I knew about this matter at that time, and it was actually very dramatic!

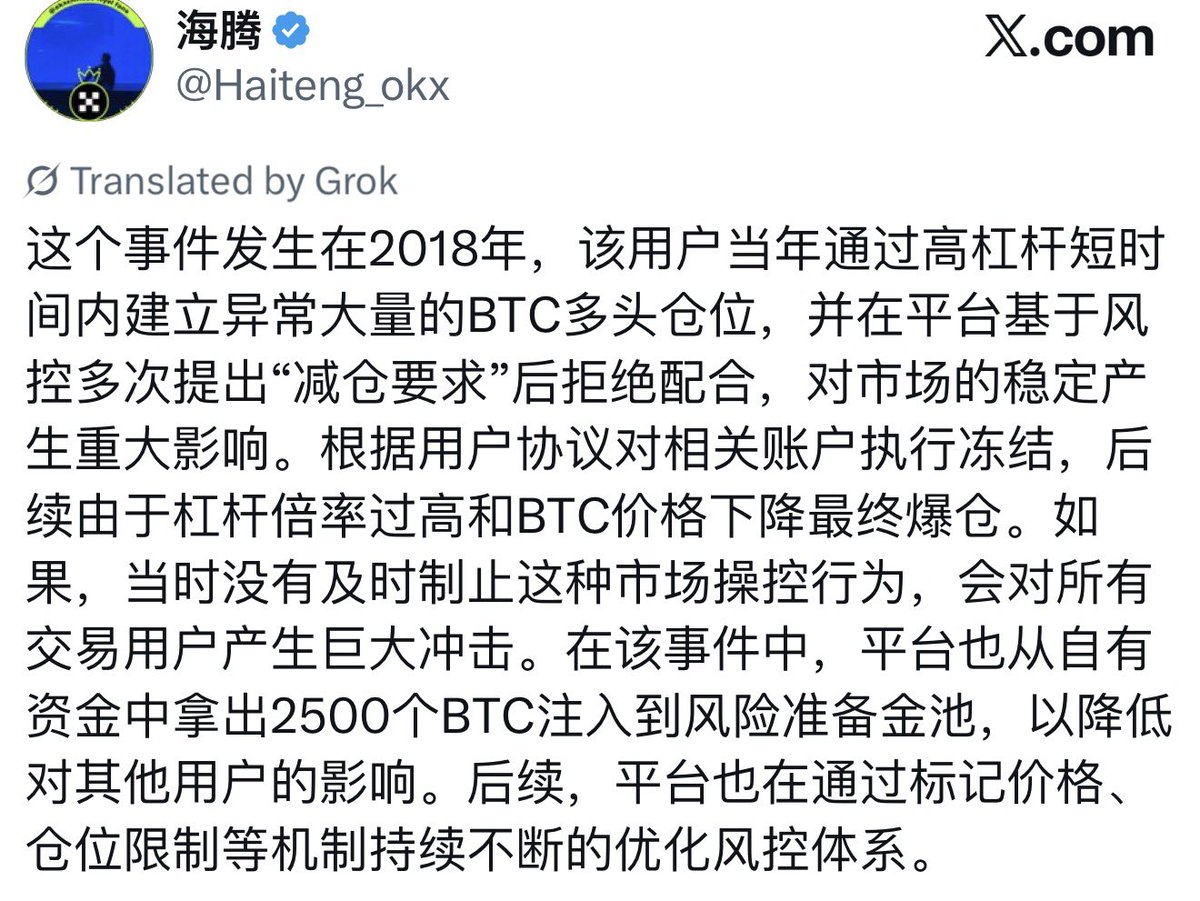

The key point is that in 2018, under an environment of extremely low liquidity and high leverage, the abnormal concentration of positions in a single account had already touched the boundaries of systemic risk.

1️⃣ The market depth that year was extremely thin, with large players leveraging 20x, which itself had already changed the market structure.

2️⃣ After a liquidation, if the market cannot absorb it, a massive gap will form, which needs to be distributed among the profitable parties.

3️⃣ From the perspective of the exchange, this is not just a profit and loss issue for a single account, but it will affect all users holding positions.

4️⃣ If OKX does not intervene in advance, it may trigger platform-level risks and large-scale distribution.

5️⃣ Injecting 2500 BTC into the risk pool prioritized protecting system stability, without completely passing the losses onto the market.

In summary: In a high-leverage market, there is no mature liquidation takeover mechanism; the platform must prioritize system safety over the trading freedom of a single account.

Of course, the market later learned its lesson, and the exchange has evolved well into what it is today.

I don't know why this old matter suddenly started being discussed again,

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。