Pair trading remains one of the more underutilized strategies in crypto.

Your exposure becomes the spread between two assets rather than the direction of the market.

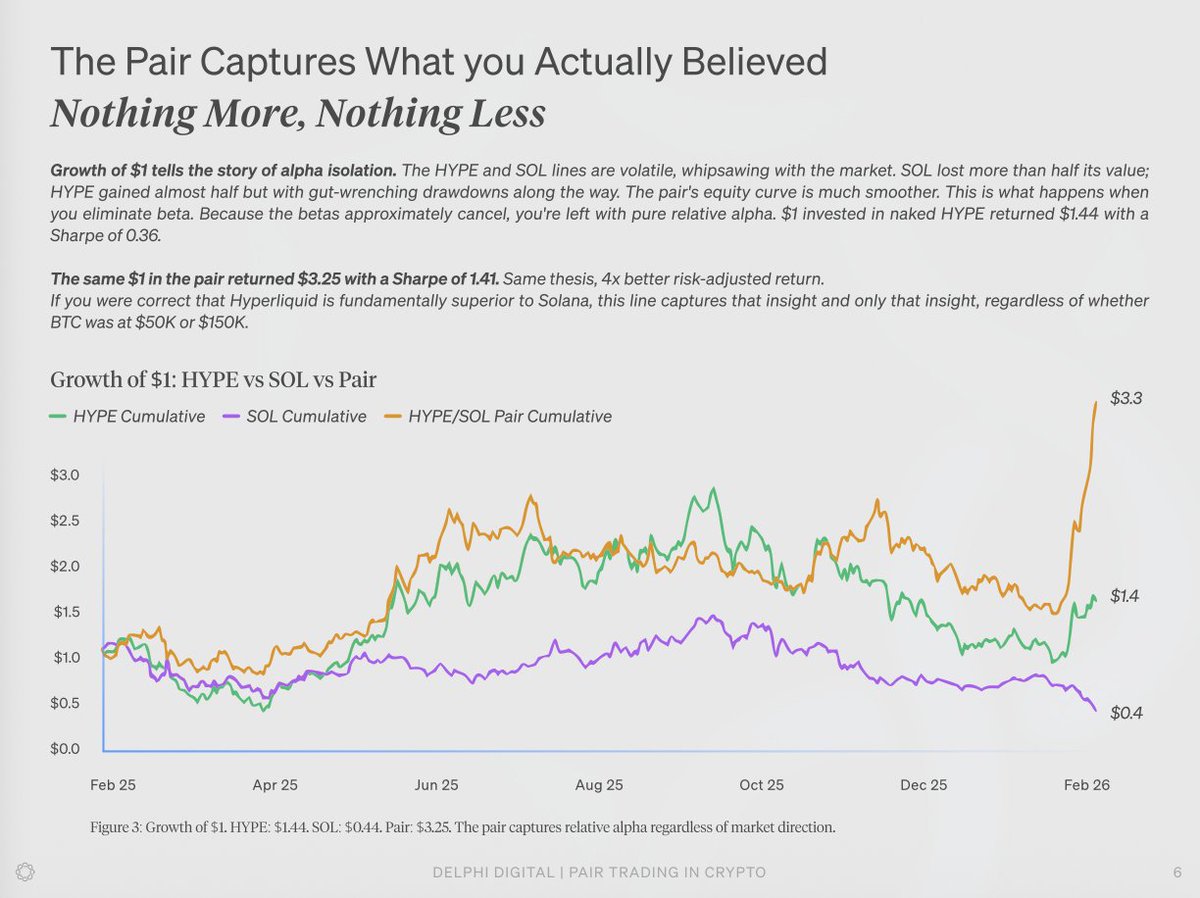

In one case study our analyst examined, adding the short leg took the Sharpe from 0.35 to 1.45. Max drawdown dropped from 64% to 45%. Volatility declined by over 20%.

The pair sat at all time highs while the long leg alone was down 40% from its peak.

Pair trading allows you to express a relative view without taking on full directional exposure. You can profit while both assets decline, as long as your outperformance thesis holds.

The wider the gap between winners and losers in crypto, the more valuable this approach becomes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。