy VC money dries up, projects are being forced to focus on product-market fit, user growth, and sustainable revenue rather than token hype. Reduced insider influence could also mean fewer aggressive token unlocks and improved alignment between builders and communities.

Commenting on this, @thedefiedge, a decentralized finance (DeFi) research firm said, “When VC influence fades, the projects that win are the ones with real users and real revenue. Hopefully less chains, and more builders who optimize for product instead of the next raise.”

The downturn may mark the end of capital-driven token cycles and the beginning of a more fundamentals-driven crypto ecosystem.

FAQ 📊

- Why are most 2025 tokens down?

Weak demand and declining VC-driven momentum are pressuring prices. - How much did VCs raise in 2022?

Nearly $17 billion in Q2 2022 alone. - Is new crypto VC funding slowing?

Yes, new fund creation is at a five-year low. - What does this mean for crypto projects?

Teams must prioritize real users and revenue over hype.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。