Written by: Max.S & Classmate Octopus Nikki

Just 24 hours ago, Japan's financial history was rewritten. The Nikkei 225 index surged violently by over 2,700 points, reaching a historic high of 57,000 points. This is not just a numerical breakthrough, but a direct pricing of the results of the shortest alternative period (16 days) House of Representatives election since the end of World War II — the ruling coalition led by the Liberal Democratic Party and the Japan Innovation Party secured an absolute majority of two-thirds of the seats in the House of Representatives.

However, while stock traders popped champagne, bond trading desks were on high alert. Japanese government bonds (JGB) faced a fierce sell-off, with the 30-year bond yield soaring to 3.615%, which is akin to a tsunami in a country like Japan that has long maintained low interest rates.

As financial practitioners, we need to look beyond the candlestick charts to dissect the logic behind this "Game of Ice and Fire": the global market is trading a brand new "Japanese narrative," which is intertwined with the rebound of U.S. tech stocks, the $5,000 threshold for gold, and China's signals of selling U.S. Treasuries, forming a complex macro puzzle.

The surge on February 9 had only one core driving force: expectations of fiscal expansion brought about by political certainty.

According to the latest vote count, the Liberal Democratic Party secured 316 seats, along with 36 seats from the Japan Innovation Party, giving the ruling coalition an absolute dominant position among the 465 seats. This grants the government unprecedented legislative power, including the controversial constitutional amendment issues and, more importantly, radical fiscal stimulus policies.

The logic chain of this trade is very clear:

Political endorsement: An absolute majority means the opposition parties (such as the Constitutional Democratic Party) have been rendered nearly powerless.

Policy expectations: The "temporary reduction of the food sales tax," although explained by Finance Minister Katsunobu Kato as "limited to two years and not reliant on bond issuance," clearly indicates that the market is pricing in a longer-term fiscal easing.

Industrial policy: Defense and industry are at the core of high market policies. This also explains why defense concept stocks like Mitsubishi Heavy Industries are leading the charge, while SoftBank Group's 8% surge is a direct response to liquidity easing and an improved tech investment environment.

For quantitative funds, yesterday's strategy was very simple: go long on the Nikkei, short the yen, and short Japanese bonds. This is a typical "reflation" trading model.

If the stock market is trading "growth," then the bond market is trading the prelude to "default risk" — or at least the deterioration of fiscal sustainability.

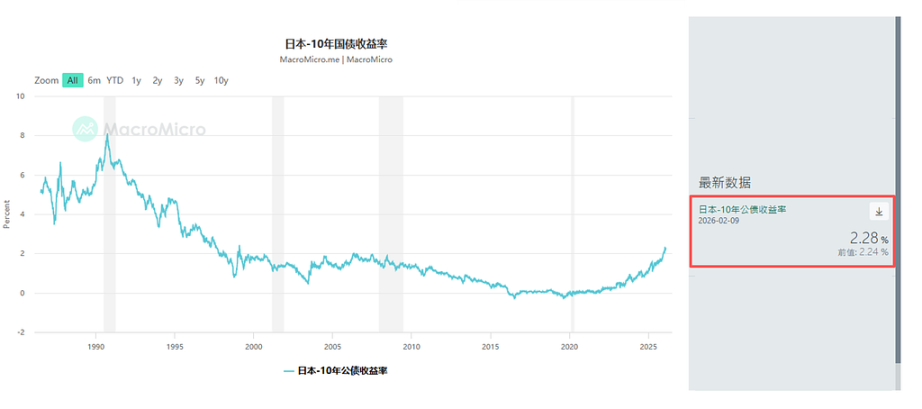

The sell-off in the JGB market was not unexpected. As early as January, global macro funds, including Schroders Plc and JPMorgan Asset Management, had begun to reduce their holdings of ultra-long Japanese government bonds. Yesterday, the 10-year bond yield rose by 4.5 basis points to 2.28%, while the 30-year yield increased by 6.5 basis points to 3.615%.

This sends a dangerous signal: the term premium is returning.

Investors are concerned that the combination of tax cuts and an already heavy debt burden will force the Japanese government to increase the issuance of government bonds. Although officials are trying to reassure the market that tax cuts will not rely on deficit financing, in the liquidity-starved JGB market, any slight disturbance will be magnified.

