原文标题:《刚花 2.5 亿买公司,又裁员 30%,Polygon 换了个活法》

原文作者:David,深潮 TechFlow

今天看到一条消息:Polygon 裁掉了大约 30% 的员工。

虽然 Polygon 官方没有正式公告回应,但 CEO Marc Boiron 在采访中承认了裁员,同时说因为有新收购的团队加入,总人数会保持稳定。

社媒上也有被裁员工发帖,变相印证了这个事实。

但也就是在同一周,Polygon 曾宣布花 2.5 亿美元收购两家公司。一边裁人一边花大钱,是不是有点奇怪?

如果是单纯收缩,不会同时砸 2.5 亿做收购。如果是扩张,也不会砍掉 30% 的人。两件事放一起看,更像是在换血。

裁掉的是原有业务线的人,腾出来的位置给收购进来的团队。

2.5 亿买的是牌照和支付管道

被收购的两家公司,一家叫 Coinme,一家叫 Sequence。

Coinme 是 2014 年成立的老公司,做法币和加密货币之间的兑换通道,在美国 5 万多个零售点运营加密 ATM。它最值钱的资产是牌照,持有 48 个州的货币转移牌照。这东西在美国很难拿,PayPal、Stripe 这些公司花了好多年才凑齐。

Sequence 做钱包基础设施和跨链路由。简单说就是让用户不用自己处理桥接、换 Gas 这些麻烦事,一键就能跨链转账。它的客户包括 Polygon、Immutable、Arbitrum 这些链,还和 Google Cloud 有分销合作。

两笔收购加起来 2.5 亿美元。Polygon 给这套东西起了个名字叫「Open Money Stack」,定位是稳定币支付的中间件,想卖给银行、支付公司、汇款商这些 B 端客户。

我理解的逻辑是这样的:

Coinme 提供合规的法币出入金通道,Sequence 提供好用的钱包和跨链能力,Polygon 自己的链提供结算层。三块拼起来,就是一套完整的稳定币支付基础设施。

问题是,为什么 Polygon 要做这个?

L2 这条路,Polygon 已经很难走了

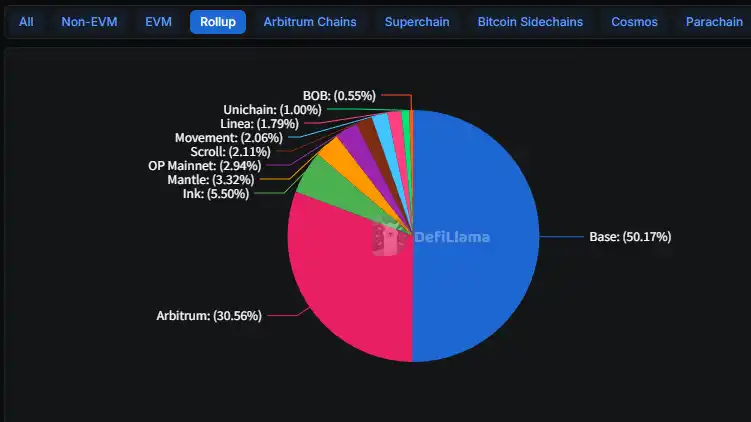

2025 年的情况很清楚,Base 赢了。

Coinbase 的这条 L2,从去年年初 31 亿美元 TVL 涨到 56 亿,占了整个 L2 赛道的 50%。Arbitrum 守住了 30% 但基本没增长。剩下几十条 L2,大部分在空投发完之后就没人用了。

Base 赢在哪?Coinbase 有上亿注册用户,任何产品功能上线,用户自然就来了。

举个例子,Morpho 这个借贷协议在 Base 上的存款,从去年初 3.54 亿美元涨到现在 20 亿,核心原因是它被集成进了 Coinbase 的 App。用户打开 App 就能用,根本不需要知道什么是 L2、什么是 Morpho。

