撰文:Bitrace

最近,一笔交易刷爆了各个社群:

在美国突袭委内瑞拉的前一天,一个刚注册的神秘账户,精准地在 Polymarket 上投入了 3 万美元押注相关预测。仅仅 24 小时后,这笔资金就暴涨至 40 万美元。

预测市场似乎总是比新闻跑得更快。从美国大选到地缘政治「黑天鹅」,万物皆可交易。大家都在谈论 Polymarket,也有人看好合规的 Kalshi 或是新秀 Limitless。这些平台有的在美国,有的在巴拿马;有的用美元结算,有的用加密货币;有的记在内部数据库里,有的记在区块链上。

但想知道谁才是真正的领军者,光看新闻通稿可不行。本文旨在基于 Dune Analytics 上@datadashboards构建的 Prediction Markets Dashboard,尝试深入解析如何通过代码逻辑,清洗并重构 6 大主流预测平台的链上交易数据,还原最真实的市场流向。

一、 数据源与覆盖范围

预测市场的数据具有天然的异构性。为了实现全网视角的统计,分析模型覆盖了以下核心平台及网络。

Polymarket (Polygon): 依然是目前体量最大的市场,包含 AMM 与 Orderbook 两种模式。

Limitless (Base): 新兴的基于 Base 链的平台,同样具有混合交易模式。

Kalshi (Web2/合规): 美国监管批准的平台,只能用美元交易。

Myriad (Abstract/BNB/Linea):主打「多链部署」的预测协议,允许用户在 Abstract 等不同链上创建市场,近期非常活跃。

Opinion (BNB):基于 BNB 链的去中心化平台,交易极度活跃。

Predict (BNB):同样深耕 BNB 生态,专注服务于币安链上的庞大用户群,提供各类热门事件的预测服务,是币安生态用户的重要根据地。

挑战在于:这些平台散落在不同的区块链网络上,且交易机制各不相同,无法直接进行对比。

二、 核心分析逻辑

为了构建一个标准化的「总流水」指标,我们采取了以下三层清洗逻辑:

1. 异构数据的聚合

这是分析中最繁杂的一步。我们需要针对每个平台独特的合约架构编写特定的提取逻辑:

AMM 模式:

基础原理:用户直接与智能合约(流动性池)进行交易,价格由数学公式(如恒定乘积)自动计算。

核心优势:长尾市场友好。对于那些关注度较低的小型预测(如「下周二巴黎会下雨吗?」),即使没有专业的做市商挂单,AMM 也能保证用户随时可以买卖,彻底解决了冷门市场的流动性枯竭问题。

数据提取:对于这部分数据,我们追踪 FixedProductMarketMaker 工厂合约创建的所有池子,并监听其 Swap 事件。

Orderbook 模式

基础原理:买家和卖家直接挂单(Bid/Ask),由撮合引擎进行点对点成交。

核心优势:热门市场首选。对于像「美国大选」这样拥有海量资金关注的超级事件,订单簿模式能提供极深的流动性和极低的滑点。在高频交易下,它比 AMM 更接近真实的市场定价效率。

数据提取:对于这部分交易,我们直接追踪交易所合约(Exchange Contract)的 OrderFilled 事件。为了精准识别交易方向与金额,我们需要在复杂的撮合日志中进行逻辑判断:识别挂单者或吃单者哪一方提供的是基础资产。一旦锁定资金方,我们便通过其对手方的预测代币数量除以 2,来反向推算出真实的本金投入价值。

将分散在 Abstract、Base、Polygon、BNB 等多条链上的数百万条交易日志,聚合为一张标准化的交易数据集。

2. 交易量的标准化

在链上数据中,原始数值往往无法直接使用,必须进行精细的标准化处理:

精度处理:不同预测平台支持不同的代币支付,我们引入了价格预言机,将所有原生代币金额统一换算成USD。

双边计算剔除:在订单簿模型中,一笔撮合交易通常会在日志中同时记录买单和卖单,区块链通常会记录两条日志:A 地址卖出,B 地址买入。或者在铸造代币时,1份本金对应2份代币(YES+NO)。为了避免统计虚高,计算总流水时,我们对 Myriad、Limitless、Polymarket、Opinion 以及 Predict 均严格执行了 Volume / 2 的逻辑,确保只统计单边真实的资金流入。

3. 时间维度的透视

为了捕捉市场趋势,我们在查询的最后阶段引入了多维度的时间透视。除了计算「历史总流水」外,我们构建了年度与月度的数据透视表。这种处理方式能够帮助我们回答以下关键问题:

存量 vs 增量:哪些平台是靠早期的存量资金支撑,哪些平台在 2025 年展现出了强劲的增量?

市场周期性:重大事件(如选举、体育决赛)前后,各平台的流量留存率如何?

