Powell accused the Justice Department investigation of being political pressure in front of the camera, while Federal Reserve officials in the conference room were engaged in heated debates over the decimal points of inflation data. A covert battle between monetary policy and politics is unfolding.

The Federal Reserve is about to hold a key meeting since the interest rate cut cycle began in September 2025. The market is closely watching for the possibility of a pause in rate cuts at this meeting.

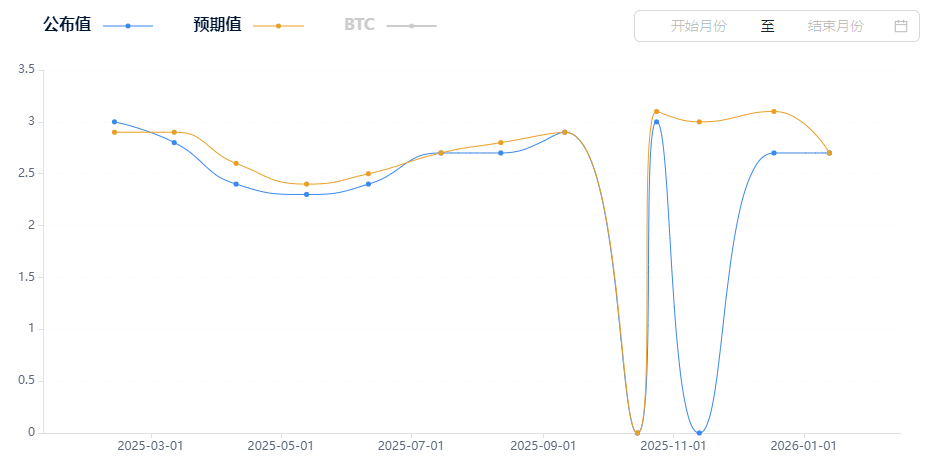

The inflation rate stubbornly remains at 2.8%, well above the Fed's target of 2%, while the job market growth has clearly slowed down but has not collapsed.

1. Meeting Background

● The Federal Reserve is set to hold a monetary policy meeting in a complex macroeconomic and political environment. Since the interest rate cut cycle began in September 2025, the Fed has lowered rates three times in a row.

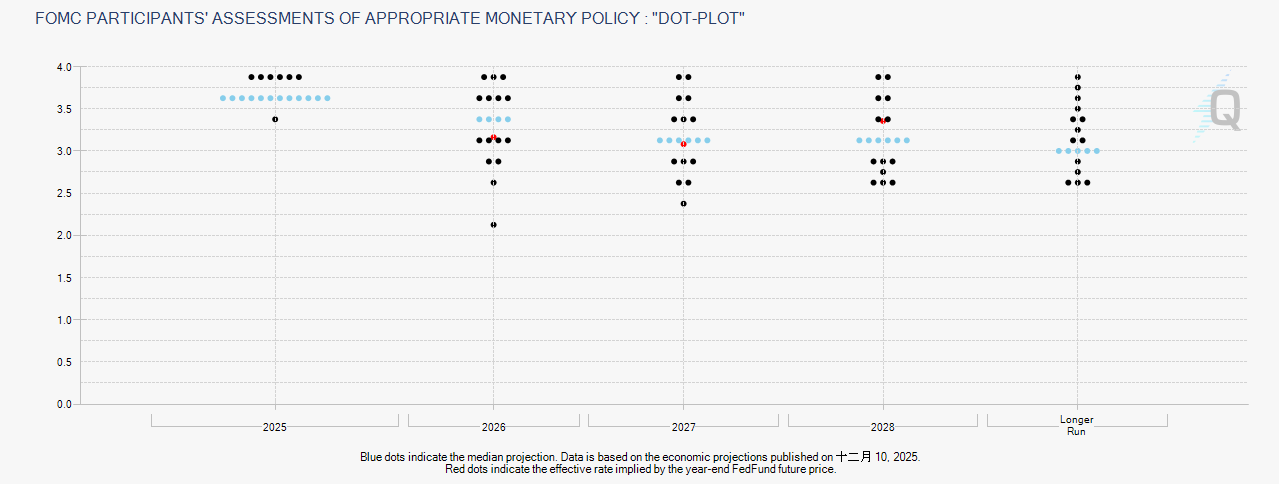

● The current benchmark interest rate is maintained in the range of 3.5% to 3.75%, a level that some analysts believe is close to the "neutral rate," with its restrictive effect on the economy diminishing.

