Bitcoin is trading just above $68,000 on Feb. 16, after fluctuating between roughly $60,000 and $71,000 in recent weeks, demonstrating resilience even as sentiment in derivatives markets turns sharply negative.

While the price has slipped about 45% from its October 2025 peak above $126,000, it has not collapsed. Instead, BTC continues to defend the upper-$60,000 region, frustrating aggressive bears who expected a faster unraveling.

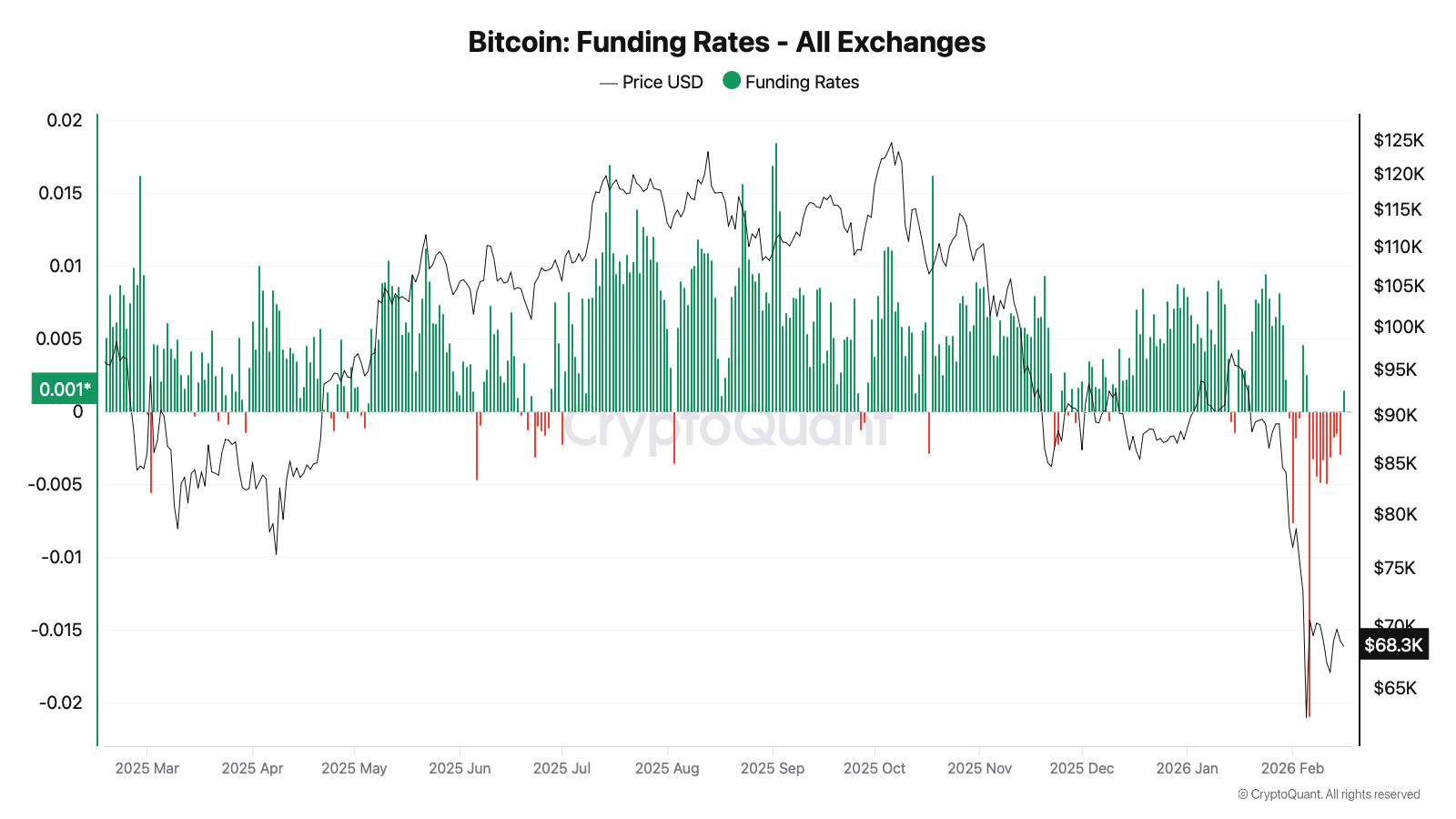

The real tension lies beneath the surface. Cryptoquant.com metrics show that aggregated funding rates across major exchanges have dropped to their most negative levels since August 2024, reflecting heavy short positioning. When funding rates turn deeply negative, short sellers pay longs to maintain positions — a signal that bearish bets are overcrowded.

That same pattern emerged in August 2024, when bitcoin carved out a bottom near $55,000 before rallying more than 90% in the following months. Today’s setup carries similar ingredients: extreme short exposure, elevated leverage, and a price refusing to break decisively lower.

Source: Cryptoquant.com

History may rhyme, but repetition is never guaranteed. Just because events unfolded that way before does not mean the same outcome is destined to materialize now.

According to coinglass.com stats, bitcoin futures open interest stands at approximately $43 billion as of Feb. 16, 2026, remaining moderately high despite a modest 24-hour dip. Elevated open interest often precedes volatility, as crowded positions create liquidation risk on either side of the trade.

Exchange-level data reveals a slight overall tilt toward shorts, with a global long/short ratio near 49.79% long versus 50.21% short. On Bitfinex, however, shorts dominate at 67.61%, highlighting concentrated bearish positioning among larger players.

Liquidation math adds fuel to the narrative. A 10% move higher in bitcoin’s price could trigger roughly $4.34 billion in short liquidations, compared with $2.35 billion in long liquidations on a similar decline. In other words, the upside liquidation imbalance is nearly double — a setup that can accelerate rallies if momentum builds.

Recent liquidations show how fragile positioning has become. Over the past 24 hours, about $235.5 million in positions were wiped out, with both sides taking hits during choppy price swings. Earlier this month, total crypto liquidations briefly reached $3 billion to $4 billion, showcasing just how quickly leverage can unwind.

Exchange-traded fund (ETF) flows and institutional behavior complicate the picture. While U.S. spot bitcoin ETFs recorded modest $15.1 million net inflows on Feb. 14, the past three months saw $5.8 billion in outflows across the category. That suggests tactical trimming rather than wholesale abandonment.

Meanwhile, large holders appear to be accumulating. Addresses holding more than 1,000 BTC added roughly 53,000 coins during the recent dip, signaling conviction beneath the surface volatility.

Technically, bitcoin remains range-bound, with support near $67,300 and resistance around $71,751. A decisive break in either direction could force the derivatives market to react violently.

For now, bitcoin’s ability to hold near $68,000 while funding rates sink into deeply negative territory paints a market split between conviction and caution. Whether this becomes a classic short squeeze setup or the prelude to deeper downside will likely hinge on macro catalysts, ETF flows, and whether bulls can reclaim $70,000 with authority.

- Why are bitcoin funding rates negative?

Negative funding rates mean short sellers are paying long traders, reflecting aggressive bearish positioning in perpetual futures markets. - How much futures open interest is currently in bitcoin?

Total bitcoin futures open interest stands near $43 billion, remaining fairly elevated by historical standards. - What happens if bitcoin rises 10%?

A 10% price increase could trigger roughly $4.34 billion in short liquidations, potentially accelerating upward momentum. - Is this similar to August 2024?

Yes, funding rates are as negative as they were before the August 2024 bottom, which preceded a significant rally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。