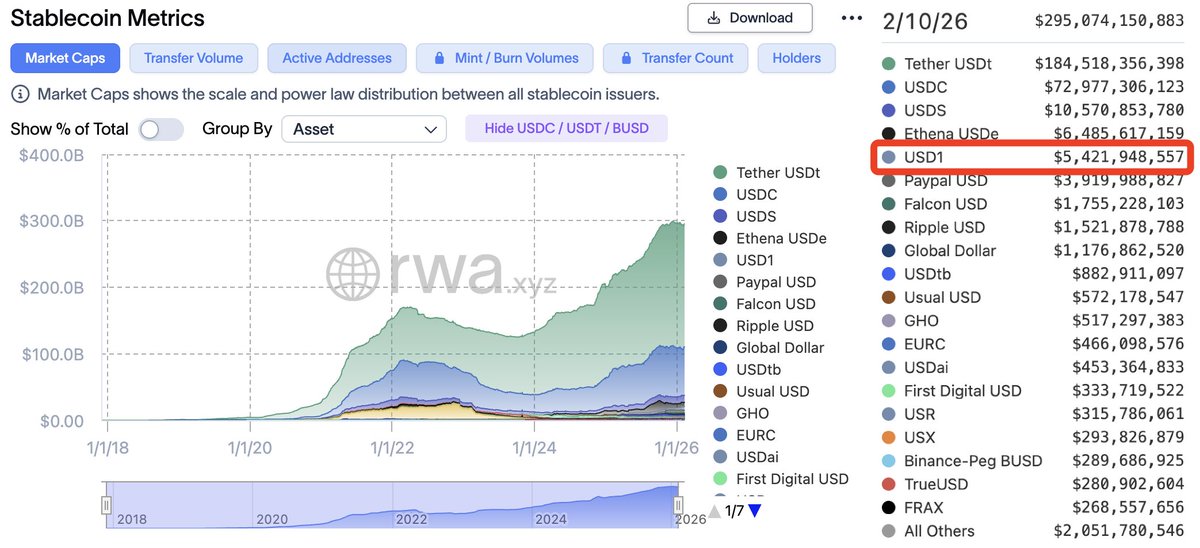

This wave of the #USD1 incentive program has allowed many people to avoid the plunge and steadily earn around 15% annualized returns, while the #USD1 market capitalization has reached 5.4 billion USD, making this marketing push extremely successful! 🧐

This reminds me of a quote from Peter Thiel, the founder of PayPal, in his book "From Zero to One": "Poor marketing can ruin a product, but good marketing must be part of the product."

25 years ago, PayPal did something crazy—it gave new users $10 for signing up and another $10 for referring a friend, burning through 60 million dollars to gain 1 million loyal users. PayPal's cash giveaway wasn't just about discounts; it directly gave the product "liquidity." When users discovered that the $10 in their account could buy the eBay stamps or cameras they desired, they could never go back to the era of writing checks.

In contrast, the current #USD1 strategy is similar. It first incentivizes with a 15% annualized reward (WLFI tokens). While it sounds like a subsidy, it is actually purchasing users' muscle memory and consumption habits.

The logic is simple: first, let us deposit our money; then, get everyone accustomed to using it for transfers and transactions; finally, make it indispensable in this ecosystem. It's like how we once put money in Yu'e Bao for that little interest, and now we even use Alipay to buy a fried dough stick.

Why is #USD1 so bold? (Its three main strategies show great confidence)

I studied its expansion roadmap, and this guy has astonishing ambition, progressing in three steps:

1️⃣ Moving from "small circles" to "big life"

Currently, USD1 is still revolving around Web3 lending and investment. But its ultimate goal is to become a Web3 version of Cash App. Imagine: our wallet is directly connected to our bank card, and when we swipe it at Starbucks, it automatically settles into USD1. Once the floodgates for offline payments are opened, the user base will not be in the hundreds of billions, but rather in the trillions.

2️⃣ Bypassing SWIFT as the "global mover"

How expensive and slow cross-border remittances are doesn't need much explanation. USD1 is quietly capturing "pricing power." As more and more assets start to be priced in USD1, it becomes a lubricant for global trade. This low-friction, instant settlement experience is something that the outdated SWIFT system of traditional banks simply cannot match.

3️⃣ Paying AI "salaries"

This is the most sci-fi aspect. In the future, the work done for us may be by AI agents, such as the recent #Clawdbot 🦞, which many might have played with; when a command is issued on TG, it can work automatically, and in the future, when we let it order takeout or book flights, it will need to make payments, right? The USD1 + WLFI architecture, which is programmable and allows for instant settlement, is a "digital wallet" tailor-made for AI.

🧐 Many people may ask, what about the sustainability of such high subsidies?!

From a long-term perspective, this is actually a sustainable "seigniorage tax" war. In investment, we often say, don't just focus on that little interest; look at what the issuer is earning.

Stablecoins are superficially pegged 1:1 to the US dollar, but in reality, issuers take that money to buy US Treasury bonds, earning 4-5% risk-free returns. This is the so-called "seigniorage tax." If USD1 captures 10% of the stablecoin market, equating to 30 billion USD (the current total market cap of stablecoins is about 300 billion USD), it could earn over 1.2 billion USD a year just by holding interest.

So spending 40 million USD is completely sustainable, and there's no need for concern at all. The tokens it is distributing now are purchasing user habits and the interest income for the next several decades.

In summary, USD1’s current approach is a classic example of "redefining finance with internet thinking," using high returns to attract users, retaining them with application scenarios, and ultimately relying on economies of scale to obtain seigniorage tax. This strategy and method should be participated in early on, as the dividend period is often quite long! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。