After feeling uncomfortable with the homework for several days, it finally started to get a bit easier to write. Yesterday, I was still quite pessimistic. If the CPI data really turns out to be as bad as the market expects, the upcoming New Year holidays in China, South Korea, Vietnam, Taiwan, and Hong Kong, as well as the short holiday in the US, will make this liquidity issue worse. If a significant drop occurs on Friday, the holiday next week will be even worse. Perhaps they don't want everyone to struggle too much. Surprisingly, this time the CPI data turned out to be unexpectedly good.

Together with the non-farm employment data from a few days ago, which ensured the resilience of the US economy and increased expectations for a Fed rate cut, a market rebound is understandably taking place. Entering the holiday with this sentiment has also made the coming days somewhat easier, and the Supreme Court announced today that the opinion day for Trump's tariffs will be on February 20. I've mentioned this many times; let's see the results.

Looking at the Bitcoin data, today's rise has lifted the mood significantly. The number of short-term investors is also decreasing, and the market will likely enter a wait-and-see period. Moreover, with the upcoming weekend adding many holidays, market liquidity should become a mess. At such times, not encountering unexpected issues would be good. The next opening of the US stock market will be on Tuesday; let's see what happens then.

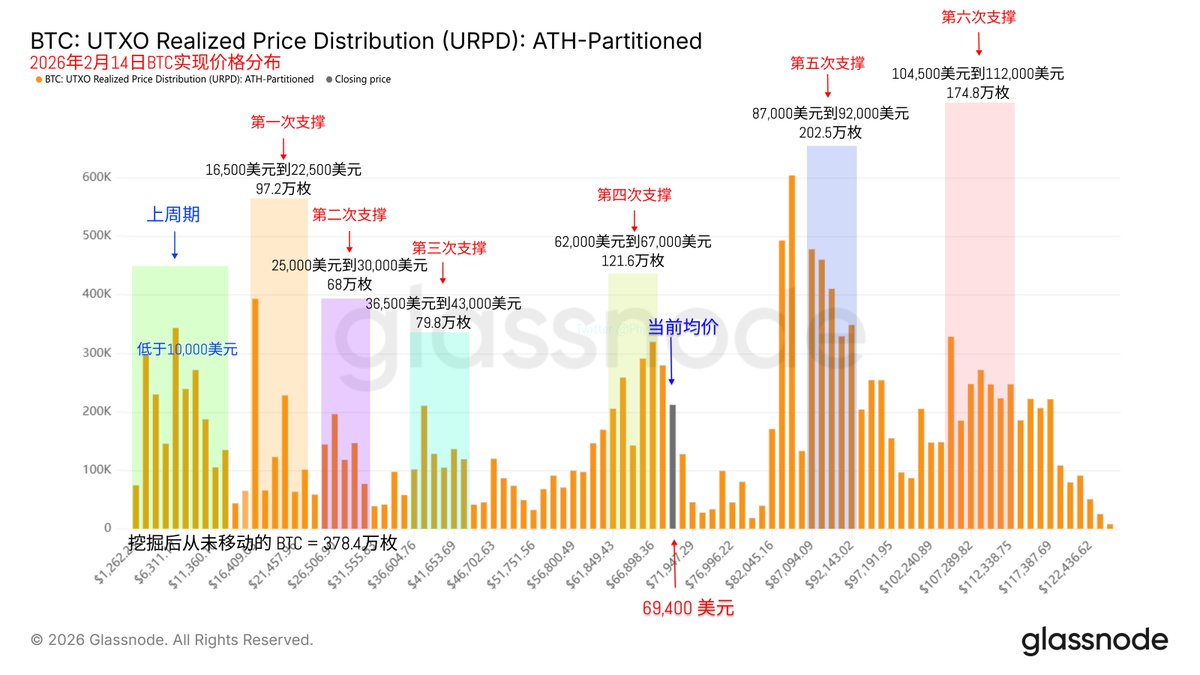

Currently, the fourth support level seems quite strong, but this is also the first time I have seen two support levels continuously broken. The previous two support levels still maintain a strangely good condition. This indicates that even loss-making investors still have confidence in the future of $BTC and are not in a hurry to cut losses and exit the market.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。