三、 分析结果与洞察

通过这套严谨的「清洗-换算-去重」流程,我们得到了一份截至 2025 年底的完整市场报告,数据展示了三个洞察——

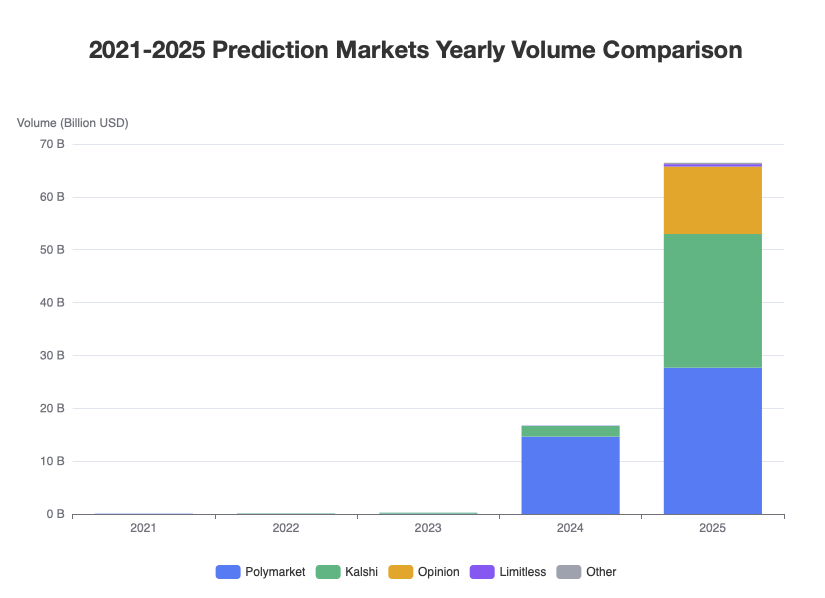

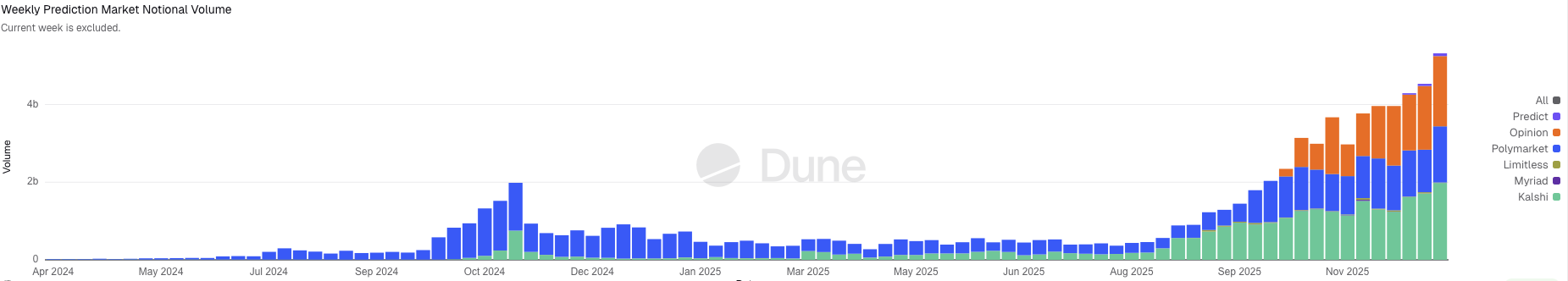

1. 2025年预测市场增长强劲

数据不撒谎。Polymarket 在 2024 年的总流水约 146 亿美元,而到了 2025 年,这个数字飙升至 276 亿美元。整个赛道的资金体量在一年内实现了翻倍式的增长,预测市场不再是小众玩具。

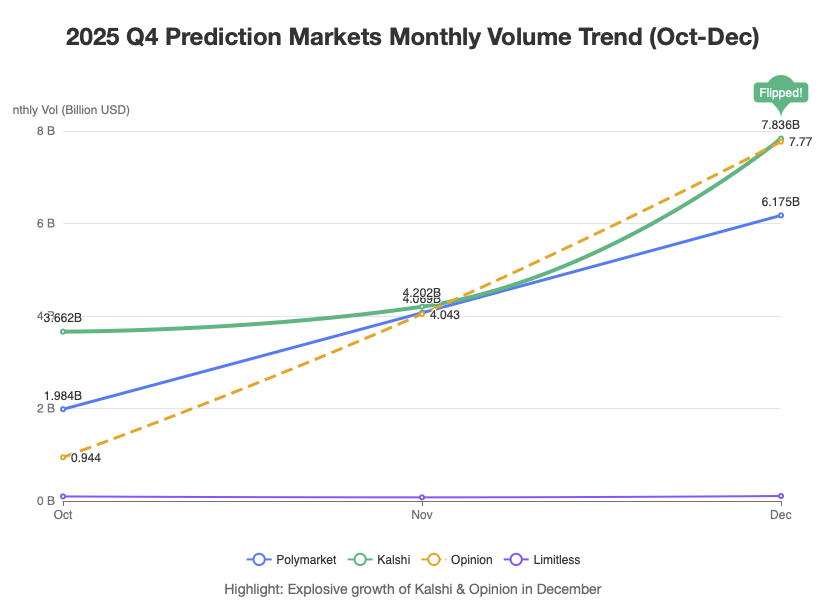

2. 合规当立 Kalshi 逆袭登顶

如果你只看新闻,会以为 Polymarket 依然一家独大。但数据显示了一个惊人的转折点: 虽然 Polymarket 的年度总流水依然最高,但在 2025 年 12 月,合规平台 Kalshi 的单月流水达到了惊人的 78 亿美元,一举超越了 Polymarket 的 61 亿美元。

合规资金正在大举入场,市场的风向标已经悄然改变。

3. 神秘黑马 Opinion

这是数据挖掘最大的惊喜。Opinion(基于 BNB 链)这个平台在 2025 年 10 月前几乎没有存在感。

然而,仅仅在 Q4 三个月内,它就实现了从 0 到 单月 77 亿美元 的恐怖增长,在 12 月的数据中,它几乎与 Kalshi 并驾齐驱,将老牌巨头甩在身后。

四、 结语

链上数据分析的价值,不仅在于统计出每一个数字,更在于通过严谨的逻辑,抹平各平台间的技术差异,构建一个公平的横向对比维度,由此对基于加密货币的新型预测市场获取客观的洞察。

尽管这一形态的平台在当前充满争议,但市场毫无疑问对其投入了高度的热情,Bitrace 将以审慎的态度,在未来对相关产业保持数据监测。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。