Polygon 没有这种入口。它 2024 年也裁过一次员,当时裁了 20%,那次是熊市收缩,大家都在砍人。

这次不一样,账上有钱还要裁,说明是主动选择换方向。

记得以前,Polygon 讲的故事是企业采用,比如和 Disney 搞加速器、星巴克 NFT 会员计划、Meta 的 Instagram 铸造、Reddit 头像等等。

四年过去,那些合作大部分没了声音。星巴克的那个 Odyssey 计划去年也关了。

在 L2 赛道继续和 Base 正面打,Polygon 几乎没有赢面。技术差距可以追,用户入口追不了。与其在一个打不赢的战场耗着,不如去找新的机会。

稳定币支付是个好方向,但很挤

稳定币支付,确实是个在涨的市场。

2025 年稳定币总市值过了 3000 亿美元,比前一年多 45%。用途也在变,从以前主要在交易平台之间搬砖,扩展到跨境支付、企业财务、工资发放这些场景。

但这个市场已经很挤了。

Stripe 去年花 11 亿美元买了稳定币基础设施公司 Bridge,最近又拿下了 Hyperliquid 上 USDH 稳定币的发行权。PayPal 的 PYUSD,在 Solana 上已经占到 7% 的稳定币份额。

Circle 自己在推 Payments Network。摩根大通、富国、美银这些大行在组联盟准备发自己的稳定币。

Polygon 创始人 Sandeep Nailwal 接受 Fortune 采访时说,这次收购让 Polygon 和 Stripe 形成竞争关系。

老实说这个话有点大了。

Stripe 收购花了 11 亿,Polygon 花 2.5 亿。Stripe 有几百万商户,Polygon 的客户主要是开发者。最重要的,Stripe 积累了十几年的支付牌照和银行关系。

硬碰硬的话,这不是一个量级的对手。

但 Polygon 可能押注的是另一种打法。Stripe 想把稳定币吃进自己的闭环,让商户还是用 Stripe,只是结算层换成稳定币,更快更便宜。

Polygon 想做的是开放的基础设施,让任何银行、支付公司都可以在上面搭自己的业务。

一个是垂直整合一个是水平切入。这两种模式未必直接竞争,但在抢同一批客户的注意力。

换个活法,前路未卜

最后话说回来,加密行业这两年裁员不稀奇。

OpenSea 砍了 50%,Yuga Labs、Chainalysis 都在收缩。ConsenSys 去年裁了 20%,今年又裁。大部分是被动收缩,账上没钱了,先活下去再说。

Polygon 不太一样。账上有钱,还能拿出 2.5 亿做收购,但还是选择裁掉 30% 的人。

换血换个活法,但也有风险。

Polygon 收购的那个 Coinme,核心业务是加密 ATM,在全美 5 万多个零售点铺了机器,让用户拿现金买币、拿币换现金。

麻烦在于,这生意去年出了事。

加州监管机构罚了 Coinme 30 万美元,理由是 ATM 让用户超额取款,违反了每日 1000 美元的上限。华盛顿州更狠,直接下了禁令,去年 12 月才解除。

Polygon 的 CEO 曾说 Coinme 的合规情况「超出要求」。但监管处罚是白纸黑字的,漂亮话改变不了这一点。

再把这些事对应到代币上,$POL 代币的叙事也就变了。

以前是链被用得越多,POL 就越有价值。收购之后,Coinme 每笔交易抽佣,这是真金白银的收入,不是代币叙事。官方说预计每年能做到 1 亿美元以上。

如果真能做到,Polygon 就可能从「协议」变成「公司」,有收入、有利润、有估值锚点。这在加密行业是稀缺物种。

不过,传统金融下场的速度明显加快,留给加密原生公司的窗口正在收窄。

行业里有个说法,叫熊市建设,牛市收割。

Polygon 现在的问题是,它还在建设,但牛市的收割者可能已经不是它了。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。