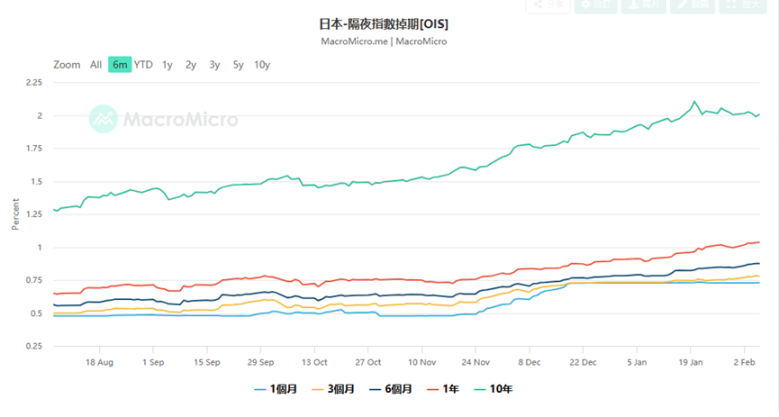

This also presents a huge dilemma for the Bank of Japan (BOJ). Overnight index swap (OIS) data shows that the market is currently pricing in a 75% probability of a 25 basis point rate hike by the BOJ at the April meeting, with some traders even betting on a rate hike in March.

Why bet on a March rate hike? Because if the yen depreciates uncontrollably due to fiscal deterioration (it briefly fell below 157.76 yesterday), the central bank must raise rates to defend the exchange rate, even if this exacerbates debt servicing costs. This is a classic "fiscal dominance" dilemma. Yusuke Matsuo, a senior market economist at Mizuho Bank, warns that we need to closely monitor hawkish comments from BOJ members, which may be verbal interventions to prevent a collapse of the yen.

The Japanese market is not an island. When we broaden our perspective to the global stage, we find that the market movements on February 9 are part of a global return to risk appetite, but also accompanied by deep structural fractures.

Chinese Market: This was the most intriguing macro news from yesterday: Chinese regulators suggested that financial institutions control their holdings of U.S. Treasuries, citing "concentration risk and market volatility." Although the official wording was cautious, emphasizing that this does not involve geopolitics, this action by the second-largest holder of U.S. Treasuries undoubtedly puts upward pressure on U.S. Treasury yields (prices falling). This is also one of the reasons why U.S. Treasury yields rose in tandem with Japanese bonds yesterday. It effectively tells the market: the anchor of global sovereign credit is loosening.

U.S. Market: On Friday, the semiconductor sector led the rebound, with Nvidia, AMD, and Broadcom all rising over 7%. This sentiment directly transmitted to Asia, with semiconductor equipment giants like Tokyo Electron and Advantest becoming the main drivers of the Nikkei index's surge. The capital expenditure (Capex) story for AI infrastructure continues, and although Amazon's massive spending has raised concerns about margins, as long as demand for Nvidia's GPUs remains strong, the logic of the hardware cycle still holds.

Precious Metals Market: After experiencing significant volatility, gold prices have once again surpassed $5,000 per ounce. This is not a safe haven; it is a "credit hedge." As Japan engages in fiscal expansion, the U.S. faces debt ceiling issues, and China diversifies its reserves, gold becomes the only "supra-sovereign currency." U.S. Treasury Secretary Scott Bessent's accusation that Chinese traders influence gold price fluctuations reveals the U.S. Treasury's anxiety over its pricing power of the dollar.

In the face of such a fragmented market — stock market euphoria vs. bond market collapse, how should investors respond?

Equity Market: Long volatility. Although the Nikkei has reached a new high, the decline in the VIX index may just be the calm before the storm. This Wednesday's U.S. labor market data and Friday's inflation data (CPI) will be key variables. If U.S. inflation rebounds, combined with the BOJ's hawkish turn, global liquidity will face a double tightening.

At this time, holding core growth stocks (such as semiconductors and Japanese trading companies) while allocating put options for protection is wise. Current Skew data shows that put options remain expensive, indicating that institutions have not fully relaxed their vigilance.

Currency Market: Tactical rebound of the yen. The yen has a strong intervention risk around the 157 level. Japanese Finance Minister Katsunobu Kato has explicitly stated that he is in close contact with the U.S. Treasury Secretary, which means that the possibility of joint intervention cannot be ruled out. If the BOJ confirms a rate hike in March or April, the yen may experience a rapid short covering. For carry traders, now is the time to gradually take profits.

Alternative Assets: Focus on "hard assets." In an era where the credibility of fiat currencies is wavering (whether due to fiscal concerns over the yen or debt concerns over the dollar), gold, silver, and certain cryptocurrencies that have stabilized during this round of correction (Bitcoin > $70k) have long-term allocation value. Particularly for silver, after experiencing a 50% sharp correction, tight physical inventory may trigger a new short squeeze.

On February 9, 2026, the Nikkei at 57,000 points is a milestone and a watershed. It marks Japan's complete farewell to the era of deflation, entering a "new normal" of high growth, high inflation, and high interest rate volatility. The supermajority of the high market is a double-edged sword: it can push stock prices up through aggressive policies, but it can also destroy bond market confidence through uncontrolled fiscal deficits.

For financial practitioners, the past era of "bull markets in both stocks and bonds" has ended. What we need to adapt to is the extreme scenario of the failure of the negative correlation between stocks and bonds, or even a simultaneous collapse of both. In this new era, keeping an eye on the central bank's balance sheet may be more important than monitoring corporate profit statements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。