● Macroeconomic data presents contradictory signals: on one hand, the inflation rate still hovers around 2.8%, persistently above the Fed's 2% target; on the other hand, job growth has clearly slowed, while the unemployment rate remains relatively stable.

2. Pause Signal

● The market generally expects that the Fed will choose to "stay put" at this meeting, pausing the rate cut pace. This will be the first pause since the rate cut cycle began last September.

● The core dilemma facing policymakers is: when and under what conditions can rate cuts be resumed? Analysts point out that this decision depends on which of the two types of risks manifests first—a significant deterioration in the job market or inflation convincingly returning to the 2% target trajectory.

● Since the December meeting last year, neither of these situations has occurred. Although job growth has slowed, it has not collapsed; inflation remains high.

3. Core Disagreement

There are significant divisions within the Federal Reserve regarding the path of monetary policy. The degree of this division is reportedly at a ten-year high.

● On the fundamental issue of how to measure inflation progress, officials have formed different camps. One faction, represented by Chairman Powell, believes that "tariff impacts can be ignored," viewing tariffs as a one-time price shock. According to this logic, the underlying inflation trend is already close to 2%.

● The other faction is more focused on official statistics, and official data shows that the inflation rate is still close to 3%. This fundamental difference in data interpretation may take months to bridge.

● The dot plot shows that the predictions of Federal Reserve officials for the federal funds rate in 2025 exhibit a highly polarized distribution, with a gap of 50 basis points between the most common and the second most common predictions.

4. Political Game

This meeting is held against an unusually turbulent political backdrop. The Federal Reserve is facing extreme pressure from the White House. In January 2026, the Justice Department unusually launched a criminal investigation against Fed Chairman Powell. Powell publicly stated that this move is a government-made excuse to force rate cuts.

Meanwhile, Trump's advisors hinted that Trump is about to announce a new candidate to replace Powell, whose term as Fed Chairman will end in May.

5. Waller's Choice

● The voting stance of Federal Reserve Governor Christopher Waller has become a key focus of this meeting. He is one of the popular candidates considered by Trump for the next Fed Chairman.

● Waller advocated for a 25 basis point rate cut in July 2025 due to concerns about the deterioration of the labor market, casting a dissenting vote as the majority of committee members decided to keep rates unchanged. This made him one of the representatives of the dovish voice.

● Trump has made it clear that he "will not choose anyone who opposes his demand for lower financing costs." If Waller votes in favor of a rate cut, it will align with Trump's demand for rate cuts, potentially enhancing his prospects for competing for the Fed Chair position.

If he votes with the majority of officials to support pausing rate cuts, while it may demonstrate independence, he could lose the opportunity to secure the chair position.

6. Market Expectations and Impact

● The market is cautious about further rate cuts by the Federal Reserve. Analysts generally believe that unless the job market deteriorates significantly, it will be difficult to see rate cuts before mid-year.

● Deutsche Bank's Chief U.S. Economist Matthew Luzzetti bluntly stated: "Inflation management has basically been stagnant for the past 18 months." He predicts that the Fed's next rate cut may not come until September.

● Historically, in the three months leading up to the nomination of a Fed Chair, market risk appetite tends to be under pressure; after the nomination is confirmed, risk appetite tends to recover. If Waller is nominated, the market may trade on the notion that the Fed's rate cut space still largely depends on economic fundamentals.

7. Future Path

● Looking ahead, the policy path of the Federal Reserve is filled with uncertainty. To reach a consensus at this meeting, the leadership needs more conclusive evidence than in December last year to prove that inflation is indeed declining. Regarding the conditions for resuming rate cuts, analysts point out that if the labor market remains stable, Trump's tariffs may lead to a resurgence of inflation, thereby preventing the Fed from cutting rates in 2025.

● Another possibility is that if the U.S. economy collapses in the summer, the Fed may begin to cut rates rapidly by 75 basis points starting in September.

● Philadelphia Fed President Anna Paulsen pointed out that nearly all new jobs in the private sector last year came from the healthcare and social assistance sectors. "A healthy economy should not rely solely on this one engine."

The market expects the Fed to maintain rates in the 3.5% to 3.75% range while waiting for clearer economic signals. Wall Street traders have invested at least $38 million in the U.S. Treasury market, betting that the yield on the 10-year Treasury will fall to 4%.

Analysts judge that Waller's vote is not only a statement of policy stance but also a litmus test for whether the Fed can maintain its independence under political pressure. Monetary policy stands at a crossroads, while the navigation system shows contradictory signals.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。